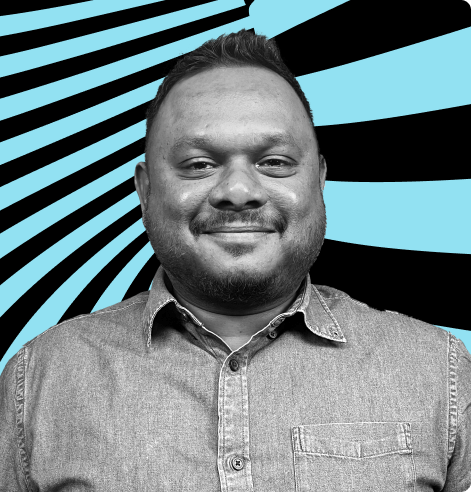

In the latest episode of “The State of Retention Marketing” podcast, host Ankur Gattani sits down with Deepak Oram, the VP of Growth Marketing and Martech at HDFC, to discuss the role of marketing technology (MarTech) in the banking, financial services, and insurance (BFSI) industry.

The conversation begins with a discussion on Oram’s learnings from ICICI & IDFC, & how he moved from an offline to a 100% digitized banking in the early stints of his career. It follows up with a discussion on the maturity of MarTech in traditional banks & Oram highlights their need to keep up with the evolving MarTech landscape to stay relevant in the market.

The duo then delves into the concept of verticalized product offerings and the challenges they pose for banks. While such offerings may work well in certain industries, Oram explains how they can limit the options available to customers and result in a negative impact on retention. Instead, banks must focus on revolutionizing their people & processes to support a personalization ecosystem, at scale.

The conversation then shifts towards the importance of customer segmentation in BFSI and how it can unlock the full potential of cross-selling opportunities. Oram emphasizes the need for banks to identify and prioritize their high-value customers and tailor their offerings to meet their unique needs. He also shares his thoughts on omni-channel orchestration and the role it plays in ensuring communication consistency for cross-selling.

The duo then discusses the challenges associated with segmentation complexity and how banks can effectively navigate them. Oram suggests adopting a data-driven approach to segmentation that involves a combination of demographic, behavioral, and transactional data to offer personalized experiences to customers.

The conversation then moves towards the pricing strategies adopted by banks and the product-marketing interface. Oram highlights the need for banks to adopt dynamic pricing models and offers insights on how to strike a balance between pricing and profitability.

The discussion then takes a deep dive into the state of retention marketing in BFSI and the need to view marketing as a revenue generator. Oram shares his thoughts on how banks can adopt a customer-centric approach to marketing and drive revenue growth through effective engagement and tactical interventions.

The conversation concludes with a discussion on the challenges associated with breaking data silos and HDFC’s steps towards achieving an ideal org structure. Oram also shares his thoughts on the traditional banks vs. fintech startups battle and what drives him in the BFSI industry.

This episode provides valuable insights on the role of MarTech in the BFSI industry and the need for banks to adopt a customer-centric approach to stay relevant in the market. With practical advice and real-world examples, it is a must-listen for anyone interested in retention marketing in BFSI.