Ensuring borrowers meet their Equated Monthly Installments (EMIs) is not just a critical financial consideration; it’s also a key factor in maintaining strong borrower-lender relationships. Several studies have found that a majority of borrowers tend to falter on their repayments, leading to penalties and disruption in the loan availed.

Guaranteeing timely EMI payments is a constant challenge faced by many lending institutions, be it peer-to-peer lending platforms, small finance banks, or nationalized ones.

This challenge arises from various factors, such as borrower financial constraints, changing economic circumstances, and individual repayment behaviors. Lending institutions need to adapt their strategies to accommodate these diverse challenges.

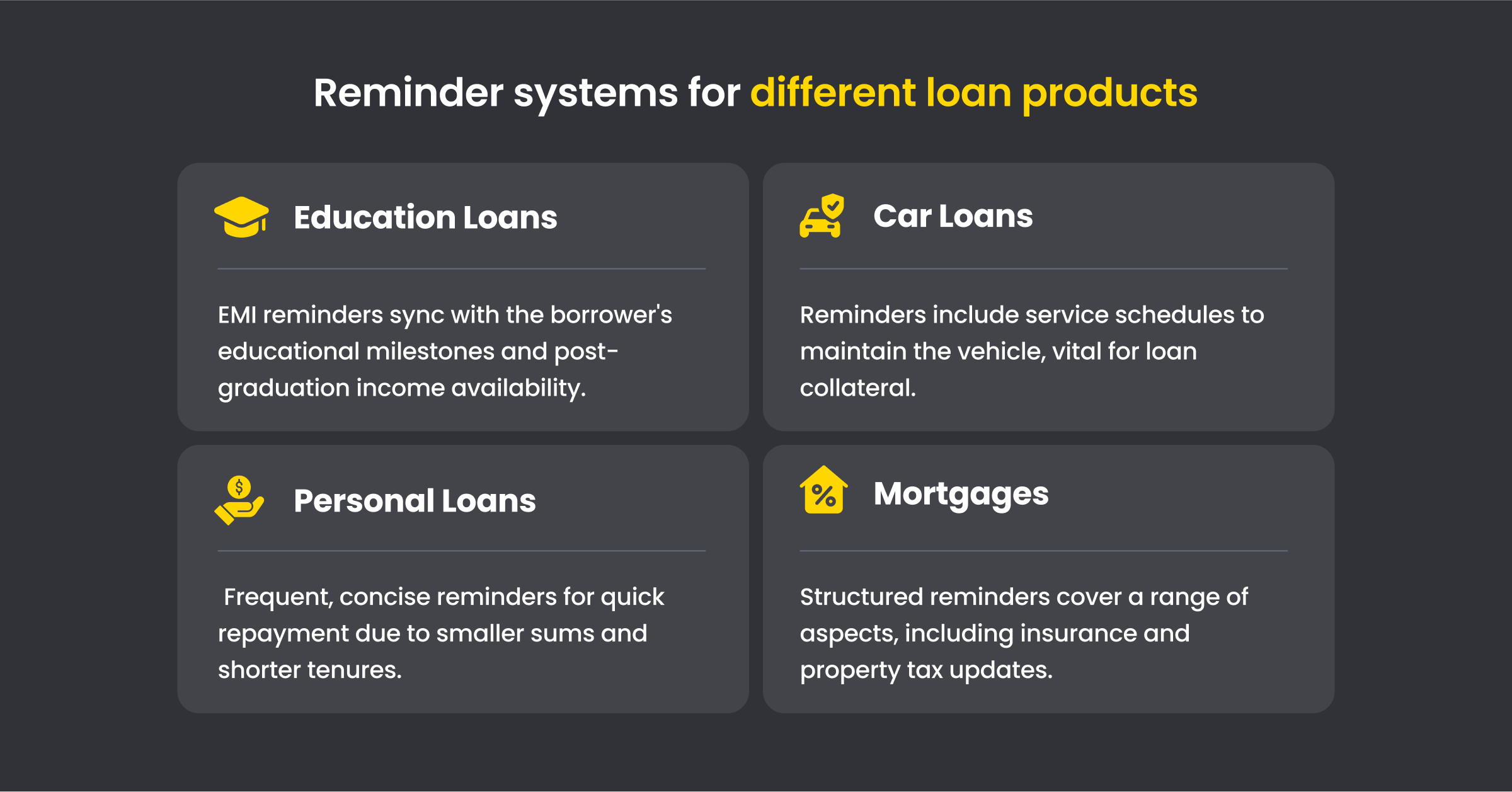

However, the approach to EMI reminders varies across different lending models and loan product types.

Let’s take a closer look into these EMI reminders and how they are customized to suit various lending models and loan products:

P2P Lending: Peer-to-peer lending platforms connect individual lenders with borrowers. EMI reminders in this model often require a more personal touch, given the peer-to-peer nature of the transactions.

Consumer Lending: Traditional consumer lending institutions often employ automated EMI reminder systems, which are more uniform and structured. These reminders ensure regular repayments, focusing on maintaining a low default rate and steady cash flow.

Co-Lending: This partnership between banks and NBFCs merges traditional and alternative lending. EMI reminders adopt a dual approach, where each lender may use different communication strategies. Ensuring coordination and consistency is crucial in these situations.

Here’s a quick glimpse of different loan products and their reminder systems:

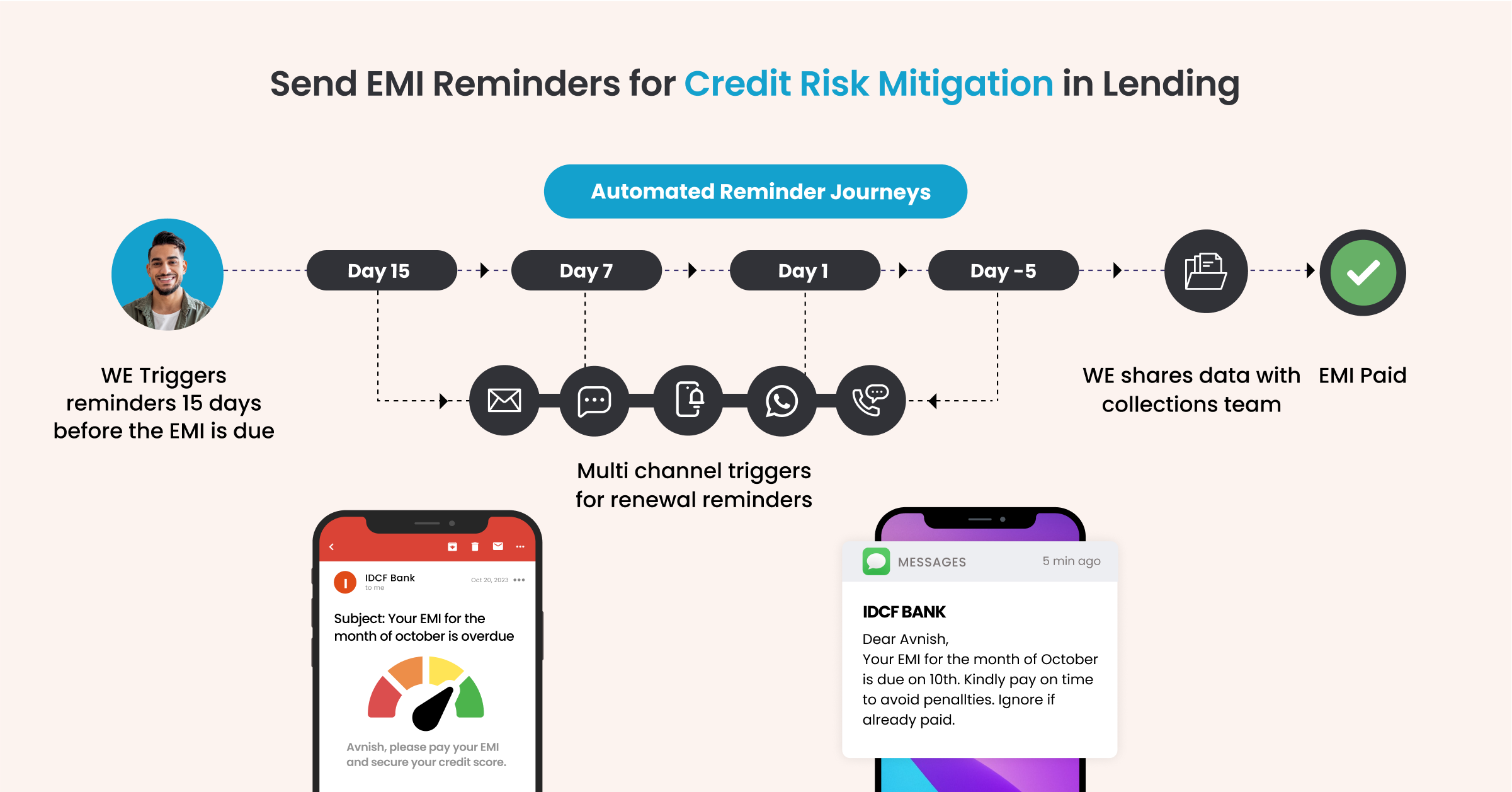

With user attention scattered across the digital clutter, the question is- what can your lending businesses do differently to improve their collection rate?

Answer: Set up automated omnichannel collection reminders.

In this post, we tell you why and how to get started.

Shortcomings of Traditional Lending Reminder Systems

In a rapidly evolving digital landscape, here’s why relying heavily on the generic or mass blast of text or email reminders is no longer an effective strategy for your lending business:

1. Overwhelmed by Spray Campaigns

In an era where everyone’s inundated with notifications – from app updates to promotional offers – crucial EMI reminders can get lost in the shuffle. For you, this means that borrowers who deal with a barrage of digital information daily can easily overlook a generic SMS or email EMI reminder. This risks late payments and strains lender-borrower relations.

2. A One-Channel Approach Doesn’t Fit All

As a lending firm, your customers range from tech-forward enterprises to tech-savvy individual borrowers. All these customers have diverse communication preferences.

For instance, Younger individual borrowers may prefer SMS, WhatsApp, or app notifications, while older businesses favor detailed emails or formal letters. Conversely, tech-forward enterprises opt for real-time platforms like WhatsApp, while traditional B2C corporations prefer personalized emails. Recognizing this diversity enables lenders to engage effectively, fostering trust and strengthening customer relationships.

3. More Than Just a Deadline Reminder

Today’s consumers, when borrowing, look for transparency and clarity. An alert that merely mentions a repayment date isn’t enough. Borrowers expect detailed instructions:

How can they initiate a transfer?

What are the bank details?

Is there an option for automated deductions?

Offering a comprehensive guide, including options for repayment methods like net banking, cheque submissions, or automated transfers, facilitates prompt payments and minimizes confusion.

The Power of Omnichannel Automated Reminders

Leveraging an omnichannel approach for EMI reminders goes beyond mere notifications. It offers a strategic blend of engagement, customization, and clarity that traditional methods can’t match.

1. Enhanced Engagement

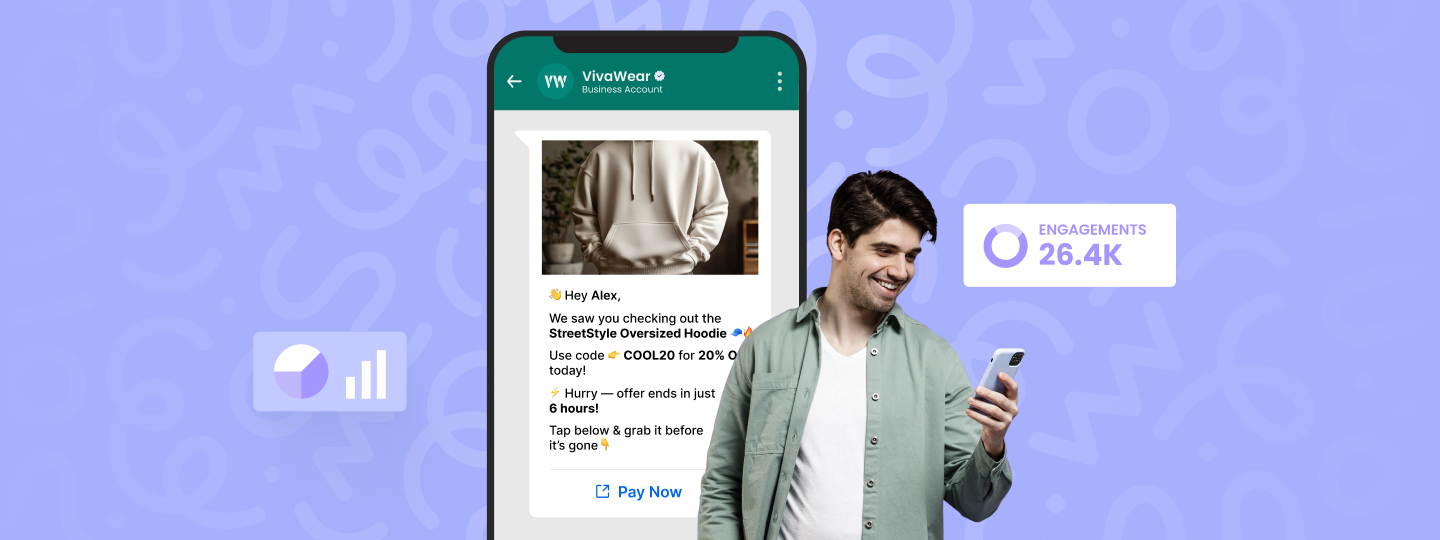

As consumers become increasingly mobile-dependent, automated Whatsapp and app push notifications serve as influential touchpoints. These channels penetrate the daily digital routines of customers, ensuring reminders aren’t just seen but acted upon. This level of engagement fosters timely payments, reducing the risk of missed deadlines.

2. Tailored Experiences

Modern lending platforms possess rich data on user behaviors and preferences. By harnessing this data, brands can segment users and create personalized experiences for their audience.

For instance, a consumer who regularly interacts with emails during business hours might find an email alert more effective. But a consumer who’s more active on messaging apps throughout the day may miss the email and be more responsive to the WhatsApp notification instead. This tailored communication ensures that the message reaches its audience and resonates with them.

3. Clear Call-to-Action

Clarity is crucial when it comes to financial transactions. Omnichannel reminders can be enhanced with distinct details – like the exact due date, penalty implications, and seamless next-step directives.

By guiding customers through their payment journey, from reminder to transaction completion, your lending institution can reduce friction and increase the likelihood of prompt EMI payments. Ensuring there is one clear call to action per message can further help improve positive outcomes.

Strategies to Mitigate Potential Default Risks

Being proactive and strategic can greatly impact repayment outcomes in the lending industry. Here’s how your lending business can reduce default risks:

1. Intelligent Predictions

Through sophisticated data analytics tools, you can identify nuances in customer behavior. Spotting trends suggestive of potential payment delays allows for timely interventions. Proactive measures, such as early reminders or specialized support plans, can decrease default likelihood significantly.

WebEngage utilizes advanced Machine Learning capabilities to analyze user data and identify patterns that are indicative of users’ activities in the future. This helps lending companies create segments of users with similar intents and actions – e.g., frequent borrowers, collection risk cohort, etc.- allowing them to run targeted campaigns based on the insights gained from the predictive segment feature.

2. Personalized Touchpoints

Upon identifying potential defaulters, you can engage them using a more personalized touch. Beyond generic reminders, you can send targeted notifications offering personalized repayment strategies or alternative financial solutions to match their current predicaments. Addressing their specific concerns with flexibility can enhance the probability of on-time payments.

3. Educative Communication

Educate your borrowers subtly about the ramifications of missed payments without resorting to aggressive measures. Clearly lay out subsequent steps post a missed payment, associated penalties, and available support avenues for their benefit.

For example, highlighting the importance of maintaining a good CIBIL score between 650-749 to avail better interest rates, access pre-approved loans, and other benefits can keep the lender on schedule without being too pushy.

However, It’s important to note that every communication needs to be tailored for every segment.

Let’s take a look at three different customer segments and the variations in their communication approach:

Dissatisfied Platform Users:

Approach: Address concerns empathetically, provide clear instructions, and offer dedicated support to transform negative experiences into positive ones.

Impact: Building trust and resolving issues promptly can prevent churn and enhance long-term customer loyalty and brand perception.

Regular Users

Approach: Maintain consistent communication to reinforce positive payment habits and offer occasional incentives to express appreciation for their continued business.

Impact: Sustained engagement ensures customer retention, strengthens brand loyalty, and cultivates a sense of reliability, leading to stable, long-term relationships with the lending institution.

Loyal Customers:

Approach: Recognize loyalty with proactive reminders and exclusive incentives to reinforce positive payment behavior and foster a strong, lasting connection.

Impact: Providing special rewards encourages continued loyalty, leading to positive word-of-mouth referrals and enhancing overall brand experience and customer satisfaction.

By tailoring the communication strategy based on these distinct segments, lending institutions can effectively address their customers’ needs, build trust, and encourage responsible financial behavior.

4. Proactive Customer Support

Offering an accessible and responsive customer support channel can be a game-changer. Sometimes, customers might be willing to pay but face technical or informational barriers. By providing immediate assistance through helplines or chatbots, you can address queries, resolve issues, and guide customers through the repayment process, reducing the chances of unintentional defaults.

For example, CASHe, India’s online credit lending app, increased its repeat user base by 75% setting up an omnichannel marketing strategy. Along with the existing channels (SMS, Email, and Push), the company also set up an IVR to engage dormant users who dropped out of the user journey without completing their profile and needed assistance.

The WebEngage Advantage for Lending Institutions

WebEngage emerges as a prefered tool for timely automated reminders, offering lending firms a blend of versatility and efficacy. Its omni-channel approach ensures that whether through email, SMS, Whatsapp, or app push notifications, clients are engaged where they’re most active. Moreover, by leveraging segmentation, WebEngage delivers tailored messages, ensuring each communication resonates deeply with its intended audience.

Beyond personalized outreach, WebEngage helps you to get a unified view of your customers activity, allowing to engage them across 12+ channels with automation workflows, and hyper-personalize their experiences with a state-of-the-art personalization engine, all backed by a solid analytics framework.

RangDe India’s first and pioneering social peer-to-peer (P2P) lending platform was able to increase its MAU by 26% within 5 months with WebEngage. With hyper-personalization and omnichannel marketing strategy, the company was able to improve open rate of campaigns and increase sign-ups.

Wrapping up

Traditional reminder systems fall short in today’s crowded digital environment where borrowers are inundated with notifications. In the fast-moving world of consumer finance, it’s essential for lending companies to revamp their communication strategies. By being where their customers are and truly grasping their evolving needs, they can forge meaningful connections that stand the test of time. Using data analytics and proactive support, lending institutions can reduce default risks and improve relationships with borrowers.

With WebEngage, you can achieve these goals effectively. We has helped 800+ brands to personalize their communication across channels, enabling customer journeys that lead to higher engagement and conversions.

To learn about how leading lending companies are approaching omnichannel communication with personalization, book a quick demo with our experts today.

Diksha Dwivedi

Diksha Dwivedi

Prakhya Nair

Prakhya Nair