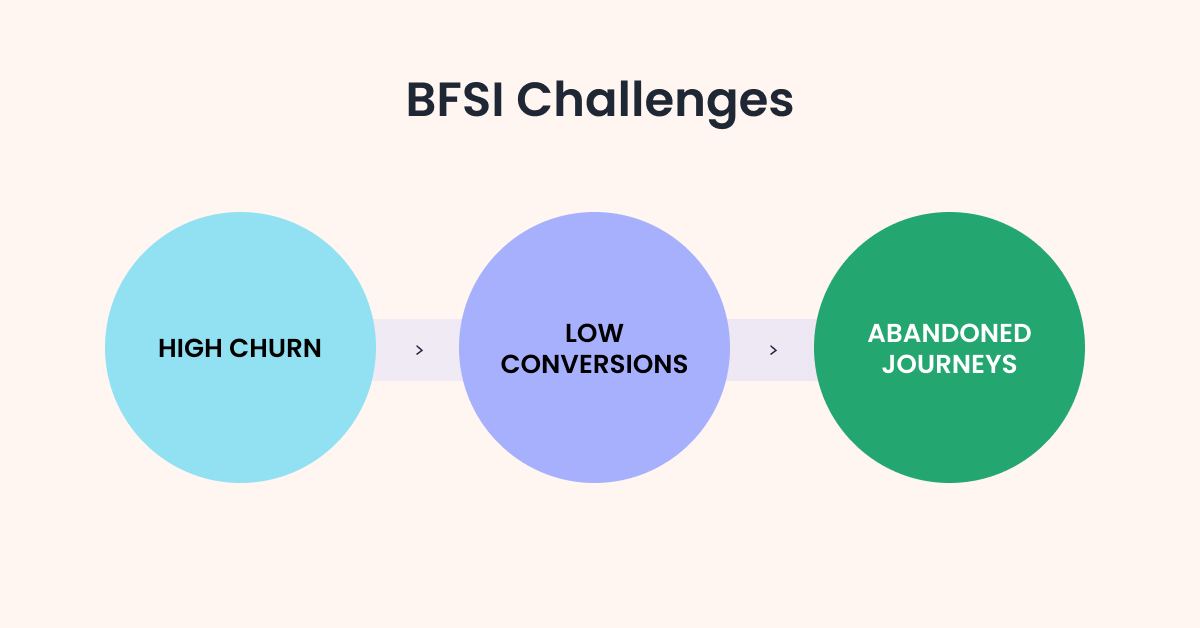

Customer engagement is a top priority for Banking, Financial Services, and Insurance (BFSI) brands, but issues like high churn, low conversions, and abandoned journeys make it tough to sustain growth. How can you overcome these challenges and turn them into opportunities?

WebEngage has collaborated with BFSI leaders like Acko, Angel One, RangDe, and CASHe, using data-driven strategies to tackle these exact pain points. This blog gets into how our solutions transformed these challenges into measurable business growth, highlighted through compelling Impact Stories™.

Use Case 1: Streamlining KYC: How CASHe and RangDe Optimized Conversions

Know Your Customer (KYC) is a foundational step in customer onboarding and long-term engagement, not merely a compliance requirement. Efficient KYC processes can cut onboarding time by 80%reduce abandonment rates by up to 60%, and save up to 35% to 60% on compliance costs, all while boosting customer satisfaction by 70%.

According to Delta Capital, the average onboarding time in financial institutions is around three weeks, with a first-time quality control pass rate of 76% and an abandonment rate of 23%.

The challenge fintechs face is streamlining this process without compromising on accuracy, leading to reduced friction for customers and increased conversions.

How KYC Conversion Boosted CASHe’s Customer Base

CASHe, a fintech platform offering consumer lending solutions, faced a significant challenge with user drop-offs during the KYC and profile completion processes. To counter this, WebEngage implemented omnichannel campaigns utilizing SMS, email, push notifications, and Interactive Voice Response (IVR). This multifaceted approach encouraged users to complete their profiles.

CASHe’s KYC Conversion Boost:

- 47% growth in Monthly Active Users (MAUs) over a year

- 35% of users nudged via IVR progressed further in the sales funnel

- 75% increase in the repeat user base

This data-driven approach resulted in a seamless onboarding experience, driving both new customer acquisitions and increased customer retention.

How Email Campaigns and User Segmentation Boosted RangDe’s KYC Conversion

RangDe, India’s first peer-to-peer social lending platform, aimed to simplify financial inclusion by offering affordable credit to underserved communities. However, the platform struggled with low conversion rates from signups to KYC completions. WebEngage’s targeted email campaigns and user segmentation helped boost conversions significantly.

RangDe’s KYC Conversion Lift:

- 26.6% increase in average email open rates

- 7.7% rise in ‘Signup to KYC’ conversions

- 26% growth in monthly active users over five months

By improving user journeys and sending timely nudges, RangDe saw a marked improvement in KYC completions and overall user engagement.

Use Case 2: How did Angel One and CASHe Keep Users Hooked with Their Engagement Tactics?

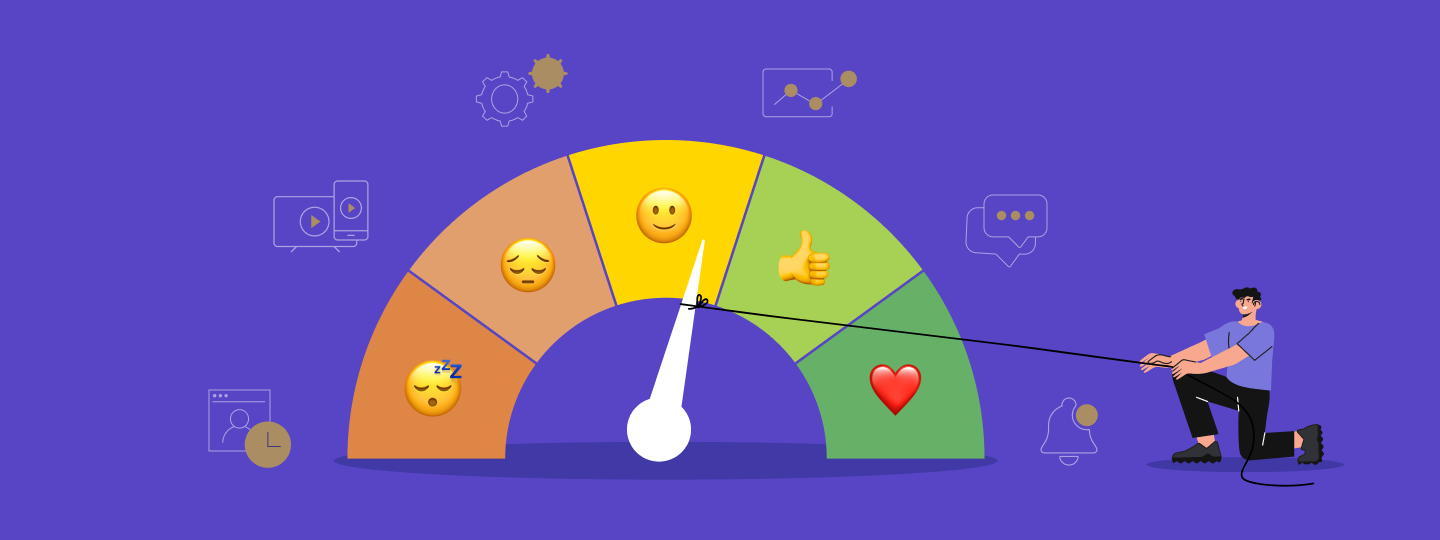

User engagement, especially in the fintech industry, is pivotal for retaining customers and driving long-term loyalty. According to Galaxy UX, a Daily Active Users (DAU) rate of 20% indicates strong engagement. Apps that average over eight minutes per session demonstrate a deeper connection with users, which often translates into higher conversion rates.

For fintech platforms, improving engagement goes beyond keeping users active; it’s about ensuring every interaction adds value.

How Did Angel One’s Transform it’s User Engagement?

Angel One, a leading retail stockbroking company in India, needed to enhance user engagement and convert website visitors into active users. WebEngage deployed push notifications, personalized content, and multilingual campaigns to localize the user experience, which resulted in a significant increase in lead closure rates.

Angel One’s Engagement Transformation:

- 2X increase in conversions within six months

- 17% month-over-month lead closure rate

- 50+ users re-enabled communications via web push notifications

The use of targeted notifications and rich content allowed Angel One to build a stronger connection with their audience, increasing both user activity and conversions.

How CASHe Enhanced User Engagement Using Personalized and Omnichannel Approach

CASHe also focused on improving user engagement to drive growth. By using WebEngage’s omnichannel campaigns, CASHe reactivated inactive users and provided personalized communication through channels like email, SMS, and push notifications. This engagement strategy not only brought back users but also improved their overall experience.

CASHe’s User Engagement Surge:

- 47% growth in Monthly Active Users (MAUs) over a year

- 75% increase in repeat users

The personalized and omnichannel approach effectively re-engaged users, enhancing their overall experience and driving growth.

Use Case 3: Turning Users into Loyalists: Retention Success Stories from Acko and CASHe

Customer retention is often the most cost-effective way to grow a business. For the financial services sector, the average customer retention rate is 78%, with banking retention slightly lower at 75%. Retaining customers translates into higher lifetime value, reduced churn, and more predictable revenue streams.

Acko’s Customer Retention: Leveraging Automated Customer Journeys for Success

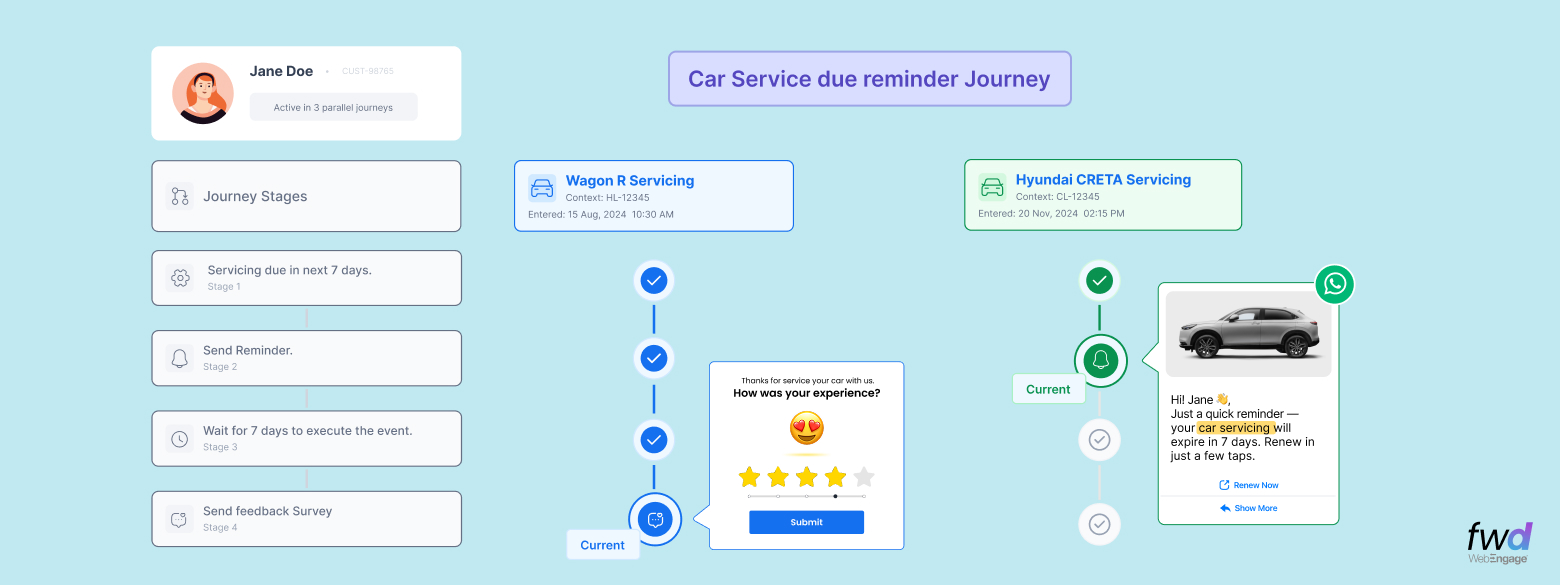

Acko, a leading digital insurance provider in India, known for its innovative offerings like zero-commission insurance and a fully digital claims process, struggled with managing its lead data and re-engaging existing policyholders. With WebEngage, Acko automated customer journeys using win-back campaigns and multi-channel reminders, which significantly improved policy renewals.

Acko, a leading digital insurance provider in India, known for its innovative offerings like zero-commission insurance and a fully digital claims process, struggled with managing its lead data and re-engaging existing policyholders. With WebEngage, Acko automated customer journeys using win-back campaigns and multi-channel reminders, which significantly improved policy renewals.

Acko’s Retention Success:

- 14.76% lead conversion rate to policyholders

- 17.32% increase in policy renewals

- 2X reduction in human hours for policy management

Acko’s ability to automate user engagement processes not only saved time but also improved customer satisfaction, leading to higher retention rates.

CASHe’s Retention Strategy: Personalized Journeys and Targeted Re-engagement Campaigns

CASHe’s faced a challenge with their older customer base gradually becoming inactive, which threatened to impact their growth trajectory. WebEngage helped reactivate these users through personalized journeys and targeted re-engagement campaigns.

By focusing on retention, CASHe not only saw a significant uplift in customer activity and repeat transactions but also experienced a positive impact on their revenue streams. Retaining existing customers proved to be more cost-effective than acquiring new ones, leading to:

Impact at a Glance for CASHe:

- 26% rise in Monthly Active Users (MAUs)

- 7.7% increase in user retention

By focusing on personalized communication and re-engagement strategies, CASHe successfully revitalized its older customer base, significantly improving customer activity and repeat transactions.

Driving Success Through Data-Backed Engagement

For BFSI companies, customer engagement is the key to long-term success. Through WebEngage’s solutions, brands like Acko, Angel One, CASHe, and RangDe have seen significant improvements in conversions, retention, and user engagement.

By leveraging data-driven strategies, these brands have been able to achieve significant improvements in their key performance indicators. Their Impact Stories™ serves as a testament to the effectiveness of data-driven marketing in the BFSI sector, even in rapidly evolving market conditions.

Interested in improving your BFSI business’s customer engagement and retention?

Learn more about WebEngage’s solutions and how they can help your brand achieve similar success. [Request a Demo Today!]

FAQ Section:

Q1: Why is KYC conversion so important for fintech platforms?

KYC conversion is critical because it ensures the proper verification of users, minimizes onboarding friction, and reduces abandonment rates, all while ensuring compliance.

Q2: How can fintech platforms improve user engagement?

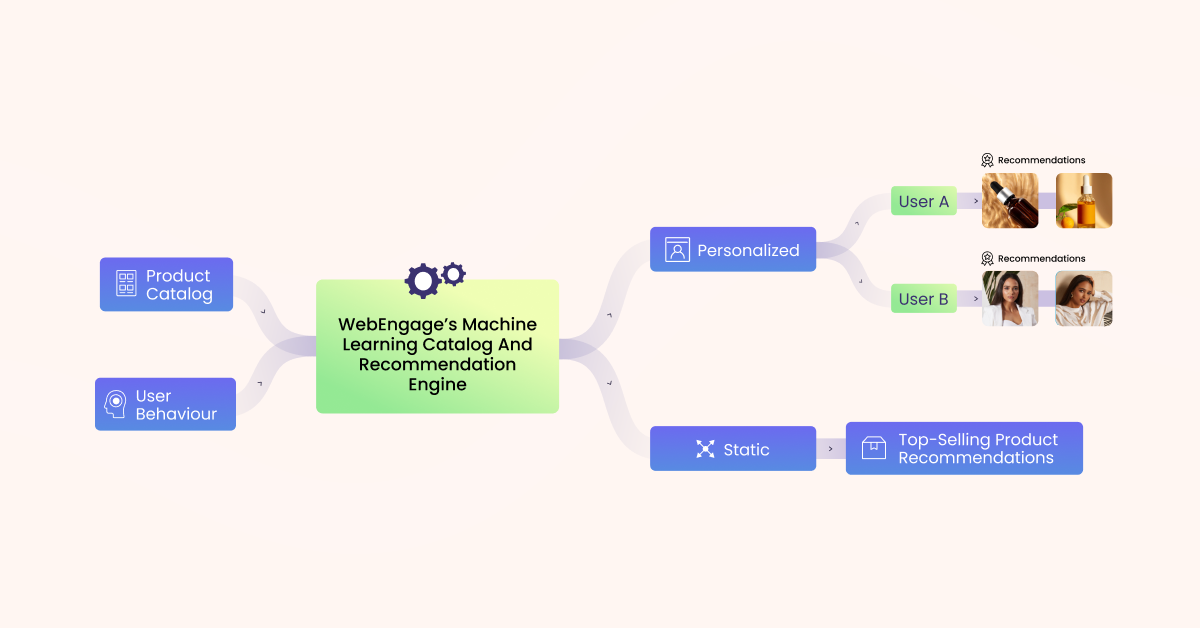

Fintech platforms can boost engagement by using personalized content, timely push notifications, and an omnichannel approach to provide value-driven, meaningful interactions.

Q3: What is a good retention rate for fintechs?

The financial services industry sees an average customer retention rate of 78%, with banking retention around 75%. Aiming for a rate within or above this benchmark indicates strong customer loyalty.

Q4: How can automation improve customer retention?

Automation streamlines customer communication sends timely reminders, and enables personalized re-engagement campaigns, reducing manual efforts and improving efficiency.

Q5: How can WebEngage help BFSI companies increase conversions?

WebEngage uses personalized campaigns, behavioral segmentation, and automated journeys to engage users at the right time and drive higher conversions.

Q6: What role does automation play in WebEngage’s solutions?

Automation helps streamline customer journeys, reduce manual intervention, and ensure timely communication, leading to improved customer experiences and operational efficiency.

Q7: How does WebEngage assist BFSI brands in reducing user abandonment?

WebEngage uses omnichannel campaigns, including IVR, push notifications, and emails, to recover users who abandon key processes like onboarding or transactions.

Harshita Lal

Harshita Lal

Manoj Chawda

Manoj Chawda

Inioluwa Ademuwagun

Inioluwa Ademuwagun