What is RFM Analysis?

One of the founding tenets of modern marketing is a widely used concept of Segmentation, Targeting, and Positioning. STP has stood the test of time to stay relevant in these ever-evolving, dynamic times.

At an elementary level, segmentation is the core of all successful marketing campaigns. Using segmentation, you divide your audience into homogenous groups in order to send them relevant communication that resonates with them.

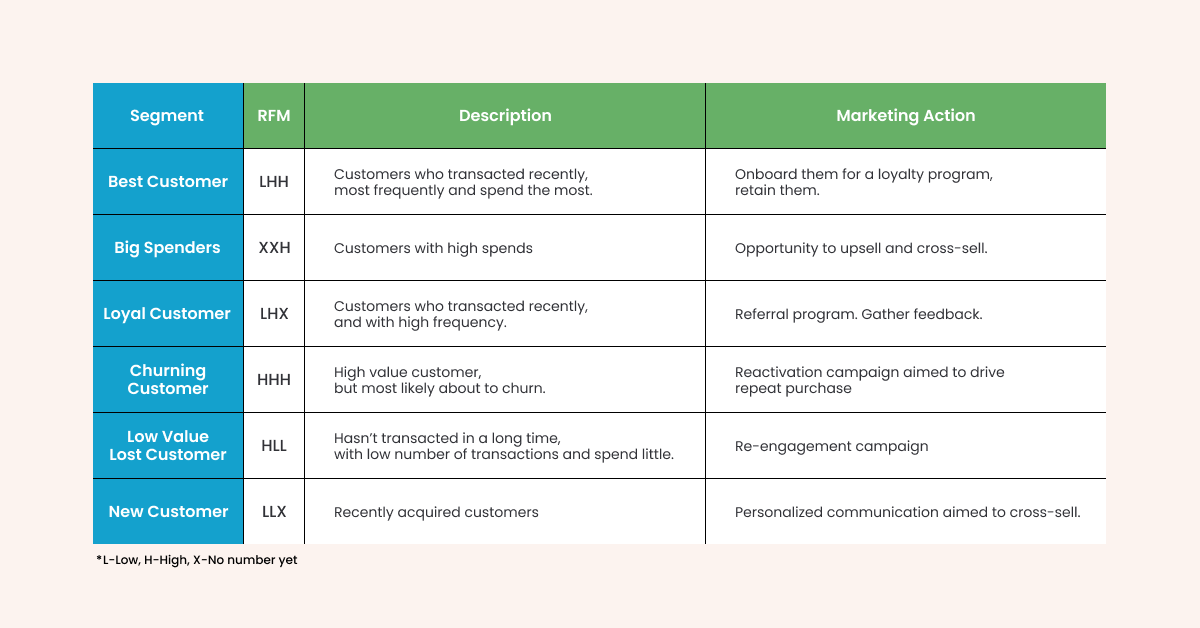

One such data-backed segmentation technique is RFM (Recency – Frequency – Monetary) segmentation; through RFM analysis, you can segment your customers into buckets like best customers, loyal customers, big spenders, lost customers, etc., much needed for customer lifecycle segmentation and marketing.

RFM customer segmentation gained significant popularity in the retail industry as such businesses capture the purchase data needed to segment customers using RFM.

Let’s get down to understanding RFM (Recency – Frequency – Monetary) & how they work:

Recency: [Time since last transaction]

Time elapsed since the last interaction a customer had with your business. Often, purchase is considered as interaction, but there are activities like site visits and email openings also taken as reference. Generally, the more recent the interaction, the more responsive the customer is to your communication.

Frequency: [Number of transactions]

The number of interactions a customer had within a specified period. It is a good indicator for distinguishing one-time buyers from repeat buyers. Moreover, customers who are frequent buyers are likely to be more engaged and satisfied with your business.

Monetary: [Average Order Value per transaction]

The contribution per transaction performed by a customer towards the top line of a business. It is used to categorize high-value purchasers from low-value purchasers. For this fundamental reason – heavy spenders should be treated differently from the ones who spend little.

Want to know how Sulekha.com increased its CLV by 3X? Check out this case study!

Benefits of implementing RFM Analysis within customer lifecycle segmentation and marketing campaigns

RFM (Recency, Frequency, Monetary) analysis offers many benefits that can significantly enhance marketing strategies and customer relationship management. Here are some key advantages of implementing RFM analysis in your business:

Enhances customer segmentation

RFM analysis allows for precise customer segmentation based on purchasing behavior. By categorizing customers into distinct groups based on recency, frequency, and monetary value, you can tailor your marketing efforts more effectively, ensuring that the right message reaches the right audience.

Helps identify valuable customers

RFM helps in pinpointing your most valuable customers – those who buy frequently, spend more and have interacted with your business recently. This lets you focus your resources and marketing efforts on retaining these high-value customers.

Improves customer retention

By understanding your customers’ purchasing patterns, RFM analysis aids in developing strategies to increase customer retention. It helps in identifying at-risk customers, allowing you to take proactive steps to re-engage them before they churn.

Optimizes your marketing spending

RFM analysis provides insights into which customers are worth investing in, helping you allocate your marketing budget more effectively. This ensures that your marketing spend is directed towards the highest return segments.

Enhances Customer Lifetime Value (CLV)

By focusing on customers who are more likely to make repeat purchases, RFM analysis helps in increasing the CLV. It enables businesses to nurture their relationship with loyal customers, encouraging them to continue their patronage.

How to calculate RFM metrics

For implementing RFM segmentation analysis, it is recommended to use data for a longer time frame. For upstarts, it could be since the inception of the business. The time frame also depends on the nature of the product category. Let’s illustrate the same with examples: recency of purchase for consumer durables is different from recency for consumables. Likewise, it is inappropriate for a subscription-based product to sub-categorize the recency in days when the subscription is a minimum for a quarter.

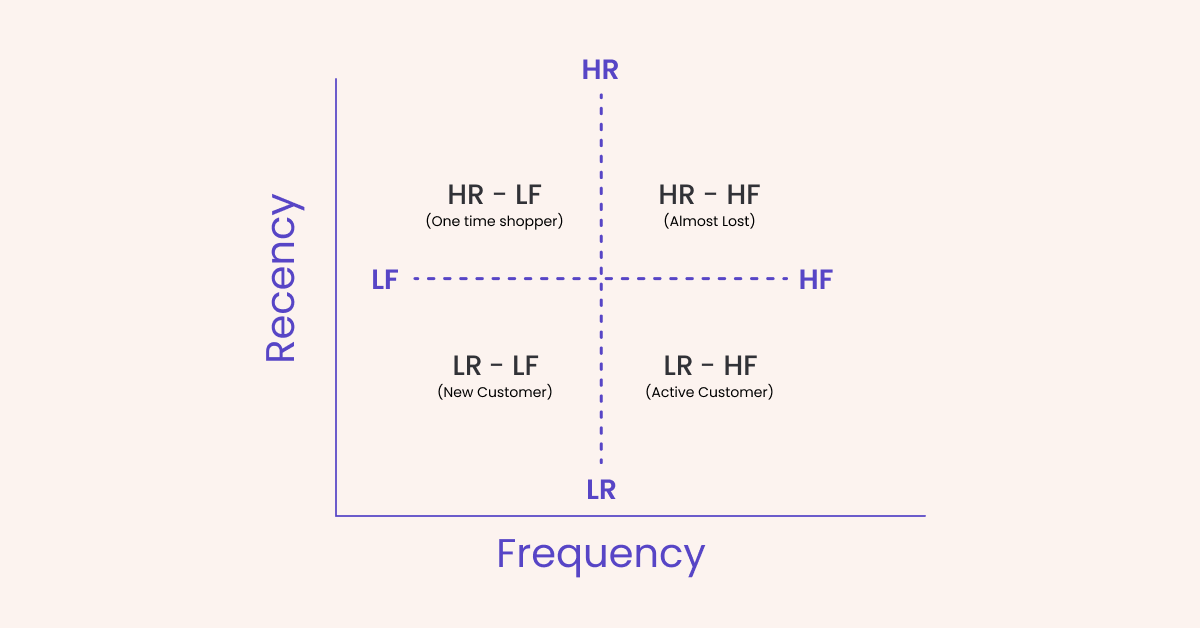

Not setting the time frame correctly may lead to skewed data and misrepresentation. If the time window is set too low, the repeat buyers will fall into new customers (LR-LF). For the analysis to make sense, data for a considerably longer time frame is required.

Step One

These are the basic datasets you need to begin with RFM customer segmentation:

1. Transaction Identifier,

2. Transaction Date,

3. Transaction Value,

4. Customer identifier.

Using the data from the above transaction variables you’ll be able to get:

1. The count of days elapsed since the last purchase date.

2. The accumulated number of transactions for each customer (count of transaction ID mapped by customer ID).

3. The accumulated value of transactions for each customer and hence average transaction value.

Step Two

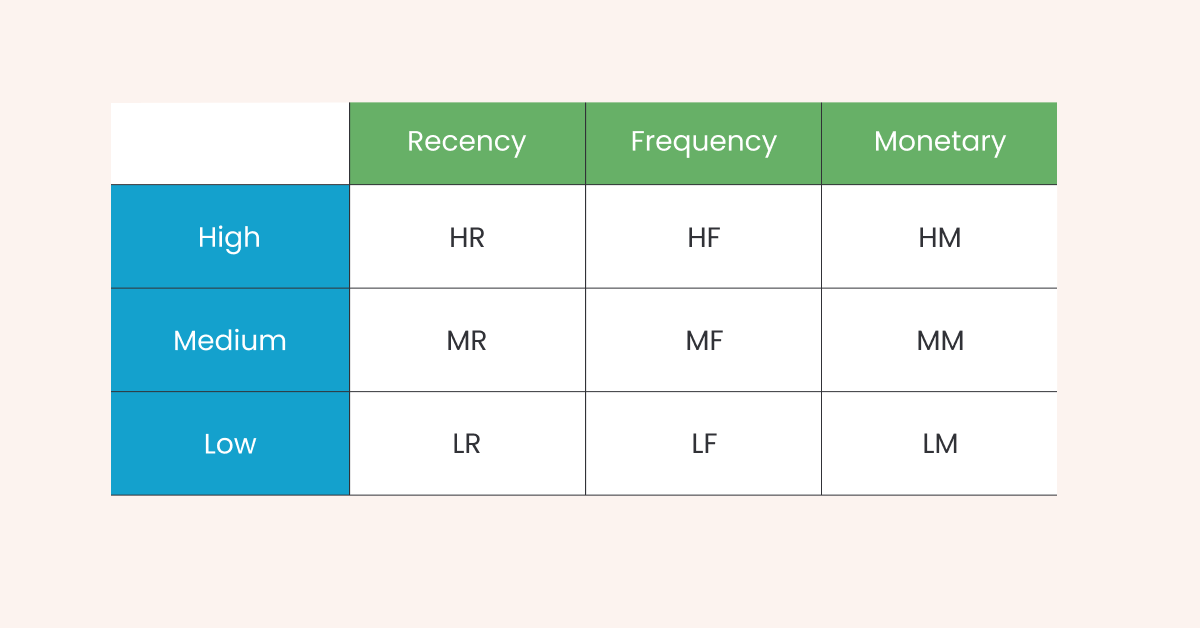

Next, you need to sub-categorize data further to define different buckets for each variable.

Depending on the volume of data, nature of repeat purchases, and variation in average ticket size, you can choose to define buckets based on Quartiles or even Deciles. For the sake of simplicity, we have decided to define three values – High, Medium, and Low to each of the dimensions -Recency, Frequency, and Monetary. The three values make a total of 27 combinations (3x3x3) for RFM analysis.

Note that recency is defined in a counter-intuitive manner that considers HIGH to represent a long time since the last transaction and a LOW recency for a recent transaction. Consider customer A, who transacted 180 days before, and customer B, who transacted just 15 days before. ‘A’ will have High and ‘B’ Low Recency.

Step Three

Using RFM analysis you’ll be able to categorize customers into different buckets.

Recency (R): This metric measures how recently a customer made a purchase. To calculate it, identify the date of a customer’s last purchase and subtract it from the current date. The shorter the time interval, the higher the recency score. Recency is often measured in days, but depending on the business model, it can also be calculated in weeks, months, or even years.

Frequency (F): Frequency assesses how often a customer makes a purchase within a given time frame. To calculate this, count the number of purchases made by a customer in a specific period. A higher frequency indicates greater customer loyalty and engagement.

Monetary Value (M): This metric represents the total amount of money a customer has spent over a period. Calculate it by adding up all the purchase amounts made by a customer. Customers who spend more are generally considered more valuable.

Scoring RFM Metrics

After calculating these values, customers are typically scored on a scale for each metric, often from 1 to 5 (with 5 being the highest). The scoring can be done based on quintiles or other statistical methods to segment customers into different groups.

Let’s take an example of a customer, Riya, who has made several purchases from an online store over the past year. We will calculate her RFM scores based on her transaction history.

Transaction history of Riya:

Last purchase date: March 1, 2023

Number of purchases in the last year: 8

Total amount spent in the last year: ₹12,000

Current date for calculation: June 1, 2023

Step 1: Calculating Recency (R)

Recency is calculated as the number of days since the last purchase.

Last purchase date: March 1, 2023

Current date: June 1, 2023

Days since last purchase: 92 days (March to June)

Recency Score: If we assume a scoring system where a score of 5 is for customers who purchased within the last 30 days, 4 for 31-60 days, and so on, Riya’s Recency score would be 2 (as her last purchase was 92 days ago).

Step 2: Calculating Frequency (F)

Frequency measures how often Riya has made purchases in a given period (last year).

Number of purchases in the last year: 8

Frequency Score: If the scoring system is such that a score of 5 is for customers with more than 10 purchases, 4 for 7-9 purchases, and so on, Riya’s Frequency score would be 4.

Step 3: Calculating Monetary Value (M)

Monetary Value is the total amount spent by Riya in the last year.

Total amount spent: ₹12,000

Monetary Score: Assuming a scoring system where a score of 5 is for spending over ₹15,000, 4 for ₹10,000-₹14,999, and so on, Riya’s Monetary score would be 4.

Combining RFM Scores

Once individual scores are assigned for Recency, Frequency, and Monetary metrics, they are combined to form an RFM score for each customer. This score can be a simple concatenation of the three scores (e.g., 5-4-3) or an average, depending on the business’s analytical approach.

In the above example, Riya’s individual RFM scores are R=2, F=4, M=4. Her combined RFM score can be represented as 2-4-4.

Utilizing RFM Scores

With these scores, businesses can segment their customers into various categories, such as VIPs, loyal customers, potential loyalists, at-risk customers, and more. This segmentation allows for targeted marketing strategies, personalized communication, and efficient allocation of marketing resources.

In the case of Riya, Frequency and Monetary Scores of 4 suggest that she is a frequent buyer and spends a significant amount, indicating high value and potential for loyalty programs or upselling opportunities. However, a Recency Score of 2 indicates that Riya hasn’t purchased recently, which might place her in a segment that needs re-engagement strategies.

For a customer like Riya, the store might consider sending re-engagement emails or special offers to encourage her to make a purchase soon. Since her Frequency and Monetary scores are high, personalized product recommendations or exclusive deals could be effective in increasing her purchase frequency and amount.

RFM Use Cases

To further showcase the importance of an RFM segmentation strategy for your business, let’s explore a few use cases for a few industries:

BFSI (Banking, Financial Services, and Insurance):

Use Case: Customer Churn Prediction

In the BFSI industry, RFM marketing could be used to segment customers based on their transaction frequency, recency of interactions, and monetary contributions. This segmentation could help predict potential churners, allowing financial institutions to engage these customers proactively with personalized offers and services to retain their business.

EdTech (Education Technology):

Use Case: Course Engagement Analysis

In the EdTech industry, RFM analysis could help assess the engagement level of students taking online courses. By analyzing the recency of logins, frequency of course interactions, and monetary contributions (such as course purchases), EdTech platforms can identify highly engaged users and tailor their learning experience to increase satisfaction and retention.

E-commerce/D2C (Direct-to-Consumer):

Use Case: Personalized Product Recommendations

For e-commerce and D2C businesses, RFM analysis can be used to segment customers based on their purchase behavior. By understanding recency, frequency, and monetary spending, businesses can create targeted marketing campaigns and offer personalized product recommendations, enhancing the overall shopping experience and driving higher conversions.

Media & Entertainment:

Use Case: Content Consumption Strategy

In the media and entertainment industry, RFM analysis can be employed to analyze how users engage with different types of content. By evaluating the recency of content consumption, frequency of visits, and any monetary contributions (e.g., subscriptions), companies can optimize their content distribution strategy to increase user engagement and subscription renewals.

Travel & Hospitality:

Use Case: Loyalty Program Enhancement

For travel and hospitality businesses, RFM analysis can help segment customers based on their travel behavior. This information can be used to enhance loyalty programs by offering exclusive perks and rewards based on recency of bookings, frequency of travel, and total spending, thereby incentivizing repeat bookings.

Gaming:

Use Case: In-game Purchase Optimization

In the gaming industry, RFM analysis could be applied to segment players based on their in-game activities. By evaluating the recency of gameplay, frequency of logins, and monetary spend on in-game purchases, game developers can create targeted promotions and offers to encourage players to make more purchases, leading to increased monetization.

Master RFM customer segmentation for enhanced customer engagement and growth.

RFM – Variations and Limitations

Variations of RFM include RFD and RFE, replacing Monetary Value with Duration and Engagement, respectively. These variations are generally used by content websites that value metrics like time spent and viewership on their platform.

RFM segmentation focuses on just three variables, while others could be critical for a business. Another downside of RFM customer segmentation is it only takes historical data points into consideration, while there are advanced techniques like predictive analytics that use AI to predict future customer behavior.

Take your marketing to the next level with real time analytics offered by WebEngage. Book a demo to know more.

FAQ

What is RFM in consumer behavior?

RFM (Recency, Frequency, Monetary) analysis is a marketing technique used to understand and categorize consumer behavior based on their transaction history. It’s a method that segments customers according to how recently they made a purchase (Recency), how often they make purchases (Frequency), and how much money they spend (Monetary Value). This segmentation helps businesses tailor their marketing strategies to different customer groups, enhancing customer engagement and increasing sales.

What is a good RFM score?

A good RFM (Recency, Frequency, Monetary) score is a relative measure and depends on a business’s specific context and goals. However, in general, higher scores in each RFM component indicate better customer engagement and value.

Let’s break down what constitutes a good score in each category:

Recency (R)

A high recency score means the customer has made a purchase recently.

Good Score: Typically, a score of 4 or 5 is considered good. This might mean the customer has made a purchase within the last 30 days or a similarly short period, indicating active engagement with the brand.

Frequency (F)

A high Frequency score indicates the customer makes purchases often.

Good Score: A score of 4 or 5, where the customer is making purchases more frequently than the average customer, often signifies loyalty and regular engagement.

Monetary (M)

A high monetary score suggests the customer spends a significant amount when they make a purchase.

Good Score: Again, a score of 4 or 5 is ideal. This might represent customers who spend above a certain threshold,

such as being in the top 20% of spenders.

Are RFM models good?

RFM (Recency, Frequency, Monetary) models are considered highly effective in marketing and customer relationship management. RFM marketing allows businesses to segment their customers into distinct groups based on their transaction history. This RFM segmentation is crucial for personalized marketing and targeted communication.

Diksha Dwivedi

Diksha Dwivedi

Surya Panicker

Surya Panicker