The first thing I learnt in this exercise? Zepto needs to chill with its push notifications.

Every August, Independence Day morphs into a marketing free-for-all. But this year, I decided to stop scrolling mindlessly and actually analyze what’s happening.

I collected and reviewed over 60+ campaigns across 8 channels — WhatsApp & WhatsApp Communities, RCS/SMS, Email, Meta, In-App, Push Notifications, and a handful of other plays. In total, around 25+ brands made it to my lens.

My mission: figure out who nailed it, what trends popped up, and where brands missed the mark. The output is not just screenshots (though I have plenty), but insights into what brands did well, where they fell flat, and what’s the bigger story for marketers. 🤝🏼

Notable mention: Brands I was looking forward to messaging me in some capacity that did not capitalize on the opp: CRED, Duolingo, Airtel, Uber, Souled Store.

Observations by Channel

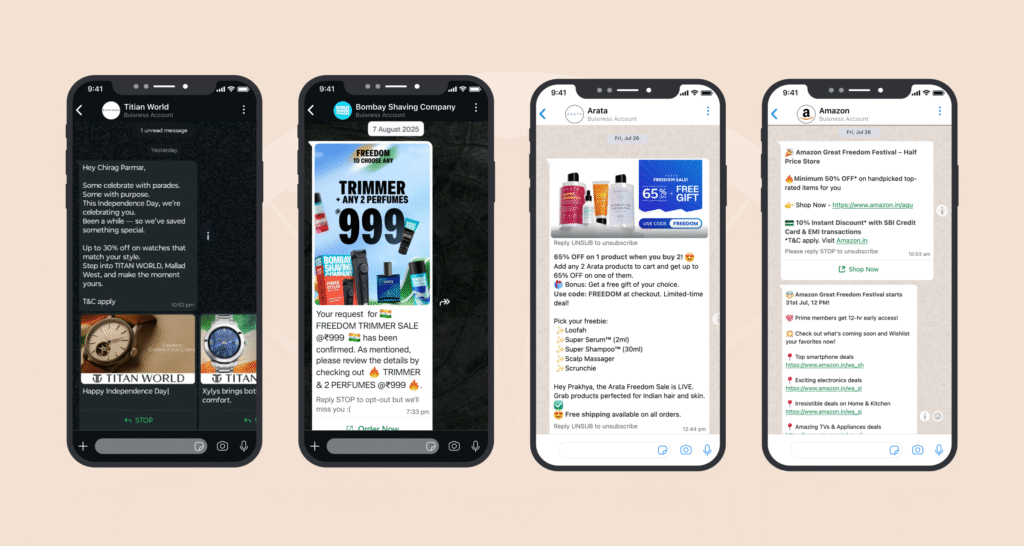

Brands: Arata, Bombay Shaving Company, Amazon, Titan World

What I saw: Static images with discounts and festive greetings. Some leaned on tricolor visuals, others just slapped a % off badge.

Missed opportunities: WhatsApp is built for 2-way engagement — quick reply buttons, product catalogs, conversational flows. None of these showed up. Messages felt like SMS in a WhatsApp wrapper.

Insight: For a channel where CTRs can hit double digits, most brands are under-leveraging interactivity. Independence Day could’ve been a playground for shoppable catalogs (“Freedom Sale Picks”) or simple interactive hooks (“Choose your Independence Day style”).

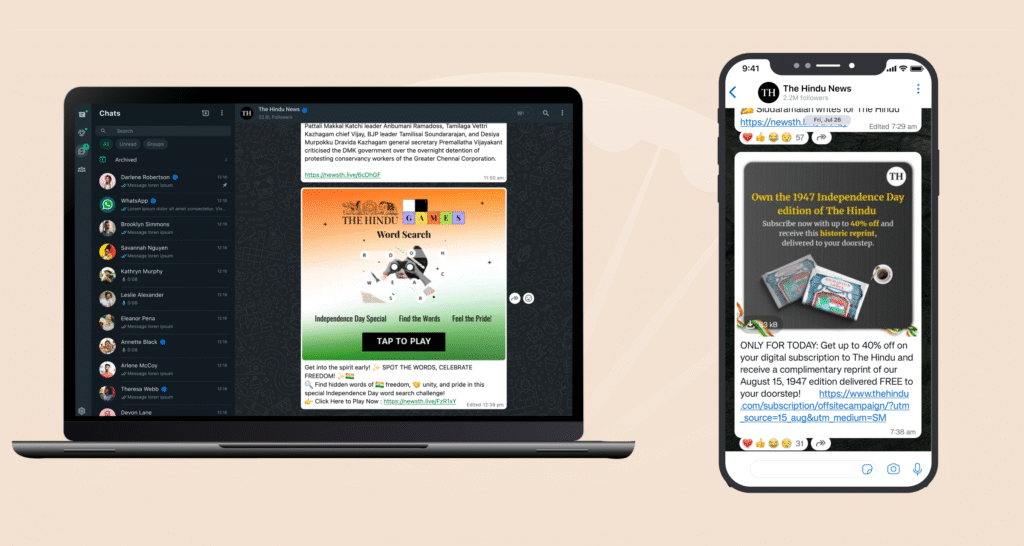

WhatsApp Communities

Brands: The Hindu, Tata CLiQ

What I saw: Only The Hindu shared newsy updates and links. Not even Duolingo. Fun fact: most brands mentioned in this list do not leverage the WhatsApp Community to their benefit. 👀

Missed opportunities: Communities are a white space. No retailer or D2C brand attempted to leverage them for “exclusive deals” or behind-the-scenes storytelling.

Insight: If WhatsApp pushes are noisy, Communities are the opposite — quiet, high-trust channels. Perfect for curated drops or loyalty-first storytelling.

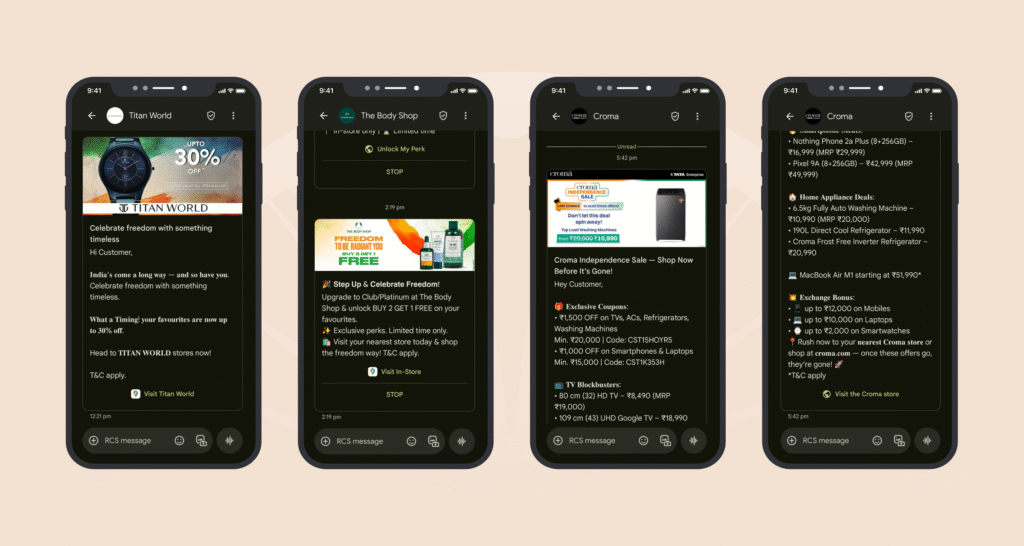

SMS / RCS

Brands: Croma (TATA Enterprise), Titan World, Ajio Luxe, The Body Shop

What I saw: Croma and Titan went direct — product + % off. Ajio Luxe used exclusivity cues (“Luxe Independence Offers”) and offered multiple products in a gif/carousel of sorts.

Missed opportunities: RCS allows rich carousels, clickable CTAs, images — none of which were meaningfully used.

Insight: Independence Day themes like “Freedom to choose” could’ve been perfectly brought alive with carousels (“Choose your deal”). The tech exists; adoption lags.

Also read: WhatsApp vs RCS vs SMS | The Messaging Crossroads

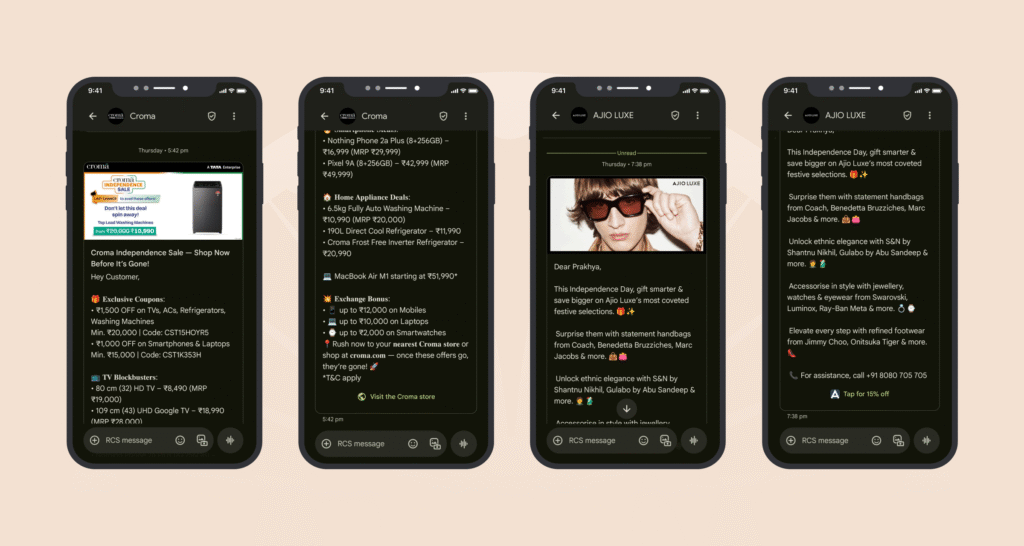

Brands: Perplexity, Akasa Air, Nobero

What I saw: Perplexity pushed a tricolor-themed mailer, and honestly? This is one of my biggest standouts. It was a crazyyyy campaign to run with the Independence theme. This is the only 10/10.

Akasa Air promoted discounted fares; Nobero ran creative with patriotic visuals.

Missed opportunities: Emails defaulted to banner + discount. No storytelling, segmentation, or personalization. Nobero stuck to plain text. ( In 2025? Whew.)

Insight: Email could’ve carried editorial angles (“Freedom to travel smarter,” “Freedom to express your style”) paired with behavior-driven triggers (cart abandons, last-viewed nudges). Instead, campaigns blended together.

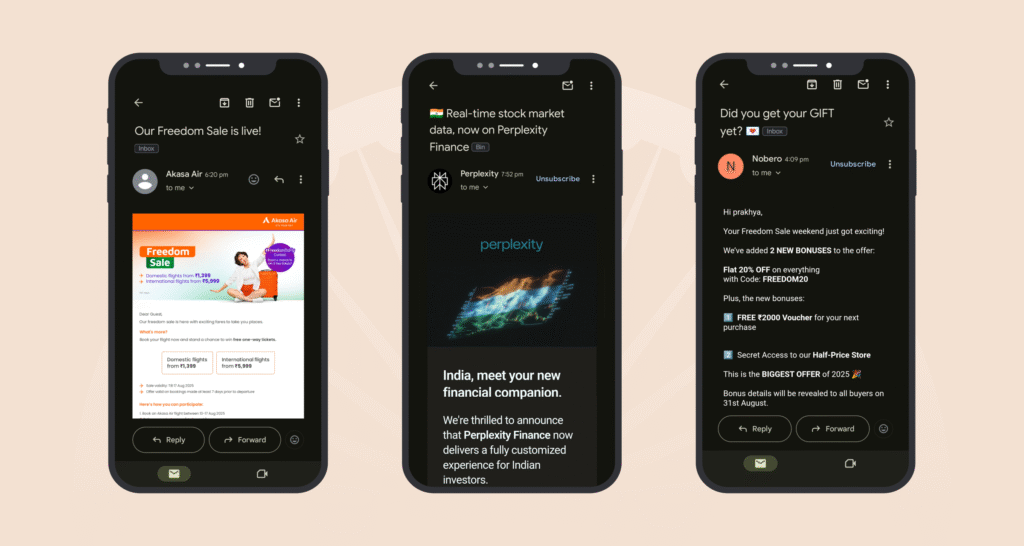

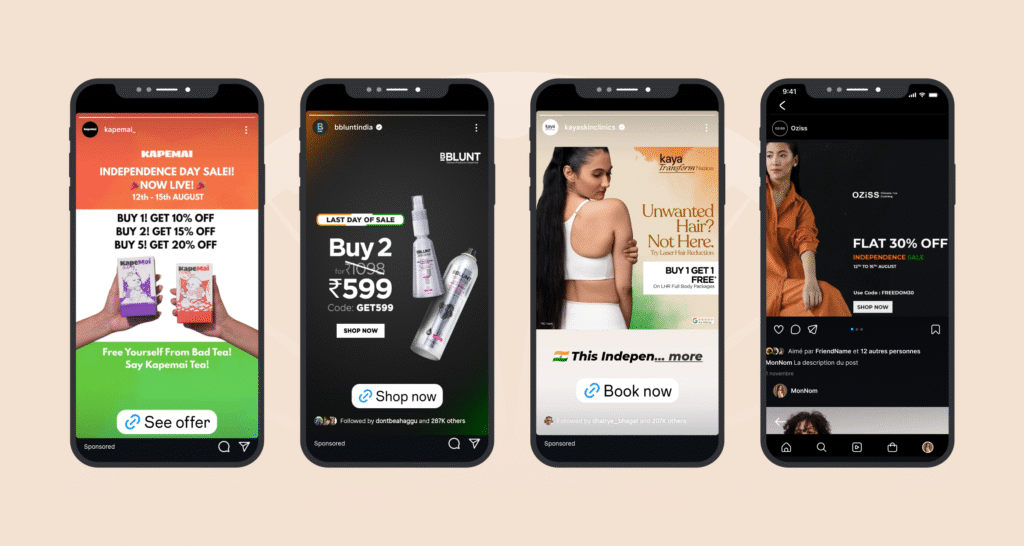

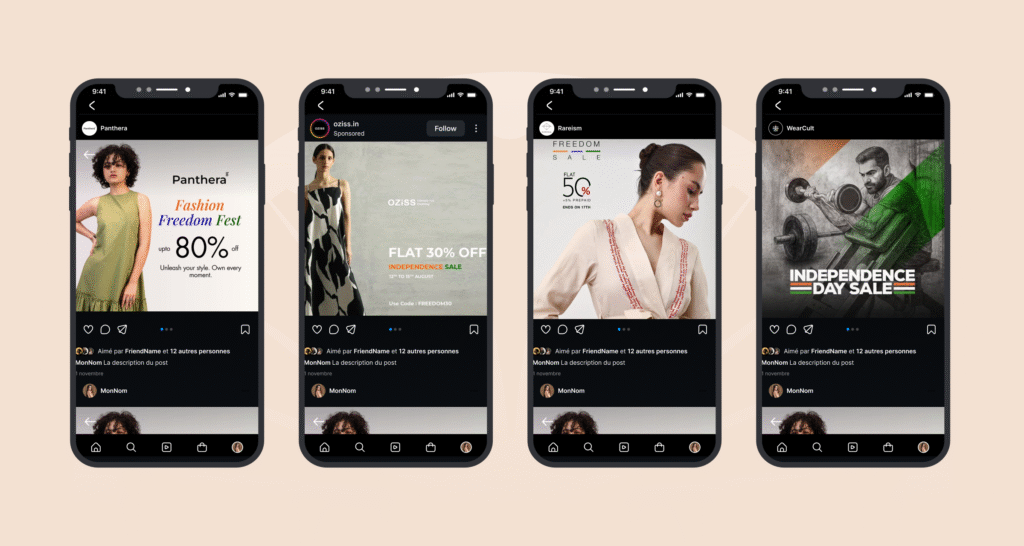

Meta Ads

Brands: Oziss, Rareism, Panthera, Kaya, Kapemai, Cultpass, BBlunt

What I saw: Almost every ad was a variation of tricolor creatives + flat discount.

Missed opportunities: Limited creative distinction. Very few experimented with motion/video, and almost none used cultural storytelling beyond the flag.

Insight: On scroll-heavy platforms, blending in is the worst outcome. A simple 15-second reel with “Freedom challenges” or UGC-style storytelling could’ve broken through the noise.

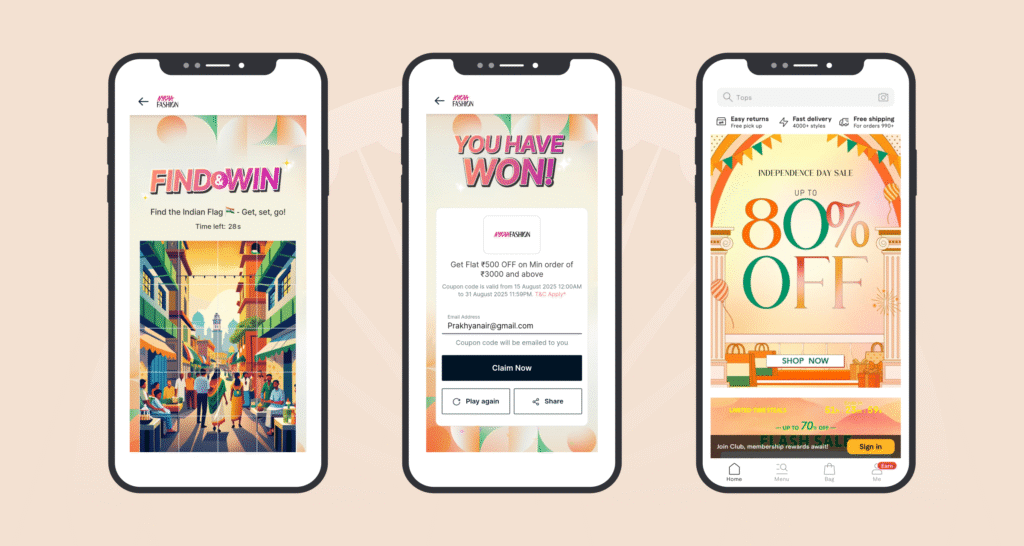

In-App

Brands: Nykaa Fashion, Savana

What I saw: Static banners inside apps, highlighting Independence Day deals for Savanah. However, Nykaa fashion did come through with its gamification, this is my other 10/10 for the day.

Missed opportunities: In-app is a goldmine for gamification; Savana clearly missed out.

Insight: Festivals are sticky moments. Instead of just banners, apps could’ve turned Independence Day into a gamified experience tied to daily engagement.

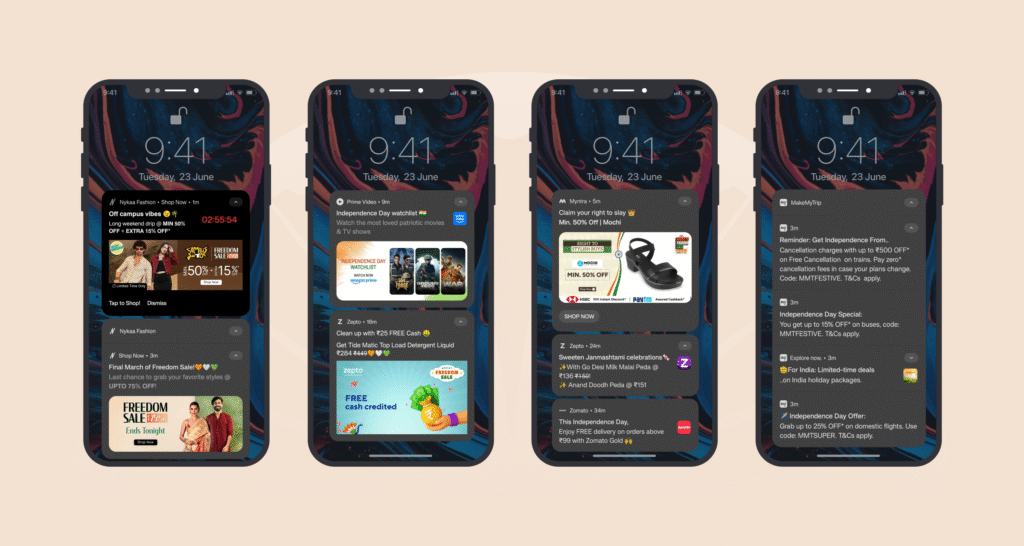

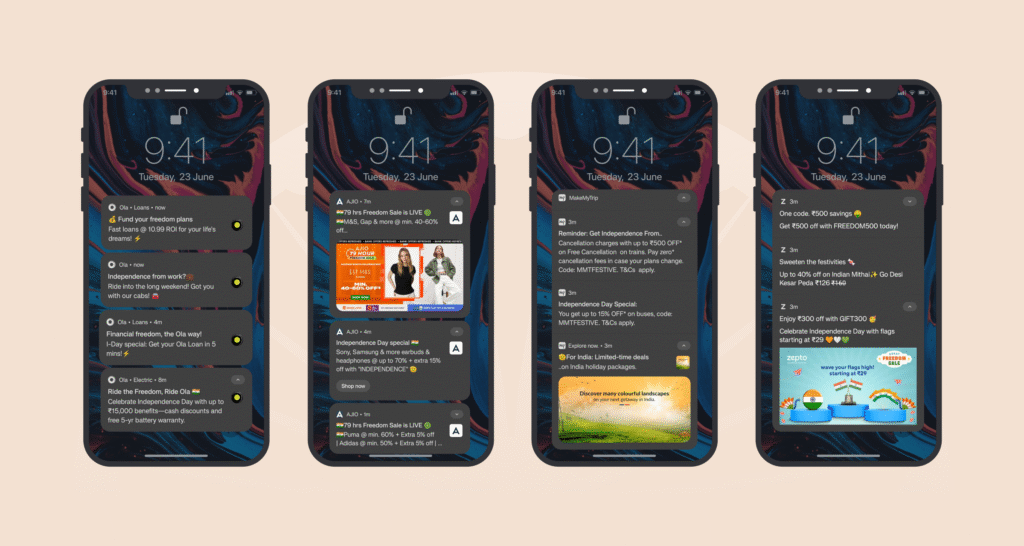

Push Notifications

Brands: Ola, Zepto, Ajio, Myntra, MakeMyTrip, Prime Video, Nykaa Fashion, Zomato

What I saw: A flood of Independence Day pushes, mostly one-line sale nudges.

Missed opportunities: Pushes are low-attention by nature. Few used deep links (taking you directly to sale pages), personalization, or contextual messaging. For a brand that did the ‘Arent Accepting Orders Anymore’ campaign, Zomato sure didn’t live on its legacy, even with its new ad.

Insight: Push works best when anchored to user behavior. Example: Ola → “Freedom from waiting, your cab is 5 mins away.” MMT → “Freedom fares for your saved Goa search.” That’s the next level.

Others

Brands: UrbanMonkey, The Bombay Canteen

What I saw: UrbanMonkey hinted at cultural cues; Bombay Canteen leaned on experiences. Both broke the monotony of “% off.” HOWEVER, Urban Monkey’s attempt to give me ‘a tax off’ on the website, however innovative, clearly received enough backlash in its comment section.

Missed opportunities: These were refreshing, but niche. With a cultural event like Independence Day, storytelling could’ve gone deeper — “Made in India” narratives, local collabs, nostalgia marketing.

Insight: The few that tapped into emotion stood out. Everyone else defaulted to transactional.

4 Big Takeaways for Marketers

4 Big Takeaways for Marketers

-

Discounts Don’t Differentiate – Everyone can shout “Flat 50% Off.”

The real play is tying your offer to a narrative.

Example: Ola could’ve said “Freedom from surge pricing.”

Nykaa → “Freedom to choose clean beauty.” -

Channels Deserve Their Own Playbook:

- WhatsApp ≠ SMS. Add buttons, catalogs, quick replies.

- RCS ≠ SMS 2010. Use carousels and rich CTAs.

- Push ≠ spam. Contextual + deep-linked = actual clicks.

- In-App ≠ static. Gamify and tie it to sessions.

Use each channel for what it’s built for, not as another megaphone.

-

Don’t Ignore Storytelling in the Rush for Sales

Independence Day is an emotional trigger. “Made in India,”

“freedom to choose,” “local pride” → none of these narratives were maximized.

The few who leaned cultural stood out. -

Plan for Lifecycle, Not Just Launch Day

Most campaigns were one-off bursts. But festivals have natural arcs:- Teaser (build curiosity)

- Live sale (convert)

- Last call (close stragglers)

- Post-sale (nurture new users)

Brands who run sequenced plays will see compounding impact.

✨ Bright Spots Worth Calling Out

- Perplexity (Email): A content-driven mailer that stood out.

- UrbanMonkey & The Bombay Canteen (Others): Played the cultural card instead of only sales.

- Nykaa (In-App): Polished design execution with gamification.

Closing Thoughts

After scanning 60+ campaigns, one thing became clear: Independence Day was treated like just another sale.

But festivals are not just discount seasons — they’re cultural moments. The brands that will stand out next year are the ones that balance offers with originality, and use each channel for what it’s truly built for.

Methodology

Simple, but rigorous:

- Collected campaigns from Aug 10–16 across channels.

- Tracked WhatsApp, WhatsApp Communities, SMS/RCS, Email, Meta Ads, In-App, Push Notifications, and Others.

- Criteria: Only explicitly Independence Day themed campaigns (tricolor creatives, “Freedom” messaging, timed offers).

Brands Analyzed

- WhatsApp: Arata, Bombay Shaving Company, Amazon, Titan World

- WhatsApp Community: The Hindu, Tata CLiQ

- SMS / RCS: Croma (TATA Enterprise), Titan World, Ajio LUXE, The Body Shop

- Email: Perplexity, Akasa Air, Nobero

- Meta: Oziss, Rareism, Panthera, Kaya, Kapemai, Cultpass, BBlunt

- In-App: Nykaa, Savana

- Push: Ola, Zepto, Ajio, Myntra, MakeMyTrip, Prime Video, Nykaa Fashion, Zomato (with Levi’s, ONLY, Monte Carlo, M&S, Gap, Red Tape, Reliance Trends)

- Others: UrbanMonkey, The Bombay Canteen