You get paid.

You pay bills.

What’s left?

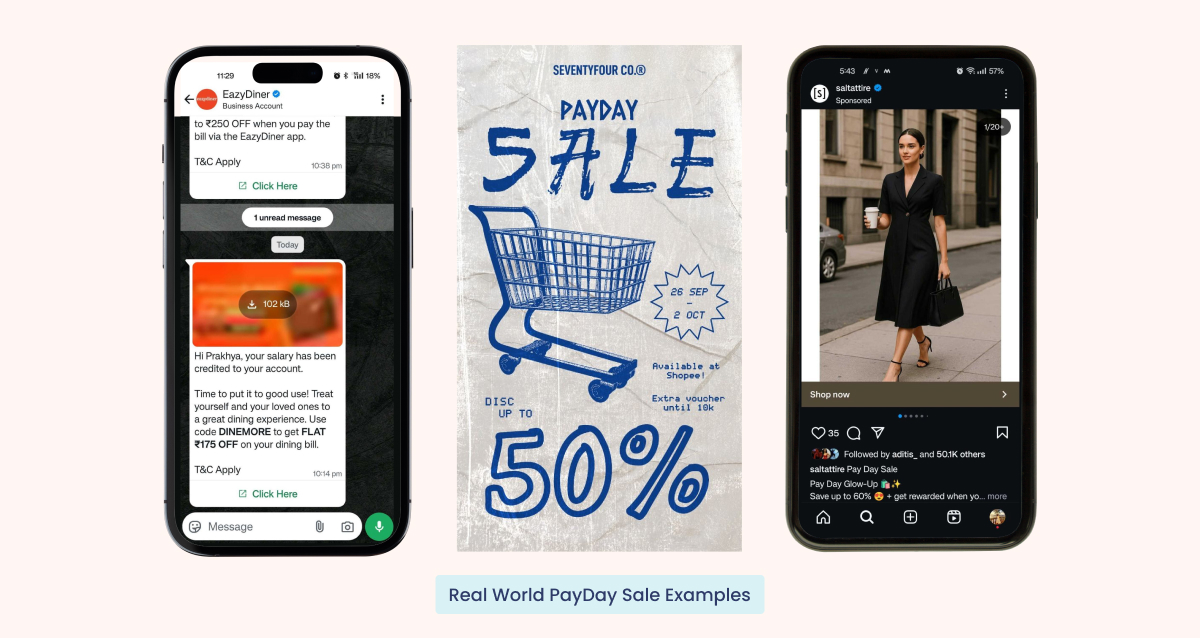

In 2025, disposable income is rising, but so is selective spending. Payday sales, once the cornerstone of marketing strategies, now face a reality check. The question isn’t just what consumers are buying, but why—and how brands must adapt to meet these evolving needs.

Rising Disposable Income: A Shift in Consumer Behavior

While much of the conversation around retail still focuses on economic downturns, data from Advisor Perspectives shows real disposable income in the U.S. grew by 0.5% in March 2025. However, consumers are more mindful than ever, prioritizing quality and experiences over impulsive purchases.

Rather than chasing discounts, consumers increasingly focus on value-driven purchases—whether for premium goods or meaningful experiences.

The Problem with Discount-Only Mindsets

For years, payday sales have worked by leveraging timing—targeting customers right after they receive their paycheck. But today, that approach is losing its edge. Consumers aren’t just looking for cheaper products; they’re seeking products that align with their aspirations. In a world where quality over price is becoming the norm, payday sales need to reflect value beyond just a price cut.

The key for brands is to reframe the sale—from offering discounts to creating meaningful experiences. Whether it’s offering bundles, personalized products, or exclusive loyalty rewards, the opportunity lies in redefining the sale experience and aligning it with consumer values.

A Shift in Strategy: How to Adapt Payday Sales for 2025

Think Long-Term Engagement:

Payday sales are transactional, but real growth lies in relationship building. Brands need to focus on loyalty-driven engagement rather than short-term sales. Engagement should be about understanding ongoing consumer needs and offering value over time.

Value Over Discount:

Instead of slashing prices, create value. Focus on bundles or exclusive products that elevate the customer experience. This isn’t just about selling a product; it’s about offering something that aligns with a consumer’s needs.

Reflect Consumer Values:

Today’s consumer is more selective than ever. They aren’t buying just to save a few bucks—they’re investing in quality and personal growth. Brands that tap into these deeper desires will thrive, while those relying only on discounts risk losing relevance.

Conclusion: Rethinking Payday Sales for the Modern Consumer

In 2025, payday sales need a makeover. As consumers demand more meaningful engagement and real value, brands must look beyond price cuts and focus on long-term loyalty. The shift from transactional discounts to experiential value isn’t just inevitable—it’s essential for staying competitive in today’s market.

The future of payday sales isn’t about selling at a discount; it’s about building a brand that resonates with the consumer’s evolving aspirations.