A millennial customer wants to purchase a health insurance policy. Like most customers of this age, this customer begins their search online. Shall we see what they encounter? While the website of this veteran insurer offers customers some basic information about the product, it lacks any other tools, such as a chatbot or personalized pages, to keep the customer engaged.

Instead, it puts the onus on the customer to visit their branch or to call them.

On the other hand, this digital-first insurer does not currently have the product the customer wants. However, by encouraging the customer to share their phone number, they have potentially opened a channel of communication that they can leverage later to keep the prospect on their radar for the future.

This is just one way to get on the digital transformation bus that can put your business in the fast lane in the competitive insurance business ecosystem.

Digital Transformation is Inevitable

Digital transformation is a big change for a company that still earns 95% of its revenue via offline channels. Thus, the resistance to going digital is partly the feeling of, “Why fix something that isn’t broken?” and partly the idea that change is hard and will require heavy investments on which the ROI seems negligible.

The fear of failure, mammoth change management challenges, and driving adoption within the organization are also a deterrent. However, not prioritizing digital transformation is a decision that leads to stagnation.

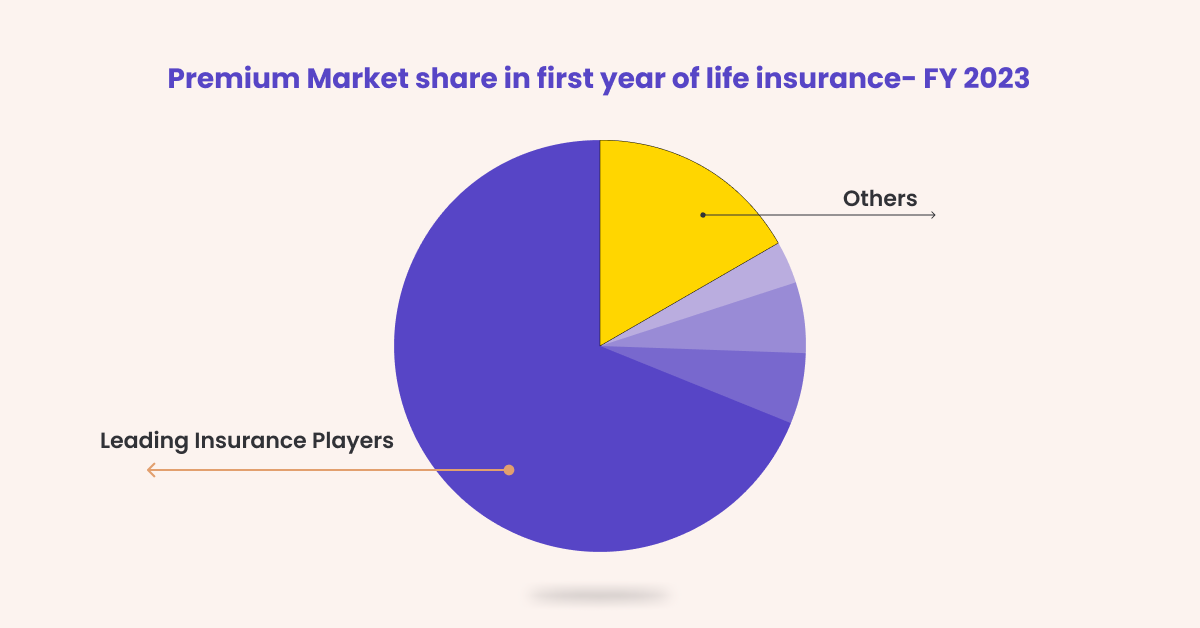

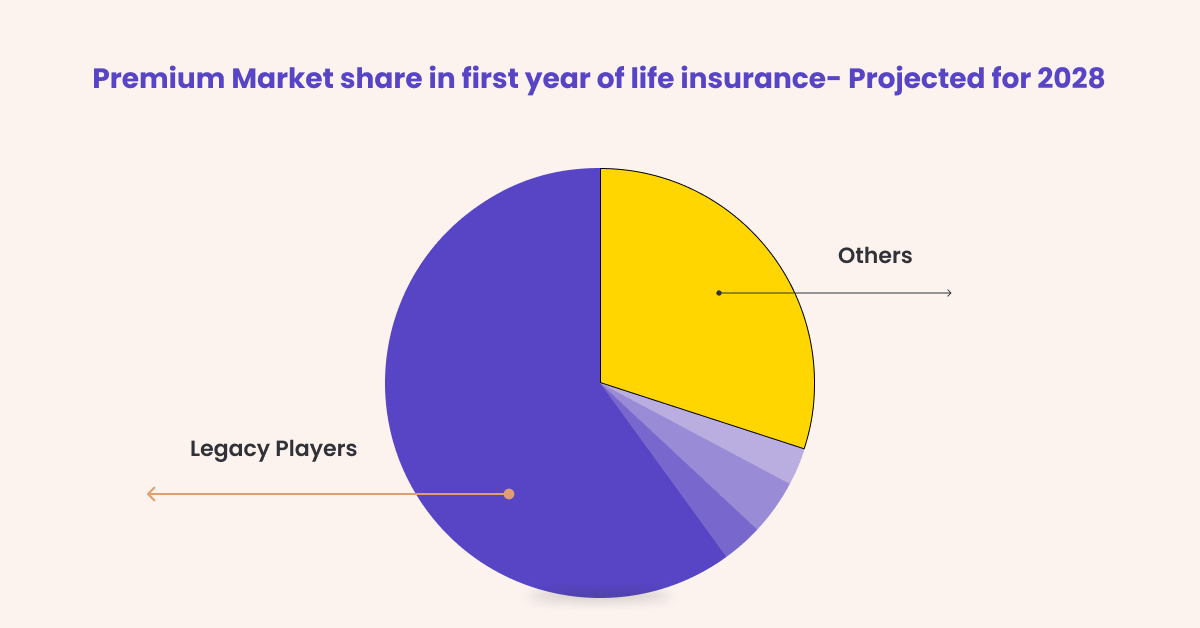

Sharing below an indicative split of major insurance players in the market.

But fast forward a few years, and if veteran firms do not adopt digital transformation, we see a few things changing:

Veteran companies will lose market share as digital-first companies capture the millennial and Gen Z customers who prefer shopping for everything from appliances to groceries to financial products and services online.

India has the world’s third-largest online shopper base and is expected to overtake the US in the next few years, thanks to how digitization has birthed the “convenience economy.”

Speaking specifically of insurance, the digital influence on insurance sales stands at 13% for life Insurance, 15% for health insurance, 9% for motor insurance, and 21% for travel insurance. These figures are only expected to grow exponentially, given that digitization has the government’s support and growing consumer adoption.

The Digital Competitive Edge in Insurance

An insurer with foresight who adopts a customer-first approach gains a competitive advantage in the following ways:

Digital Marketing Enhances Reach

Digital Marketing allows you to reach more customers in the most active channels with less effort and smaller budgets. It allows for greater personalization of marketing communications as well.

Marketing Automation in Website Journey Improves Conversion Rates

Using digital analytics and data-backed course correction in omnichannel campaigns improves funnel conversion rates because it becomes easier to plug leaks at various stages through the funnel, from form fill to document submission to the final policy purchase. This enhances ROI on marketing expenditure. How this benefits the org in the long run is even more exciting.

With more transacting customers and engaged users, you ultimately get brand advocates who improve brand recall, build credibility, and ultimately drive down your CACs. These are some formidable arguments for adopting automated marketing retention.

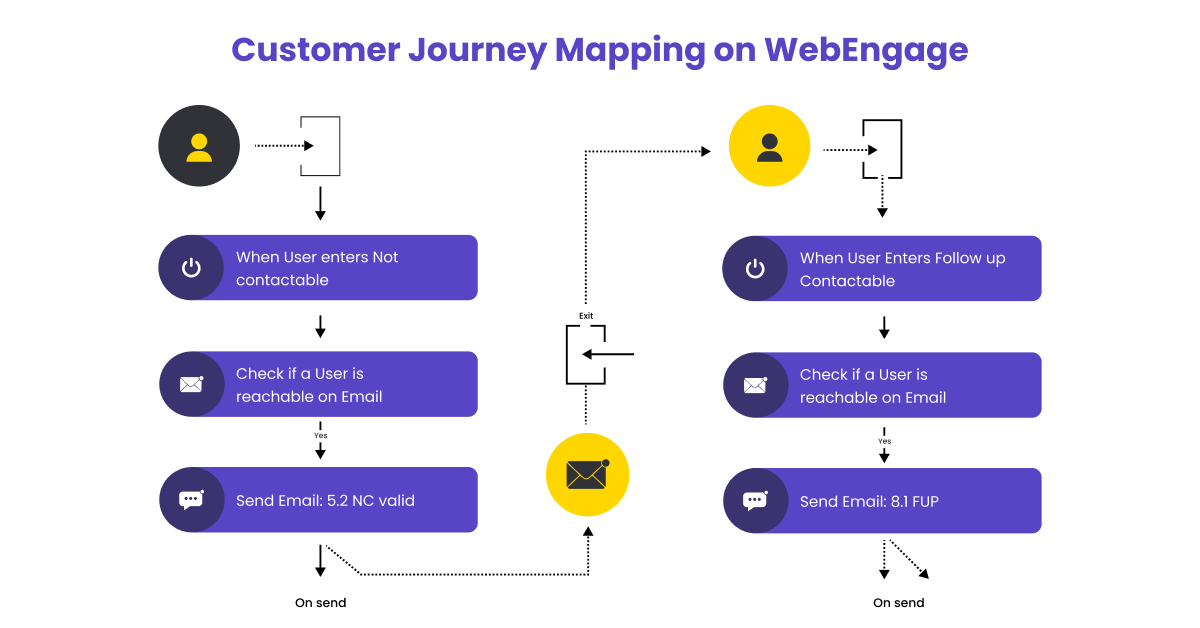

A great example is Edelweiss Tokio Life, which uses an automated and personalized approach to nurture leads. The results were a high email open rate of 20-30% and a ~50% increase in conversions. Edelweiss Tokio was able to achieve this using WebEngage’s Journey Designer, a drag-and-drop storyboarding tool that you, too, can easily employ to make an impactful user journey.

Customer Engagement Drives Down Churn

A digital-first approach makes it easier for brand and content-led engagements to reach the customer throughout the policy period instead of just reaching out to them when it is time for a policy renewal.

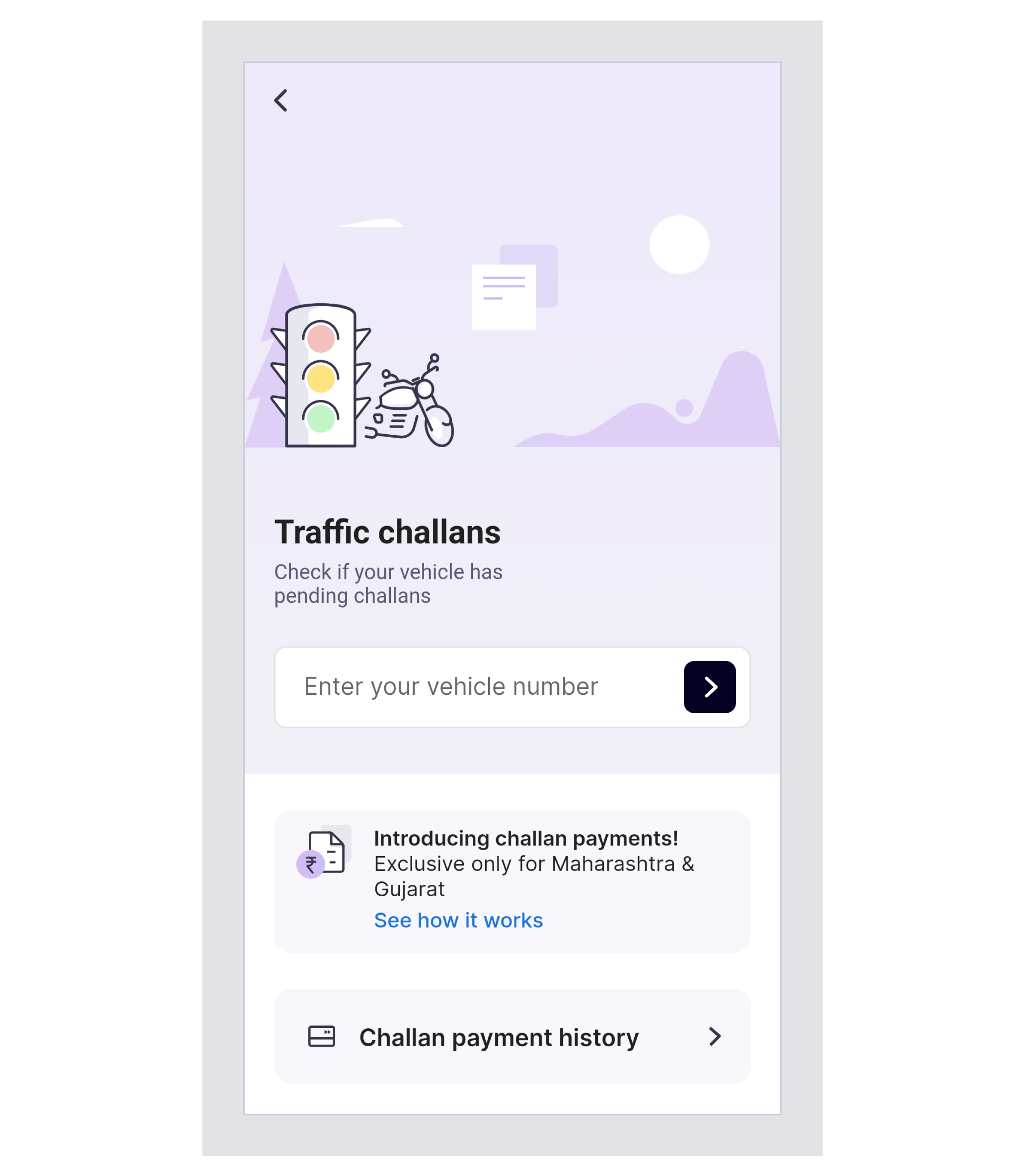

Acko, for example, keeps customers coming back to its app using its challan feature, which allows customers to check if they have any outstanding challans from the traffic department. This ensures that the customer keeps the app on their phone and keeps checking in with it on a regular basis, encouraging habit formation and better App open rates for the firm.

In The End, It Is All About Improved Customer Lifetime Value

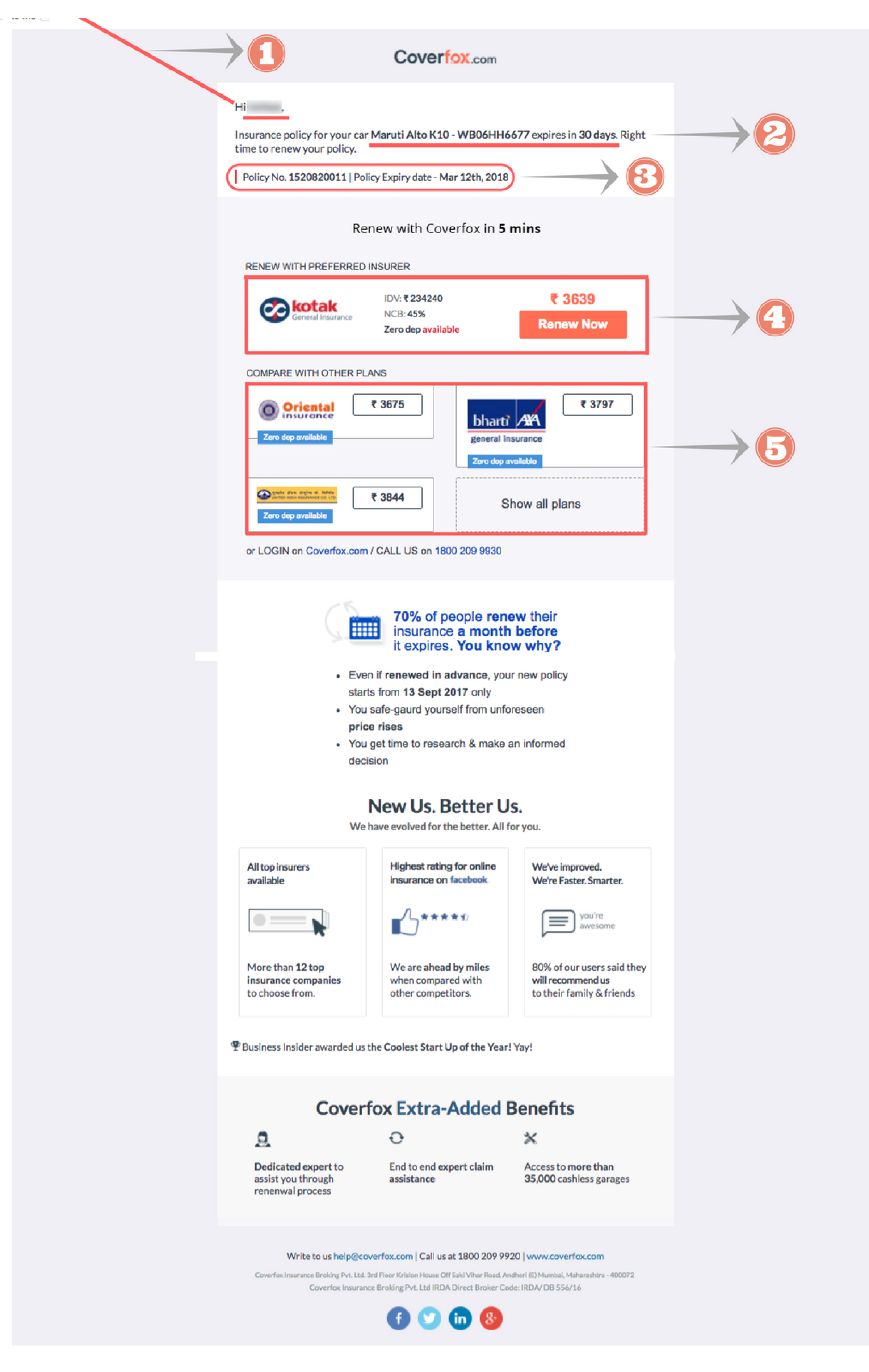

Now that you are linked to your customer digitally, it is possible to leverage automated renewal reminders across channels much before it is time for renewals. This keeps your brand at the top of the customer’s mind, and if ‘ease of use’ is well registered in the user’s mind, they are less likely to switch to another provider.

CoverFox, for example, was able to increase its policy renewals significantly by partnering with WebEngage and using omnichannel engagement to send personalized information to customers about their policies at regular intervals. With WebEngage, you too can leverage advanced automation capabilities to improve your Customer Lifetime Value.

Here’s What Experts Have To Say

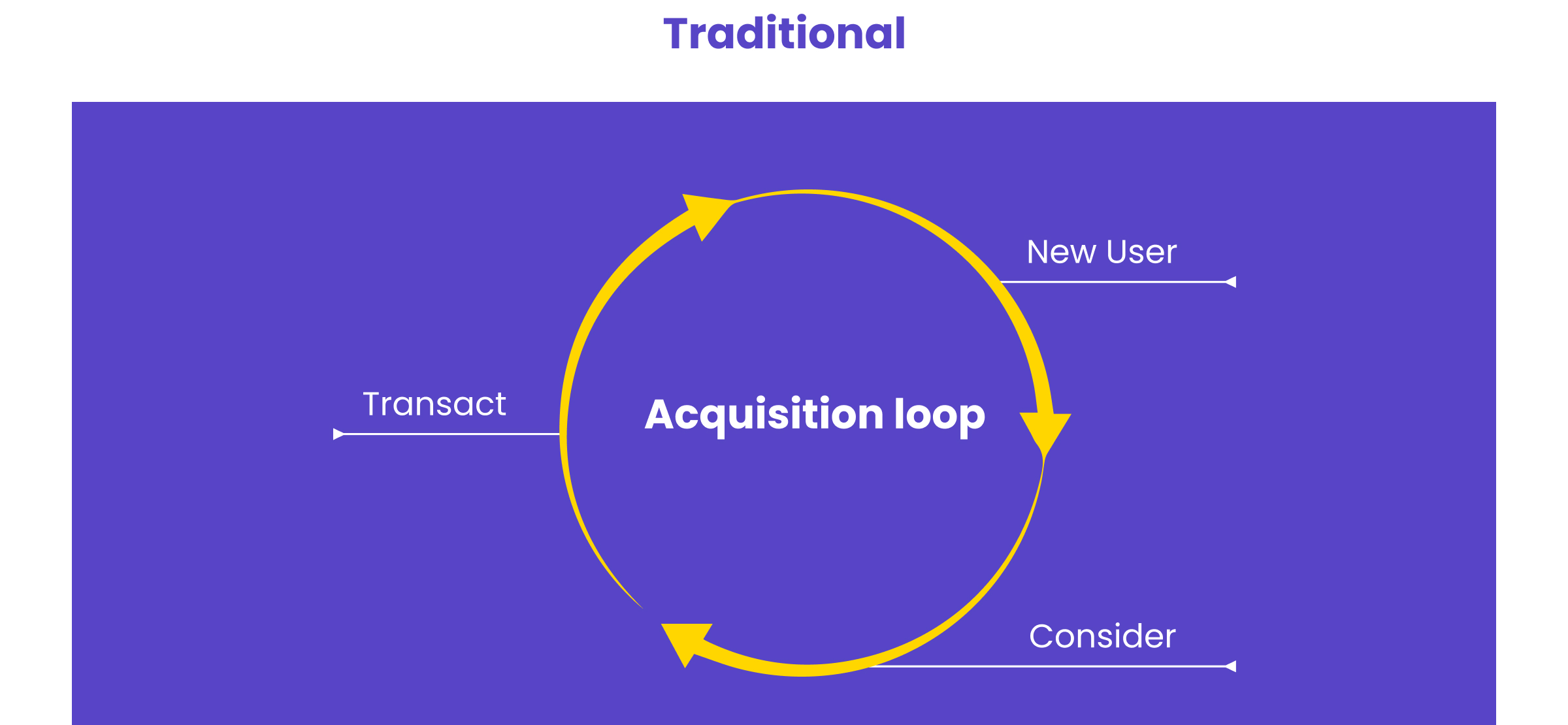

Sameer Jain points out in this insightful episode of WebEngage’s State of Retention Marketing podcast that growth cannot be sustained only by focusing on customer acquisition. The focus needs to be understanding the customer’s journey through the funnel and making it as friction-free as possible. This is what will drive retention. And retention, in turn, is the ‘X factor’ that will give you an edge over your competitors.

Investing in retention drives your CAC low, as it means that there are a greater number of repeat customers, as well as customers to whom upselling/cross-selling is possible, creating brand advocates who, in turn, make acquisition easier, aka cheaper.

As Vadiraj Aralappanavar of Acko points out in this episode of the State of Retention Marketing podcast, the information pertaining to a customer can be shared across verticals. As a result, a customer who has purchased travel insurance can be sent information about life or health insurance policies as well. So, the advantage for a technology-led player is that they get a larger share of the customer’s wallet for longer periods of time.

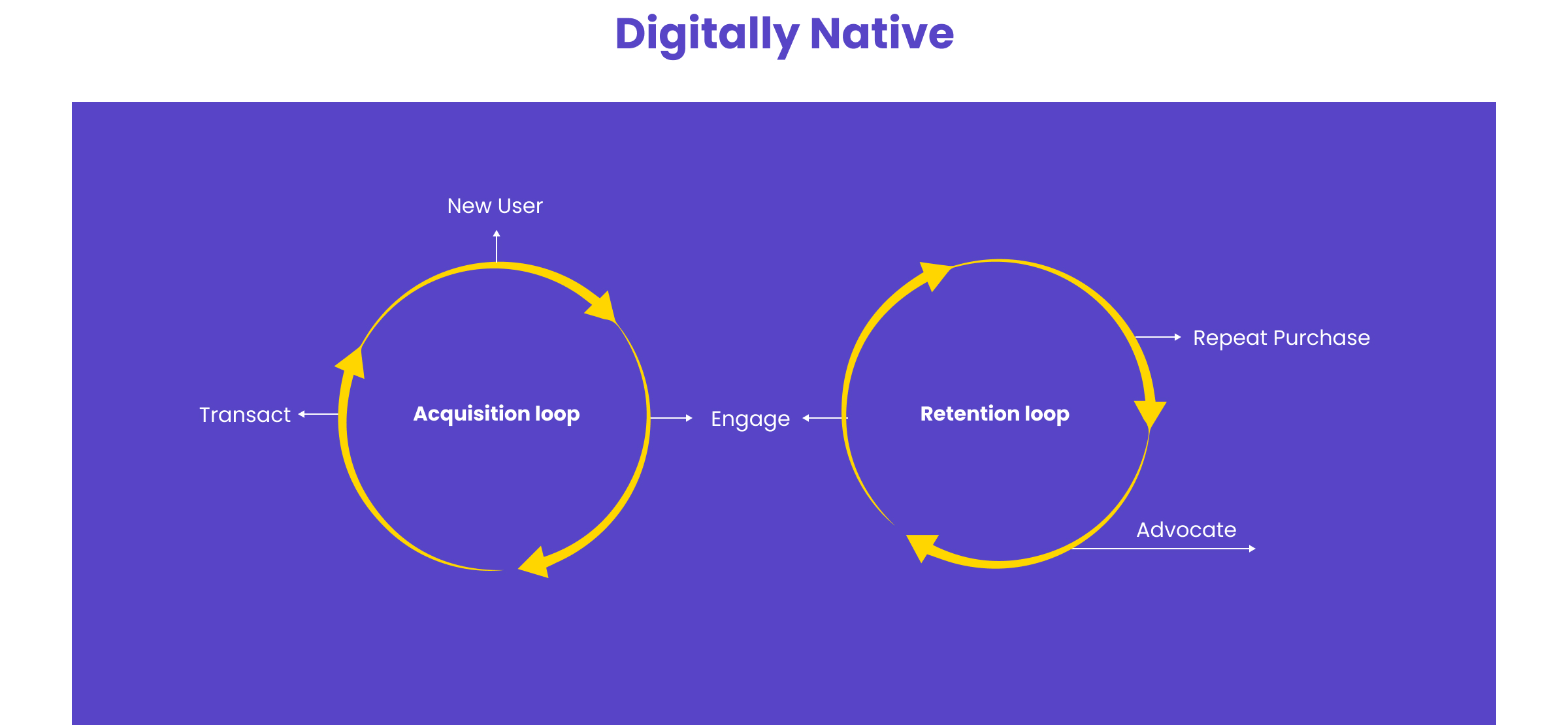

Engaged customers are also more likely to become brand advocates, creating a self-perpetuating ‘growth loop,’ as shown in the picture below.

Still Unsure? Here are Some Numbers

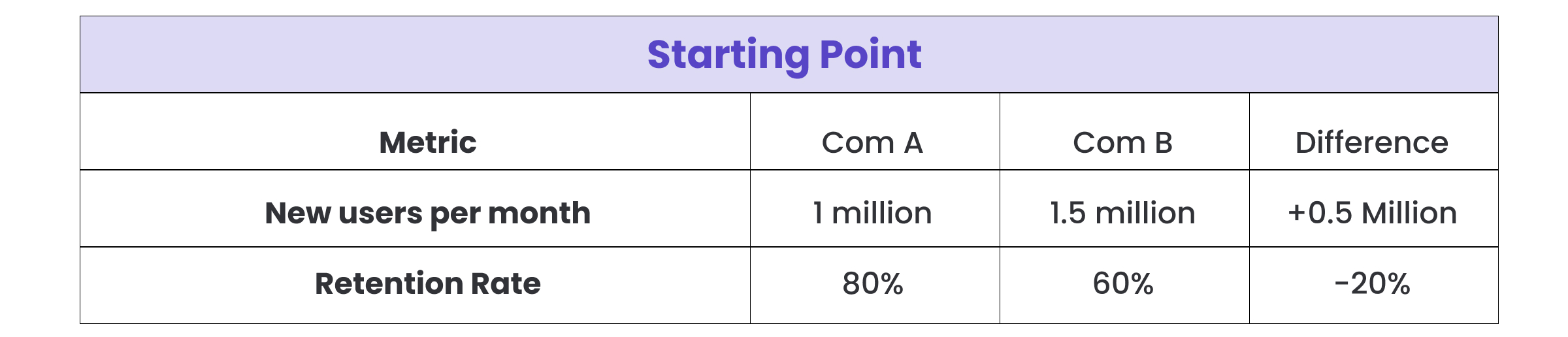

Let us consider Firm A and Firm B, who acquire 1 Million and 1.5 Million new users per month, respectively. The difference in their retention rates is mentioned below.

Now, Company B has a clear lead here, and a mere 20% retention difference might not move the needle much with 0.5 Million incremental new users being acquired monthly, right?

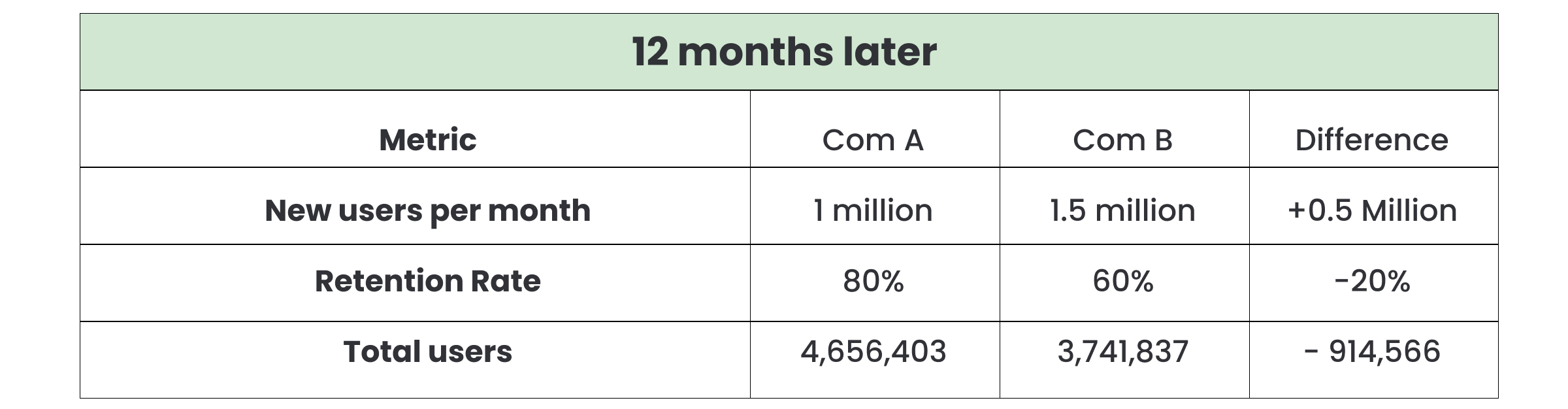

Let’s see what happens 12 months later:

Well, Company A is clearly ahead now, even with lower acquisition rates per month. 1.2X ahead, to be precise.

Conclusion

Relying on traditional channels for customer acquisition and retention or a non-personalized basic website is no longer an option nor a luxury. Digital transformation is a necessity both in the short as well as long run. WebEngage has successfully assisted many insurance companies like yours to leverage technology and scale. Request a call back to explore how WebEngage can make sure that you’re on the shotgun seat of the digital transformation bus.

Vanhishikha Bhargava

Vanhishikha Bhargava

Dev Iyer

Dev Iyer

Sanjay Mishra

Sanjay Mishra

Harshita Lal

Harshita Lal