Consumers today are no longer just driven by how a company packages their products and services, the pricing or the discounts they are willing to offer. They care about whether the company can meet their individual needs, interests and preferences. And the same holds true for fintech businesses.

As per studies, 66% of consumers today expect companies to understand their unique needs and expectations. But apart from an understanding of what adds value to them, they expect companies to be able to communicate with them with as much clarity and context.

Now if you think about fintech products and services, when was the last time you made a purchase on an impulse?

Be it a new debit card, credit card, insurance policy or a loan, you take time to explore all the options available to you – it’s an important purchase after all.

But being able to look into individual interests at every stage of the funnel from awareness to lead generation, nurturing and closure, is easier said than done. That’s why we built our catalog and recommendation engine.

And in this blog, we are going to walk you through how this engine is exactly what a fintech business needs for personalization.

Quick recap: What is catalog and recommendation?

For a fintech business to go beyond personalization based on user action (such as filling a form, requesting a call, adding a product or service to call, visiting the office, and more), your strategy needs to look into:

- Having the right product and service information

- Adding value by saving time

- Recommending similar purchase options

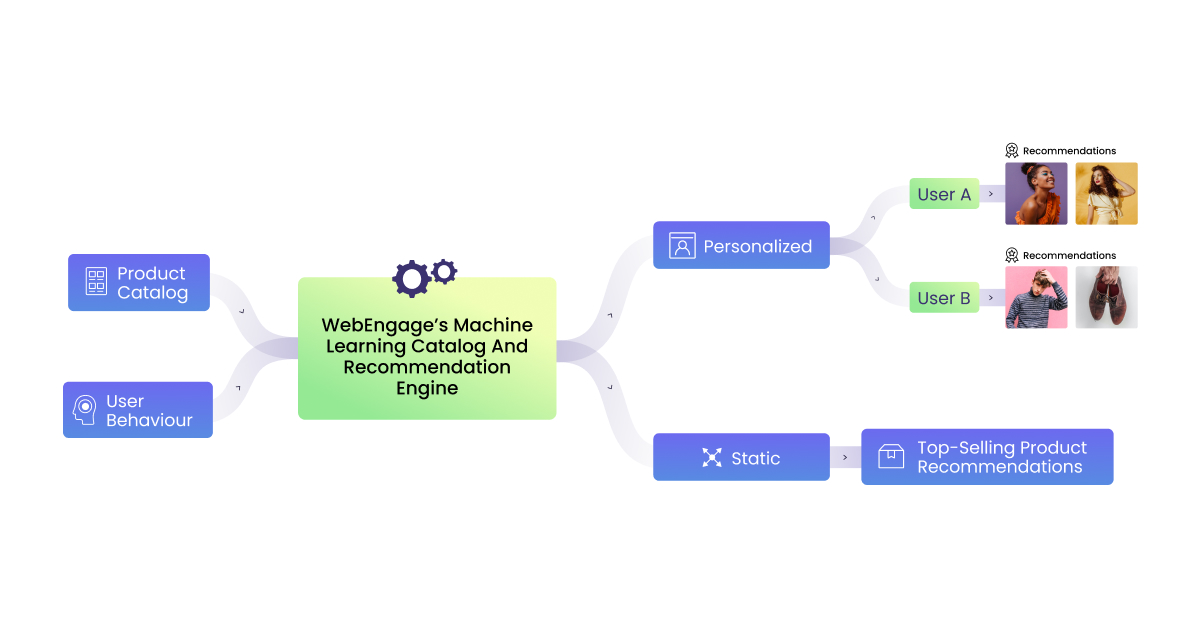

These are the two key aspects based on which WebEngage has built the personalization engine:

- Recommendation: Let’s personalize communication with recommendations of products and services based on a consumer’s actions or events. For example, if someone purchases a credit card, you can recommend subscribing to a priority pass for airports.

- Catalog: Let’s keep all product and service information up-to-date. This helps you send relevant information related to the recommendations you make in minutes. For example, you can fetch the information around what the priority pass will cost, which airports are included and what benefits it gets the consumer.

Here’s a glimpse at how our engine works to enable the above:

Now let’s take a look at some of the ways fintech businesses can use catalog and recommendations for better customer engagement, retention and experiences.

Different ways to use catalog and recommendations in fintech

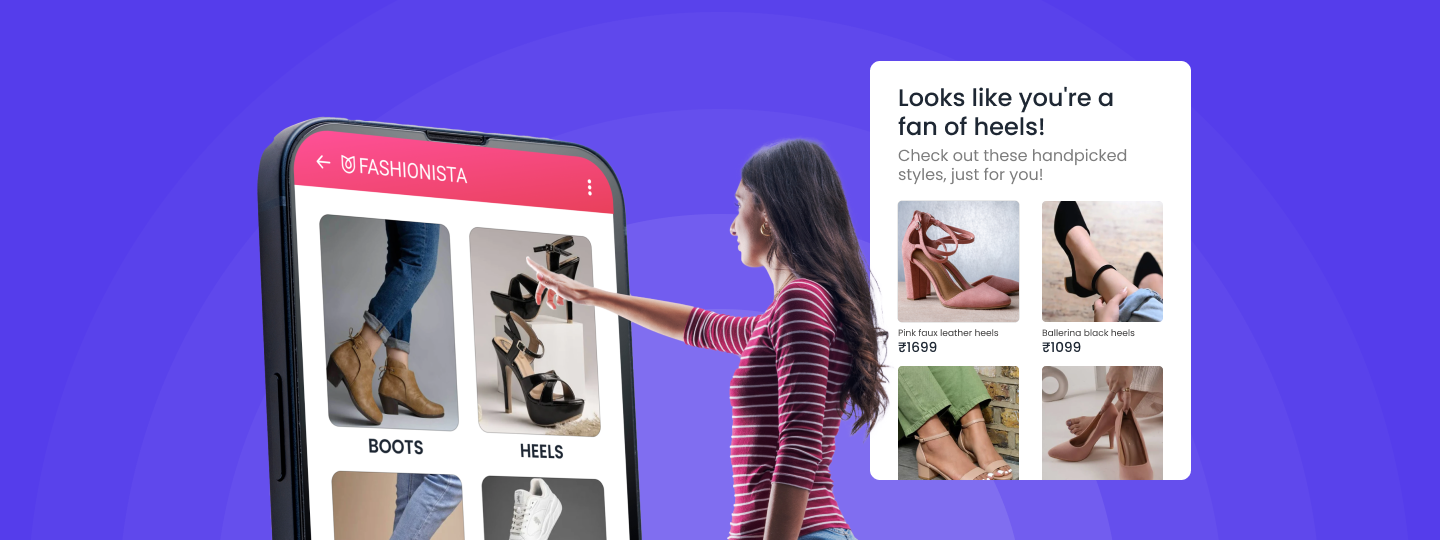

While the way in which you use our personalization engine for catalog and recommendations may vary based on the type of fintech business you have, the products and services you sell, here are some ideas to get you started:

1. Nurture prospects with personalization

As we mentioned before, no one buys fintech products and services on a whim. To get the best available option, they fill out multiple forms, speak to different companies and agents and make comparisons.

The first way you can use catalog and recommendations is hence based on custom events.

This lets you generate recommendations that are based on the action a consumer has taken – this can include requesting a PDF, scheduling a call or visit by an agent for a product/ service, filling out a form to get more details, adding a product/ service to cart or browsing data. In the example below, we’re showing recommendations based on the insurance policy added to cart:

Companies like Edelweiss Tokio Life use a personalized approach to lead nurturing, using the catalog and recommendation engine to enable contextual communication across multiple channels. This has helped the fintech company build 10 nurturing journeys, see a 47% conversion uplift and get 35 dispositions nurtured.

2. Highlight best-selling products and services

Another way to use catalog and recommendations is to showcase your best-sellers for any custom event. For example, if someone has purchased a credit card recently, you can use that as a custom event to showcase other best sellers like the different benefits cards they can now subscribe to at a minimal cost.

3. Keep customers up-to-date

Most fintech companies struggle to keep their customers engaged after a purchase is made. By using catalog and recommendations, you can do this easily for every individual. For example, you can update clients about their investments by sending portfolio statements or the performance so far.

4. Help with informed purchase decisions

A lot of times fintech purchases of products, services or even investments are based on the understanding of a client. And at other times, it is based on the suggestions that come through their friends and family – this can either work for them in the long run or end up being bad decisions. Instead of having them seek information and suggestions outside, become their go-to for information. Showcase the most bought investment avenues, or even display recommendations coming from different industry leaders.

5. Share information

No amount of reading up is enough when it comes to fintech purchases. But more often than not, the content a prospect or a client often refers to is often limited to what is available on the website or conveyed to them on a call when they request one. Build transparency in your relationship by making updated information readily available with the help of catalogs.

6. Share reviews

A fintech business catalog can also be used to showcase social proof. This includes the ratings, reviews and testimonials that your product and services have received over a period of time, or more recently. This can help with two things – assure an existing client of the purchase they have made and help a prospect see the value you can potentially offer to them.

7. Share account manager details

Upon successful purchase of a product or service from your fintech company, you can use Catalog to fetch relevant information such as agent name or account manager name, email address, phone number and branch details. This makes it easier for the client to reach the right person instead of having to take the longer route through customer support.

8. Educate your customers

Make it a point to continually add value to your customers and clients. To be able to do so, you will need to move past just being able to recommend and sell related fintech products and services. Based on the last interaction – be it a purchase of a service, renewal of a policy, etc, from catalog data, recommend content that can help them understand the finer nuances better – example, top benefits to avail from your policy.

Does your fintech company need catalog and recommendations?

Consumers today are becoming increasingly information driven.

And they want access to this information with more ease as compared to the traditional route of reaching out to fintech companies, scheduling calls, being directed to the right agent, planning a visit and so on.

Catalog and recommendations are designed to help fintech companies deliver personalized experiences at scale across the funnel stages, keeping in mind this changing consumer preference.

Want to know more about catalog and recommendations for your fintech company?

Diksha Dwivedi

Diksha Dwivedi

Harshita Lal

Harshita Lal

Dev Iyer

Dev Iyer

Amit Shinde

Amit Shinde

Niket Raja

Niket Raja