A Salesforce study states that over 33% of insurance customers switched brands in a matter of 12 months. So, what drives customers to change providers?

One big reason is a lack of engagement throughout the customer’s lifecycle.

As the saying goes – “out of sight is out of mind,” your customers need frequent nudging post sales and not just reminders a mere fifteen days before policy renewal so they don’t churn off.

This piece will walk you through the urgent need to focus on insurance customer engagement and what campaigns and strategies motivate customers to stay.

But first, how and where are insurance companies losing customers the most?

Problems Insurance Companies Face To Retain Customers

Here are some common issues insurance providers like yourself across verticals face with retaining customers:

1. A High Churn Rate During Policy Renewals

A survey by Global Consumer Insurance Insights suggests that 95% of participants want to hear more about their policies and claims from insurers, and a third of respondents stated they never received communication from their insurers.

A high customer churn rate could be due to a couple of other reasons, like:

- Customers finding similar insurance coverage for a lower premium.

- Insurance providers not being consistent with their engagement and establishing their unique selling proposition.

- Lack of transparency in explaining policy terms and pricing.

- Lack of effective targeting strategies.

- Poor customer service.

- Lack of a proactive notification system for policy renewals.

And more.

2. Poor Customer Response Rate To Engagement Campaigns

Noticing poor customer response rates despite running engagement campaigns like email promotions, SMS campaigns, etc.?

You may be lacking a more targeted, contextual communication to win customers back and get them to renew policies on time.

Simply sending reminders closer to the renewal date does not help reinforce the value you bring, making the relationship entirely transactional.

3. Evolving Customer Expectations

Insurance customers’ needs and expectations are ever-evolving due to more digitization with social media and changing user demographics, for example, new Gen Z and Millennial customers over Gen X.

Customers expect you to reach them across their desired touchpoints with personalized, relevant communication.

The solution?

Solving the insurance customer engagement and retention puzzle

Five strategies to reduce churn rate and bring repeat policy purchases:

1. Running event-based campaigns

A more data-driven approach to engagement campaigns can land you repeat customers and cap churn rates.

Using customer data and tapping into their preferences, you can send event-based engagement campaigns to support contextual, thoughtful communication that customers appreciate.

Acko saw a 17.32% increase in policy renewals. They took an event-based approach to automatically settling claims by tracking user actions on its app and website and mapping them. Event-derived data helped them trigger contextual communication to policyholders every time they raised a claim request.

Here are some specific event-based campaign examples:

- Birthday campaigns: Send personalized birthday wishes to your policyholders via email, SMS, WhatsApp, and/or app push notifications. You could go the extra mile and offer a special discount for the upcoming policy premium payment.

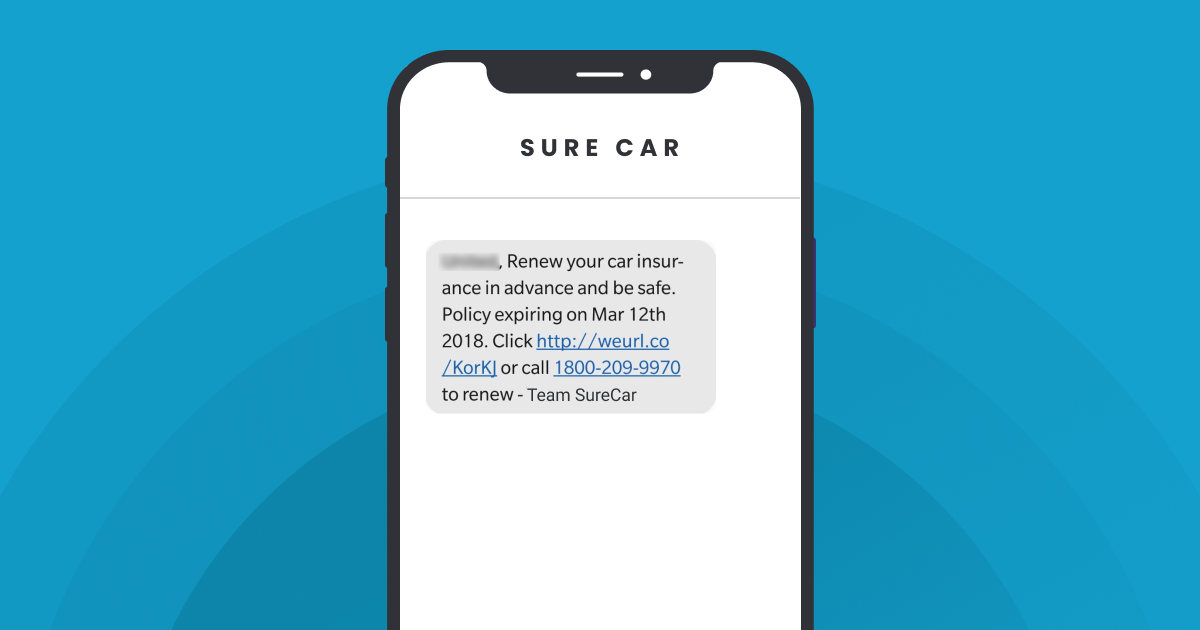

- Reminder campaigns: Keep track of policy renewal dates and send weekly reminders across customer channels like emails, SMS, or WhatsApp. Offer customer support with renewing and explaining policy changes.

- Milestone and anniversary campaigns: Send well-wishes for customers’ life events and anniversaries like retirements, promotions, renewal term completions, etc.

2. Sending Hyper-Personalized Communication

Personalize all your campaigns to ensure policyholders don’t miss out on any communication landing in their email or messaging inboxes.

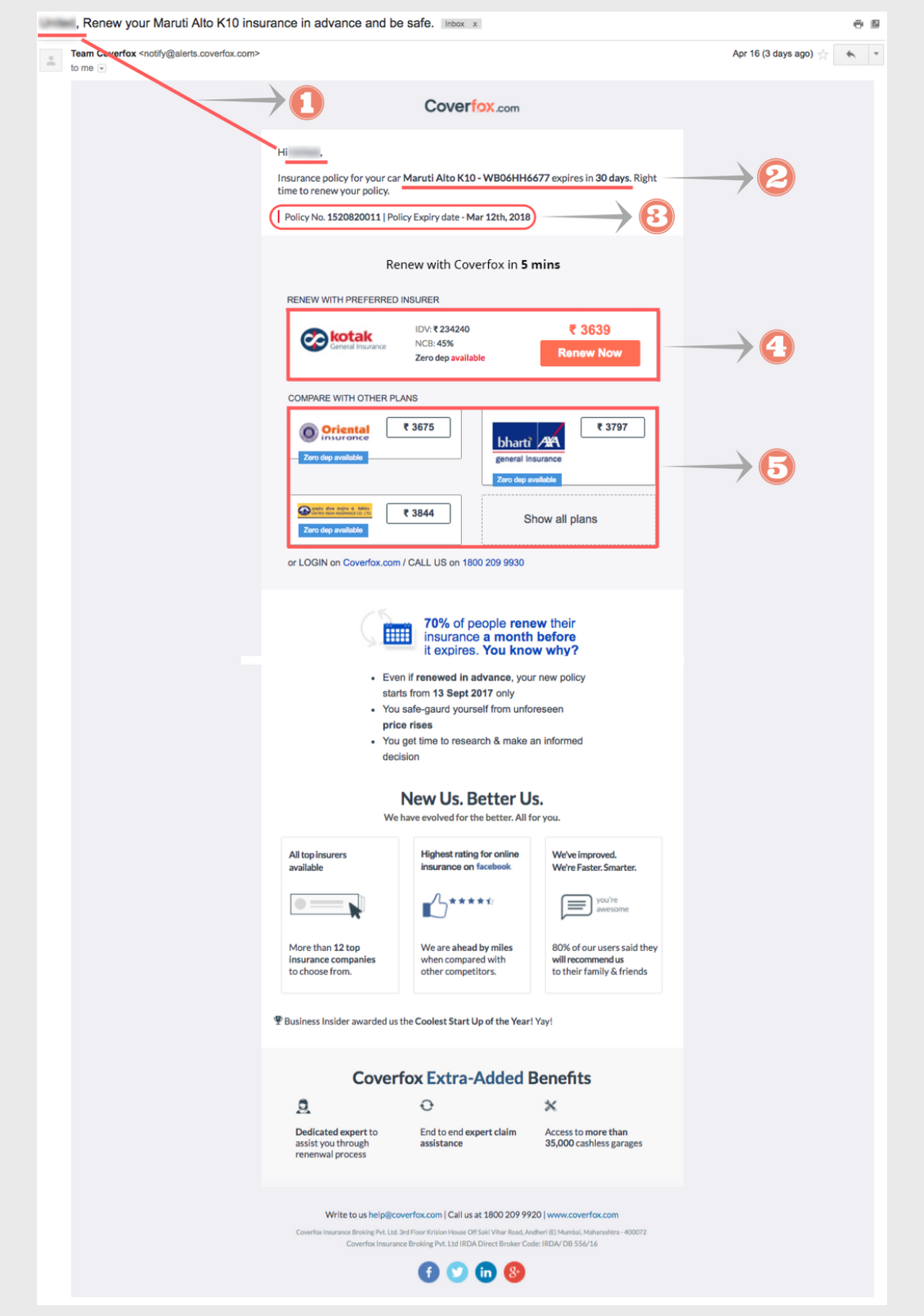

For example, say you offer motor insurance, and a customer’s policy renewal date is fast approaching. You can send them hyper-personalized emails and web notifications by:

- Addressing them by their first name to boost open rates.

- Adding the car’s model name and number to be specific.

- Including a countdown timer indicates the number of days left to renew the policy.

- Adding policy pricing details and reasons for change, if any.

- Adding last and upcoming renewal dates for clarity.

- Triggering personalized pop-up web notifications.

Here’s an example of the level of personalization that Coverfox brought into their email communication to increase policy renewals by 30%.

Tip: Induce FOMO into your omnichannel marketing approach for better reach across customer touchpoints. For instance, create FOMO with social proof or highlight a potential price hike after payment due dates.

3. Segmenting Customers

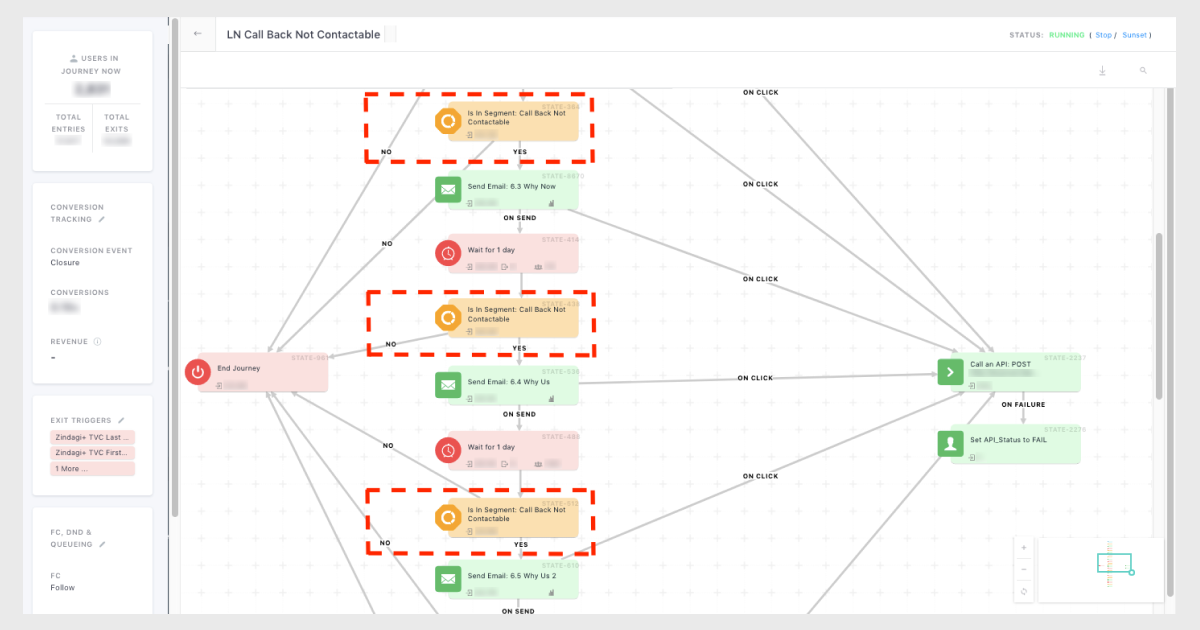

Grouping customers into granular segments based on their behavioral and demographic data lets you send targeted messaging across touchpoints that policyholders can actually relate to and click through.

Customer segmentation is especially beneficial for insurance providers whose customers hold multiple policies.

For example, you can segment customers with motor insurance to send personalized informatory communication, such as emails on new traffic rules or notifications about FASTag.

Similarly, segment health insurance customers based on their demographic data to send them SMS reminders for health checkups nearby, dietary to-dos, etc.

Edelweiss Tokio Life puts adequate segment checks throughout the lead nurturing journey. The workflow setup guides every customer along a unique path, based on their actions and reactions to messaging and events. This approach helped them achieve a 47% conversion uplift.

4. Analyzing Cohorts

A cohort is grouping users based on a common identifier or event within a specific time period. And analyzing cohorts means to derive insights based on each group’s behaviors.

For insurers, a cohort can be a group of specific insurance policyholders who bought a plan in the same year – say, a family health insurance policy in May 2021.

Cohort analysis lets you understand user behavior, for instance, what leads to insurance customer actions like app installs, user churning, channel-wise engagement, and so on, necessary to explore customer lifecycles and increase sales.

5. Using Funnel Analytics

Funnel analytics involves actions taken by customers from initial awareness of a product or service until conversion. From an insurance companies’ perspective, a funnel can be the step-by-step process across touchpoints a potential customer goes through until purchasing or renewing a policy.

You can dissect funnels for insights based on various parameters like events (filling a signup form, downloading a policy brochure, etc.), time taken to convert, engagement channels (emails, ads, notifications, referrals, etc.), and so on.

Analyzing funnels lets you uncover potential bottlenecks hampering conversions like on-time policy renewals and offering opportunities to optimize customer journeys. For instance, users drop off during payments due to card-related concerns, lack of policy explanations, etc.

If your insurance company has been struggling to improve customer retention, it’s time to re-strategize communication with customers and look beyond automated renewal reminders.

Diksha Dwivedi

Diksha Dwivedi

Surya Panicker

Surya Panicker