What is a Contribution Margin?

In simple terms, the contribution margin is the difference between the selling price and the variable cost per unit. To understand from a business perspective, let’s break it into two parts: the word contribution in this context means to contribute to fixed costs, whereas margin stands for the profit earned after each unit/service sold.

Once a business’s contribution margin fully covers its fixed costs, it becomes profitable. Safe to say that this is one of the most important goals for every business.

What is the formula for calculating the Contribution Margin?

You can calculate your Contribution margin like so:

Revenue – Variable Cost

The contribution margin ratio can be calculated as

(Revenue – Variable Costs) / Revenue.

What’s the difference between variable and fixed costs?

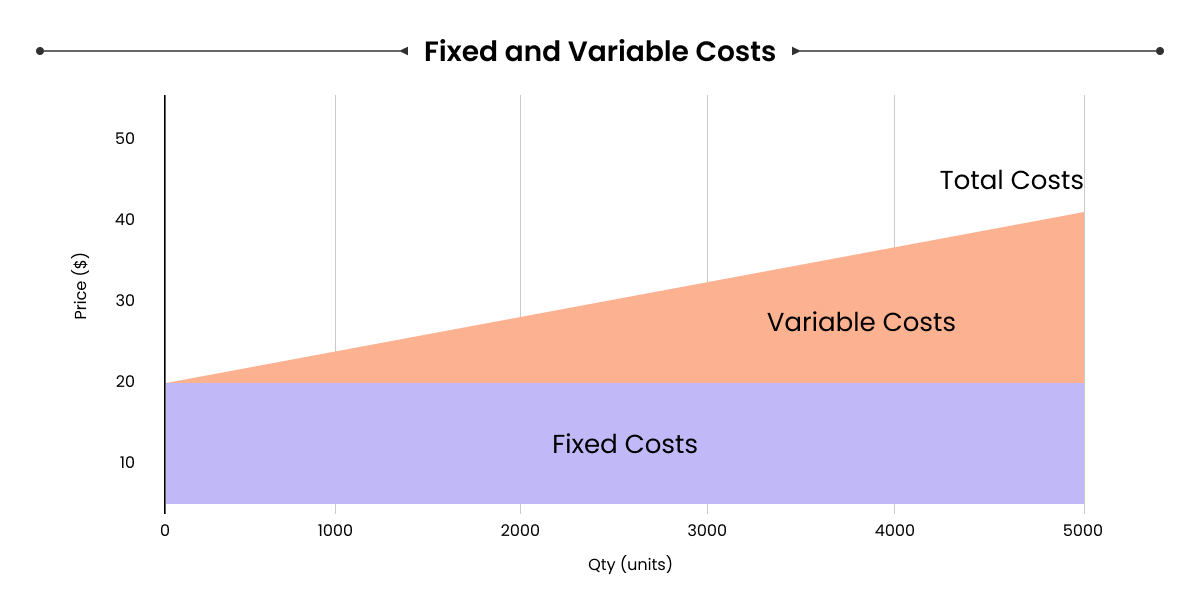

- The variable cost for a business keeps changing constantly. It is likely to change more when the number of units sold increases. However, it is never a linear growth — for example, the cost of raw materials in a furniture factory.

- Fixed costs are largely indifferent to the number of units sold. These are long-term investments and rarely change during the course of business. For example, the heavy machinery used to manufacture a product or rent an office.

On a side note, it is also essential to keep in mind the gross margin. The gross margin is the difference that remains after the elimination cost from the revenue. The gross margin also includes fixed overhead costs. Hence it will be higher than or equal to the contribution margin.

Let’s dive in deeper with a practical example of Contribution Margin:

Scenario: A toy company manufactures dolls and sells each doll for $10 and the fixed cost of the business is $10,000

Let’s assume that each doll is priced at $10 (revenue), and the variable cost for each doll is $6. So, your contribution margin per doll would be:

$10 – $6 = $4 (40%)

Now, look at a slightly bigger picture and apply the same formula for 1000 dolls.

$10,000 – $6,000 = $4,000

(Revenue – Variable cost = CM)

Now, this is the important part: the toy company will use this $4000 to cover their fixed costs.

However, it is still less than $10,000, which is the fixed cost for the business.

Time to expand the picture even more. Let’s do the same for 2000 dolls.

$20000 – $12000 = $6000

We’re still short of $4,000 to cover the fixed cost of $10,000. Selling more units will eventually help the company cover more and more of its fixed costs until they start earning a contribution margin of $10,000 or more.

The toy manufacturing company will reach a happy place the day the contribution margin equals or surpasses the fixed cost.

When the company starts earning a contribution margin of $10,000, it will reach a no-profit, no-loss scenario, also known as the break-even point, which is good news for every business.

Going forward, as the number of units sold keeps on increasing, there will come a point where their contribution margin is more than the fixed cost. This will mean that the business has started earning profits!

Another way to increase the contribution margin is to reduce the variable cost.

Reasons why you should pay close attention to Contribution Margin:

- Your potential investors look at the company’s contribution margin to decide whether they should invest their resources in a company or not.

- You can figure out your star product by keeping a record of the contribution margins for all your products and focusing your resources on that.

Conclusion

Long story short, businesses should focus on contribution margin from day zero because it takes the load off your brain for paying for fixed expenses like rent and other utilities, even when the revenue is low or initially non-existent.

On a side note, it is also essential to keep in mind the gross margin. The gross margin is the difference that remains after the elimination cost from the revenue.

Remember, the goal is to break even!