How Financial Services Companies can reactivate their Idle/Lost Users with the help of RFM Segmentation and Marketing Automation

Conversion Funnel Optimization 101 is an all-inclusive Marketing Automation Guide for Financial Service Providers. In this post, we’ll discuss how they can identify their churned or inactive users with the RFM Model, and reactivate them by integrating a Marketing Automation platform.

We’re finally at the last part of this blog series!

The last two posts covered everything from reducing pre-purchase drop-offs to engaging with customers post-purchase.

In this post, we’ll talk about how companies in the finance sector can identify inactive users with the help of RFM segmentation. Furthermore, we’ll discuss how they can use marketing automation to reactivate them.

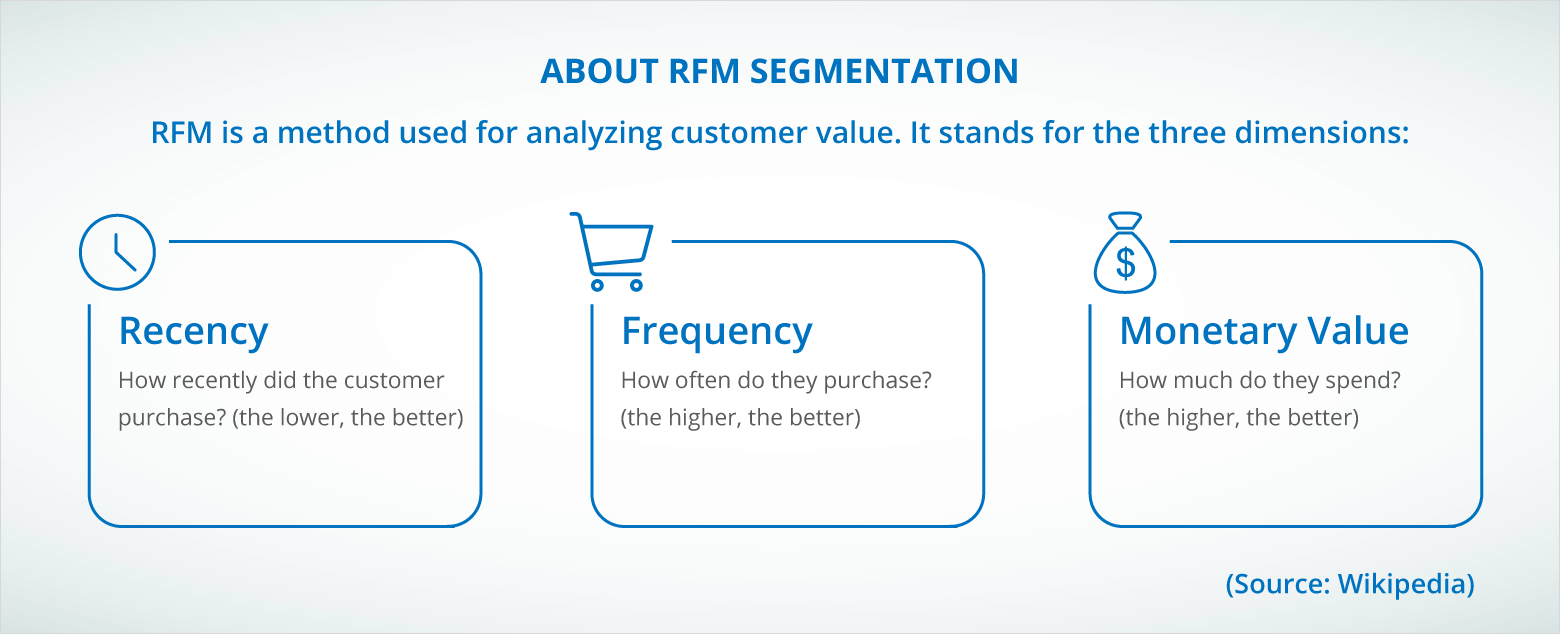

But before we proceed further, let’s touch upon the basics of the RFM Model.

To learn more about RFM Model and analysis, you can check out this post by Putler.com.

ALSO READ: How To Use RFM Segmentation for Customer Lifecycle Marketing

RFM Analysis by Financial Services Companies (FSCs)

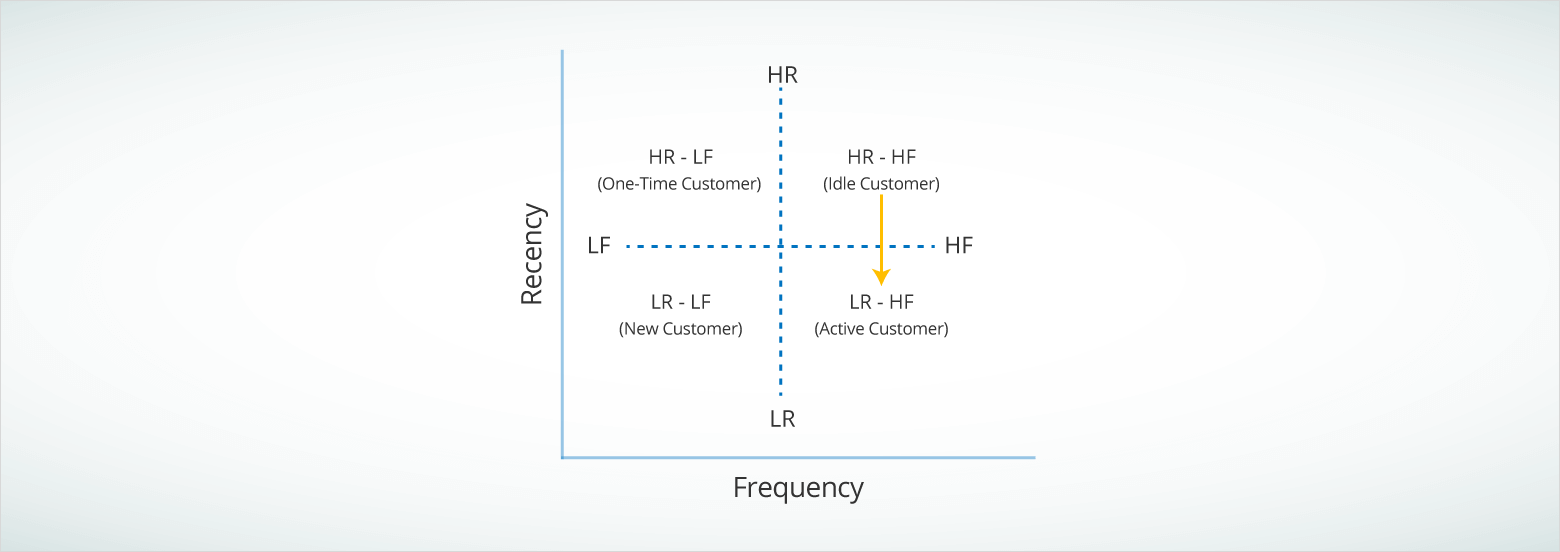

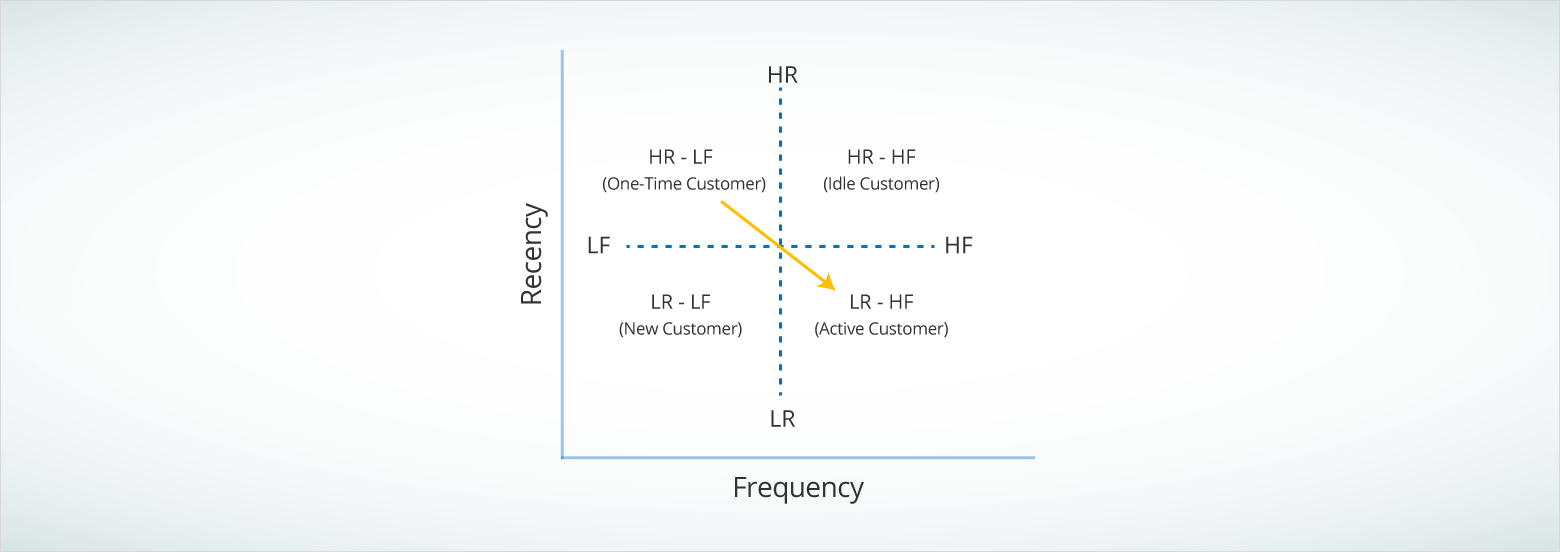

For the simplicity of this post, let’s keep the RFM segmentation model two-dimensional and use Recency and Frequency only.

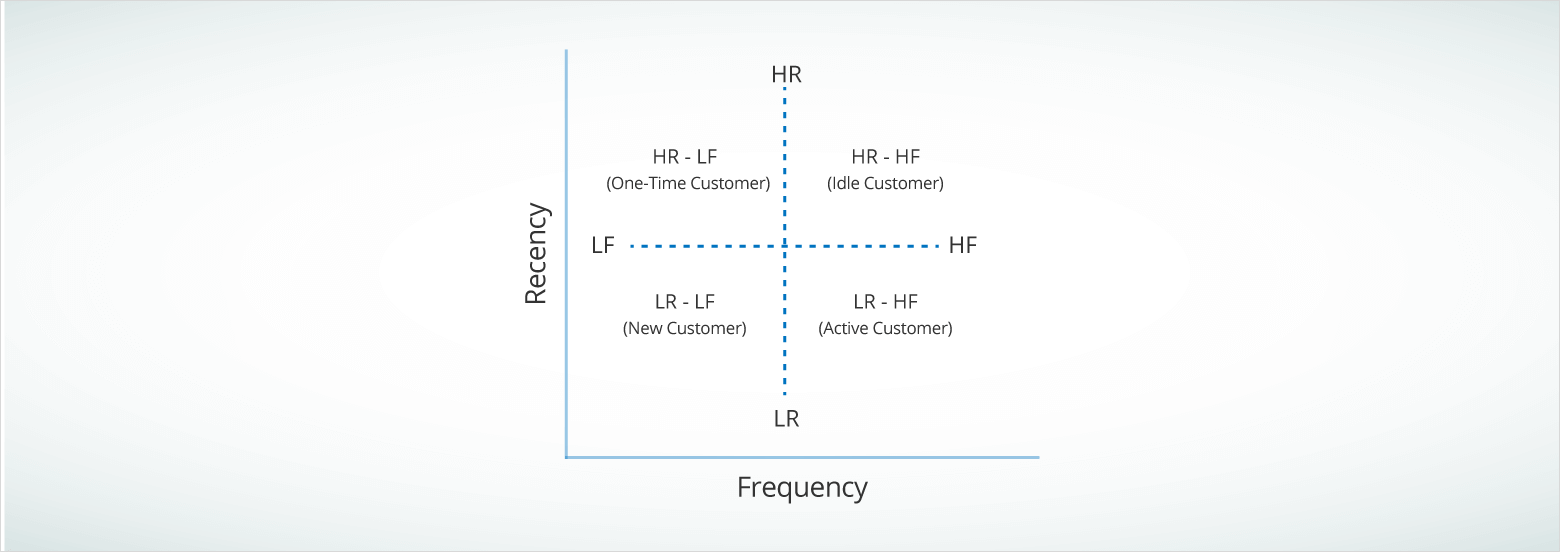

Here’s how the 2D RFM Model for a financial services company would look like:

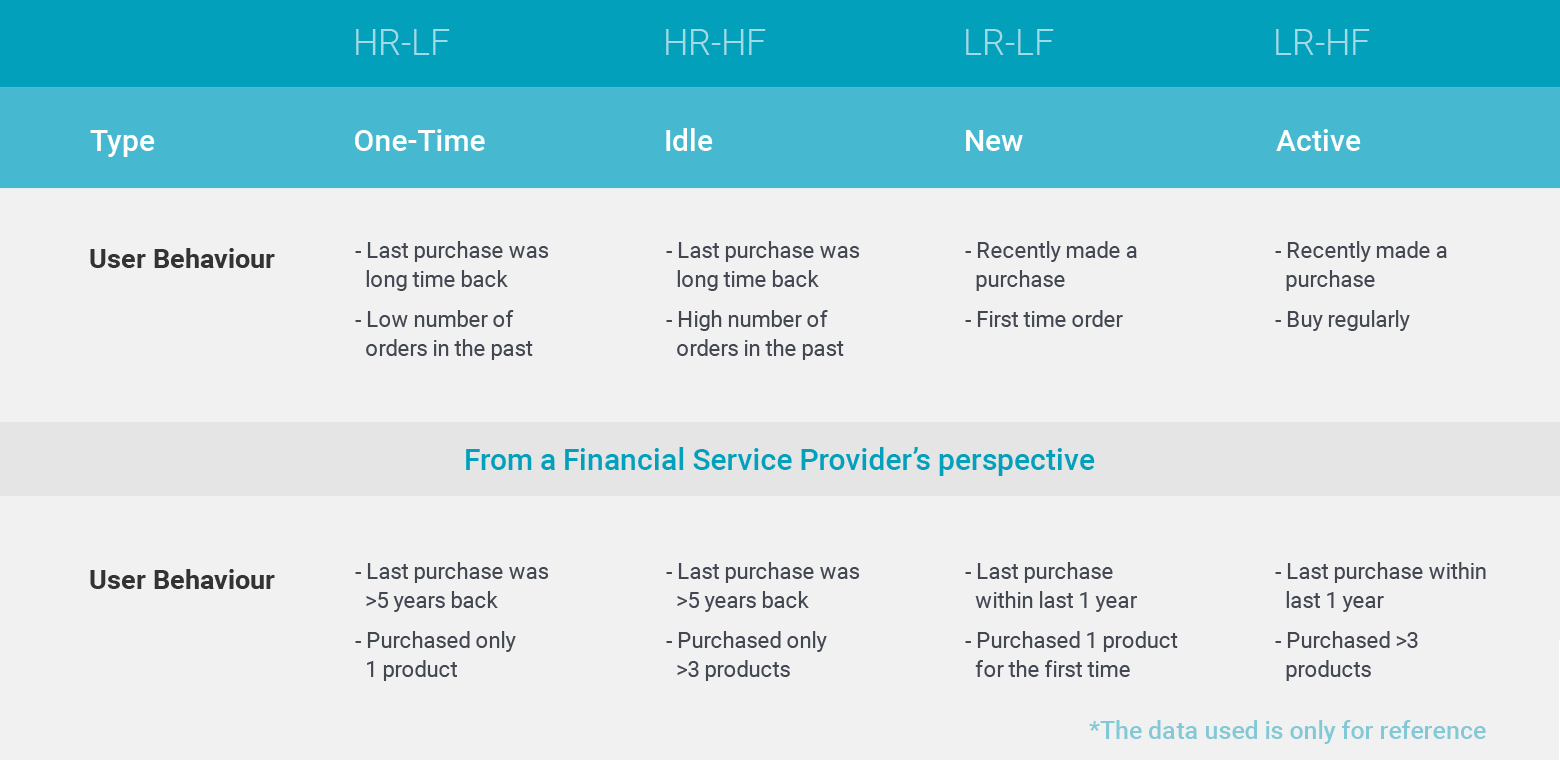

Each quadrant of this model represents a customer segment. From a financial service company, these segments can be broadly defined in the following manner:

By segregating customers into 4 groups, financial services companies can identify which customer is turning idle (HR-HF) and/or is at the risk of getting lost (LR-HF). And they can implement reactivation campaigns to recover the lot with the WebEngage Journey Designer.

For those who don’t know, it’s a drag-and-drop automated workflow builder for creating intuitive customer journeys. You can orchestrate multi-channel/multi-device marketing campaigns without breaking into a sweat. To know more about, check out this Blog Post or this Explainer Video.

Reactivating Idle/One-Time Users with WebEngage Journey Designer

Use Case #1: HR-HF (Idle) → LR-HF (Active)

As idle customers are the ones who used to be active but haven’t transacted in recent times, one can infer that these customers have either stopped using the product/service altogether or have switched to a competitor.

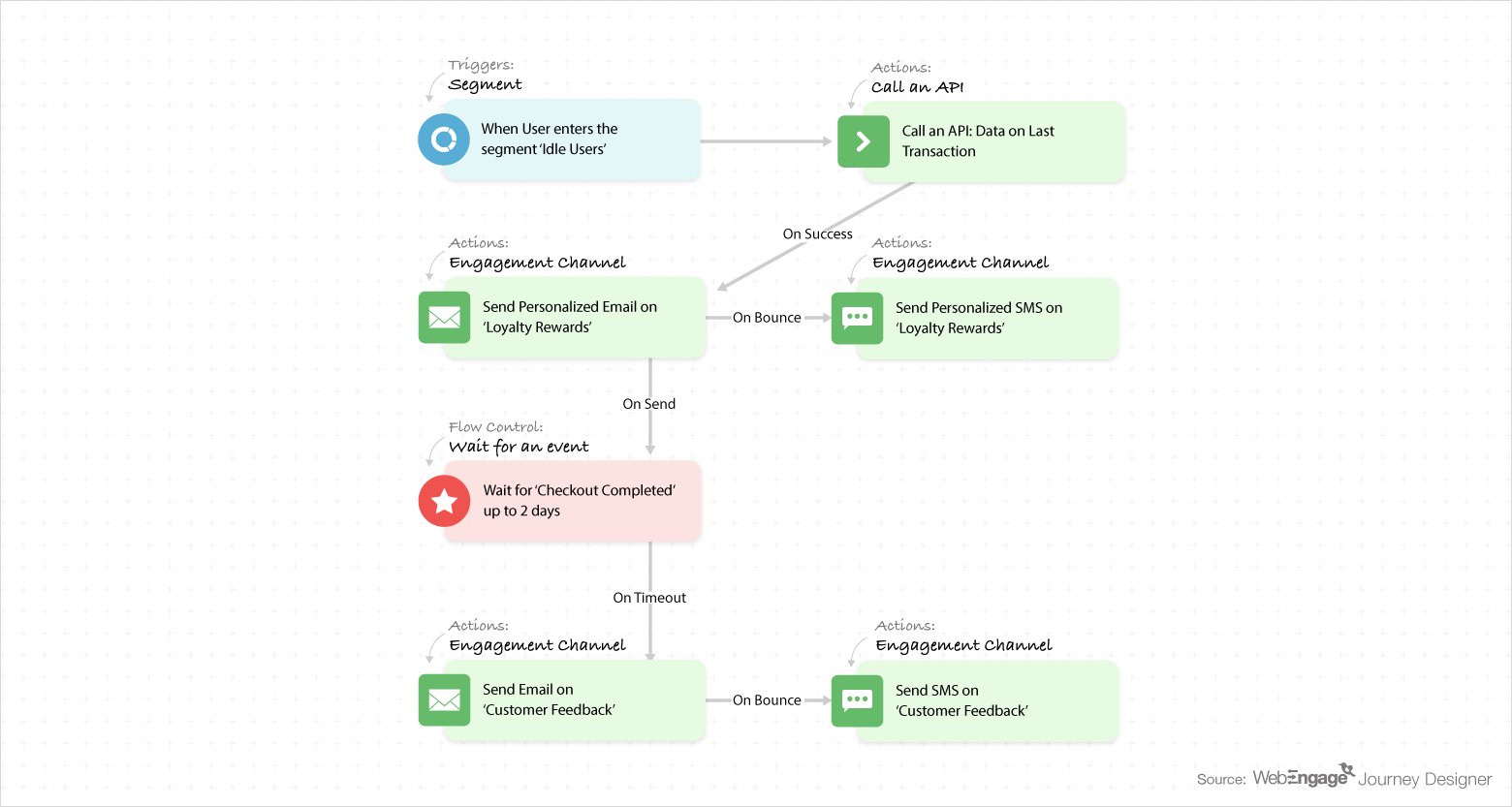

In order to nudge them to reconsider and reactivate, financial services companies can design a workflow around loyalty rewards and customer feedback like this:

(You can know more about the Journey Designer elements here)

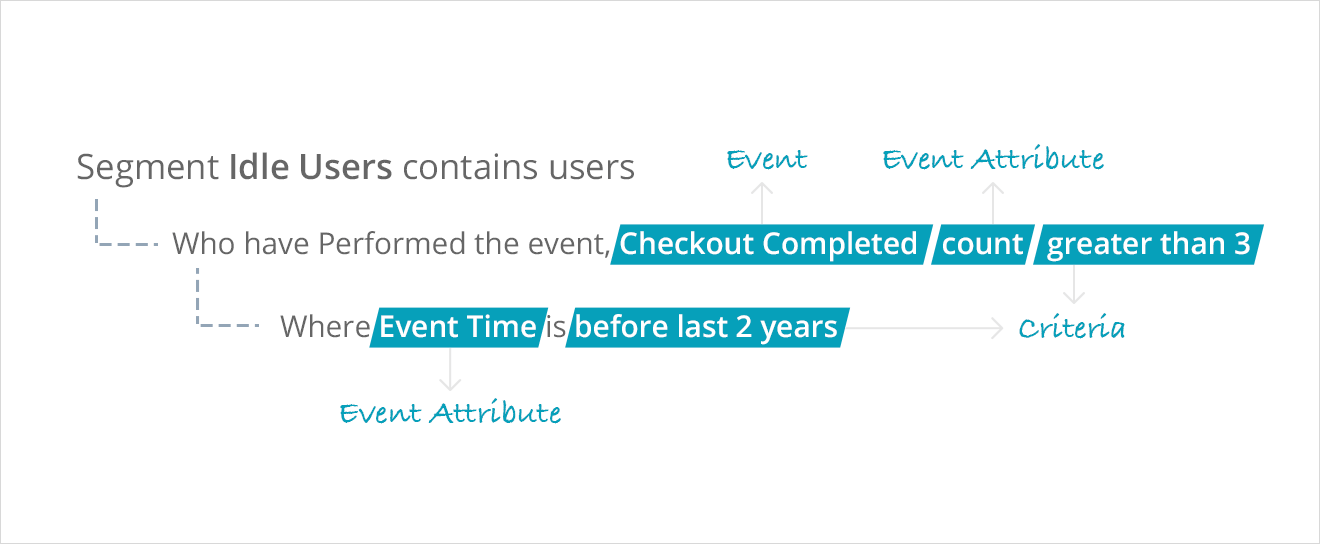

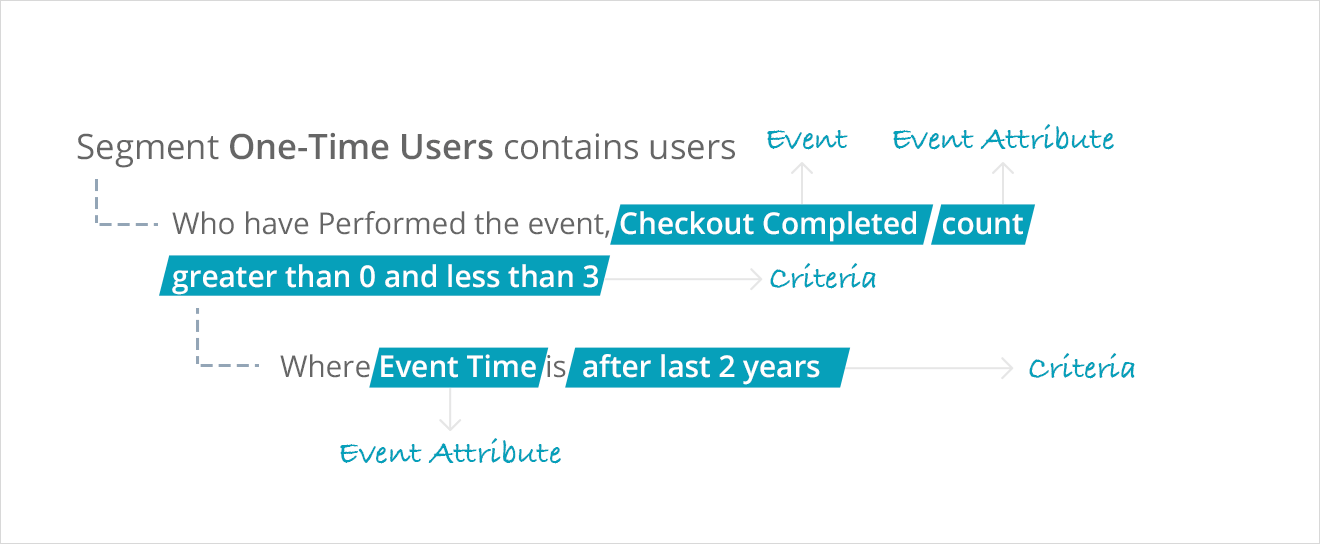

As you can see, this journey will trigger for users who enter the following segment:

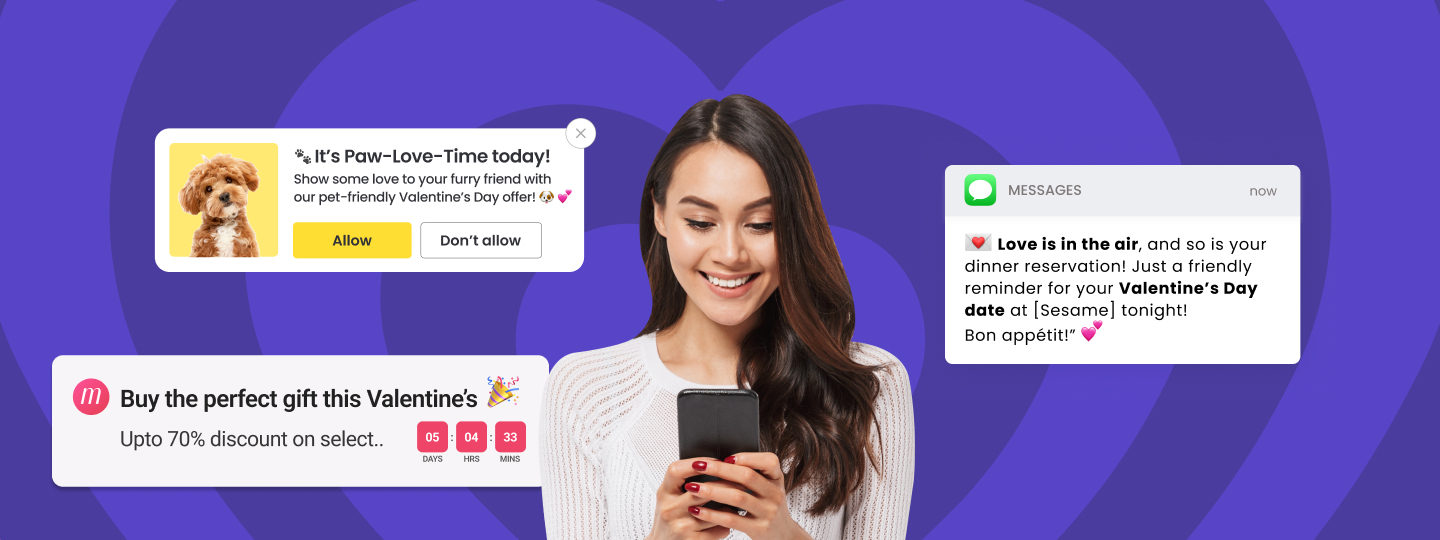

And they will receive the following messages via (personalized!) Email and SMS for the loyalty program…

…..and this Email and SMS for receiving customer feedback:

Use Case #2: HR-LF (One-Time) → LR-HF (Active)

One-Time Users, who had transacted only once or twice (with additive incentives like discount coupons) long time back before going inactive, are the ones who are lost. They are non-brand loyalists and/or deal seekers. Similar to lazy users, they might have either discontinued using the product/ service or might have gone ahead with a competitor’s offering.

To reactivate One-Time Users, a financial service company could explore the following marketing tactics:

- Cross-selling

- Offering cashbacks

- Giving incentives for higher value or higher frequency transactions.

Remember: the key is to be relevant and personalized for higher impact.

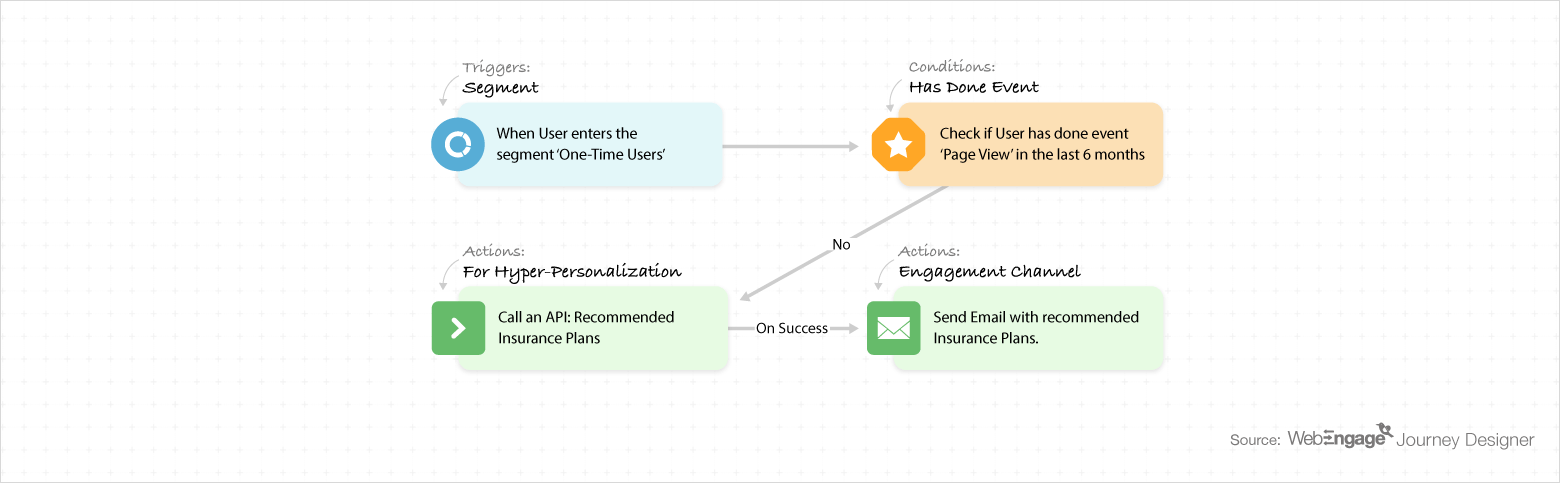

For instance: suppose XYZ Insurance wants to cross-sell related insurance plans recommendations to all its inactive users who purchased an insurance plan 2 years back. This workflow will help them do the needful:

(You can know more about the Journey Designer elements here)

The journey will start for all the users in this segment:

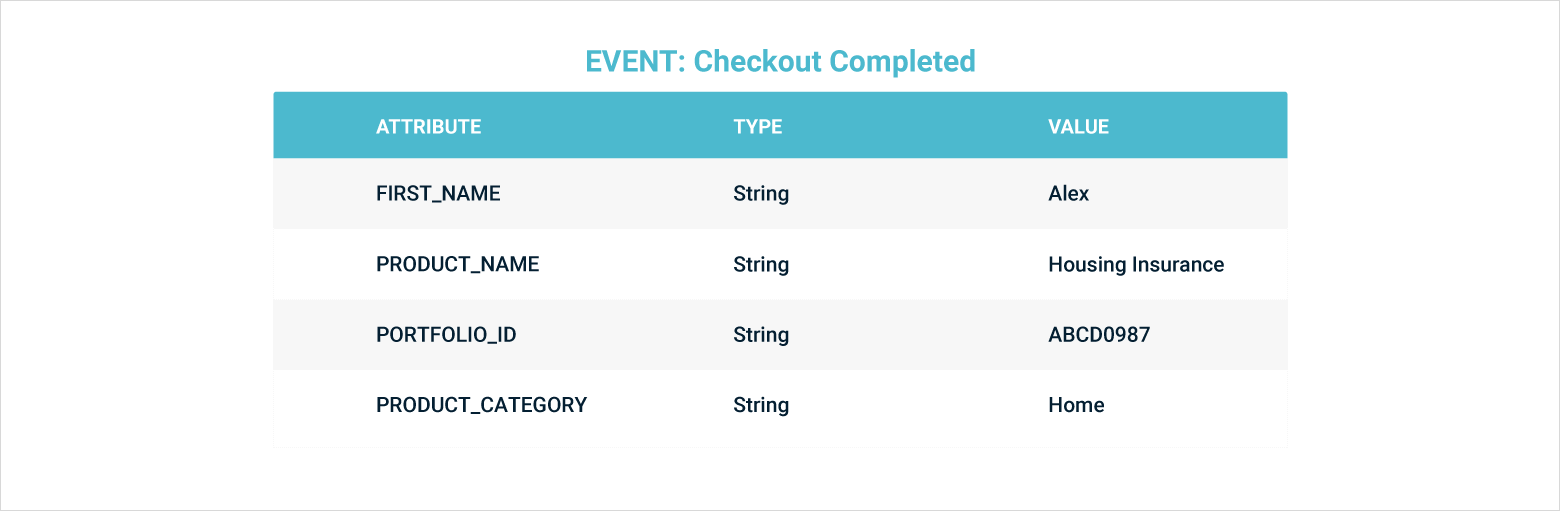

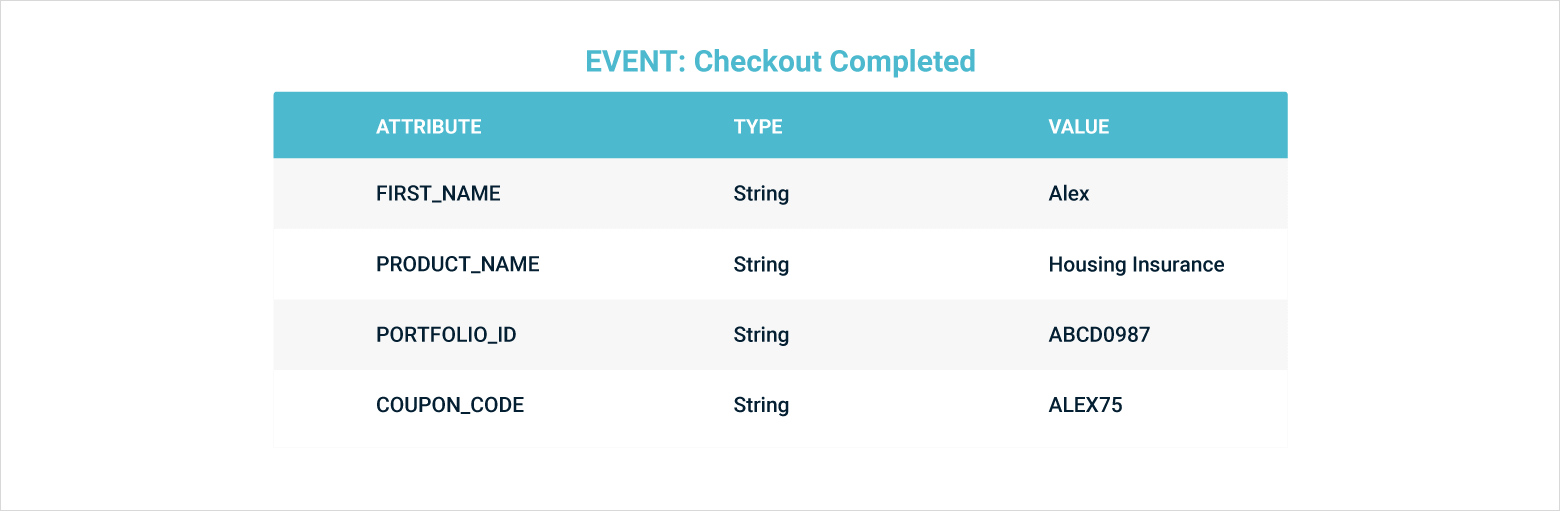

After ensuring the user has been inactive and uninterested since the first purchase, we’ll use ‘Call an API’ block to fetch recommendations from XYZ Insurance’s platform. For example, if one of the users, Alex, bought a Home Insurance Plan 5 years back, he’ll be recommended the following plans: Theft Insurance, Renters’ Insurance, Family Health Insurance, and Pet Insurance.

And this is how the hyper-personalized email would look like:

ALSO READ: How Goibibo used Hyper Personalization in Emails to Increase Conversions by 11%

With this, we come to the end of our blog series on Conversion Funnel Optimization 101 for Financial Services Companies. As you learned, the WebEngage Journey Designer can be used in a plethora of ways throughout a customer’s lifecycle. This drag-and-drop tool uses a fraction of your time to set up a fully-functioning personalized, timely and contextual multi-channel campaign.

If You are Confused About How Journey Designer Can Complement Your Business then Talk To Us Now

Surya Panicker

Surya Panicker

Sharath Byloli

Sharath Byloli

Diksha Dwivedi

Diksha Dwivedi