The most important aspect of any business is said to be its customers. But there’s more to business than acquiring customers through a one-time sale or deal. In today’s competitive business landscape, acquiring new customers and retaining and converting them into loyal brand advocates is crucial. That’s where customer lifecycle management (CLM) comes in. CLM is a process that involves identifying, attracting, maintaining, and maximizing the value of your customers, which is crucial for achieving long-term success.

However, during a recession, the impact on the customer lifecycle can be twofold, making it challenging to maintain your customer base and generate revenue. This can result in increased customer churn, decreased loyalty, lower lifetime value, and potential loss of future revenue and referrals. According to a recent Acorns/CNBC study, 35% of all income brackets have canceled a subscription within the past year.

We have compiled ten essential tips to help you navigate the recession and optimize your customer lifecycle management strategies. These tips will help you streamline your customer lifecycle management, improve customer experience, and boost your bottom line. With a robust customer lifecycle management (CLM) strategy in place, you can weather the storm of recession and emerge even stronger on the other side. Moreover, by focusing on the customer lifecycle and building loyalty, you can continue to thrive long after the recession has subsided.

What is Customer Lifecycle Management?

CLM is a vital process businesses undertake to manage and maintain long-term customer relationships. It involves tracking and managing customer interactions through each customer journey stage, from initial contact to retention and loyalty. This process helps businesses comprehensively understand customers’ needs, preferences, and behavior, enabling them to deliver a seamless and positive experience.

An effective customer lifecycle management(CLM) strategy requires a data-driven approach that leverages customer data to identify trends, preferences, and opportunities. It involves implementing the right technology and tools, such as CRM software, marketing automation tools, and customer feedback systems, to manage the customer journey effectively. Doing so can streamline your business processes, gain efficiencies, and provide an outstanding customer experience.

Customer lifecycle management also involves understanding the different stages customers go through as they interact with your business. Each stage has unique goals, metrics, and strategies that you can use to create a seamless customer journey.

Stage 1: Awareness

At this stage, the customer becomes aware of your brand’s existence, products, or services through various marketing channels such as advertising, social media, word of mouth, etc. The goal of this stage is to generate interest and attract potential customers.

Stage 2: Consideration

Once a customer is aware of your brand, they may begin to consider whether they want to engage with it. During this stage, the customer is researching and comparing your brand’s products or services with others. This stage aims to persuade the customer to choose your brand over the competitors.

Stage 3: Purchase

At this stage, the prospect transitions into a customer by considering and choosing to purchase your products or services. This stage aims to make the purchase process as easy and seamless as possible.

Stage 4: Retention

Once the customer has made a purchase, the brand’s focus shifts to retaining them. This involves providing excellent customer service, support, and follow-up to ensure customer satisfaction. This stage aims to create a loyal customer base who will continue to buy from you.

Stage 5: Advocacy

The final stage of the customer lifecycle involves converting loyal customers into brand advocates who actively promote your brand to others through social media, word of mouth, reviews, and other channels. You can achieve this by providing exceptional customer experience, enhanced loyalty programs, and better referral incentives.

By effectively managing each stage of the customer lifecycle, you can create a seamless and positive experience for your customers, deepen their relationships, and maximize their lifetime value.

Bonus Read – Read more about how E-commerce Firms Can Automate Customer Lifecycle Marketing

10 tips to boost customer lifecycle management during a recession

1. Build Strong Relationships with Existing Customers

Your existing customers are your company’s biggest assets, and retaining them can help increase customer retention rates, drive repeat purchases, and ultimately boost your revenue. Therefore, building a solid relationship with them is crucial, especially during difficult economic times.

In fact, 86% of customers are more likely to continue doing business with a brand if they feel an emotional connection with the brand. Therefore, investing in building an emotional connection with your customers can significantly impact your business’s success and longevity.

The following tips will help you build a solid relationship with your existing customers:

Provide personalized experiences: Personalization is key to building strong customer relationships and enhance your customer lifetime management. Use customer data to personalize interactions and offers to each customer’s needs and preferences.

Offer value-added services: Offer your customers additional services or resources to help them navigate the recession. This could include educational resources, free trials of new products or services, or other relevant offerings.

Reward loyalty: Offer loyalty programs or other incentives to reward and retain loyal customers. This could include exclusive discounts, access to special events or products, and other benefits.

Build long-term relationships: Focus on building relationships that will last beyond the recession and continue to provide value to customers over time.

ApnaKlub, a B2B wholesale distribution platform, recognized the importance of building strong brand connections with its users to improve retention and minimize churn. To achieve this, the company implemented a user communication strategy that extends beyond the app interface.

By sending targeted communications based on specific events and touchpoints in the user’s journey, ApnaKlub was able to provide a personalized experience that fostered stronger relationships with its users. As a result, ApnaKlub boosted user retention and drove over 30% month-on-month repeat orders.

2.Use Data to Understand Customer Needs

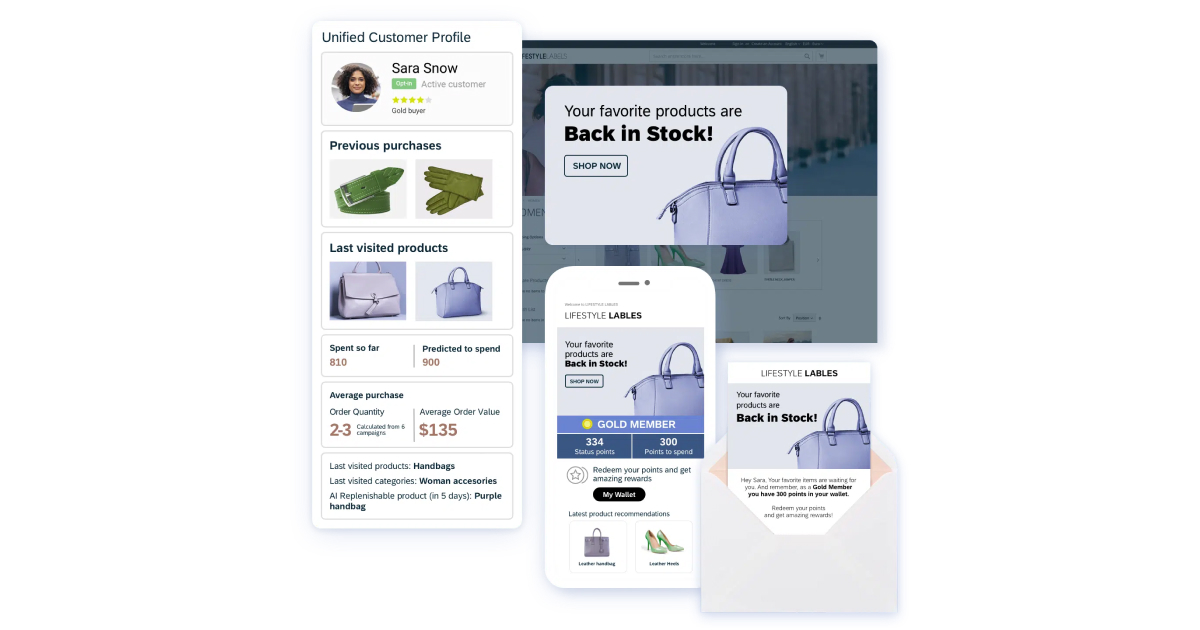

To establish a strong relationship with your customers, it is essential to understand their needs and behavior. This is where tools like WebEngage come in, enabling businesses to track and analyze customer data to gain valuable insights.

By leveraging customer data, you can identify patterns and trends in customer behavior, enabling you to personalize your offerings and tailor strategies to meet customer demands during the recession.

Additionally, data-driven insights can also help identify warning signs of churn and allow you to take proactive measures to retain customers. For instance, if a customer is using fewer services than usual, it could indicate that they are considering leaving you. By recognizing this trend early and providing incentives or addressing any concerns, you can retain customers and enhance overall customer lifecycle management.

City Beach, an Australian fashion retailer targeting young customers, faced a challenge leveraging its vast customer database with varying shopping behaviors. Identifying and targeting the right customers quickly and efficiently was a significant problem for the company.

To overcome this challenge, City Beach implemented relevant tools to enhance its data analysis and gain a better understanding of customer behavior. This enabled City Beach to target customers with relevant offers and messages effectively, improving customer engagement and reducing churn. In just 90 days, City Beach achieved a 48% lift in win-back customers, demonstrating the effectiveness of its data-driven strategy.

3.Keep customer communication transparent and empathetic

Effective customer lifecycle management is built on the foundations of empathy, transparency, and constant support throughout the customer journey. These elements can help your business build customer trust and loyalty, especially during difficult times like a recession.

Empathy and transparency in communication can go a long way in building strong relationships with your customers. Being open and honest with customers about your pricing, payment options, and refund policies can reduce uncertainty and anxiety during financially challenging times.

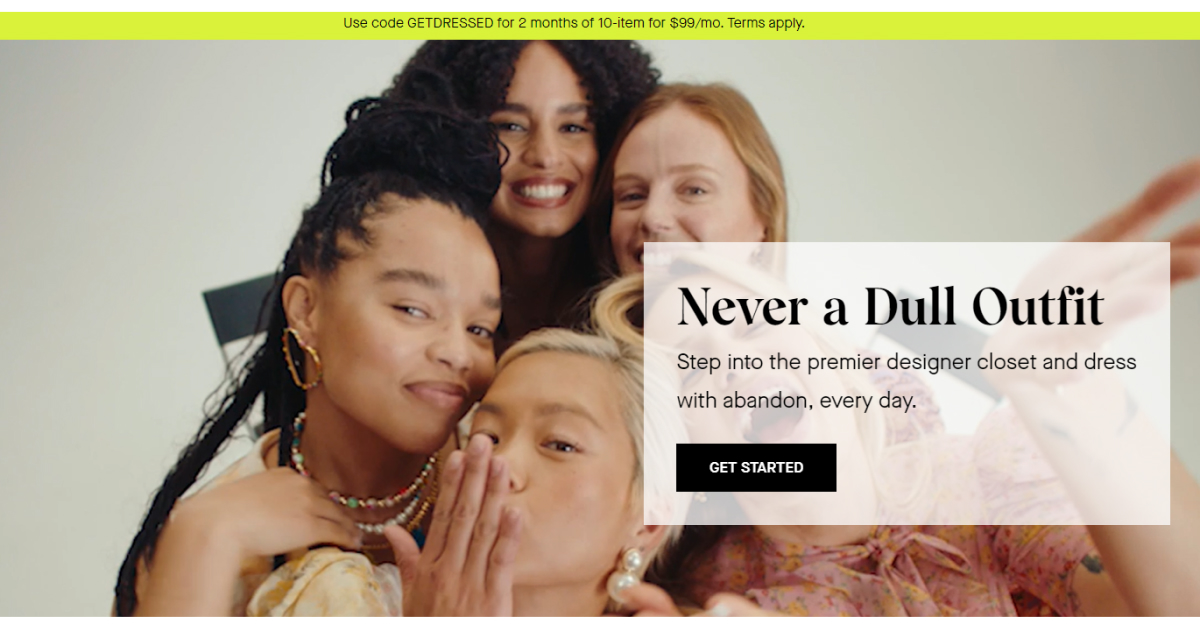

Rent the Runway, an e-commerce platform that allows users to rent, subscribe, or buy designer apparel and accessories, showed how transparent and empathetic communication can improve customer lifecycle management during difficult times.

The company recognized that its customers might be concerned about the cleanliness of their clothing rental process during the pandemic and took proactive steps to address these concerns. They sent out correspondence to all their customers and external stakeholders, explaining the scientific implications of their new cleaning processes based on legitimate Centers for Disease Control and Prevention (CDC) research.

This communication showed that the company cared about the safety and well-being of its customers and was taking measures to address their concerns. As a result, the brand retained its customers’ loyalty and maintained a positive customer lifecycle management.

4. Optimize pricing and promotions

During a recession, customers are more price-sensitive than usual, and you need to be strategic with your pricing and promotions to uplift your customer lifecycle management.

By leveraging customer data, you can offer personalized discounts or promotions to customers who make repeat purchases. This will enable you to reward customer loyalty and encourage future purchases, leading to increased customer retention.

Additionally, carefully crafted pricing strategies can help you capture market share during the recession.

Here are a few strategies to optimize pricing and promotions for better customer lifecycle management:

- Conduct market research: Before setting prices or offering promotions, it’s important to do your research and understand customer behavior, preferences, and purchasing habits. This information can help you tailor your pricing and promotions to meet customer needs and expectations.

- Adjust pricing based on demand: Customers’ priorities and spending habits may shift during a recession, and adjusting pricing based on demand allows you to meet the changing needs of your customers by offering products or services at a competitive price.

- Bundle products or services: Offering a product or service bundles can help you increase the average transaction value per customer. By offering a bundle at a discounted price, you can incentivize customers to purchase more products or services at once, which can increase their overall value to your business.

- Implement loyalty programs: Loyalty programs can encourage customers to return and make repeat purchases. Offering rewards, such as discounts or free products, motivate customers to continue doing business with your company.

5. Offer flexible payment options

Providing customers with flexible payment options is an effective strategy to make your products or services more accessible, particularly during challenging economic times. This approach increases the likelihood of purchases and customer loyalty by showing that you empathize with your customers’ financial situations and are willing to work with them to find solutions.

Some flexible payment options include:

- Customized payment plans

- Deferred payment options

- Installment options

- Waiving late fees

- Discounts for early payments

- Subscription-based payments

- Easy financing options

- Interest-free financing

- Buy now, pay later

Providing these flexible payment options to your customers can significantly reduce their financial burden and increase their willingness to purchase. Although, in the short term, putting customer needs at the forefront may seem daunting. However, providing these payment options will certainly improve your business’s cash flow and financial stability in the long run.

Additionally, by offering convenient payment plans, you reduce the risk of late payments or bad debts, improving your business’s overall financial health. This approach will also enable you to set a strong foundation for a long-lasting, mutually beneficial relationship with your customer.

6. Offer Exceptional Customer Service

Delivering exceptional customer service forms the bedrock of efficient customer lifecycle management. According to a report, 89% of companies that provide a customer experience significantly above average outperform their competitors financially.

With a tighter budget, customers may be more likely to switch to a competitor if they are not happy with the level of service they receive. By offering exceptional customer service, you can reduce the likelihood of customer churn and retain your customer base.

Here are some actionable tips to boost your customer lifecycle management through exceptional customer service:

- Train your staff: Make sure your staff is adequately trained to handle customer inquiries and complaints. Invest in training programs focusing on active listening, conflict resolution, and effective communication.

- Use technology to enhance customer experience: Employ tools like chatbots, automated emails, and self-service portals to enhance customer experience.

- Provide Educational Resources: Educational resources such as blog posts, videos, or webinars can help customers stay informed and engaged with your brand. This can also help you establish your business as a thought leader in your industry.

- Solicit Feedback: Ask for feedback from your customers regularly and use this feedback to improve your service offerings. This shows customers that you value their opinion and are committed to continuous improvement.

7. Innovate and Adapt

An economic downturn can substantially change customer behavior, preferences, and needs. To remain competitive, you must respond quickly and effectively to these changes, which requires constant innovation and adaptation to be ahead of the curve.

Innovating and adapting involves constantly identifying emerging trends, technologies, and strategies that can enhance customer experience and working towards it. This could involve creating new products or services, revamping current ones, or implementing new customer engagement channels such as social media, chatbots, or mobile apps. Your brand can establish its resilience through innovation and adaptation, fostering customer trust and loyalty during uncertain times, thus improving your customer lifecycle management.

Furthermore, consistent innovation and adaptation can assist the brand in identifying new revenue streams and business prospects, ultimately advancing customer lifecycle management even after the economic downturn subsides.

Here is an example of Overstock, a leading American online furniture retailer that experienced a significant increase in demand for home decor and furniture during the pandemic. To keep up with the rapidly changing demand and enhance its customer lifecycle management, Overstock adopted a fully automated Smart Bidding strategy. This improved their landing pages and enhanced site speed, providing customers with a superior online shopping experience. As a result of these efforts, Overstock observed an impressive boost in retail sales and growth in its customer base in just a year.

8. Segment Customers and Target Campaigns

Customer segmentation and targeted campaigns combined make for a powerful strategy to identify and focus on the most profitable and valuable customer segments during a recession–thus improving ROI. This can also help you better understand your customer needs and priorities, enabling you to develop more effective product and marketing strategies.

Targeting campaigns to specific customer segments during a recession can also help brands optimize their budgets and resources. Rather than using a broad approach with high investments, businesses can focus on the most profitable customer segments, avoiding unnecessary expenses on customers who are unlikely to buy their products or services.

Montblanc, a luxury goods manufacturer, experienced a 118% increase in conversions by offering a Father’s Day deal that provided a free gift to customers spending over £200. This threshold was carefully selected to align with the spending expectations of Montblanc’s target audience, contributing to the campaign’s success.

9. Leverage automation

In times of recession, you must find ways to reduce costs, improve efficiency, and manage a more extensive customer base. Automation can be the perfect solution to achieve these goals effectively.

Automating repetitive or time-consuming tasks can free up resources to focus on more strategic initiatives, such as improving the customer experience or developing new products and services.

Furthermore, automation can help businesses scale their operations more efficiently, which is crucial when managing a growing clientele. By automating tasks such as lead management, customer segmentation, and personalized marketing campaigns, you can effectively engage with your customers at every stage of the customer lifecycle, from acquisition to retention.

Calendly, a business communication scheduling platform, struggled to manage its customer support tickets effectively, resulting in lost leads and missed opportunities. To address this problem, the brand implemented automation, significantly improving lead nurturing and conversion rates.

An automation tool was used to send notifications to the sales team when a support ticket for a new lead transitioned to a specific view. This helped the Sales team promptly follow up with leads while they were still hot. This approach has drastically improved response and conversion rates and helped Calendly save a lot of time.

10. Continuously Monitor and optimize your customer lifecycle management (CLM)

Market conditions can become highly volatile during a recession, making it crucial for brands to stay agile and responsive. Continuous monitoring and optimizing your customer lifecycle management strategies is one critical way to achieve this.

By regularly reviewing and improving your customer lifecycle management processes, you can identify any issues and proactively address them. This will provide a positive customer experience and boost conversion and retention rates. This agile approach will allow your business to stay ahead of the competition and thrive, even in challenging economic times.

Conclusion

In today’s highly competitive and uncertain market, effective customer lifecycle management has become more critical than ever before. To help you navigate these challenging times successfully, we have provided ten actionable tips for optimizing customer lifecycle management. These tips are designed to help you stay competitive, maximize revenue, and build customer loyalty during difficult economic and long-term economic times.

In addition to implementing these tips, you can further streamline your customer management strategies by investing in the right tools. One such tool is WebEngage, a comprehensive platform that enables businesses to manage and optimize their customer journeys with ease.

Deliver Meaningful Messages For Your Business Today, Request A Demo Now

Harshita Lal

Harshita Lal

Priyam Jha

Priyam Jha

Diksha Dwivedi

Diksha Dwivedi