Setting context for the BFSI Industry

The BFSI sector in India is valued at Rs. 81 trillion and is likely to become the third-largest by 2025. The Indian banking system consists of 18 public sector banks, 22 private sector banks, 46 foreign banks, 53 regional rural banks, 1,542 urban cooperative banks, and 94,384 rural cooperative banks as of September 2019. Core banking, retail, private, corporate, investment, cards, and similar services all fall under the banking umbrella. Examples of financial services are stock trading, payment processors, mutual funds, etc. Life and non-life risks are covered by insurance.

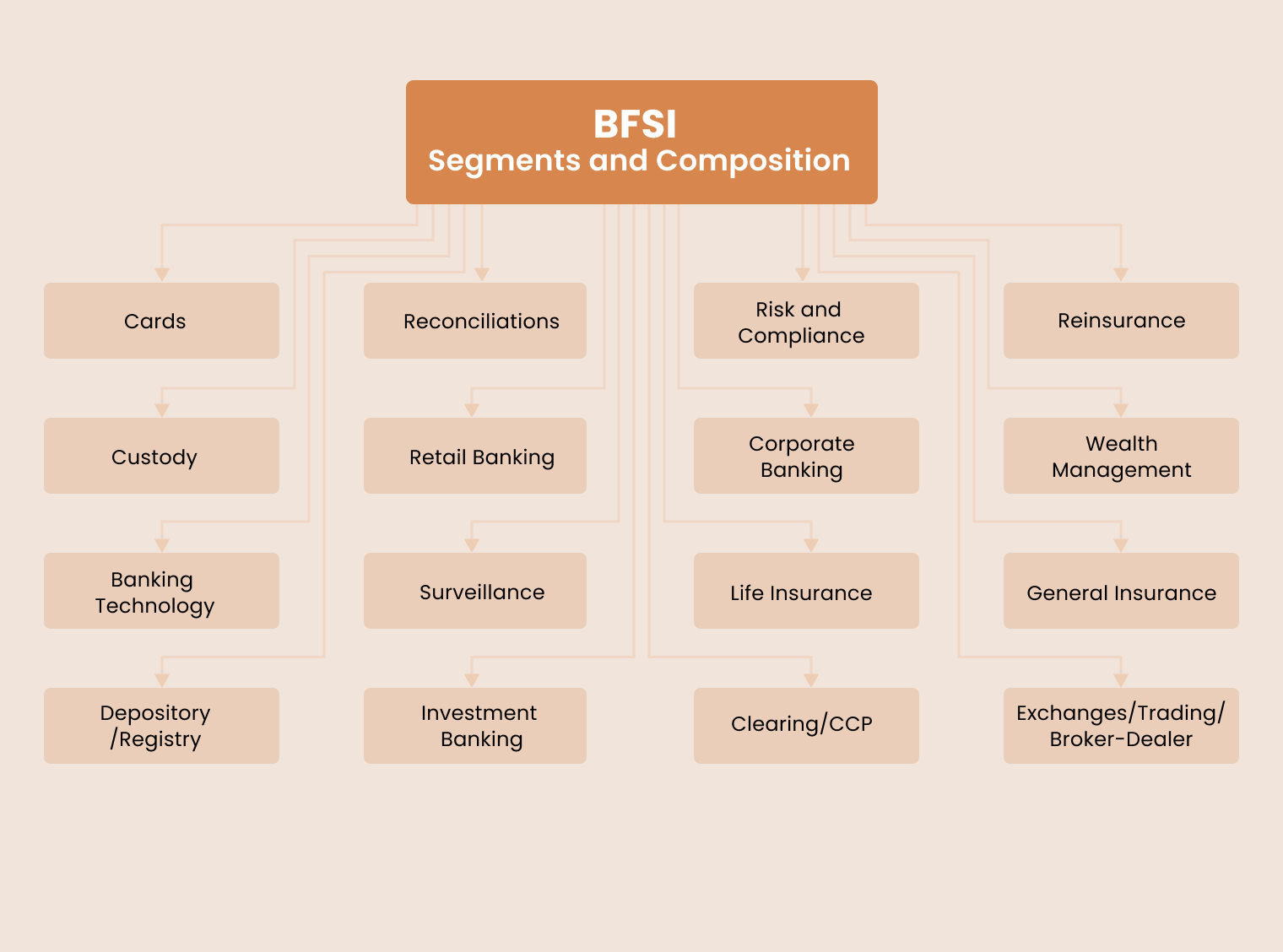

BFSI Segments and Composition

Some segments of the BFSI Industry are:

A nation’s banking system is a crucial pillar supporting the financial system of the nation’s economy. Banks’ primary function in a financial system is to mobilize deposits and distribute credit to diverse economic sectors. India’s complex, current financial system has developed over many years.

Subscribe to our newsletter to stay updated on the latest in B2B marketing

BFSI sector – A building block for the economy

We all are well-versed in how badly COVID-19 affected everyone’s lives, not only in terms of health but also financially and professionally. But still, in the current digital economy, the Banking, Financial Services, and Insurance vertical categories have seen the most development. The business sector has repeatedly shown how utilizing technology-based solutions has enhanced the end-user experience. The macroeconomic circumstances of today call for some realignment of priorities in the use of technology. However, it is anticipated that in 2023, technology-based change will continue to gain strength.

Thanks to technology, the BFSI sector may now access new markets and provide innovative goods and services via effective distribution. On the other hand, the banking and insurance industries depend heavily on data security and the availability of information updates, which requires a high level of network uptime, quick fault detection, and prompt problem resolution. The infrastructure of the banking and financial sector is plagued by a significant number of legacy systems that still need to be put into use. (No other reason why there’s so much space for Fintech startups.)

Top 4 Trends in the BFSI sector

Customers’ Banking Apps Are Developing Into Advanced Digital Assistants

In 2023, customer relationship management platforms, which foresee user needs and provide personalized advice based on those needs, will replace banking applications as basic self-service tools. The banking software will transform into a ‘smart digital assistant’ that can understand the user’s wishes and preferences based on the user’s financial history and behavior.

Big Data and Analytics

Big data allows banks to centralize their business models on customer behavior. They may increase income and provide more personalized services by fully employing predictive analytics. The success of a bank’s digital transformation in the future will depend on how much it can learn from its customers. Market segmentation and cross-selling to current clients will depend heavily on analytics. As a result, banks will better understand consumer behavior and spending patterns, which will help them develop products and services that are more suited to their target market.

Open Banking Puts More Pressure on the Market

Although open API banking is still in its infancy, it has the potential to alter the way we conduct business fundamentally. Banks can communicate data with “fintech” companies and other external service providers thanks to open APIs. These apps make transacting on digital platforms easier, faster, and more secure.

Experience-driven Sector

Future financial services providers may expect to differentiate themselves significantly from competitors through their customer experience, both in the brand and attracting and retaining customers.

Many banks place a strong emphasis on the customer experience. At the same time, they undergo digital transformation, making sure the solutions they create will meet all of their client’s expectations in terms of convenience, security, comfort, and engagement.

Customers already expect more personalized offers, including taking into account their recommendations and preferences when creating a service that makes things easier for them. By 2023, the ability of banks to anticipate customer needs and provide great experiences will set them apart from their rivals.

Download Impact Story – Check how Fintech Platform Glide Invest sees a 30% Uptick in MoM Engagement Rate

Customer Retention in BFSI

The average customer retention rate for financial services is 78%. In comparison, the retention rate for the banking industry is a fraction lower at 75%, as per a report published by Business Wire. Traditional banks have a long way to go in adapting technology to scale their user retention without increasing manpower compared to the new-age FinTech companies booming because of the early adaptation of online tools.

Challenges in the Financial Sector

Although customer satisfaction and client onboarding systems are in place, a thorough understanding of customer behavior across all business lines with a connection to results is still absent.

Within five years, personalization will be the main force behind marketing success.

Businesses must grow to stay ahead of the curve. Across all business lines, use data analytics, technology advancements, and personalization to provide a far more individualized and ‘human’ experience. Strong relationships are built on the foundation of empathy, the capacity to relate to and comprehend another person’s emotions. Building trust requires an understanding of social signs and the ability to adapt to them. Digitally or on a large scale, that is challenging.

Customer Retention is non-negotiable.

The next level of personalization offers a significant opportunity to connect various actors in the customer journey (financial analyst, retail staff, cash machine behavior, etc.), which will help to deliver more seamless and consistent customer experiences throughout all phases of their decision journey.

It involves aligning holistic solutions with the customer experience lifecycle to forge lasting connections with customers beyond product concerns, promotions, and distribution channels. In the challenging digital environment, truly engaging your customers requires satisfying products and services. Additionally, strengthening your client acquisition and retention rates will be made possible by developing an emotional connection with customers at key times. Also, it is important to differentiate common customers from valued customers and be able to give a complete picture.

Some ways in which WebEngage empowers BFSI brands tremendously

Lead nurturing

Edelweiss Tokio Life increased their conversions by 47% just by nurturing their leads through personalization. WebEngage allows you to create unique experiences and tailored recommendations for different customers.

Renewal campaigns

Acko increased their policy renewals by 17.32% with a 2x reduction in manpower using WebEngage campaigns.

With multichannel targeting capabilities in a single platform, WebEngage can help identify the right opportunities for growth and help you act upon them to deliver an unparalleled insurance experience to your end consumers.

Contextual communication

Scripbox witnessed an email open rate of 25-30%, 3X user engagement, and a 25% reduction in unsubscribe rate through WebEngage’s email marketing campaigns.

Customer segmentation based on demographics, location, etc., and dashboard features like A/B testing, send intelligently. Personalization changes the game for most WebEngage loyalists. These lead to engagement skyrocketing and spam reports decreasing tremendously.

You can do so much more for your customers quickly, easily, and smoothly through WebEngage, showing you tangible results immediately.

Deliver Meaningful Messages For Your Business Today

Vanhishikha Bhargava

Vanhishikha Bhargava

Dev Iyer

Dev Iyer