In the fast-paced world of finance, where opportunity and uncertainty intertwine, staying ahead requires more than just adapting to change—it demands a deep understanding of the evolving landscape, strategic innovation, and a steadfast commitment to client success.

The post-pandemic transformation of the broking industry underscores its remarkable resilience, offering a captivating lens into the intricate dynamics of consumer behavior.

The remarkable leap in active clients, from 1 Crore in FY20 to an impressive 1.8 Crore in FY21, peaking at approximately 3.5 Crore in FY22, speaks volumes about the growing interest in trading and investments. What truly stands out is the influx of new-to-market customers, primarily from tier-II/III cities and beyond, who played a pivotal role in this expansion. However, as of January 2023, a decline of 3.35 Crore active clients occurred, largely due to initial onboarded clients becoming inactive.

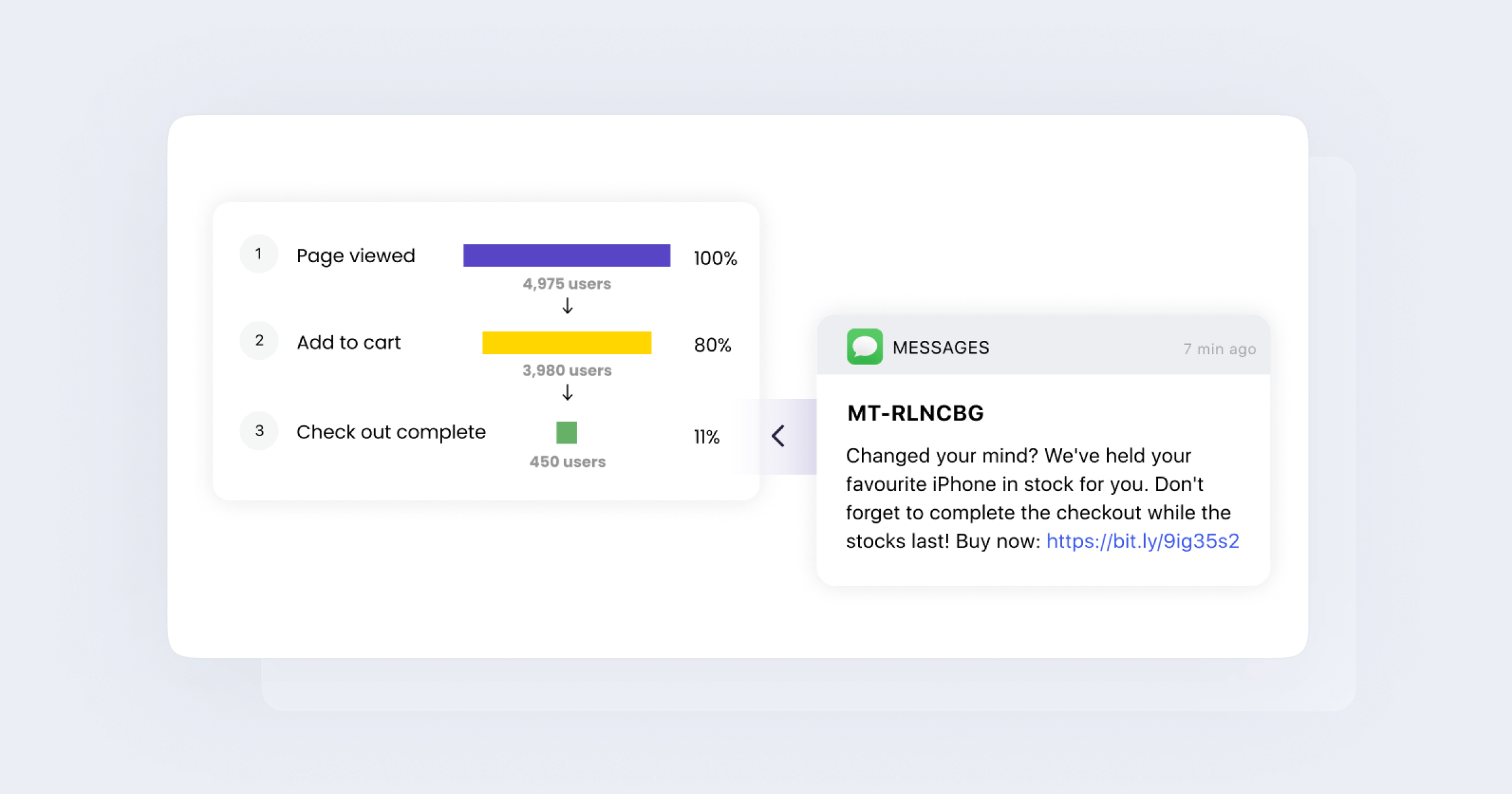

This shift in the trajectory presents a crucial challenge for brokerage firms – how to retain and engage these clients effectively? This is where funnel analytics, a powerful tool for understanding customer behavior, steps in.

By meticulously analyzing the customer journey, from the initial interest to the point of inactivity, brokerage firms can gain invaluable insights. Understanding where and why customers drop off can help pinpoint pain points, fine-tune strategies, and implement targeted measures to reignite interest and curb attrition.

But before we jump into the intricacies of funnel analytics, let’s take a quick glimpse and understand how a brokerage firm operates.

What is a Brokerage Firm?

A brokerage firm is a liaison connecting buyers and sellers. Their primary function is to buy products, like stocks, shares, bonds, and other financial goods, on behalf of their customers. Brokers are paid in commissions or fees charged post a transaction.

The firm’s total revenue depends on the number of customers completing their journey, from initiation to transaction and purchase.

As a brokerage firm, you heavily depend on pooling customers to boost revenue. But each customer’s journey and intentions vary as they go through the funnel – and so does the time they spend at each stage.

So how can you keep high-intent prospects and customers engaged across the funnel?

This is where deep diving into funnel analytics becomes important.

In this article, we discuss eight ways to dissect your funnels to look for hidden insights that can help boost user engagement and improve customer lifetime value.

What Are Funnel Analytics?

Funnel analytics are a chronological series of user events or actions leading to an end goal, such as a conversion. Events within a funnel can take place within mobile apps, products, emails, websites, and other customer engagement touchpoints.

Sales and marketing teams benefit from funnel analytics as they let them understand customer journeys and behaviors and uncover funnel anomalies.

Discover how WebEngage Funnel Analytics helps you identify bottlenecks and boost conversions

What does it mean from a brokerage firm’s perspective?

Funnel analytics for a brokerage firm means looking into channels a prospect has used to engage with the firm and when and where the conversions actually happen.

A typical prospect goes through five stages of the marketing and sales funnel:

- Acquisition – Prospects visit your company’s website by clicking an ad or through a web search, or a promotional email.

- Activation – Prospects create a free account with you by filling out an online form. For example, account registration and verification, making an initial deposit, and setting up account preferences.

- Retention – Active users who revisit your website or mobile app to engage continuously. This happens post-transaction or purchase.

- Referral – Users like your product and start referring it to others.

- Revenue – You generate more revenue from current customers by up-selling products, for example, stocks, or upgrading users to a premium plan or purchase.

8 Ways to Dissect Your Funnel for Insights on User Engagement

As a brokerage company, you continuously interact with customers at scale across touchpoints. So we have eight ways for you to tap into funnel insights and spike engagement:

1. Analyze Based On Events

Funnels consist of various user events, also known as user actions. It could be a prospect interacting with your mobile app, website, or campaigns.

For a brokerage firm, prospect events can be filling out an online form to open an account as part of onboarding, activating their accounts, purchasing a financial product, wishlisting products, downloading the firm’s brochure, etc.

Analyzing based on prospects’ event attributes lets you understand user behavior and specific actions they take when: visiting/dropping off your site, moving on to the next stage in the funnel, successfully purchasing a product, and so on.

2. Analyze Based On The Time Between Engagement

How long does it take for a potential client to first engage with your marketing campaign and move to the next stage?

Start analyzing based on the time prospects take between two points of engagement. It gives you an idea of how long it can take for someone to evaluate and decide what you have to offer and if it’s the right move for them.

For example, the time taken between them reaching out to you for a discovery call and them making a purchase.

You also gain insights into how well your campaigns have influenced the prospect’s decision and the average time prospects take to move to a successive stage.

Brokerage firms tend to also see drop-offs across the funnel – at the point of account registration, adding funds to the brokerage account, while executing trading. Mapping events and the time it takes between each engagement to occur can impact the overall conversions and the customer lifetime value.

3. Analyze Based On The Time To Convert

Analyze the time prospects take between engagement and conversion. A high average time taken to convert may indicate improvements to be made to your marketing campaigns and overall user experience.

Analysis based on the time taken by prospects to turn into buyers can help you:

- Indicate how long a prospect takes to evaluate their preferences leading to conversion.

- Optimize the time taken in decision-making by making improvements to your funnel and components.

- Set up tailored campaigns to persuade prospects to take the next step.

- Shorten the sales cycle by rapidly moving the prospects down the funnel.

- Increase your bottom line revenue by highlighting roadblocks and rectifying them to reduce user drop-offs.

4. Analyze Channel-Wise Campaigns

Brokerage firms have potential customers coming in from all sorts of channels; online ones like paid ads, organic search, social media, emails, and offline ones like word of mouth, etc.

Because of this omnipresence of customers, businesses induce multichannel marketing to reach audiences at every nook and corner. Multichannel marketing campaigns let you reach users on their most preferred channels, engage them better, and convert faster.

So it only makes sense to dissect your funnel for insights by analyzing channel-wise campaigns. Along with leveraging multichannel marketing, start analyzing which channel drives the most engagement.

These insights are crucial to prioritizing channels your ideal customers are more likely to interact with and to understanding where your top purchase-ready customers are coming from.

5. Analyze To Segment Prospects

Segmentation helps create hyper-personalized campaigns and messaging across customer touchpoints. Tailored campaigns let your target audience resonate with the offering and push them to engage better.

How can segmentation impact your firm’s success? It allows you to create personalized campaigns for each user segment and gain repeat business. Start by segmenting active and inactive users in your funnel.

For example, Angel One, India’s leading stock broking firm, witnessed a 2X increase in on-site conversions by using localized user engagement to target different segments of their audience. They further segment inactive users or those who have blocked web push notifications by setting up on-site push campaigns.

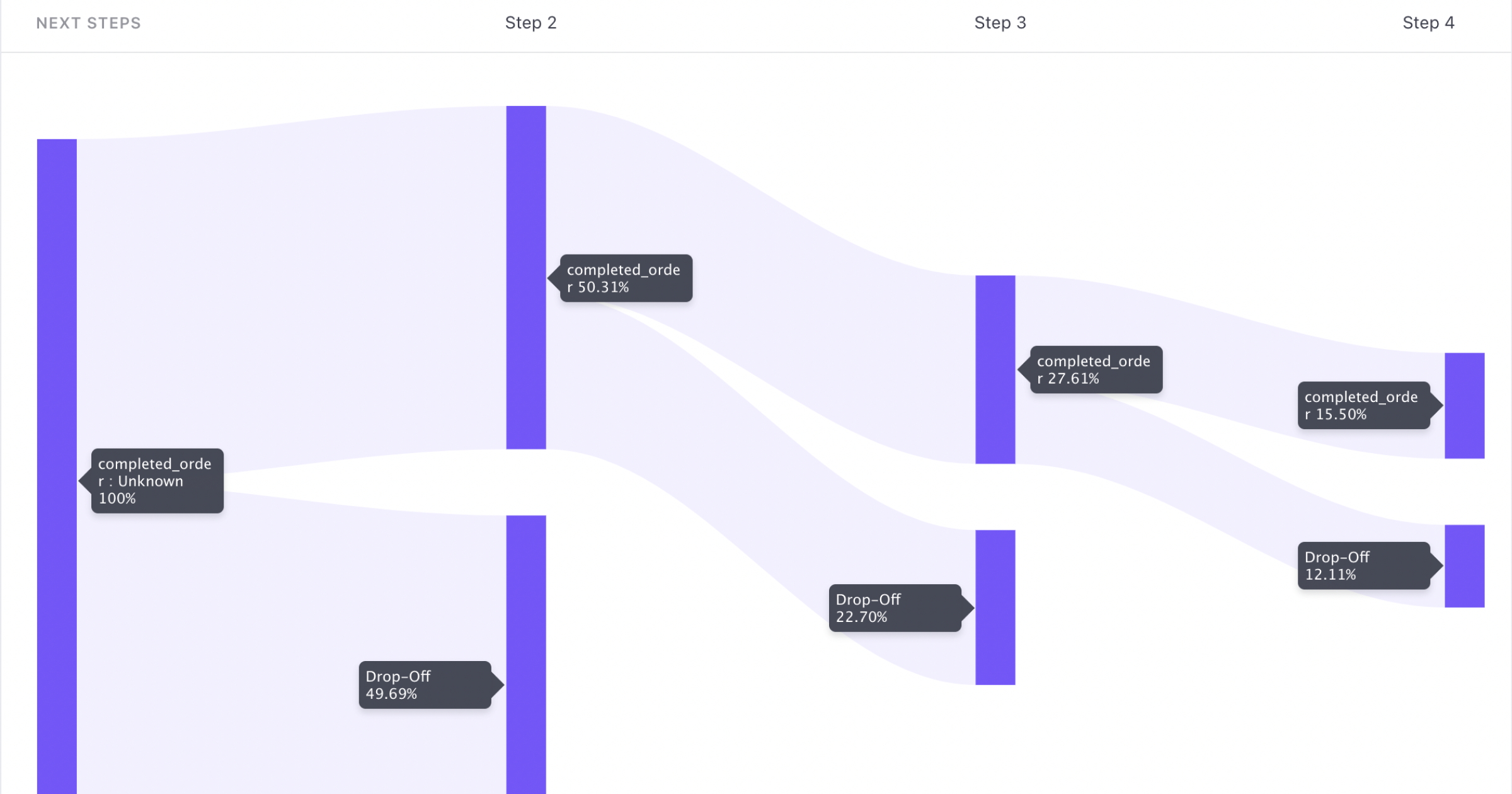

6. Analyze The Journey

Analyze the audience’s journey from start to finish, from how most of them discovered your firm, engaged with your offering, their preferred channels, and at what stage they are at each channel.

Analyzing your target audience’s path helps you uncover what they do before and after they drop off the sales funnel. As a result, you can optimize your funnel stages and channels to drive the audience toward the most optimal flow, such as signing up for a paid service, creating an account, or purchasing a product.

Path Analysis is an incredible feature that guides you in analyzing how users interact with your digital channels and where they drop off.

7. Analyze Based On Revenue

Map out digital channels your brokerage firm uses to engage with the audience along with their parent campaigns to calculate the average revenue generated over a period of time.

Find campaigns that generate the highest revenue and ROI and label the channels through which it was executed. This analysis can help optimize campaign spending for higher ROI and find what campaigns work best in tandem.

For example, an email marketing campaign that generates more appointments may drive more revenue for your firm than a paid marketing or direct mail campaign targeted at driving website visits.

Similarly, evaluating based on revenue can also help you uncover the content tilt or value proposition your target audience responds to more actively.

8. Analyze To Qualify Leads

The quality of leads you attract can make or break your brokerage firm’s revenue.

So to analyze your funnel based on leads, start by:

- Identifying channels that help drive high-intent leads over low-quality ones.

- Note the common parameters between your high-quality leads.

- Calculating how much time it takes for the identified high-quality leads to convert.

- Calculating how much revenue they help generate.

This method can also highlight which audience segments from your target market are more suited to help you drive business growth.

BONUS READ: Top 6 B2C Marketing Funnels To Track For Improved Conversions

Conclusion

Funnel analytics and insights make way for long-term growth and unlock what makes users stay or drop off your sales and marketing funnels.

And the answer to all your doubts is right in your funnels. Analyze your funnels based on user events, the time between engagement, time taken to convert, channel-wise campaigns, prospect segmentation, customer journeys, channel-wise revenue, and lead quality.

Moreover, the adoption of AI-led strategies has been transforming various functions of traditional brokerage firms. Brands are leveraging AI tools to analyze customers’ investing behaviours, website and mobile app usage, and user history, to send tailored content as per their unique preferences.

Funnel analytics play a significant role in brokerage firms. They let them stay at the top of their game by attracting quality engagement using data-backed insights.