The insurance tech space is one of the fastest-growing sub-segments in the insurance market, progressing at a CAGR of 8%. With 59 brands operating in the same field, the competition to win customers is fierce.

Each day, brands are pushed to figure out newer ways to find customers with higher LTV – spending lakhs on digital ads, hosting offline campaigns, pitching to customers at 3rd party showrooms, etc.

But the thing is, customer lifetime value is a solid bottom-line driver and not something to be overlooked.

Data by Business.com says returning customers spend ~67% more than new customers. The retention-led approach leads brands to consistent, defendable growth. It solidifies customer experience and nurtures leads when they’re already on the inside. Here’s an example:

Imagine you’ve recently purchased car insurance from Acko. A few months later, based on your interactions and preferences, Acko proactively engages with you through suggestions on the purchase of add-ons like roadside assistance or zero depreciation cover to complement your existing car insurance policy.

It can also go the extra mile by showing you a promotion for a home insurance policy on the Acko app, noting how it can provide comprehensive protection for your home and belongings. This attention hooks you into the ecosystem – Something we call a walled garden.

Even though we went fully digital, how you sell to your customers hasn’t changed. Creating and oiling such a robust online engine that supports current customers by offering them pertinent suggestions based on their buying habits, demographics, and tiers is what the insurance sector needs to bring in to increase LTV.

Acko does this and more. Learn how it’s acing insurance marketing in this Impact Story.

This can be easily done through automation tools that let you orchestrate hyper-personalized omnichannel marketing to deliver retention-led product growth. WebEngage offers an all-in-one suite along with live analytics, a personalized engine, and CDP for a smooth user experience. Creating a holistic universe using web/app push notifications, emailers, SMS, WhatsApp, and web or app personalization – brands can truly transcend their pitch. Connect with the WebEngage team to find out more.

For instance, consider company A, an online insurance aggregator. In an attempt to achieve a net retention rate between 50-60% (an average for online platforms), the brand penetrates across the breadth of its services.

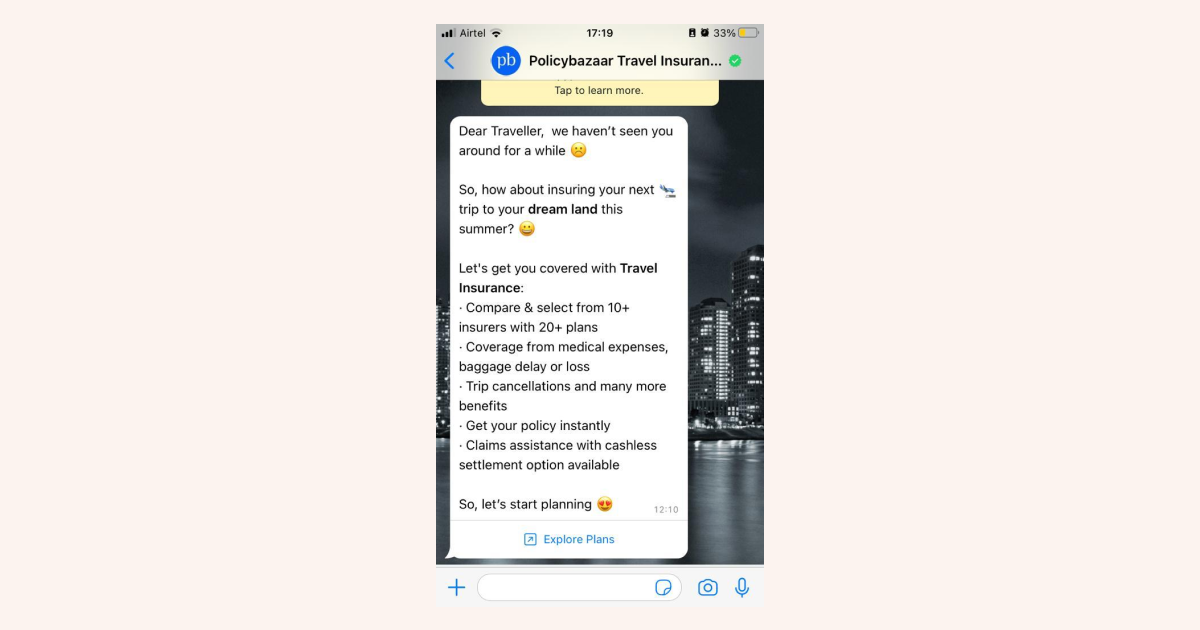

In the below example, upon buying international insurance, the brand used automated Whatsapp nudges to remind existing travelers about booking their next insurance through them. The soft nudge starts with trip planning and then delves into discussing the benefits of international insurance.

This nudge would reap more conversions than reaching out to an entirely new user base that has never transacted on the platform. When an existing customer receives branded push & converts, it suggests that their customers are staying and renewing policies, indicating a strong product-market fit and a promising path for growth.

As their net retention rate improves, the company can expect their Annual Recurring Revenue (ARR) to increase, leading to continued success in the insurance market. Conversely, if their retention rate declines, it may lead to a decrease in ARR, highlighting the importance of maintaining high customer retention.

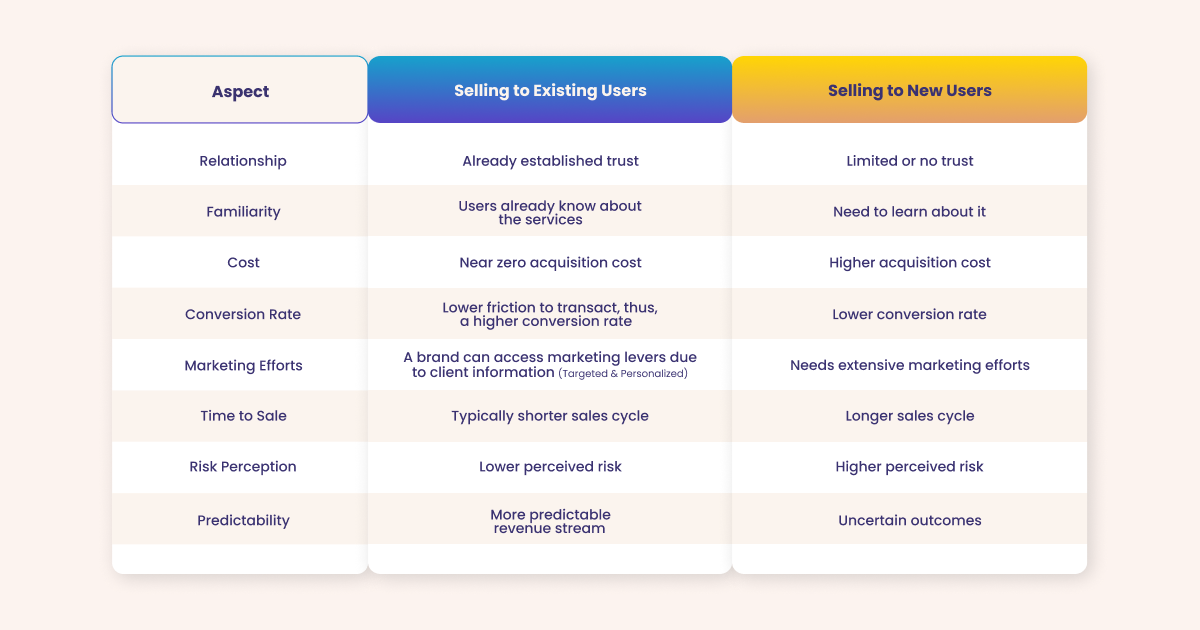

Let’s look at the differences between Selling to an Existing User vs. a New User.

From the above table, it is clear that if you invest intelligently in your existing user base, positive outcomes will be notably easier to attain at an overall level.

There’s another example of how Company A identifies customers who have recently purchased a term life insurance plan and then cross-sells them through various channels, such as email, SMS, and social media, with personalized messages like:

-

- Email Campaign: Send an email with subject lines like “Secure Your Family’s Future and Grow Your Wealth” that highlight the importance of both life insurance and investment for financial security.

- SMS Campaign: Send a text message informing customers about exclusive investment opportunities and their potential for higher returns.

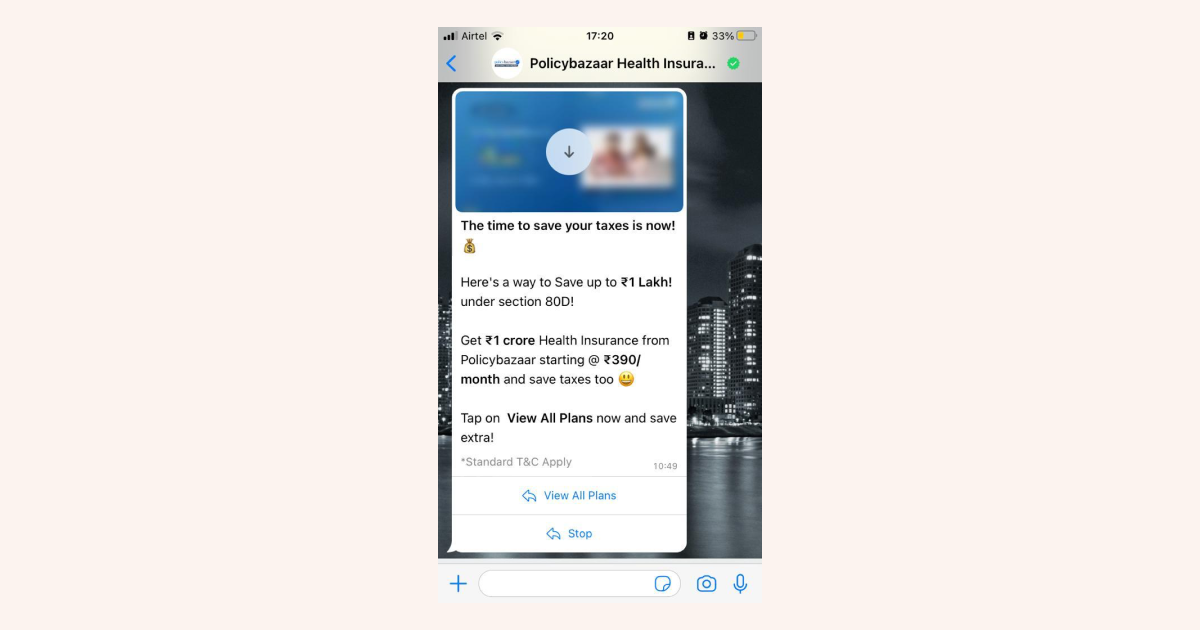

- WhatsApp Campaign: Send a WhatsApp marketing text to detail your offerings with a well-positioned actionable CTA to pique the user.

- Website Banner: Displaying targeted investment plan banners when these customers log in to their PolicyBazaar accounts.

- Push Notifications: Sending app push notifications with personalized messages like “Invest in health insurance & save taxes too.”

By strategically targeting term plan customers with investment opportunities, Company A can cater to their financial needs and preferences, increasing the chances of cross-selling.

Cross-selling and upselling policies can result in less time between a user’s purchases and a higher customer lifetime value.

It’s 2023, and nearly all leading insurance companies in India, like MAX, AEGON, Bharti AXA, and HDFC, are using some or other form of automation. This allows them to cross-sell and up-sell across categories within minutes without worrying about delivery, efficacy, and reach.

Conversions increased for 77% of marketers who used marketing automation solutions to reach their target audience.

Over 800+ brands across industries have chosen WebEngage to deliver truly omnichannel experiences to their customers. Want to understand how you can scale your business in insurance tech? Hit us up!

Kasturi Patra

Kasturi Patra

Vanhishikha Bhargava

Vanhishikha Bhargava

Diksha Dwivedi

Diksha Dwivedi