About Banksathi

BankSathi is a financial advisory platform that empowers individuals—especially across tier 2, 3, and rural India—to become financial advisors. With over 2 million advisors and 60 lakh customers, it enables grassroots entrepreneurs to recommend products like savings accounts, credit cards, and personal loans to their networks.

When a Human Voice Beats Every Offer

Many users at BankSathi had once been active, earning through the platform and trusting the process. But somewhere in the noise, they fell silent. Instead of chasing them with urgency or discounts, BankSathi took a bold, empathetic route—using voice notes that felt real and personal.

Built on WebEngage, the campaign automated audio messages tailored to each user—triggered on WhatsApp based on behavior, language, and product preference. No bots, no templates. Just a voice that said: “We remember you.”

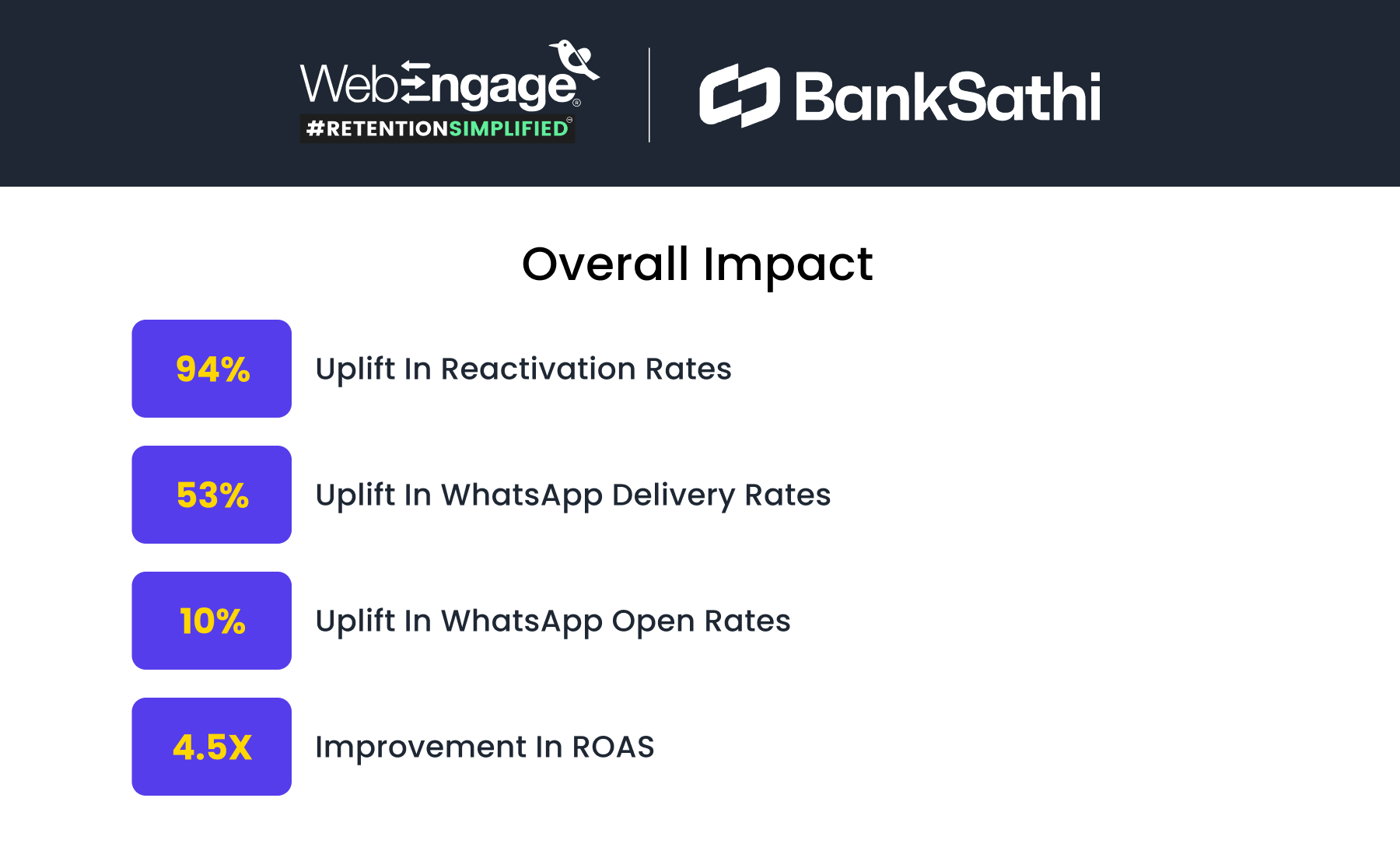

Results?

The Challenge: Dormant Value

• A large set of previously active users had stopped engaging for 4–6 months. These weren’t cold leads—they knew the platform, had earned from it, but weren’t returning.

• Now the real hurdle wasn’t strategy—it was execution.

• Fragmented tools. Long lead times to experiment. No way to personalize at scale without tech dependence.

• BankSathi needed to shift from one-size-fits-all to one-to-one, without slowing down.

• Rather than push product messages, BankSathi focused on one thing: make the message feel like it was meant for them.

Key Insight: These users already understood the value proposition—they needed reconnection, not re-education.

From Cold Segments to Conversations That Clicked

Instead of using discounts or spammy nudges, BankSathi reframed its outreach philosophy:

• Talk to the user, not at them.

• Use voice—not as a channel, but as a bridge.

• Scale trust like you scale code.

How it worked:

• Behavior-Based Segments: Built using inactivity, preferred product, signup source, and geography.

• Custom Attributes: Gender, name, product interest, and language used to drive contextual content.

• Audio Messaging: Friendly, human voice notes sent in Hinglish on WhatsApp.

• Journey Designer: Automated, multi-step flows triggered based on user behavior—reply, click, or silence.

The Hidden Transformation: From Reactive to Proactive CRM

WebEngage didn’t just help BankSathi run a campaign—it reshaped their marketing motion:

• Manual & Reactive CRM

• Real-time & Proactive CRM

• Funnels and cohorts now drive everyday experimentation

• Journey Designer is used to run 1:1 personalization without delays

• RCS, SMS, and Email are explored as new channels, unified under one platform

• No Engineers Needed: Every iteration, experiment, and flow built and optimized without tech handoffs

Why It Worked: Human Connection at Scale

• Right message, right moment

• Powered by behavior-triggered logic

• Human tone over brand voice

• Recorded messages made users feel remembered

• Hyper-personalization at scale

• Thanks to WebEngage’s flexible journey builder

The campaign succeeded by prioritizing authentic human connection over traditional marketing tactics, proving that sometimes the most effective technology is the one that feels least like technology.

Why WebEngage Was the Right Partner

The Challenge

• Fragmented automation & reporting in legacy tools

• Slow implementation cycles

• Limited personalization capabilities

The Solution

• WebEngage offered faster go-lives, flexible journeys, and deep behavioral modeling

• A single stack for personalization, reporting, and omnichannel messaging

We wish BankSathi all the best and hope to be there for all their endavors.