“Instead of focusing on the competition, focus on the customer.” — Scott Cook

The fintech industry is expected to grow at a CAGR of 30%, and a significant factor driving this growth is the innovative and customer-centric approach of fintech companies.

To continue to thrive, fintech companies need to ensure that user engagement is consistent and actively growing. A great way to achieve this is by using funnels & funnel analysis.

In real life, we use physical funnels to direct the flow of various liquids while filtering out impurities. In the digital life of fintech, funnels do the same – they direct the flow of leads through the user journey – from the time the user first becomes aware of the service being offered, to onboarding, to conversion.

Funnels help identify interest levels based on consumer behavior to nudge prospects to the next stage of the user journey. They ensure that good-quality users go through from one stage to another. For example, if a user has repeatedly shown interest in a certain financial product on an app/website, such as a home loan, but hasn’t yet taken the necessary steps to complete a purchase, a funnel analysis can help identify the possible reasons for the same, and then take the actions that will motivate the user to apply for the loan.

An effectively structured funnel will ensure a friction-free user journey and funnel analytics can help us achieve that in many ways – from onboarding interested prospects to identifying the cause of drop-offs to driving conversions and more repeat purchases. This is why a detailed understanding and application of funnel analysis is a strategic choice that can boost user engagement. It is a win-win where users get what they need while fintech companies gain a competitive edge.

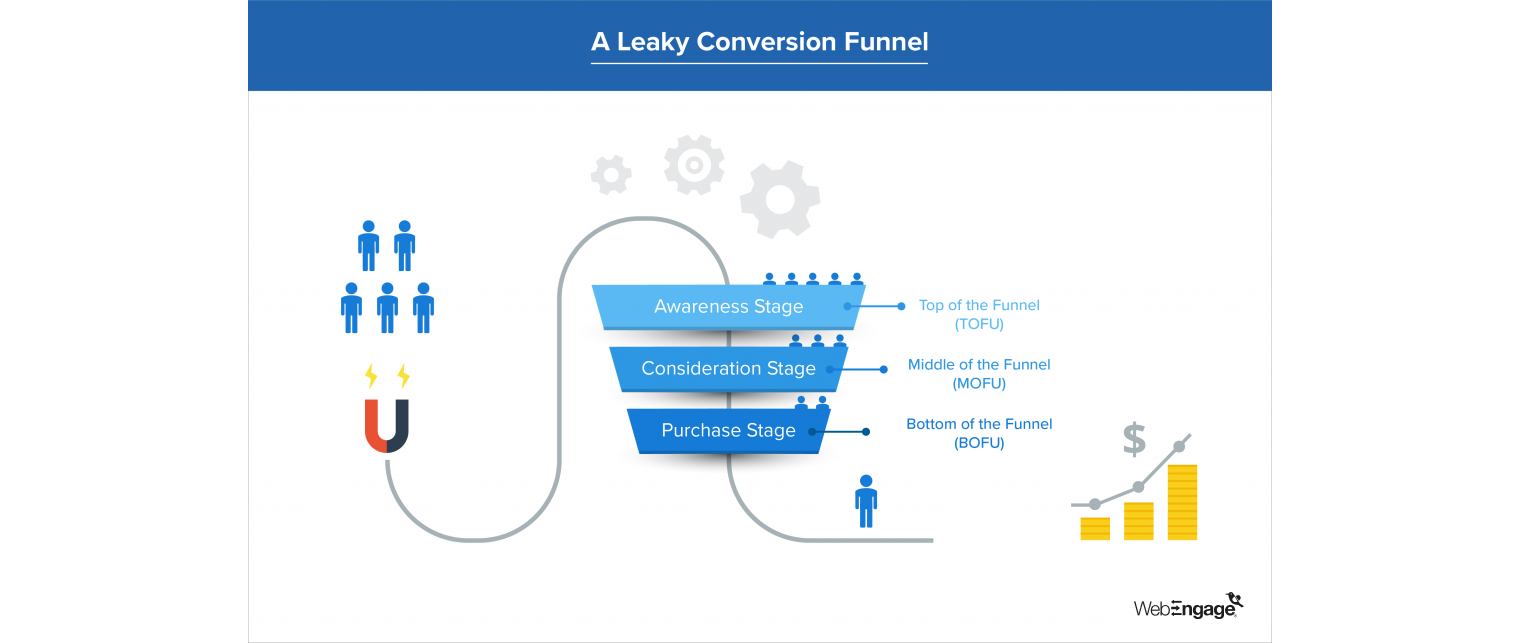

A basic Acquisition-Activation-Monetization funnel can further be split into more detailed funnels focusing on user behavior’s finer aspects, as below.

- Customer Acquisition funnel (Top of the Funnel – TOFU): Awareness – Interest – Acquisition funnel.

- Activation funnel (Middle of the Funnel – MOFU): Consideration – Intent funnel.

- Monetization (Bottom of the Funnel – BOFU): Evaluation – Purchase – Retention – Repeat Purchase—Referral funnel.

A detailed analysis of these funnels can aid incredible insights into user behavior, especially for fintech companies that organically have access to granular data about individual users.

Here are ten ways in which you can use funnel analysis to increase user engagement:

Strategy #1: Improve Onboarding Process

Onboarding, for most fintech apps or websites, is a process that leads new users on a journey via a predetermined path – from downloading the app/visiting the website, creating an account, sharing their sensitive personal and financial data, confirming their identity (often by receiving an OTP on their phone or email), and completing their first transaction. This multi-stage process is the critical first point of contact with the customer. It is also often an area of improvement for fintech startups. Customers may drop off without completing these steps if this process is cumbersome or confusing.

Funnel analysis can reveal areas of confusion or complexity, thereby helping you streamline the process. They can also provide insights into where your high-converting traffic comes from. Identifying your most successful acquisition channels can guide budget allocation.

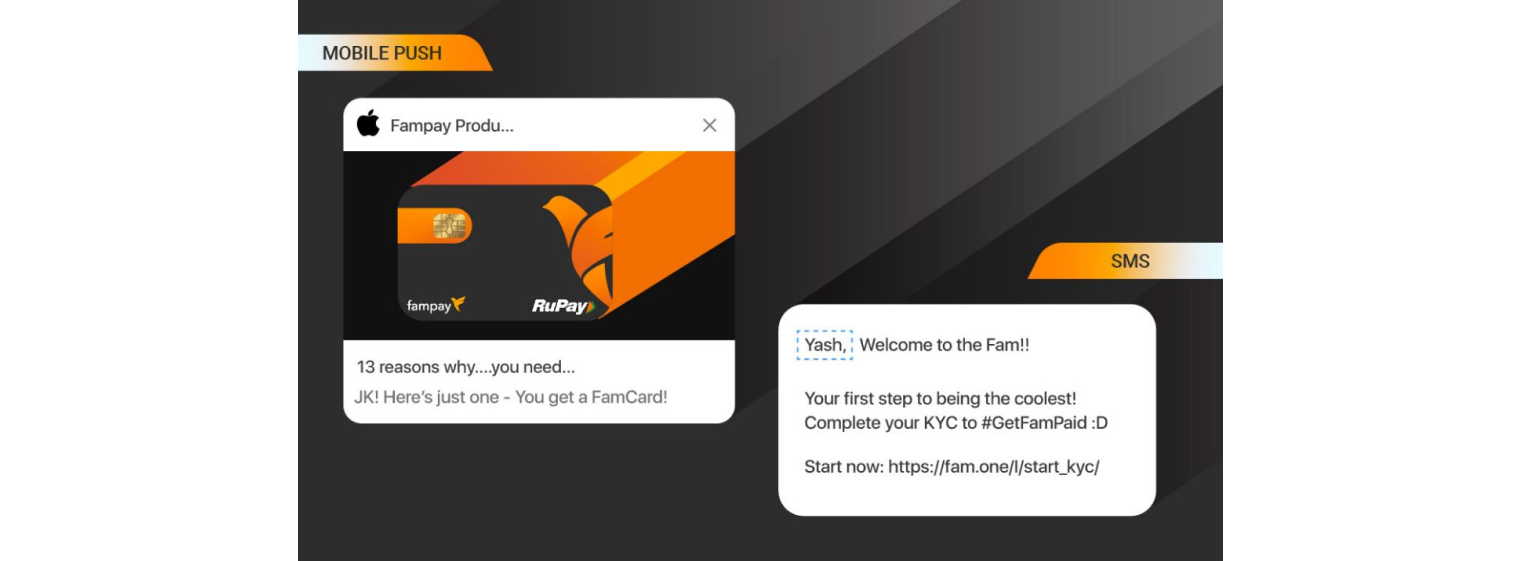

For FamPay, India’s first neo-bank for teens, the focus on improving onboarding paid off, as they experienced a 2x improvement in the onboarding funnel and a significant increase in the number of transactions made and referral users. They were able to do this with WebEngage’s help by gaining a thorough understanding of important user events and data requirements.

Strategy #2: Identify Drop-Off Points

There are leakages at each stage of the customer’s journey through the funnel. Some of these leakages are inevitable and essential – we only want “quality” users. However, when we start losing these quality users, it becomes a cause for concern. Customer retention is a huge challenge and an enormous opportunity for fintech companies.

Analyzing the funnel helps us isolate specific points where users drop off or abandon the process. By understanding what your users do before and after they drop off, you can take the necessary steps to improve the user interface and retarget the user’s engagement. Even the smallest of user actions – such as repeatedly clicking a button before dropping off – can yield a wealth of data. For example, maybe that feature is non-responsive or not fast enough for the user. Focusing efforts on optimizing features in and around these critical points is an efficient and cost-effective way to reduce friction.

Bajaj Finserv EMI Store (BSES) is a case in point. A leaky conversion funnel showed that most of their users never moved beyond the ‘awareness’ stage because of the company’s inability to reach out to customers at the right time on the right channel via personalized messages. With the help of WebEngage, they analyzed data to pinpoint drop-offs, created a retargeting ecosystem, and inserted the right plugs. As a result, BSES witnessed a 28% uplift in user engagement and a 3.5X increase in completed transactions.

Strategy #3: Optimize User Interface (UI) and User Experience (UX)

UI and UX determine the stickiness of an app or service. They make the user journey well-integrated and seamless. A well-designed UI/UX signals the user that the app/website is reliable and consistent and engenders trust and confidence. Conversely, negative user experiences with the UI can leave users feeling wary and uncomfortable, driving down engagement.

Funnel analysis can give us a detailed understanding of how users interact with the platform. This data can then be used to make UI/UX improvements, add relevant prompts, and refine features, ensuring a smooth and enjoyable user experience. For example, you can use metrics such as customer ratings/reviews, issue resolution rates, and response times to gauge customer service and satisfaction. Accordingly, you can improve the support features by adding chatbots, providing more self-service options, or better managing resource allocation during peak times.

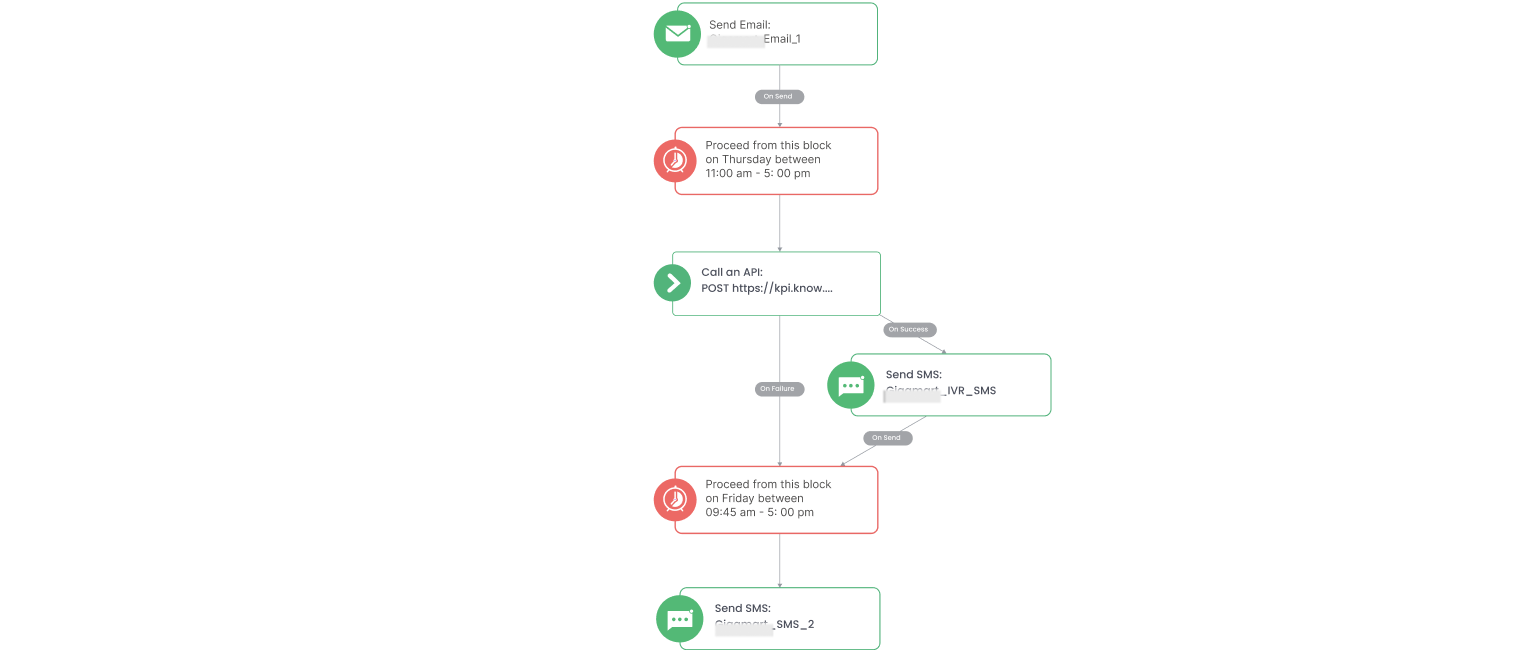

A great example of this is CASHe, a fintech platform providing consumer loans to salaried millennials. Facing the challenges of an exhaustive sales funnel and increased user churn, the company used funnel analysis to identify leakages. They then used real-time communication via IVR – Interactive Voice Response System to bridge the gaps. As a result, 35% of users were routed via IVR and redirected further down the funnel. This led to an impressive 75% increase in CASHe’s repeat user base.

Strategy #4: Personalize User Journey

User journeys are unique to each individual user. Where a new user will need more guidance, a frequent user prefers the ease of self-service and faster movement through the journey, cutting out extraneous steps. Platforms sensitive to these differences can leverage the personalization of features and communication to deliver what the user wants.

Communication primarily benefits from personalization. In this information age, users are regularly bombarded with distracting communication. To cut through the noise, and attract and hold the customer’s attention, what is necessary is a hyper-personalized approach that goes above and beyond to deliver personalized content, recommendations, and offers. This, in turn, increases engagement and conversion rates. Fintech companies can gain the insights necessary to achieve this individual-focused approach by dissecting their funnels.

DSP Blackrock innovatively used WebEngage’s email personalization tools for their new year greeting emails. Using customer transaction data, they personalized their emails by sending each customer a summary of their sound (or not-so-sound) financial decisions in the previous year. This increased the email open rate to 39% and drove up engagement.

Strategy #5: Implement Behavioral Triggers

One specific way personalization can drive engagement is by using behavioral triggers. From a behavioral economics perspective, we are subject to intuitive thinking determining our financial decisions. Understanding these cognitive biases and building solutions or triggers that challenge them enables decision-making which is the key to customer engagement.

Funnel analysis can help us identify triggers that encourage users to take specific actions. Fintech companies can then strategically implement behavioral triggers, such as personalized messages or limited-time offers, to nudge users toward conversion.

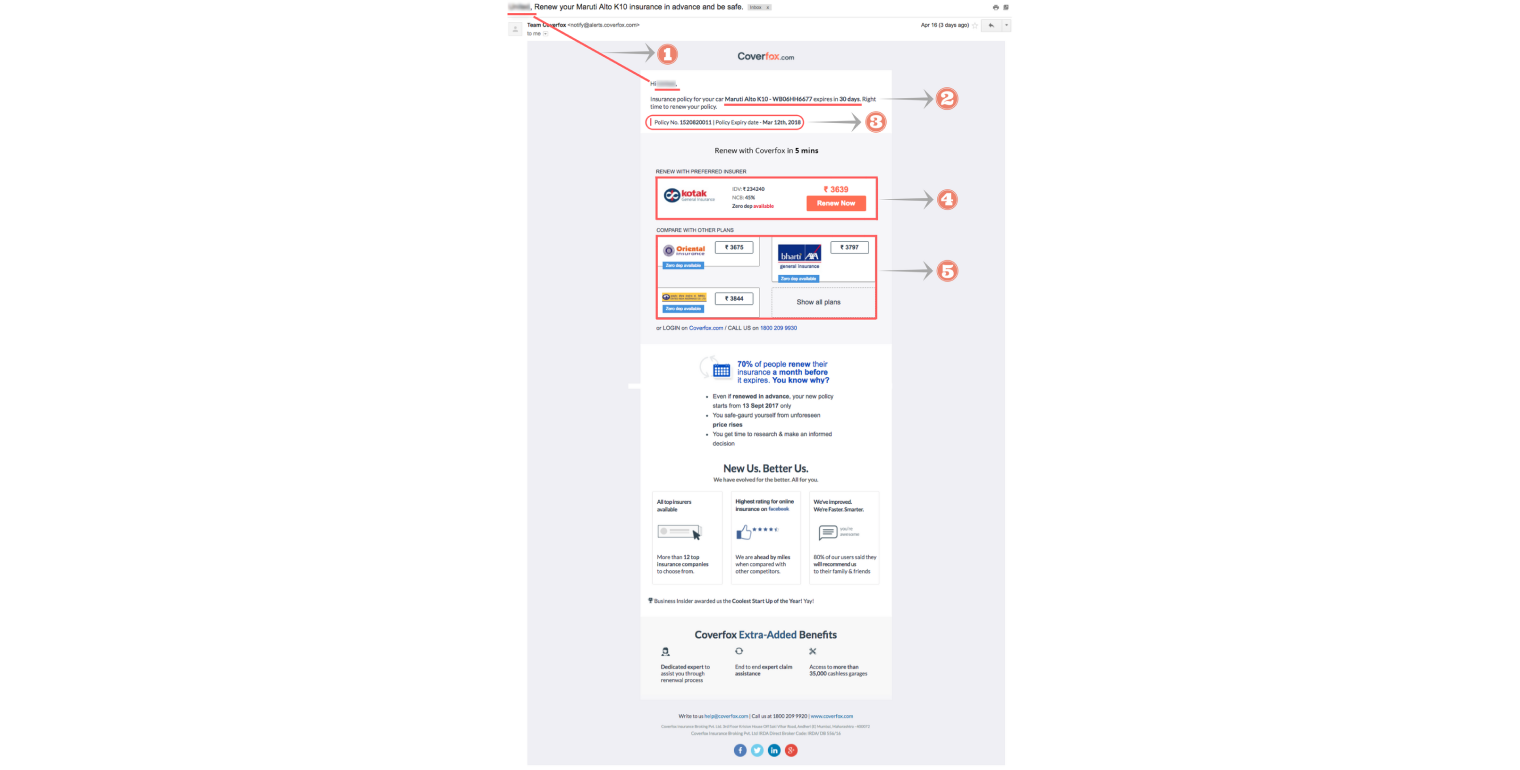

Coverfox, India’s largest Insure-tech platform, wanted to ensure existing users renewed their policies. However, behavioral mapping is complex because a single user may hold multiple policies or products. To work around this problem, Coverfox identified each policy as an individual user and then mapped everything about it to a unique user ID. They could then use a targeted and personalized communication strategy to nudge the user periodically to renew their policy, leading to a 30% increase in renewals.

Strategy #6: Streamline Conversion Process

The bottom of the funnel, i.e., the conversion funnel metrics, is a data gold mine for fintech. Using funnel analysis to track high-value conversion events and correlating them with other user activity can help us to identify any bottlenecks or unnecessary steps that may discourage users from completing a transaction. By streamlining the conversion process, fintech companies can increase the chances of successful conversions.

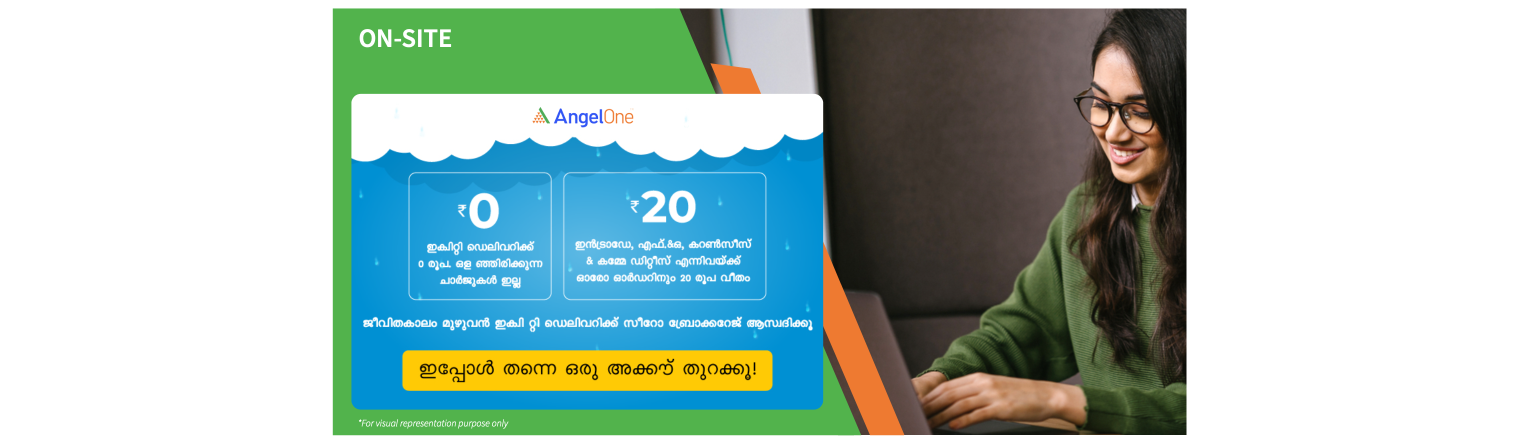

Angel One did just that with WebEngage’s help by identifying multiple opportunities to plug leaks and make UX improvements to increase conversions. This included targeted communication with ‘unknown website visitors,’ welcome campaigns via push notifications, communication in the user’s preferred language, leveraging rich notification content, and encouraging users who have blocked push notifications to reactivate them. As a result, Angel One witnessed double the number of conversions within just six months.

Strategy #7: Enhance Communication and Notifications

As we have seen in multiple examples above, timely, relevant, and personalized communication and notifications can greatly impact user engagement in fintech. Funnels can analyze user engagement with notifications, emails, and other communication channels. This data can then be used to build an effective communication strategy and deliver high-quality content and notifications that drive the user to act.

Merolagani, for example, leveraged WebEngage’s dashboard analytics tools and identified that their communication strategy needed improvement. They then effectively used push notifications, SMS, and email marketing to educate people. This led to an increase in their total user base from 8.9L to 35L and a 40% win-back rate in the first month.

Strategy #8: Increase Customer Lifetime Value (CLV)

Converting a lead into a completed purchase is great. What is better is to convert them into a frequent user who not only repeats the transaction but also purchases additional products and services. Customer lifetime value is the gold standard for fintech.

Analyzing user behavior using funnels can help identify opportunities for cross-selling and upselling to existing users. Fintech companies can position their products/services based on that data, increasing the chances of conversion. For example, as discussed earlier, DSP Blackrock increased user engagement with the help of hyper-personalized new year greetings.

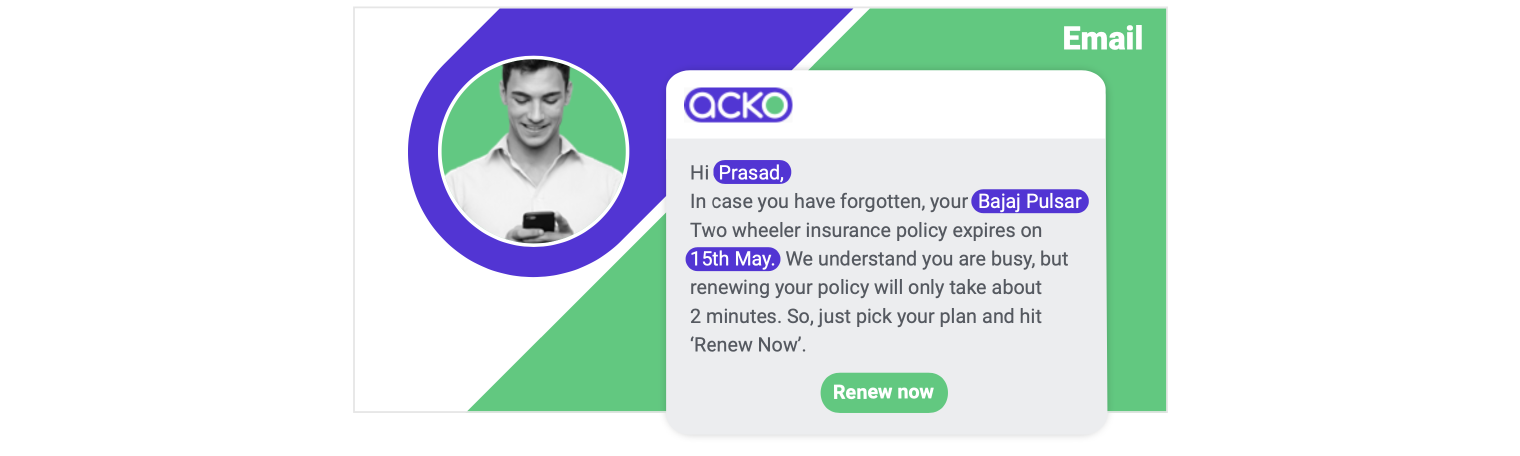

Acko General Insurance boosted its CLV by encouraging its existing policyholders to renew their policies year-on-year (YoY). As a related metric, Acko also wanted to improve its persistency ratio, i.e., how long customers stay with their policies, as indicated by the number of policy renewals. A North Star metric for Acko, the persistency ratio indicates business profitability and growth. Using targeted and hyper-personalized communication tools from WebEngage, Acko achieved a 17.3% increase in policy renewals.

Strategy #9: Optimize Retargeting Strategies

As we have discussed, leakages at various stages of the funnel could mean a potential loss of users. Leveraging retargeting strategies and initiatives effectively to win back these users increases the likelihood of conversions. However, it is necessary to be careful while employing retargeting. It is a delicate balance – too little may mean that users do not return to the platform; too much may risk annoying and alienating them. An excellent retargeting strategy is based on empathy for the user and a genuine desire to serve them.

Funnel analysis can help identify users who dropped off and their reasons for exiting. Based on the same, retargeting strategies, such as personalized ads or follow-up emails, can be designed and implemented to re-engage these users.

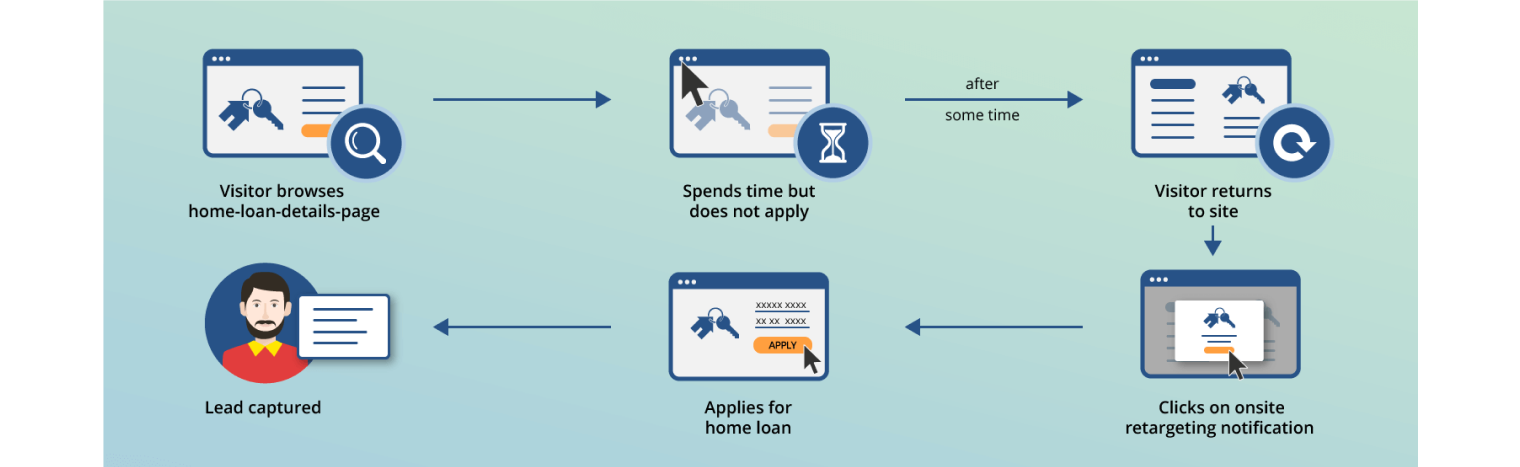

Customer drop-off was one of the challenges that Bajaj Finserv faced. With the help of WebEngage, they used onsite retargeting to engage visitors to their website with relevant promotional messaging. For example, visitors who visited home loan pages on their last visit but did not make a purchase were shown a message prompting them to ‘Apply for Home Loan’ when they revisited the site. Another microsegment of visitors was targeted using a notification to check their eligibility. The net result was a 29% increase in the monthly leads for one of their financial services products and an impressive 9% growth in the month-on-month loan disbursal.

Strategy #10: Continuous A/B Testing

Frequent A/B tests help fintech companies optimize their user journey by experimenting with different strategies, content, and user experiences. For instance, they might try out different landing pages, call-to-action buttons, or notifications. A comparison of the results through A/B testing using a step-by-step funnel analysis can help them understand what’s working and what’s not.

India’s leading digital wealth manager Scripbox applied insights about the users’ properties and behaviors to communicate the right message to the right users. Initially, they targeted users based on demographics such as age group. This did not yield the desired results. However, segmenting the users into NRI and domestic residents produced significant results. They witnessed a 3X rise in user engagement, an increase in email open rates, and a reduction in the unsubscribe rate.

Conclusion

India’s fintech industry, already the world’s third largest, is on its way to becoming Asia’s fintech capital. Fintech companies must monitor the customer to maximize opportunities and growth. Dissecting their funnels can help fintech companies gain the necessary insights to build a robust and sustainable user engagement strategy based on empathy and sensitivity to the users’ needs.

WebEngage has a proven track record of helping clients refine their customer journeys with dynamic funnels. By combining funnels with other advanced analytics features provided by WebEngage, such as Path analysis, you can gain deep insights into user behavior and drive them toward the most optimal flow. This, in turn, allows you to maximize user engagement and retention.

Curious to learn more? Check out our Impact Stories. We have helped fintech businesses like yours achieve desired results with our innovative analytics capabilities, and we are certain that we can help you, too. Go ahead and request a demo today!

Vanhishikha Bhargava

Vanhishikha Bhargava

Diksha Dwivedi

Diksha Dwivedi