In this competitive landscape of the BFSI industry, cultivating meaningful relationships with potential customers could be what gives you an edge. It can be a complete game-changer. A potential customer converts to a paying customer depending on the journey you take them on. This is where lead nurturing takes center stage for a strategic approach. In this article, we’ll discover the power of lead nurturing and how it can eventually drive sustainable, scalable growth. Let’s unlock some secrets to how you can find value in converting prospects into loyal customers!

What is Lead Nurturing, and why is it relevant?

Lead Nurturing is essentially the process of building lasting relationships with potential customers who have shown interest in a product or service and engaging with them intentionally throughout their buying journey.

Let’s go one step back to Lead Generation, which is the process of getting a potential customer to know about the service/product you’re offering and gauge their interest. If their interest is warm, then that’s when you begin to Nurture the Lead. It focuses on providing relevant and valuable information to the prospects. The final objective, of course, is to guide them towards making well-informed purchasing decisions. One of the most effective ways to get started on that is to address specific pain points and how one can overcome them in easy steps. Relatability holds a lot of power when making important decisions.

Lead nurturing is important for many reasons. It enables companies to establish trust, credibility, and expertise by effectively positioning themselves as a valuable resource in the eyes of potential customers. With personalized content and interactions, businesses can achieve the following:

- Increase conversion rates

- Shorten sales cycles

- Drive revenue growth

It is said that companies that excel at lead nurturing generate 50% more sales-ready leads at 33% lesser cost per lead! This means that a business can maximize the chances of conversion with minimal investment.

5 use cases for you to skyrocket conversions by 50%

Key takeaways from this blog include the following.

- Segmentation and hyper-personalization

- Omnichannel marketing

- Lead scoring

- Conversational marketing

- Voice search optimization

Before we go into that detail on every point, here’s how you can calculate lead conversions!

Aggregated Conversion = (Count of Converted Leads * 100) / Total Leads

1. Segmentation and hyper-personalization

Dividing a broad market into distinct, smaller groups or segments is called marketing segmentation. This paves the way for smaller groups to become more similar in things like behaviors and preferences. Based on demographics, geography, buying behavior, and needs, it becomes possible to identify meaningful segments within a larger market and cater to their needs specifically.

Marketing segmentation becomes a crucial part of businesses for multiple reasons.

- Focused marketing: By creating divisions, businesses can narrow their marketing efforts to specific groups. Because there’s a clear pattern in the said group, it allows for them to follow a targeted approach that can be tailored specifically to the unique needs that the group displays.

- Personalization: Each segment displays a very clear set of pain points and behaviors. This means businesses can deliver highly pertinent and personalized messaging that can immediately strike a chord with the group. Also, a great tool to enhance customer engagement and satisfaction. Today, just mere personalisation doesn’t cut it. Businesses have forayed into “hyper-personalisation”, which is an advanced level of personalization that comes from collecting granular level data from customers at various stages of their buying journey. Data tells us that 90% of consumers (Deloitte) find this appealing, and 78% agree that it’s likely to make them re-purchase from the same business. It also leads to an uptick in business results by up to 86% (Source)

- Increased retention: Crafting targeted retention strategies that include upselling, cross-selling etc, can go a long way in keeping the segments constantly engaged because once you know the unique needs and interests, it’s easier to create personalized communications and exclusive offers that make them feel special.

- Market differentiation: Companies can seamlessly gain a competitive edge by differentiating themselves in the market with effective segmentation. This may also lead to identifying niche markets or lesser-known segments that the competition could have overlooked.

- Allocation of resources: Resources within any company are very precious. Marketing segmentation helps businesses spend their resources smartly and only where necessary. Identifying high-potential segments helps with effective budget allocation instead of spreading resources thin across the entire market. Concentrating efforts on separate segments could drive growth rapidly and also offer a really lucrative return on investment.

Marketing segmentation in the BFSI sector

A lot of global trends point towards digitalization within the BFSI (Banking, Financial Services, Insurance) industry. That’s no surprise now, is it? Marketing segmentation becomes a very important part of BFSI in many ways as more and more customer touchpoints are shifting heavily towards digital platforms. As a result, companies are drifting towards adopting marketing strategies accordingly. This digital transformation also brings with it the big advantage of the ability to generate dynamic customer data, which, as we mentioned above, can be leveraged for hyper-personalization. In fact, Numrcxm argues that “more digitalization = more dynamic customer data”.

For BFSI to execute such marketing segmentation ideas, it becomes even more critical to analyze the existing customer base and identify patterns of behavior. Even for us at WebEngage, using parameters like demographics, behaviors, psychographic, and other relevant categories help to segment their leads, thereby leading to more potential for lead nurturing.

A powerful segmentation technique known as RFM where customers are segmented based on their Recency, Frequency, or Monetary Value. To expand on it, Recency refers to how recently a customer made a purchase, Frequency refers to how often a customer makes purchases, and Monetary value refers to how much money a customer has spent with the company. It worked wonders for a brand like Glide Invest.

Tapping into this digital landscape and using the power of data-driven segmentation, BFSI can make some empowering decisions on their strategies.

2. Unleash the Potential of Omnichannel Marketing

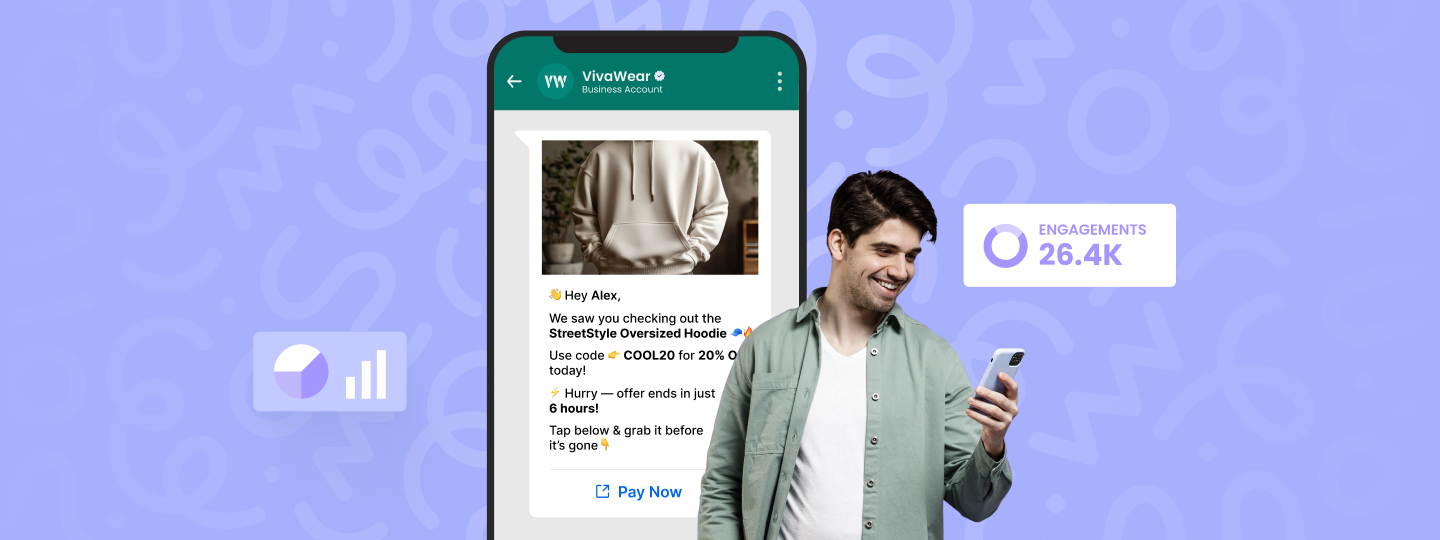

Omnichannel marketing is an integrated customer-centric approach with the aim to deliver a seamless and consistent experience across all communication channels like social media, websites, WhatsApp, push, in-app, SMS, email and others. Regardless of the channel or device used by the user, omnichannel marketing gives a brand the opportunity to create a cohesive experience. All the channels are interconnected and work together, which produces a highly unified experience.

It’s very easy to confuse omnichannel with multichannel. While they might sound extremely similar, they’re actually quite different. Multichannel marketing refers to having a presence across multiple channels. Each of these channels operates independently and does not come together to provide an integrated experience like omnichannel does.

What does this mean for lead nurturing, though? With omnichannel marketing, you have the power to deliver a unified and consistent message across multiple relevant channels instead of scattering disconnected messages in various directions. This helps to keep the leads warm and engaged.

How omnichannel marketing reshapes the BFSI landscape

As far back as 2014, Infosys was ahead of the game in recognizing the crucial role of omnichannel marketing for insurance, as insurance and customer experience are closely linked. Now in 2023, omnichannel marketing has made significant progress in recent years. Banks are no exception. According to McKinsey’s 2019 report, “To maximize sales, banks must effectively combine digital and human channels to create a seamless omnichannel offering.”

Well, it’s still very much relevant.

For a marketing professional in the BFSI sector to knead a successful omnichannel strategy into their company, the first step to take is a consistent message strategy and choosing the right channels that are relevant to the leads. At WebEngage, we offer a range of channels, including SMS, Whatsapp, web push notifications, mobile push notifications, Google remarketing and Facebook retargeting. It’s important for the marketer to keep in mind that just because channels are available doesn’t mean they use them all. The key lies in identifying which channels the leads are active on and target them only there. In the case of Scripbox, where they saw a 30% jump in open rates through automation and personalized communication.

This approach keeps the leads meaningfully engaged with content that is contextually relevant and sends them down your marketing funnel. It could also play a pivotal role in user retention when coupled with cross-sell and upsell opportunities.

3. Converting leads made easy: Master the art of Lead Scoring

Lead scoring is a vital part of Lead Nurturing. It involves assigning a numerical value to leads to gauge their level of interest in your offering. It differs from lead grading, which evaluates how well a lead aligns with your buyer persona. Lead scoring helps determine the viability of a lead, as not every lead that fits your persona will be interested in purchasing. It also helps marketers establish a better connection with the lead and test their hypotheses.

Why is lead scoring important? Lead scoring helps you clearly identify the stage of the marketing funnel your lead is currently at. You can optimize resources by saving time, money and effort on redundant leads. It’s deeply beneficial for a marketer to realize that, ultimately not every lead will convert into a sale. As a matter of fact, you might be surprised to know that statistics point to at least 50% of leads not buying from your company. As high as 50%!

The traditional lead scoring model often fails because it’s restrictive, is based on assumptions and can also be labor intensive. By implementing predictive lead scoring, a more modern and a data-driven approach, you can easily determine the compatibility and drive your focus to exactly where the possibility is the most. Warm leads that demonstrate high intent to convert, also known as SQL (sales qualified leads), are passed on to the sales team to complete the buying process. A targeted approach such as this allows for more efficient and seamless lead nurturing.

Lead scoring goes beyond a single criterion, incorporating multiple factors to provide a more intricate understanding of each lead.

Best practices for calculating lead scores in BFSI

In today’s dynamic industry conditions, every lead interaction accounts for something, hence incorporating lead scoring can be a strategically intelligent move for BFSI to incorporate to gain a significant competitive advantage.

ICICI bank says they were able to see a 7x higher conversion from ‘high propensity’ leads and higher sales conversions!

To calculate lead scores to maximize conversion, here are a few things marketers could adopt:

- Build and maintain an organized customer database

- Engage a CDP like WebEngage for cohesive data aggregation

- Use existing customers’ information to derive common behavioral traits

- Assign numerical values to user actions based on their traits

- Prioritize leads based on the scoring and optimize resources

When a brand receives tens of thousands of requests a day, manually sifting through them to determine which leads are warm or cold could be time-consuming and the leads might quickly shift to a competitor. “There’s nothing more frustrating than spending time and effort with a contact who is not in the position to make a purchasing decision.”, says Talege.

A lead scoring model could be the game changer!

4. Stay connected with your users 24/7 by using conversational marketing

Conversational marketing is a customer-centric and dialogue-driven approach that uses real-time conversations to keep users engaged. It’s a relationship built between customers and buyers by creating an authentic and credible experience. With the rise in chatbots and AI, businesses can stay connected to their users without human intervention. We live in a time where users expect immediate responses and resolve, and we currently also have the tools that assist that demand.

Data reveals that 83% of customers are satisfied while being served by a chatbot in the insurance industry. Also, 40% of web users say they don’t care if they are served by a bot or a human agent as long as they get the customer support services they need.

Adopting conversational marketing drives customer satisfaction, conversions and long-term loyalty.

The influence of conversational marketing in the BFSI sector

As per multiple industry reports, CM (Conversational Marketing) is gaining popularity among businesses belonging to the BFSI sector. Conversational marketing is an approach to marketing that focuses on engaging in real-time conversations with customers to build relationships, understand their needs, and provide personalized experiences. It offers a higher degree of personalisation and has hence seen a higher rate of adoption lately. Conversational marketing changes the way businesses communicate. For example, a bank starts to communicate online, thereby eliminating appointments and long queues at bank branches. The interactive nature of this experience humanizes the experience fostering trust in the brand.

A great example of a company that uses conversational marketing to engage with its customers is American Express. They used chatbots to supercharge their marketing campaigns, which allowed them to automate tens of thousands of conversations, with an incredible goal completion rate of a whopping 49.3%!

How did American Express leverage chatbots?

- For their website model, they used a chatbot that helped customers complete transactions, like making a payment or booking a travel and more.

- For their mobile app, the chatbot helped users check their account balance, redeem reward points, view recent transactions, and more.

- The bank also engaged Whatsapp and Facebook Messenger to offer discounts, promotions and also provide customer support round the clock.

What did they achieve through this?

- Increased customer engagement

- Improved customer satisfaction

- Increased sales

- Reduced costs

- Improved customer loyalty

The chatbots were able to achieve these results by providing a personalized and engaging experience for customers, thereby humanizing the brand for their users.

5. Expand your reach with voice search optimization

Voice search optimization is the process of optimizing digital content to cater to voice-based queries made through voice assistant devices and applications. With the rising popularity of smart speaker devices and virtual assistants like Siri, Alexa, Google and more, voice search is finding its way into the midst of a crowded communication network. In fact, reports last year pointed towards 66.3 million households owning a speaker device! The shift in this trend is due to many factors, including ease of use, minimal effort, accessibility, and also the fascination with new technology. A lot of users find it easier to speak their queries instead of typing them and waiting for a response.

Amplifying success in the BFSI sector, through voice search optimization

Evolving customer preferences ask for companies to adapt to changing trends as well quickly. BFSI sector companies stand to reap benefits from voice search commands too. A classic case study to prove this is what Axis Bank has done with Amazon Alexa.

You can simply go ahead and ask Alexa for your banking details, and an SMS is triggered to your phone immediately. If you hold multiple bank accounts, Alexa gives you the option to choose between them too, for your desired information.

Voice searches are also becoming more adept at understanding different accents, tones, and languages, enabling highly personalized interactions with the advent of new innovations like voice AI. Moreover, the technology is evolving to detect potentially fraudulent activities based on behavioral and verbal cues, which provides intelligent recommendations as well. By optimizing this feature, BFSI sector companies can definitely enhance customer engagement and provide seamless experiences to their users.

Another notable case study is CASHe’s. By leveraging WebEngage’s Retention Operating System, CASHe has successfully automated borrower engagement and retention strategies. This has enabled them to efficiently convert potential leads into prospective borrowers while increasing the percentage of repeat loans. CASHe’s seamless credit experience, powered by WebEngage, caters specifically to salaried millennials, ensuring a smooth and hassle-free borrowing journey.

In conclusion,

The above points make it clear that lead nurturing is vital for converting potential customers into long-term, loyal ones. Businesses can build lasting relationships with effective lead nurturing. It’s important to keep two key strategies in mind:

- Segmentation and hyper-personalization

- Omnichannel marketing

Deploying these strategies keeps leads engaged and warm. Lead scoring and conversational marketing are also effective techniques to optimize lead nurturing. Last but not least, voice search optimization expands its reach in the BFSI sector.

Prakhya Nair

Prakhya Nair