About ACKO

ACKO General Insurance (car, bike, health) and life insurance is a digital-first insurer redefining how Indians experience car and health insurance.

Known for its zero-paperwork policies and customer-first philosophy, ACKO leads the charge in delivering simplified, tech-powered insurance journeys across motor, health, and commercial verticals.

The Challenge

As ACKO scaled, it faced:

- High drop-offs in car and health policy renewals

- Increased acquisition costs from inorganic campaigns

- Lack of funnel visibility and fragmented engagement channels

- Heavy reliance on agent-led re-engagement calls

ACKO sought to replace scattered execution with full-funnel automation.

The Solution: One Platform, Four Plays

ACKO leveraged WebEngage’s omnichannel automation to design targeted, real-time journeys that delivered personalized communication to customers across multiple touchpoints. This allowed ACKO to automate engagement while retaining the personal touch, ultimately boosting conversions and improving customer retention.

1. Car Renewal Automation

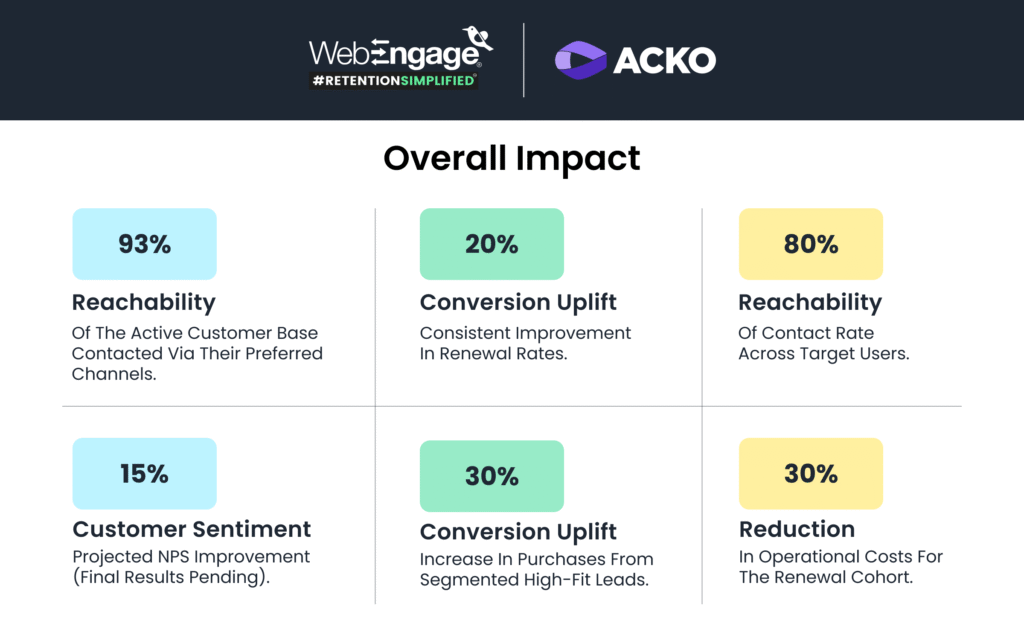

ACKO focused on boosting car insurance renewal rates by automating personalized reminders. Using WhatsApp, push notifications, RCS, email, and bot-led agent calls, the platform dynamically selected the preferred communication channel for each user based on their interaction history. Over a 90-day campaign (60 days pre-expiry, 30 days post-expiry), ACKO reached 93% of its active customer base, driving a 20% uplift in renewals.

2. App Download Campaign

ACKO utilized WhatsApp automation to drive app installs in key geographies. By offering a free challan status check to users who had engaged with the brand but not downloaded the app, the campaign achieved 4M+ nurtured users within just two weeks, with an 80%+ contact rate. Remarkably, the cost-per-install (CPI) was 5x better than traditional paid media channels like Meta and Google.

3. Car Funnel Optimization

ACKO optimized its acquisition funnel by applying propensity mapping to segment users into Core (high intent) and Balancer (lower intent) categories. This allowed for differentiated marketing strategies—targeting high-value leads with personalized pricing, quick assistance, and retargeting via WhatsApp, Meta, and SEM, while using cost-effective tactics for lower-fit leads. This resulted in a 30% increase in conversions from the high-fit Core segment.

4. Health Renewal Automation

For health policy renewals, ACKO automated reminder calls using bot-driven processes. Over 120 days, the brand reduced 30% of operational costs while maintaining high renewal rates, proving that automation could successfully replace traditional agent calls without compromising on customer experience.

Results:

Why This Matters

ACKO’s partnership with WebEngage highlights how smart orchestration can:

- Automate insurance renewals without losing empathy

- Personalize communication at scale

- Track performance across every channel

- Optimize for both cost and performance