From finding leads to conversions, selling insurance policies is anything but a cakewalk.

Most insurance companies struggle to win customer confidence and experience lower conversions on campaigns. While part of the reason is the increasing competition, the other is the complexity of the products and services they provide or their pricing – this often leads to a higher number of drop-offs across the funnel.

This is where insurance companies can start to use funnel analytics to gather insights on the different customer segments to create journeys that lead to conversions.

What Are Funnel Analytics?

Funnel analytics involves the analysis of a chronological sequence of actions taken by potential customers up to conversion. In the context of the insurance industry, a funnel represents the step-by-step process that potential customers go through from their initial awareness of an insurance product to the final conversion of purchasing a policy.

The actions can take place across various touch points like the website, the app, email, or other online digital channels. By tracking user actions at each touchpoint, insurers can gain valuable insights into customer behavior, preferences, pain points, and engagement levels. In addition, it also helps to know whether the funnel strategy is working or not, and which aspects are driving or blocking conversions.

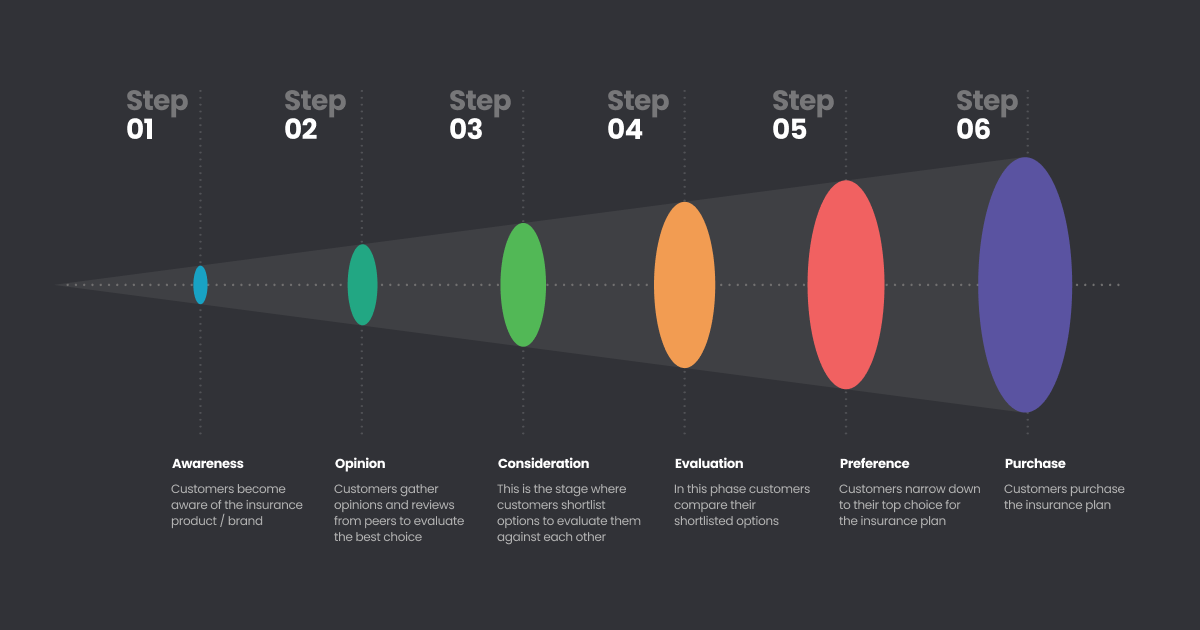

Typically, funnel analytics looks into the following stages:

- Creating brand/ product awareness

- Generating interest in the brand/ product

- Triggering consumer desire to buy the product

- Encouraging the consumer to take action (make a purchase)

However, the insurance sales funnel doesn’t follow this sequence as it is. There are a few differences. It includes more stages in addition to the above four.

| Stage | What customers do | What insurance companies do |

|---|---|---|

| Awareness | In this phase, customers compare their shortlisted options. | Content marketing, email outreach, advertisement, etc. |

| Opinion | Customers gather opinions and reviews from peers to evaluate the best choice | Present their products as the best solution. |

| Consideration | This is the stage where customers shortlist options to evaluate them against each other. | Show customers how-tos, testimonials, reviews, etc. |

| Evaluation | In this phase customers compare their shortlisted options. | Show comparative analysis with other products, etc. |

| Preference | Customers narrow down to their top choice for the insurance plan. | Offer incentives and all possible reasons so customers add your product to the cart. |

| Purchase | Customers purchase the insurance plan | Push customers to make the purchase. |

Here’s a diagram to understand the sales funnel flow better:

The ideal user journey funnel of an online insurance firm involves guiding potential customers through a series of steps. This starts from awareness of the insurance products/services to becoming a loyal and satisfied customer. The typical user journey funnel for an online insurance firm is similar to:

- Awareness Stage – The journey begins with creating awareness of the insurance firm through various marketing channels such as online advertising, social media, content marketing, search engine optimization (SEO), direct mail, directory listing, and more. This is where companies need to provide educational content.

- Interest Stage – At this point, the prospect starts to actively evaluate the products/ services offered by the insurance companies, using comparison tools and reviews as their guiding light. It’s important for companies to become the go-to source of information around this.

- Consideration Stage – At this funnel stage, prospects may request personalized quotes or estimates for specific insurance plans and products based on their needs and preferences. Companies need to provide real-time or proactive assistance here for decision-making.

- Decision Stage – Simplify the application process with a user-friendly interface and step-by-step guidance for those who want to make the purchase. Present clear pricing details, including premiums, deductibles and coverage limits.

- Action Stage – During this funnel stage, the prospect proceeds to purchase the selected insurance policy directly through the website or the checkout link provided.

The reality is, that customers can drop off at any stage in the insurance sales funnel. There are many reasons for it — they found a better insurance product on another website, better pricing, got lured into another product because of marketing gimmicks, no support from insurance companies, etc.

And that is why you have to analyze your insurance sales funnel at every stage, collect data, and optimize to drive potential customers to the next stage in the funnel.

How do you do that? Let’s dive right in.

Ways to dissect your funnel analytics for insights on engagement

While there are several ways to read the data and insights provided by funnel analytics, we recommend taking the following approach:

1. Analyze Based On Events

Consumers may engage in many events on your website, app, or other platforms. For example,

- Explore your insurance options

- Then go deeper into one type of insurance (for example, auto insurance)

- Further, they might check what the policy covers

- Then, they might click on a ‘Contact Me’ button

- Fill out a form on the website

- Download an insurance policy brochure

All these are events. When you collect data on different events, you can analyze it to understand consumer behavior.

Further, you can analyze this data in more detail. For example, many viewers may have clicked on Product X, but few clicked on the ‘Contact Me’ button. This means it’s time to optimize the Product X page to increase the clickthrough rate.

This is called even attributes. Event attributes help you analyze your user behavior at a granular level based on a specific event.

For example, an event could be “Clicked on ‘Get a Quote’ Button,” and the associated event attributes might include the specific policy type the user was interested in, the time and date of the click, the user’s geographic location, or any other relevant information.

By capturing and analyzing these event attributes, companies can tailor their marketing strategies, improve user experiences, and optimize the conversion process to meet customers’ specific needs and expectations.

For example, these are some specifics you could analyze:

- Insurance policy name

- Insurance category

- Policy cost

- Policy ID

- Policy rating

- Location

- Time

- Country

- City

- Platform

- Device

2. Analyze Based On The Time Between Engagement

Another factor in your insurance sales funnel analytics is the time between customers’ engagements on your platforms. For example, say a viewer sees a health insurance plan page on your website. Then, they return to that page after one month and move one step forward by filling out a form.

Different customers may have different engagement intervals. And hence, when you collect data, you can calculate the average engagement interval. So, how does this data help?

- It can help you understand how long customers may take to engage with different campaigns

- Based on that, you can decide how consistently you may need to promote a particular campaign

- For example, if you’re launching a new insurance policy, you will know exactly how long you’d have to run the campaigns to generate awareness, leads, and conversions

3. Analyze Based On Time To Convert

Let’s consider this instance: A prospective customer selects an insurance plan and adds it to their cart. But then, like most online shoppers, leaves your website. You wait for a few days and then re-engage them via email campaigns. And finally, the prospect completes the purchase after a few weeks. In this case, the time to convert was a couple of weeks.

You can address many aspects and components by conducting analysis based on the time it takes for prospects to convert like:

- Measure the average time to convert, to get a sense of time you have on hand and plan campaigns accordingly

- Create re-engagement and conversion campaigns to bring back customers

- Create campaigns to entice customers to make purchases

- Plan your sales and marketing calendars based on the time you have. For example, calculate commissions for insurance agents, etc.

4. Analyze Channel-Wise Campaigns

Multichannel marketing involves multiple channels such as email, social media, SMS, ads, etc.

It helps at all stages—from brand awareness to generating interest via consistent communication, to engagement and providing a good customer experience from the start to post-purchase stages.

And so, it’s important that you don’t leave out analyzing any of your marketing channels. Here’s how it can help your insurance business.

- Customers may explore your insurance products via any channel, hence, ensure all your channels are running smoothly and are consistently updated

- Find out which channels are performing the most so you can leverage that channel to boost business

- Find out which channels aren’t working well and why, so you can optimize them. Conversely, eliminate them from your plan if they aren’t performing at all

- You can identify which channel your best customers come from

- Some of the channels you must consider are: paid ads, social media, email, organic search, and referrals, among others.

5. Run Analysis To Segment Prospects

In your insurance sales funnel, you’ll have different types of potential customers. Some might be more interested and active, and others may not be. And so, a one size fits all approach to marketing campaigns will not work.

That’s why you need to analyze your prospects so that you can segment them into different categories—based on their interest, behavior, product choice, location, or any other characteristics.

Segmented campaigns have 14.31% higher open rates and 101% more clicks than non-segmented campaigns.

Let’s look at some use cases of prospect segmentation:

- Segment prospects based on the type of insurance they’re interested in, for example, health, auto, commercial, etc.

- Further, segment prospects based on the insurance product they are interested in. This is where event-based analysis will help you generate data in detail

- Categorize prospects based on their engagement levels. For example, active and inactive prospects should be approached via different messages

- To reignite the interest of inactive prospects, send them email or SMS campaigns with links to your insurance website

- For active prospects, create hyper-personalized marketing campaigns to drive conversions

6. Analyze Your Prospects’ Journey

When you sell insurance products online, even the smallest of details can help you understand customers better. But the truth is, when it comes to insurance, customers drop off at any point in their journey.

Therefore, it’s important to capture data about your prospective customers’ journey and analyze it.

Understanding these details empowers businesses to optimize their marketing efforts, enhance customer engagement strategies, and address pain points in the customer journey, ultimately improving the overall conversion rates and customer experience.

Once you know the reasons, you can run campaigns to bring the customers back and drive them towards taking the next step in their path to conversion.

For example, let’s look at an example of how capturing data at different stages of prospects’ journey can benefit your marketing strategy.

Say, your customers might be landing on your website from various sources—for example, from social media posts, ads, emails, or directly opening your website. By gathering information about where they’re coming from, you can identify which channels are bringing you more leads.

Similarly, if you find they’re dropping off at a certain stage on a particular channel, you’ll be able to optimize that path better.

7. Analyze Based On Customer Segments

Another way to look at your funnel insights is to analyze the different customer segments and the value they bring to your business.

Customer lifetime value (CLTV) is a measure of the total income a business can expect to bring in from a customer for as long as they remain with the brand. But in this case, we mean analyzing based on groups instead of individuals.

For example, calculating the CLTV for different customer segments can help your insurance company identify the long-term revenue potential of policy buyers to focus on customer retention and maximize their engagement with what you offer.

At this point, you can also use the insights to calculate the average revenue generated per customer at different stages of the funnel. This helps further segment buyers based on revenue contribution, policy type, demographics and other parameters.

According to the team at ContractorNerd, “Segmentation is critical in specialized insurance markets. Insurance providers track industry-wide metrics like loss ratio and expense ratio to evaluate profitability across different customer segments. For contractors insurance specifically, these ratios help us tailor coverage options that address the construction industry’s unique risk profiles while maintaining competitive pricing.

Insurance companies can then use this information to create campaigns focused on policy renewals, add-on purchases and cross-selling to improve CLTV and positively impact long-term revenue goals.

8. Analyze To Identify Qualified Leads

Quality is better than quantity. But like every other business, you might also be concerned about the quantity of leads coming in. However, the truth is, the quality of leads can make or break your insurance company’s growth.

For example, a lead with high-purchase intent is much better than ten leads who are exploring your products with no intention to purchase.

Moreover, you might also have leads who take months to convert. This means you’d be spending a lot of your marketing budgets, time, and effort in trying to convert those leads that have low conversion potential.

On the other hand, a high-purchase intent lead or a high-value lead would mean you spend less marketing budget, time, and effort on it.

Analyzing leads to understand which ones are worth pursuing thoroughly and which ones are not can also help you understand which product sells better in your target audience. That way, you can come up with offers accordingly.

Do you need insurance sales funnel analytics?

As you read, there are many hidden insights in your insurance sales funnel. And unless you analyze the different aspects, you won’t be able to uncover them.

Only when you analyze the funnel bottlenecks and plus points will you be able to optimize your insurance sales funnel.

To help you with funnel analytics and decode how to drive conversions, you require a solution that enables you to monitor campaigns easily.

WebEngage’s marketing automation tools help your insurance business with funnel analytics. From giving you the ability to read how each campaign impacts the different stages of the funnel to the journey each prospect dates, our insights equip you with the actionable you need to drive growth.

Diksha Dwivedi

Diksha Dwivedi

Prakhya Nair

Prakhya Nair