Imagine this: You’ve just celebrated a surge in user acquisitions, only to watch those same users gradually drift away. If this scenario feels all too familiar, you’re not alone. It’s one of the major challenges faced by fintech brands today.

So, what’s the solution?

From my experience working at CredAble, I’ve learned that building a product tailored to your customer’s needs is key to retention. In fact, did you know that 33% of SMEs use more than four financial service providers? This isn’t just a headache for them—it’s an opportunity for fintech brands to create a more comprehensive solution.

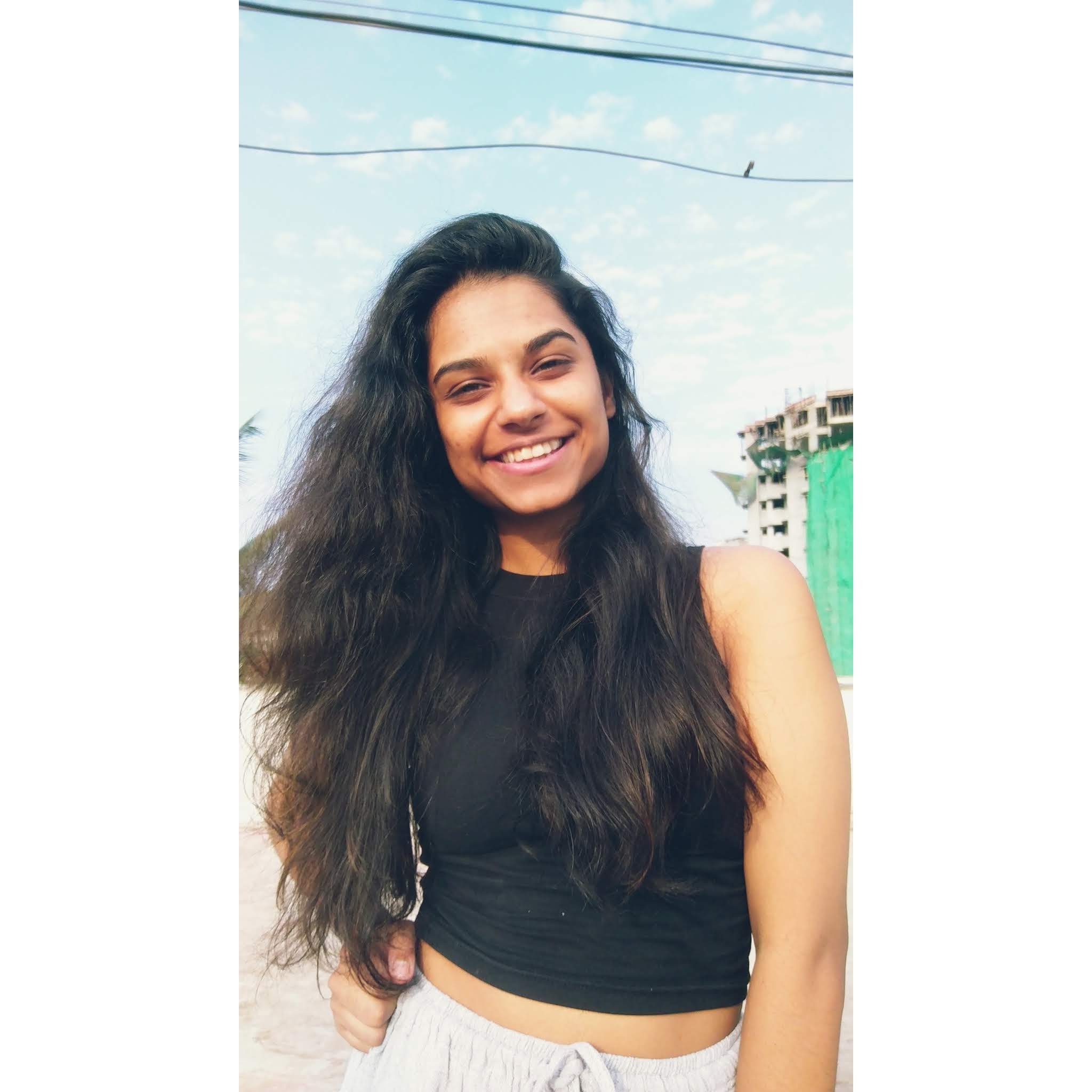

I’m Nandini Chandra, Associate Director of Product Growth at CredAble, and I’ve learned that sustainable growth isn’t just about cutting-edge tech or deep pockets. It’s about building an ecosystem that truly serves your users’ needs.

My journey from content writer to growth strategist has given me a unique perspective on scaling FinTech products. Today, I’m sharing insights that could help you refine your growth strategy and avoid common pitfalls.

Addressing User’s Diverse Financial Needs

The traditional lending model is outdated. SMEs are caught between traditional banking services that don’t fully understand their unique challenges and a sea of fintech options that can be overwhelming to navigate.

SMEs don’t just need loans; they need a financial ecosystem that grows and scales with them. At CredAble, we started with lending, but quickly realized that to truly capture lifetime value, we needed to offer more.

User acquisition isn’t a significant challenge today. Everyone knows how to leverage Google and Facebook and how to scale. But that’s exactly the problem—your competitors are already there. If you’re not doing it, they will. The real challenge is finding that sweet spot between digital and offline presence, hitting it hard, and being consistent.

But here’s the thing about the Indian market–trust is everything. You can’t just throw fancy tech at SMEs and expect them to stick. You need to build relationships, prove your value over time, and remember that in India, money and trust go hand in hand.

Creating a Financial Ecosystem

At CredAble, we’ve expanded beyond just lending to offer a suite of financial tools–invoice management, bank account aggregation, early payment discounts; you name it. But here’s the million-dollar question: How do you transition users from free features to paid ones without scaring them off?

It’s a delicate balance. We offer free bank account connections and basic features, but premium features like payment collection come at a price. The key is to demonstrate value before asking for money. Show them how your platform can scale with their business, improve accuracy, and keep them compliant.

One feature that’s been a game-changer? Real-time cash flow forecasting. It’s something a human can’t do accurately, especially when juggling multiple accounts and invoices. When business owners see how this can help them make better financial decisions, it becomes easy for them to decide to stick with us.

The Power of User Insights and Empathy

Here’s a hard truth–your brilliant tech solution means nothing if it doesn’t fit into the SME owner’s life. Many products fail because they don’t truly understand or address the real-world needs and constraints of their users. We also learned this the hard way. Initially, we focused heavily on the convenience factor, but we realized that wasn’t enough.

Now, we have a weekly ritual. Regardless of their team, everyone contacts a few users to understand their experience. We don’t ask, “How can we improve?” Instead, we ask, “What have you done? What’s the first thing you noticed?” These conversations have been gold mines of insights.

For instance, we discovered that many SMEs were more interested in cashback than convenience. It was a wake-up call. We couldn’t sustain cashback, so we had to dig deeper to find non-monetary hooks that would keep users engaged.

Building Habits and Ensuring Retention

One of our greatest realizations was that our biggest competition isn’t other FinTech platforms. It’s the local guy who’s been doing the books for years. How do you compete with someone who sends financial updates via WhatsApp for a fraction of the cost?

The answer lies in creating habits. We’ve linked our lending product with financial operations tools. The pitch? Use our platform, build your profile, and next time you need a loan, it’s just a button away.

Education is crucial. Many SMEs, especially in tier 2 and 3 cities, aren’t familiar with these financial products. We’re creating blog posts, webinars, and video tutorials to help users understand the full capabilities of our platform.

We’ve also found that onboarding is make-or-break. We need users to experience key features early on, so we’ve implemented a guided onboarding process with targeted prompts and tutorials.

Conclusion

The biggest lesson that I’ve learned so far is understanding that empathy is everything while building your product. We need to see things from the perspective of an SME owner juggling a million tasks. It’s not just about features; it’s about fitting into their lives and businesses in a way that feels natural and beneficial.

Sustainable growth in FinTech isn’t about quick hacks or burning cash on acquisition. It’s about building an ecosystem that truly serves your users, evolves with their needs, and becomes an indispensable part of their financial operations. That’s how you create real, lasting value – for your users and your business.

Thank you for exploring the journey of building a sustainable FinTech ecosystem for SMEs with me. If you’re interested in diving deeper into these insights and strategies, I invite you to listen to my recent podcast episode. In it, I expand on the topics covered in this blog and share additional experiences from my time at CredAble. You can find the podcast on Spotify or YouTube under the title “CredAble on De-addicting from Short-Term Customer Incentives”.

Authors Bio:

Nandini Chandra is the Associate Director of Product Growth at CredAble, India’s largest working capital platform in the B2B space. With a unique background in filmmaking and content creation, Nandini has navigated a diverse career path in the startup ecosystem. She began as a content writer and quickly progressed to digital marketing, gaining expertise in both B2B and B2C sectors.

Nandini’s expertise spans content strategy, digital marketing, product development, and growth hacking, making her a versatile leader in the rapidly evolving fintech landscape.