About CASHe

CASHe is a credit-enabled financial technology platform that offers consumer lending products like short-term personal loans, buy now pay later and credit line services to salaried millennials.

Launched in 2017, CASHe provides hassle-free financial assistance utilizing its proprietary decision models that are powered by its AI/ML-backed platform called the Social Loan Quotient (SLQ). SLQ assesses a person’s true ability and willingness to repay, leading to a considerable reduction in the average cost of credit. Since the launch of operations, CASHe has disbursed loans worth $300 million to over 1.5 million borrowers across India.

Adopting the right retention platform that meets CASHe’s needs

CASHe adopted the WebEngage Retention Operating System to:

- Deliver a seamless credit experience

- Increase the percentage of repeat loans

Goals

- Convert potential leads into prospective borrowers

- Increase the percentage of repeat loans

Challenges

- Lack of a unified view of each lead (potential borrower)

- Keeping track of borrowers’ actions at scale

Solutions

Hyper-personalized, omnichannel campaigns at scale

The Customer Success Manager (CSM) at WebEngage suggested that the Marketing team at CASHe to consolidate the leads’ data on the WebEngage dashboard and have a unified view of each lead.

Subsequently, CASHe leverages the WebEngage Journey Designer to engage leads on their preferred channels and encourage them to become borrowers.

Event-based, relevant nudges at the right time

To increase the percentage of repeat loans, the team at CASHe decided to create an event-based journey on the WebEngage dashboard. Using this journey, they send automated, timely communication to existing borrowers to take repeat loans for their needs.

Nishant Mehta

Executive - Digital Marketing, CASHeUsing the WebEngage dashboard, we’ve been able to automate our user engagement initiatives and save massive human hours. We are now well-equipped to send data-backed, hyper-personalized campaigns at scale. Some of the campaigns we’ve sent have resulted in more than 40% growth in repeat loans by borrowers.

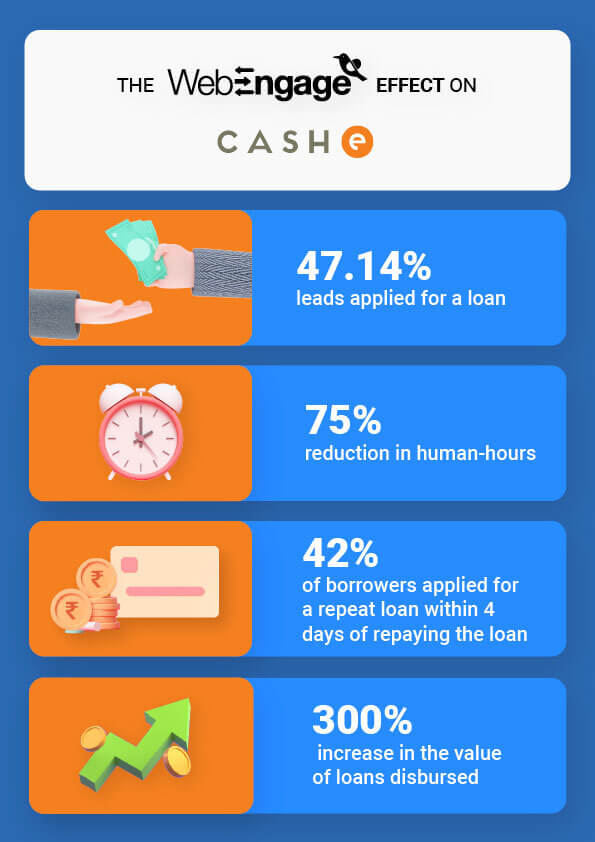

Results

CASHe has been able to automate its borrower engagement and retention initiatives, convert potential leads into prospective borrowers, and increase the percentage of repeat loans. CASHe continues to utilize WebEngage’s Retention Operating System and deliver a seamless credit experience to salaried millennials.