In today’s dynamic digital age, where every ping and buzz holds the promise of something new, the realm of financial technology, or fintech, is no longer bound by brick-and-mortar institutions. It’s traversing the ethereal pathways of the internet, reshaping the way we save, invest, and transact. At the core of this revolutionary shift lies WhatsApp, a channel that connects individuals and alters the fabric of finance. With over two billion active users globally, this platform has become the prime conductor of digital interaction, a stage where fintech’s expertise plays out in real-time.

In this blog, we will explore the top 10 use cases for WhatsApp marketing in the fintech arena, helping fintech businesses reshape customer engagement and create a brighter financial future.

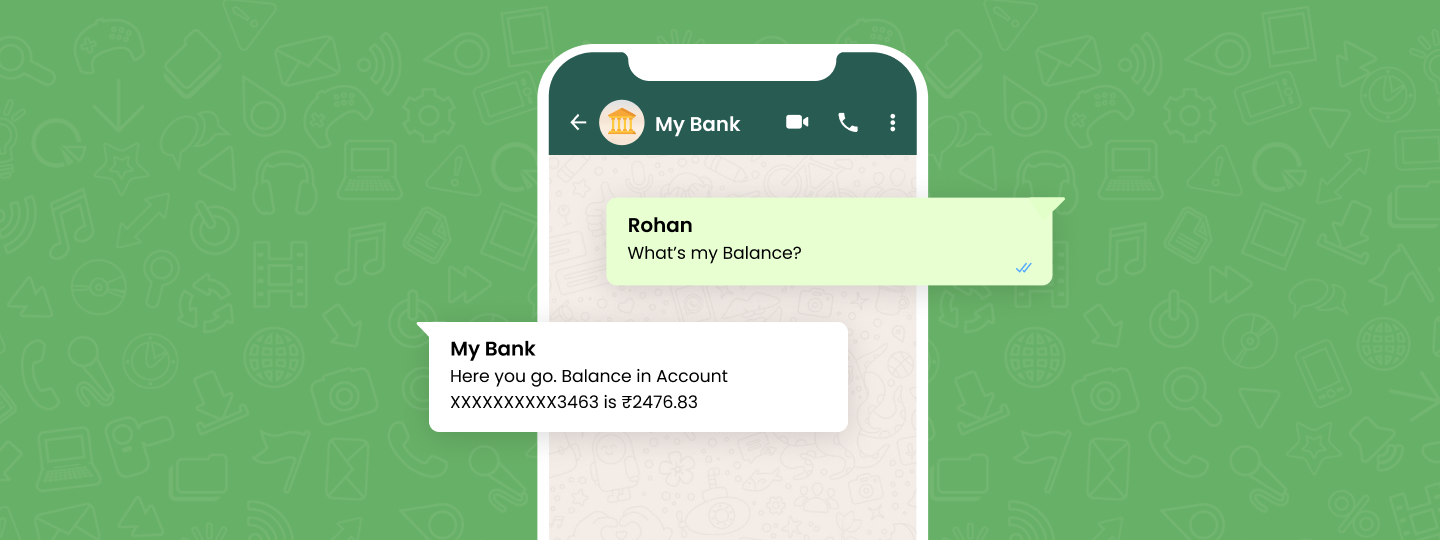

Use Case 1: Account notifications

In a world where information is gold and time is of the essence, WhatsApp is pivotal in account notifications for fintech companies. With a simple notification ping, customers receive real-time updates on transactions, balance changes, and critical account security information. This immediacy is a game-changer, enabling customers to stay in the loop without delay.

Therefore, the era of waiting for monthly statements or logging into online portals is fading as WhatsApp takes center stage in providing instantaneous account updates.

Use Case 2: Personalized Recommendations

Consider receiving a message that understands your financial goals, risk tolerance, and preferences and then offers a selection of investment opportunities or savings plans. This is where WhatsApp’s potential comes in. By utilizing user data and behavior patterns, fintech companies can craft personalized recommendations that resonate with individual customers. For example, Banco Bradesco in Brazil and ICICI Bank in India use WhatsApp to enhance customer support, provide transaction alerts, and offer personalized investment advice.

The impact of such personalized suggestions is profound. It transcends generic marketing efforts and forges a genuine connection with users. Customers are more likely to engage when they feel understood and catered to personally.

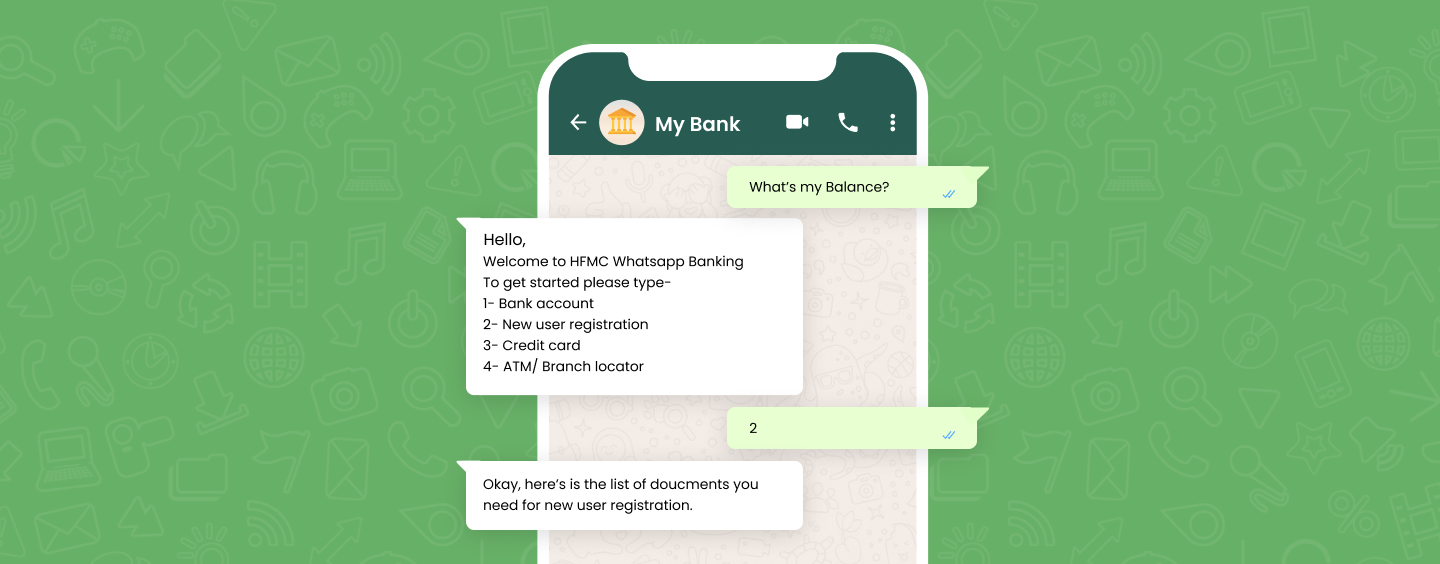

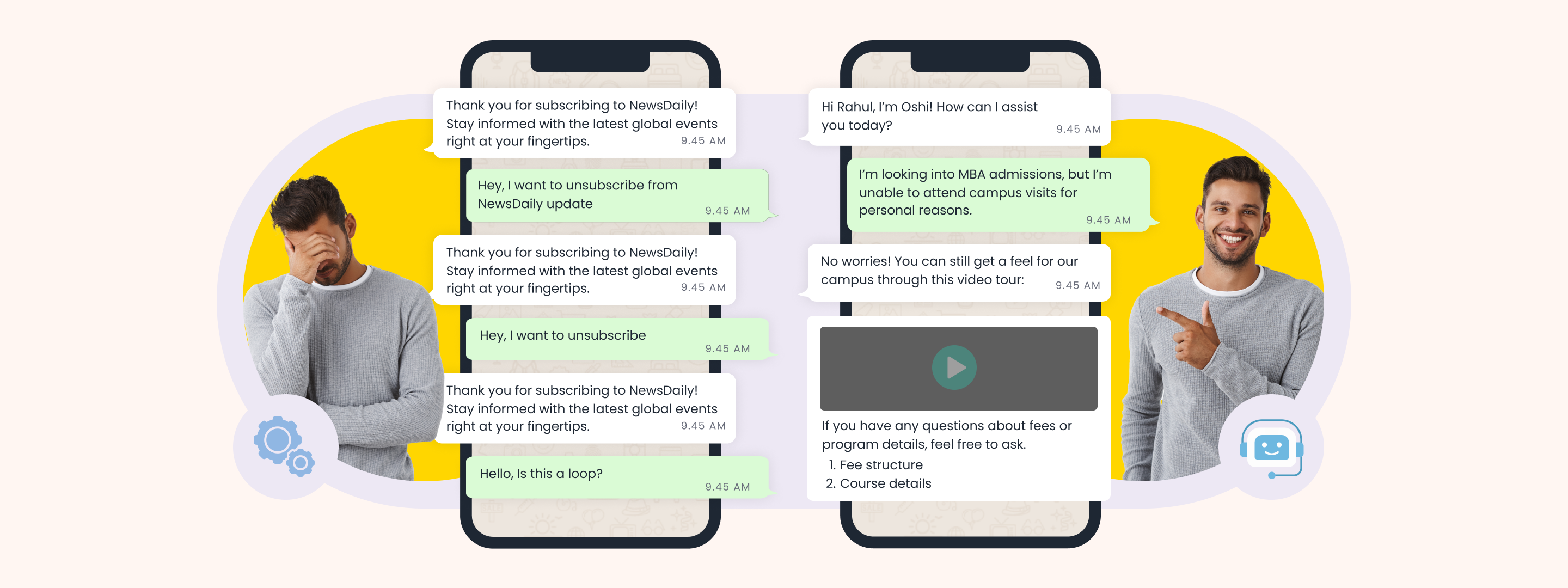

Use Case 3: Seamless Customer Onboarding!

Imagine a world where opening a financial account is as easy as chatting with a friend. With the power of WhatsApp’s revolutionary chatbot, this vision has become a reality. This means a potential customer can initiate the account opening process and seamlessly provide the required information—all within the familiar chat interface. No tedious paperwork, no lengthy forms. It’s like having a personal assistant guiding you through the process. For financial institutions, this means supercharged efficiency.

Use Case 4: Urgent Updates

Financial transactions, whether it’s a payment, fund transfers, investments, or even an unauthorized transaction, must be accompanied by an instant notification in today’s time. This is possible through the transformative power of real-time transaction updates by WhatsApp. Users are constantly updated about their financial activities, ensuring they are informed about every movement in their accounts without delay. Moreover, since financial fraud is a persistent concern even today, the ability to receive instant fraud alerts and security notifications directly through WhatsApp can prove to be a game-changer.

Use Case 5: Break the Language Barrier

WhatsApp is the champion in a world where language barriers often complicate financial conversations. With a presence in over 180 countries and support for more than 60 languages, it effortlessly bridges the gap. Whether in Tokyo or Mexico City, you can seamlessly communicate with financial operators in your preferred language. This transformation eliminates language barriers, empowering individuals to discuss their financial matters confidently and clearly, making financial services accessible to everyone, everywhere.

Use Case 6: Payment Reminders and Billing

WhatsApp can transform into a financial assistant, ensuring users never miss a beat when it comes to their financial obligations. Users receive timely alerts about upcoming due dates, helping them manage their finances with finesse. The benefits of such reminders extend beyond convenience. They act as a safety net against late payments and potential penalties.

Use Case 7: Financial Education and Tips

Beyond facilitating transactions, Whatsapp also empowers its users with invaluable financial knowledge. It’s a well-known fact that financial decisions can reverberate through our lives, highlighting the importance of access to relevant information. Informed users are more likely to make choices that align with their financial goals, ensuring a more secure and stable financial future. From bite-sized financial advice to investment insights and budgeting strategies, WhatsApp serves as a reservoir of financial wisdom, readily available at users’ fingertips.

Use Case 8: Uploading Documents

When dealing with fintech services, there’s a crucial step where one has to submit essential documents such as ID verification and proof of eligibility. But a lot of customers drop off during this phase. Because sometimes the process can be complicated, or how it’s managed isn’t the smoothest.

That’s where WhatsApp comes in. It simplifies things: Customers can send a picture of the document through WhatsApp. This makes the whole process faster and super easy. No more hassle!

Use Case 9: Exclusive Offers and Promotions

WhatsApp emerges as a direct line to financial opportunities, particularly when it comes to exclusive offers and promotions. Receiving a tailored WhatsApp message offering users an exclusive interest rate on a new savings account reflects WhatsApp’s ability to create one-on-one connections between users and financial opportunities. Users feel valued when they receive deals crafted just for them, adding a layer of personalization to their fintech experience.

Use Case 10: Surveys and Feedback

WhatsApp seamlessly integrates into customer insights, offering a platform to collect invaluable feedback and conduct surveys that help fintech companies tailor their offerings to user needs, ensuring that products and services align with customer expectations. Here, the immediacy of WhatsApp facilitates timely feedback collection. Therefore allowing users to share their thoughts in the moment, providing real-time insights that drive agile improvements.

WhatsApp Use Cases for your Fintech business | Conclusion

As the digital landscape continues to evolve, WhatsApp stands as a dynamic bridge between fintech companies and their customers, transforming how financial services are delivered and experienced. From real-time updates to personalized recommendations and payment reminders to exclusive offers, WhatsApp seamlessly integrates into users’ lives, blending convenience with empowerment.

So, let’s unite in the pursuit of innovation. Embrace WhatsApp’s potential and elevate customer engagement. Take a demo with us at WebEngage and embark on your journey to redefine the fintech experience.

Inioluwa Ademuwagun

Inioluwa Ademuwagun

Vanhishikha Bhargava

Vanhishikha Bhargava

Surya Panicker

Surya Panicker

Dev Iyer

Dev Iyer