A staggering $1.3 trillion – that’s the projected size of the Indian fintech market by 2025.

But what does this mean for lending companies?

Lending tech firms have the potential to claim a huge share of this massive growth–a remarkable 47%, translating to a substantial $616 billion. However, with all the tech and digital-first initiatives to leverage this tremendous growth, one of the biggest challenges faced by the fintech industry2 today is–earning user trust.

Customers are cautious about sharing personal financial information online and borrowing money through digital platforms. This is where secure transactions, transparent terms, clear communication, and a smooth customer journey become the pillars of trust and better user engagement.

In this blog, we’ll walk you through 5 ways to peek inside your funnels, uncover insights, and transform your user engagement. Ready to shift gears and take your lending tech firm to the next level? Let’s jump right in!

What are Funnel Analytics, and How Do They Look Like for a Lending Company?

Funnel analytics is basically a visualization tool that charts a customer’s journey from their first interaction with a brand right down to the completion of a desired action.

But why are funnel analytics so important for a lending company?

Because it paints a clear picture of where potential borrowers drop off, where they’re most engaged, and which stages require extra marketing efforts. It’s like having an x-ray vision that reveals your customers’ pain points, desires, and behaviors. This knowledge is highly instrumental in crafting strategies that resonate with the target audience and drive them further down the funnel.

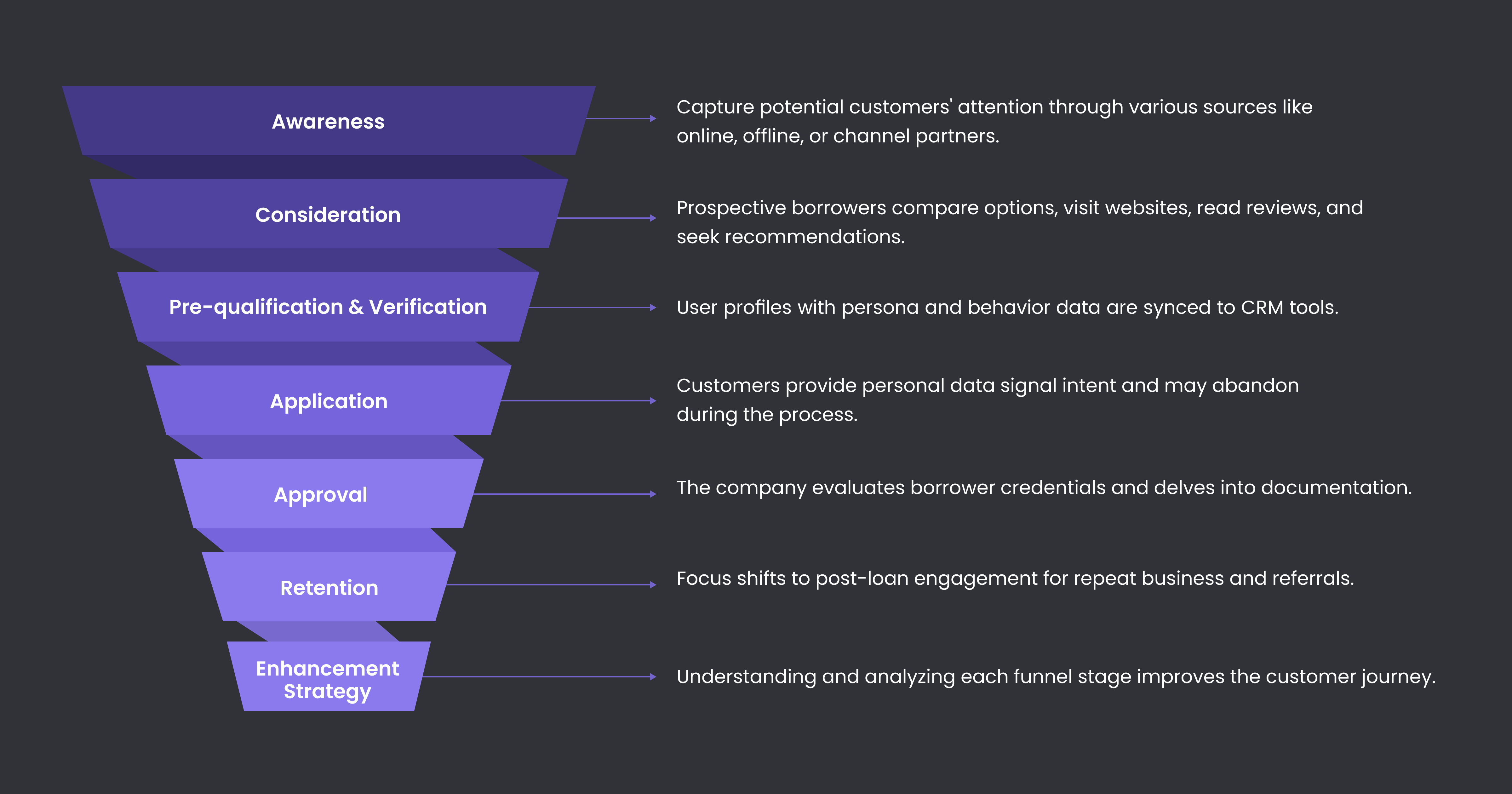

Let’s peek inside the typical lending company funnel:

By understanding and analyzing each stage of the funnel, you can identify areas of improvement and implement strategies to enhance their customer journey. This will ultimately lead to higher user engagement and more conversions.

5 ways to dissect funnel analytics to boost user engagement

The global pandemic has not only fast-tracked the digital-first shift but also heightened customer expectations for personalized experiences. As a financial institution, your sales funnel is a goldmine of customer data, encompassing everything from PII to demographic profiles and economic backgrounds. However, the missing link is effectively utilizing this data to enrich customer experiences and reduce the drop-off rates.

Here are 5 ways to dissect your funnels for insights that will help you enhance your customer engagement:

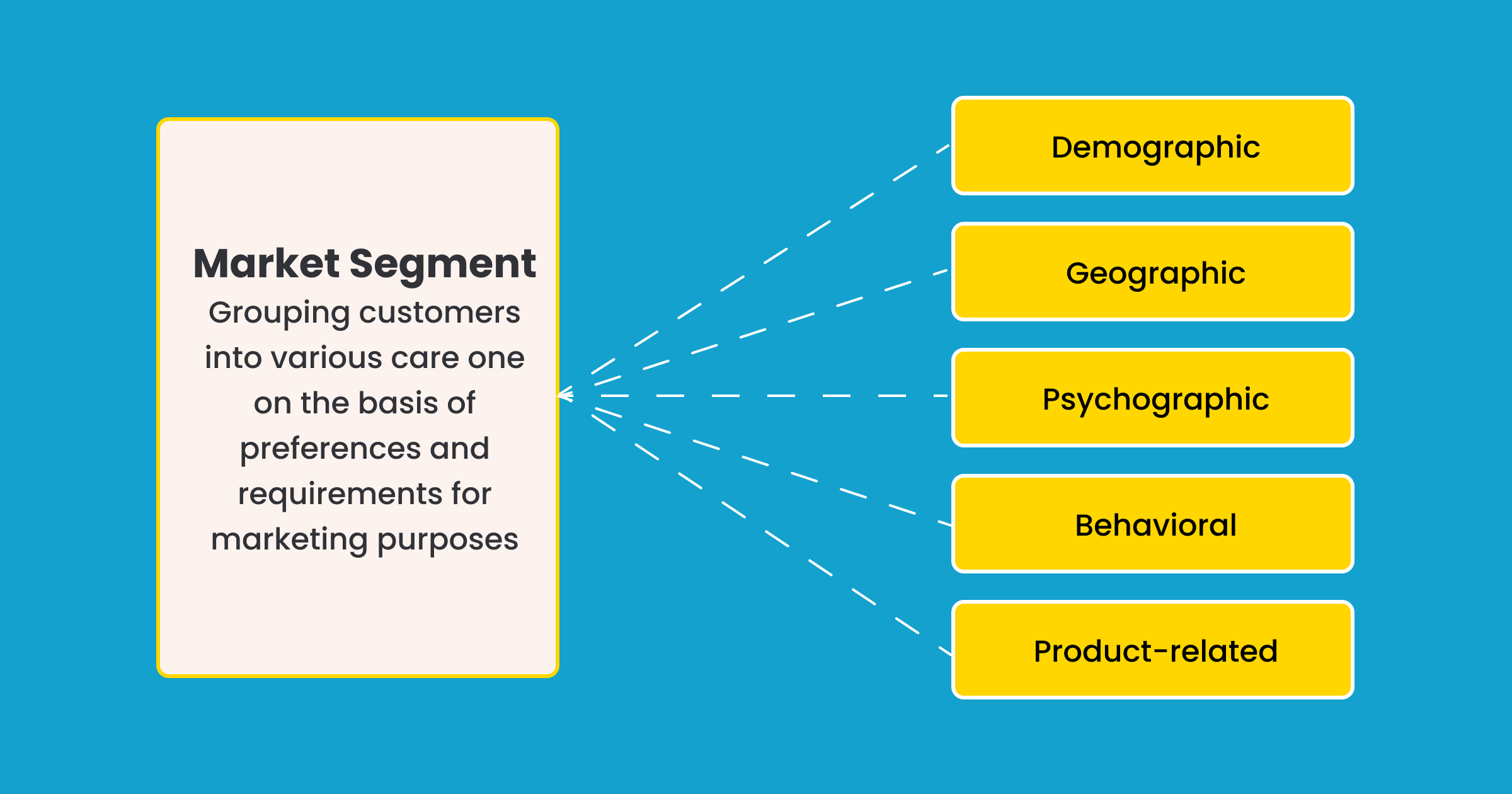

1. Analysis of Customer Segmentation

Customer segmentation is dividing your target audience into distinct groups based on shared characteristics. Think of it like organizing a library. You categorize books based on genres and authors, ensuring each reader quickly finds a book that resonates.

Now, how does this help a lending company boost engagement?

Understanding the different segments of your audience allows you to tailor your messages, offers, and content in a way that resonates with each group uniquely.

Let’s break down how customer segmentation looks for a lending tech company:

Demographic Segmentation: Based on age, income, education, and more, this is where you target specific loan offers. For instance, student loans might be aimed at younger demographics, while premium loan products might cater to those in a higher income bracket.

For example, Bank of America brilliantly segments its customers into distinct categories like young adults, families, retirees, small business owners, and high-net-worth individuals. By tailoring marketing efforts and products to these categories, they’ve carved out a robust strategy that not only sets them apart in the BFSI sector but drives consistent revenue growth.

Behavioral Segmentation: This dives into how customers interact with your platform. At which stages in the funnel do they spend the most time? Are they first-time or repeat borrowers? By gauging these behaviors, you can adapt your approach to guide them seamlessly down the funnel.

Geographical Segmentation: With varying local lending regulations and economic conditions, geographical segmentation allows you to design location-specific offers and strategies.

Technographic Segmentation: Understanding the devices, software, and platforms your customers are using is vital. Are they mobile-first users or desktop enthusiasts? This data helps in optimizing user experience across different platforms.

Risk-based Segmentation: Risk forms the backbone of the lending industry. Segmenting customers based on their risk appetites ensures that you’re recommending products that align with their comfort zones. Whether they’re risk-averse or more adventurous in their financial pursuits, curating products that fit these profiles enhances the customer experience.

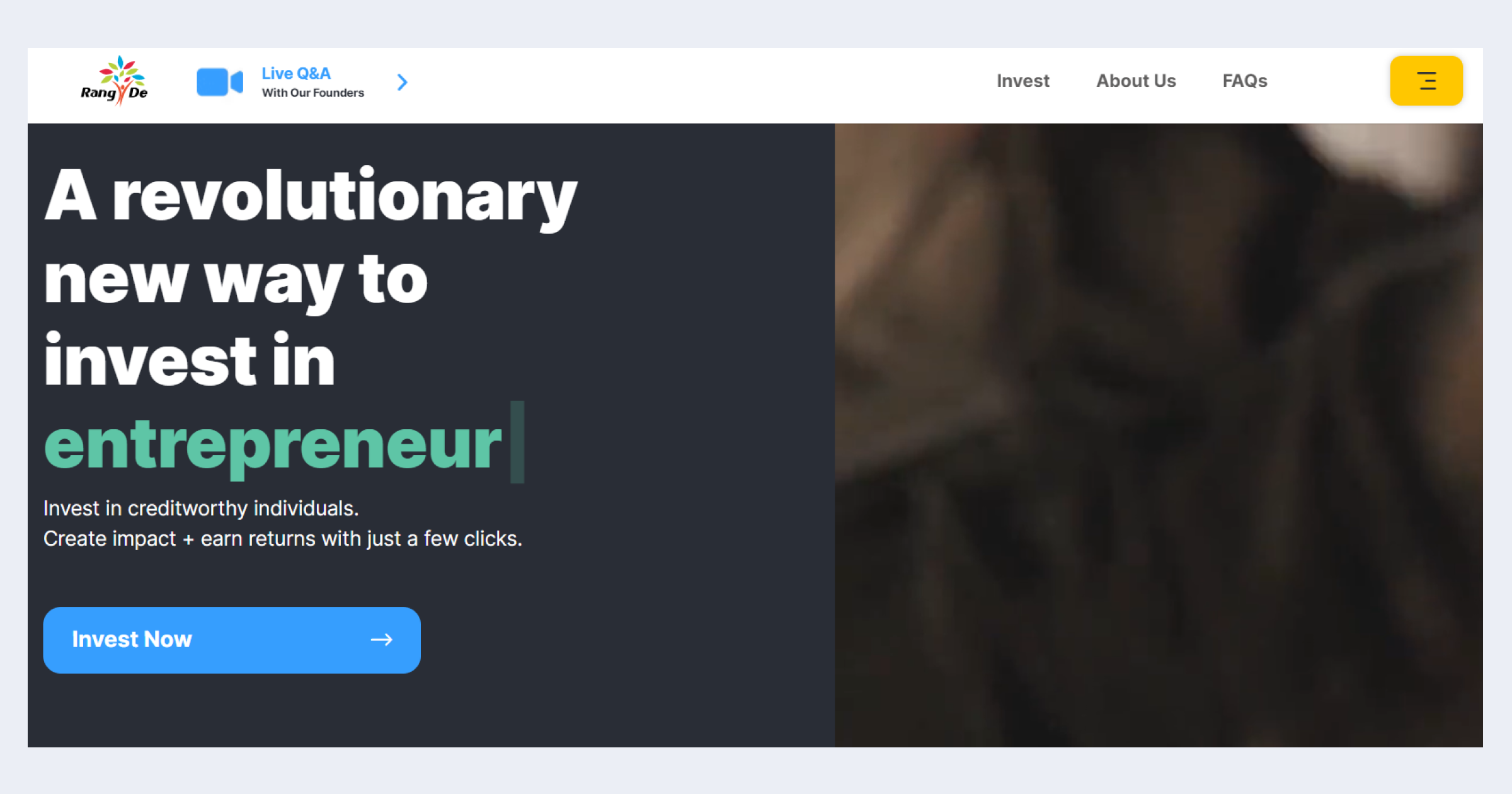

Here is an example of RangDe, India’s first social peer-to-peer lending platform. It faced several challenges, including attracting sufficient users to the platform, getting users who were dropping off to complete their KYC and initiate repeat purchases, automating user engagement initiatives, and the need for advanced and real-time user segmentation.

RangDe leveraged WebEngage’s Startup Program and got an easy-to-use, robust solution for setting up user journeys and funnels to reactivate lapsed/inactive users, setting up segments according to demographic and behavioral data, and enhancing their onboarding experience.

With the help of WebEngage, RangDe managed to increase its Monthly Active Users (MAUs) by 26% within five months. They also saw a 26.6% average email open rate and a 7.7% increase in Signup to KYC conversions.

2. Identifying Drop-off Points

For a lending company understanding your audience’s journey isn’t just beneficial – it’s imperative. One of the vital aspects of this understanding is recognizing where and why potential users drop off. But why is this important?

A staggering 73% of new fintech users churn within just 7 days. When a significant portion of your audience drops off almost immediately after interacting with your platform, it indicates underlying friction points. These drop-off points could emerge from various facets: a complex application process, unclear terms, or a dull user interface.

To tackle this, dissecting your funnel analytics and identifying at which stage users typically leave is essential. Is it during the onboarding process? Or perhaps during the initial product exploration? Highlighting these specific stages allows you to pinpoint areas that need refining.

Strategies for course correction

Once you’ve got a handle on where these drop-offs occur, you can start targeted improvements:

- Streamline Processes: Perhaps the initial steps require too much data, or the navigation feels overwhelming. Simplifying these segments can keep users engaged longer.

- Clarify Offerings: Ensure product and service descriptions are clear, compelling, and tailored to the user’s immediate needs.

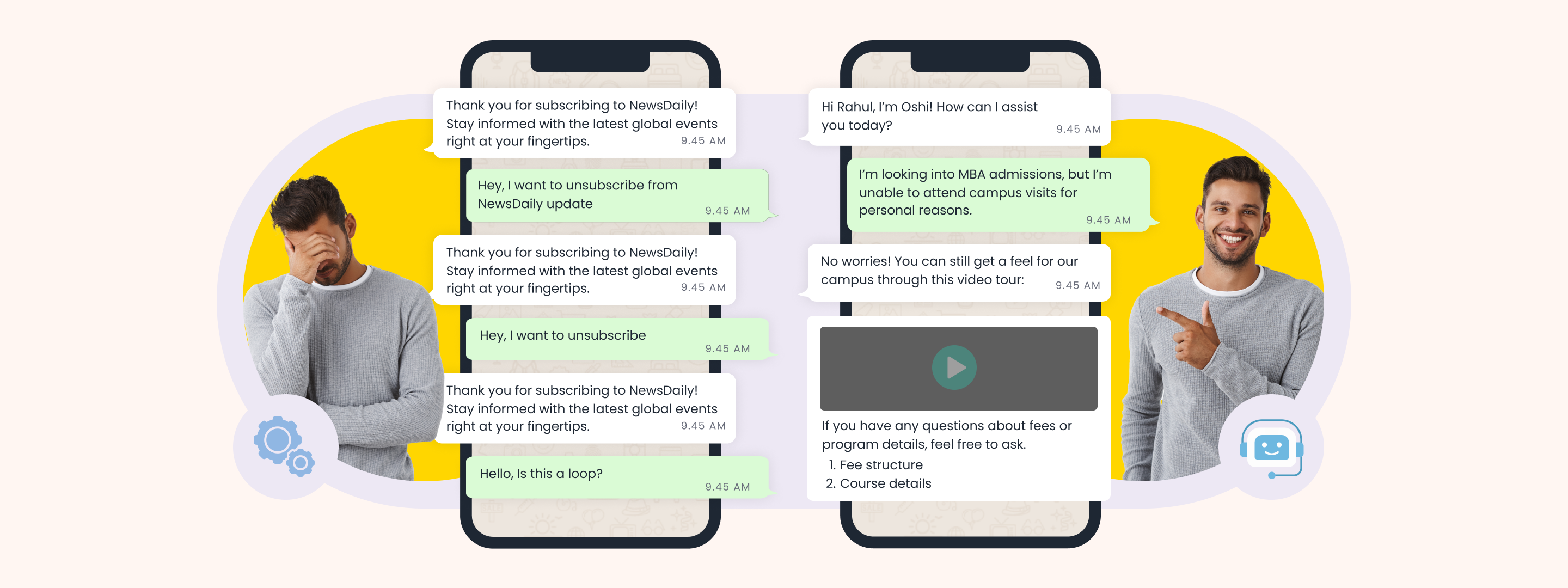

- Enhance Engagement: Introduce interactive elements or tutorials to guide new users, making them feel supported through every step. Incorporate additional outreach channels to boost engagement.

Here is an example of CASHe, a fintech platform that provides consumer lending services. They sought to execute omnichannel campaigns to minimize user drop-offs and motivate current users to finish their profile journeys for immediate loan distribution. However, they encountered difficulties with rising user drop-offs across various customer journey stages.

To boost campaign performance, they incorporated different communication channels, including email, SMS, and push notifications, and added an IVR system for voice communication. With the help of WebEngage funnel analysis, they identified the stages where users dropped out of the journey, leveraged IVR to engage them in real time, and significantly reduced drop-offs.

Through this approach, they managed to route 35% of users via IVR back into the funnel, resulting in a 47% growth in Monthly Active Users (MAUs) and a 75% increase in the repeat user base within a year.

3. Assessing Funnel Length & Duration

While it’s crucial to understand where users drop off, evaluating the length and duration of your funnel is equally critical. Why, you ask? Because in the lending sector, time is more than just money—it’s about user patience, engagement, and trust.

The longer a prospective borrower spends in your funnel, the higher the chances they might feel overwhelmed or distracted. On the other hand, a journey that is too short may give the impression of a hurry, causing potential clients to feel they are missing important details.

Understanding the ideal journey

Determining the optimal funnel length involves delivering all the necessary information without overwhelming the user with excessive steps. For lending tech companies, this could involve a clear bifurcation of stages—Awareness, Consideration, Application, and so on—while ensuring each stage is straightforward and purpose-driven.

Refining the Funnel

Once you have understood your audience’s funnel journey and their data needs, you can take these actionable steps:

- Remove any excessive steps or content that doesn’t directly aid the user’s journey.

- Provide clear guidance, FAQs, or chatbots to assist users in areas where they typically pause longer than anticipated.

- Use analytics tools to constantly assess user behavior, adapting your strategies to meet evolving user needs and market trends.

Here is an example of Lending Kart, which offers loans for small businesses. They took their conversion funnel analytics to the next level by developing a tech-powered lending platform that uses big data and machine learning AI to consider more than 5,000 data points crucial for MSME evaluation.

The platform streamlined the loan application process, reducing the time taken to fill out an application and approve and disburse loans within 72 hours. This enabled Lendingkart to make borrowing easy for over 150,000 MSMEs successfully.

BONUS READ: Want to dive into Conversion Funnel Optimization? Check out this detailed guide!

4. Conversion Rate Optimization (CRO) Analysis

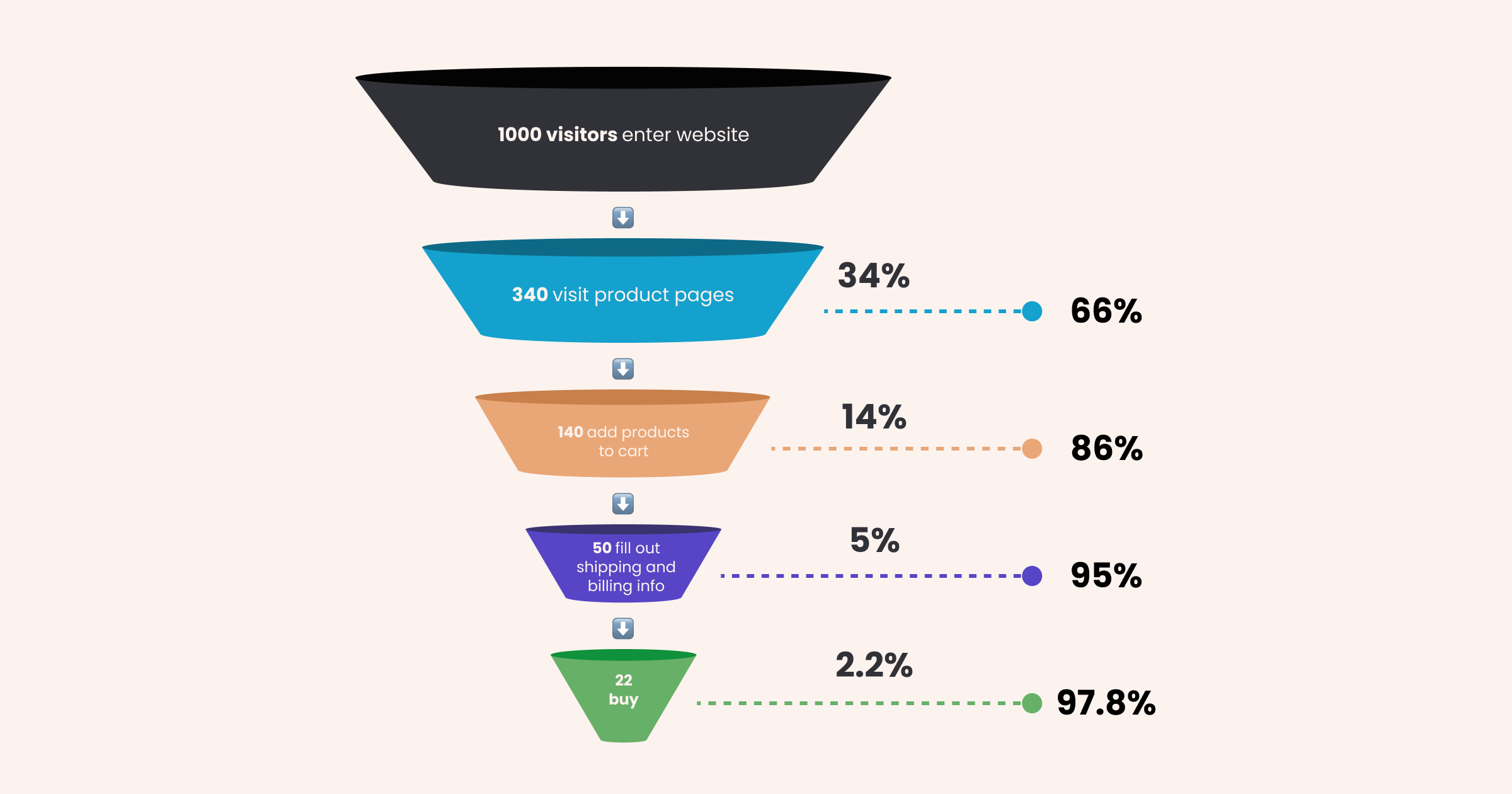

As a lending company, merely attracting potential customers isn’t enough; you need to turn these prospects into actionable conversions. This transformational journey is where Conversion Rate Optimization (CRO) plays its pivotal role.

CRO is basically the process of enhancing your website and content to boost conversions. In other words, CRO is about eliminating pain points along a user’s journey, from the initial click to conversion.

For a lending company, the prospects stand at a crucial crossroads at the application stage, where the chances of conversion and abandonment hold an equal 50-50 chance. Why? A prospect, after thorough research, might be on the verge of starting the application process, indicating conversion. On the other hand, they might abandon if they find a better offer or decide against the loan.

This is where strategic, cross-channel workflows come into play. By offering personalized content, you can guide potential borrowers more effectively. This includes providing insights about document requirements, agent details, processing fee payment modalities, and more. You can also add triggered nudges or reminders to ensure that they stay the course.

Nidhi Saraswat, the head of digital marketing, strategy, and growth at Tata Capital, offers an intriguing solution: pre-filling application forms based on obtained data. Such intuitive steps can significantly ease the application process, making users feel valued and understood, hence boosting conversion chances.

Want to dive deep into the world of lending? This “Metric Obsessed Conversion Playbook” by Nidhi Saraswat will provide invaluable strategies and techniques to optimize your lending process, boost conversions, and drive impressive results.

5. Analyzing Based on the Channel

A modern-day user might discover your service through a targeted Facebook ad, read reviews on a dedicated forum, and finally convert via a direct email campaign. Each channel serves a unique role in shaping the user’s journey.

While overall engagement metrics provide a bird’s-eye view, channel-specific data offers granular insights. Are your social media campaigns driving awareness but failing at conversions? Maybe your webinars are generating buzz, but your website isn’t sealing the deal. Such insights empower you to reallocate resources effectively and refine strategies per channel.

Steps for Effective Funnel Analytics for Channels:

- Channel Breakdown: Begin by listing all the active channels—social media platforms, email marketing, SEO, paid ads, webinars, and more. Assess the volume of traffic, engagement, and conversions for each.

- Identify High-Performers: Recognize channels that consistently deliver stellar results. These become your benchmarks, informing strategies for other channels.

- Spot the Underperformers: Identify lagging channels. Instead of immediately pulling the plug, dive deeper to uncover underlying challenges. Perhaps the messaging isn’t aligned, or the target demographics don’t match.

- Customized Strategies: Each channel caters to a distinct audience segment with unique behaviors and expectations. Tailor your content and campaigns accordingly. For instance, while a detailed article might excel on LinkedIn, a crisp video could do well on Instagram.

- Continuous Channel Evolution: Remember, the digital landscape is ever-evolving. A channel that’s at the top today might take a backseat tomorrow. Regularly revisit your channel analytics, stay updated with platform-specific trends, and ensure your strategies are always a step ahead.

Learn more about Funnel Analytics

Funnel analytics aren’t just a tool; they’re your wayfinder in the vast sea of customer data. It helps you navigate the complexities, address problems, and identify opportunities for improvement. So, leverage its power to create a better, more personalized user journey that can drive engagement and loyalty for your lending tech firm.

The 5 strategies we’ve outlined in this blog can help you spot potential roadblocks, seize opportunities, and fine-tune your approach to user engagement.

Ready to delve deeper into your funnel analytics? Elevate your marketing game by booking a demo with WebEngage today, and let us help you unlock the full potential of your sales funnel!

Inioluwa Ademuwagun

Inioluwa Ademuwagun

Dev Iyer

Dev Iyer

Vanhishikha Bhargava

Vanhishikha Bhargava

Surya Panicker

Surya Panicker