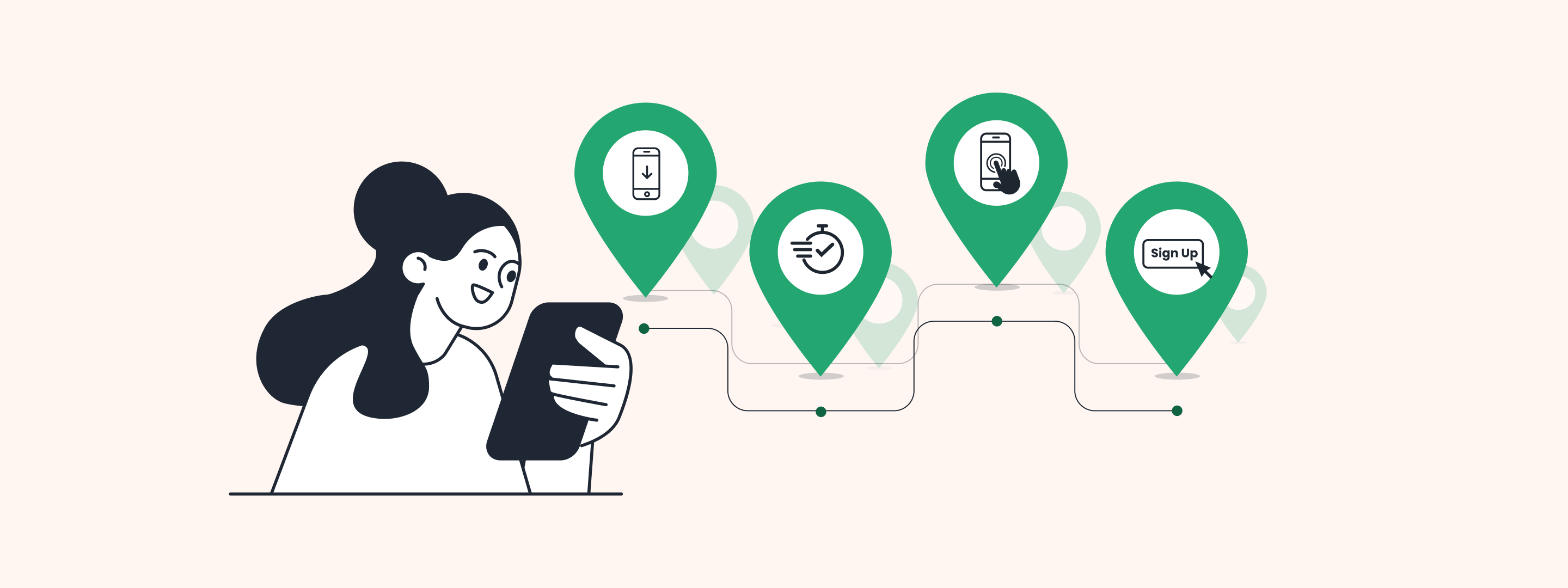

Onboarding of customers is a critical component for companies operating under anti-money laundering requirements. A smooth onboarding experience for customers can do wonders and establish long-lasting relationships. On the other hand, cumbersome and poor management may lead to customer losses.

As the world becomes more interconnected and digitalized, the significance of the Know Your Customer (KYC) procedure has become more pronounced. KYC serves as a guardian protecting businesses from various operational risks like fraud, ensures a robust security framework, and helps maintain customer trust in business activities.

Read along to learn how data analytics and seamless KYC processes can enhance customer onboarding experience.

Understanding the Role and Importance of KYC Compliance

First, let’s understand KYC before knowing its roles and importance. In simple terms, KYC is an identification process used by companies in BFSI and telecommunications to verify the customer’s identity.

The KYC process prevents fraud, money laundering, and other illegal activities. It allows institutions and companies to forge long-lasting relationships based on mutual trust.

The importance of the KYC process has been described as follows:

- Risk Mitigation

KYC allows a comprehensive understanding of a customer’s background. It helps banks and other financial institutions assess the risk associated with every customer and deal accordingly.

- Regulatory Compliance

In many countries, KYC is a mandatory process as part of anti-money laundering regulations. A streamlined KYC process will help businesses efficiently complete regulatory compliance.

- Security

Another key importance of the KYC process is that it helps maintain the integrity of the entire financial system by keeping people with high-risk profiles out of it. Such security measures also enhance the trust of law-abiding customers in the economic system.

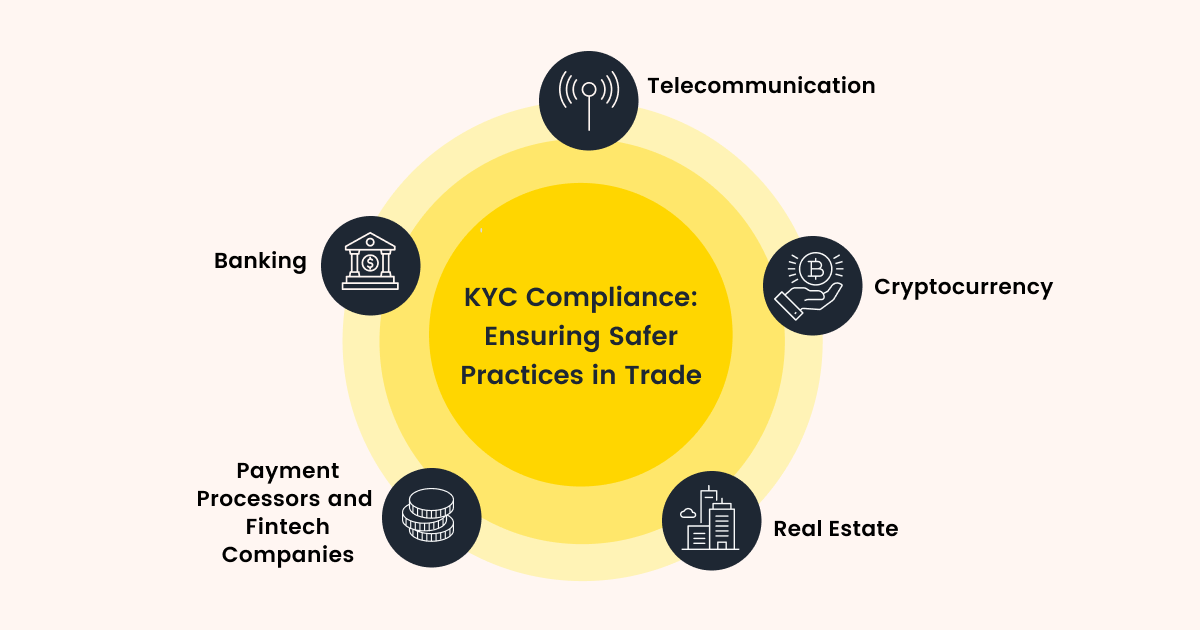

KYC Compliance in Different Industries

The major sectors in which KYC compliance is mandatory as part of the regulatory compliance system are described below:

- Banking Services: Banks mandate KYC for new account opening, loan processing, and transaction management. This helps them prevent fraud and money laundering activities. Insurance providers have also made it necessary to complete KYC before inducting customers into any policy.

- Telecommunications: Mobile and internet service providers complete KYC compliance before providing new connections or issuing new SIM cards, thereby preventing misuse and fraud.

- Cryptocurrency: All cryptocurrency holders must complete KYC before transferring digital currencies from one wallet to another.

- Real Estate: With instances of fraud rising in the real estate sector, many developers and brokers have made it mandatory for buyers to complete the KYC compliance before buying a property.

- Payment Processors and Fintech Companies: The new-age fintech companies have made KYC mandatory before opening an account, transferring funds, and using other financial services.

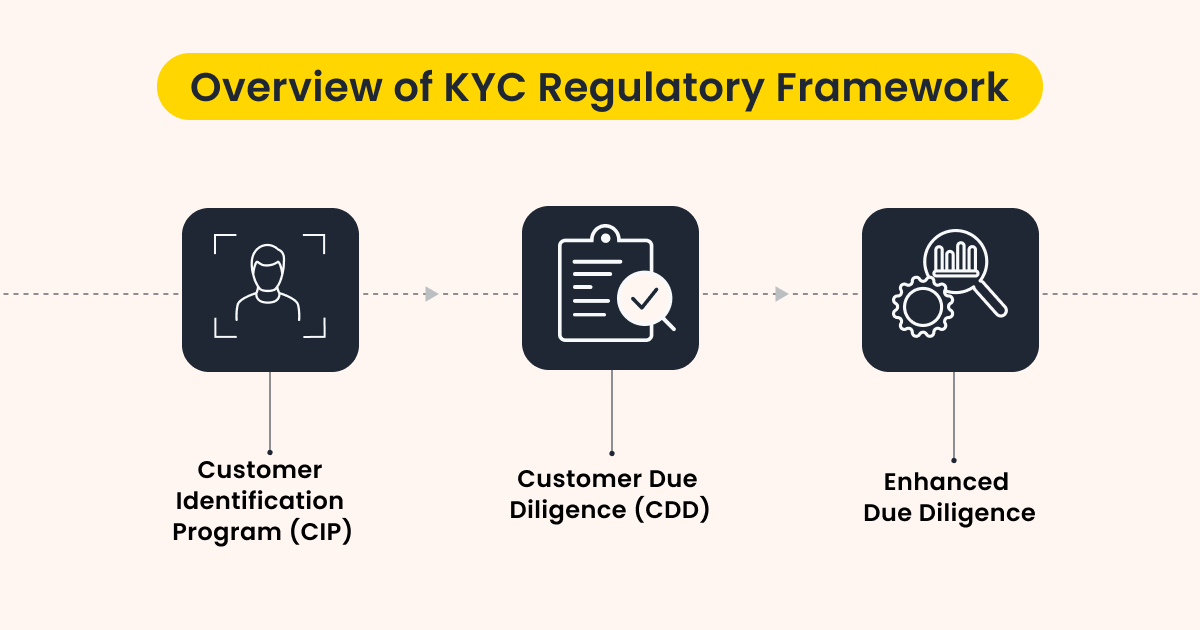

Overview of KYC Regulatory Framework

The major components of the KYC regulatory framework are as follows:

- Customer Identification Programme: The company must collect the customer’s basic details under this component. This includes name, address, occupation, DOB, and identification documents.

- Customer Due Diligence: In this stage, banks process the collected information and analyze the risk level associated with the customer.

- Enhanced Due Diligence: This is the most advanced screening stage for high-risk profiles. For this, additional information is collected from the customer, and risk analysis is carried out, giving institutions a fairer understanding of the customer’s genuineness.

The central bank, the Reserve Bank of India, is the nodal authority regarding all KYC-related issues in India. The RBI issued guidelines in 2005 and made it mandatory for select financial institutions to comply with KYC norms. Later, it was enlarged and covered other sectors.

Challenges Associated With KYC Compliance

The different challenges associated with KYC compliance are as follows:

- Manual Data Entry: Overreliance on manual data entry will impact efficiency as chances of errors are always high. Providing training to data entry operators takes a lot of time and money.

- Inconsistent Data: Another challenge associated with KYC is the different formats used by different companies for data collection and processing. This leads to inconsistency and increases the chances of inaccurate analysis.

- Regulatory Compliance: The regulatory landscape changes regularly, keeping evolving threats and risks in mind. Therefore, it becomes quite challenging, especially for small organizations, to remain aligned with these frequent changes.

- Customer Frustration: Cumbersome KYC processes can leave a bad impression on clients and force them to look for alternatives. Poor execution of the KYC process can significantly impact customer retention.

Streamlining Customer Onboarding With Seamless KYC

Here are certain tips that can improve the customer onboarding experience:

- Digital Identity Verification: You can embrace advanced identity verification solutions that use AI and sophisticated software. These are capable of capturing and verifying the data quickly and accurately.

- Risk-Oriented Approach: The KYC processes and structure should be curated based on the risk portfolio. It means a greater degree of check for risky customers and an easy verification level for less risky clients.

- Emphasize Data Quality and Consistency: All decisions are based on data collected during onboarding. Hence, companies need to pay special attention to collecting accurate data and solving problem areas that come with precise data collection.

- Use Biometric Authentication: Biometric tools like fingerprint, facial recognition, and iris scan can be an additional security layer that can help create a robust onboarding process.

- Simplifying Document Submission: A simple and convenient user interface for document submissions can also improve onboarding.

- E-Signatures: Digital signatures or E-signatures reduce the chances of forgery and make the contract agreement more enforceable.

Technological Revolution of KYC With Automation

The role of automation in KYC has been described below:

- Automated Data Collection and Processing: Automated data collection solutions can speed up onboarding and eliminate the menace of avoidable manual errors. Companies like Decentro have developed sophisticated APIs that streamline data collection, ensuring accuracy and efficiency throughout the KYC process.

- Real-Time Identity Verification: Artificial intelligence and machine learning algorithms can verify clients’ data in real time using powerful processes that can go through several government and non-government websites at lightning speed. This facility provides greater credibility to the entire process.

- Biometric Authentication: Fingerprints, facial recognition, iris scan, and voice recognition offer a secure and straightforward method of identity verification.

- Risk Assessment by Algorithms: Advanced algorithms can be used for risk assessment. They efficiently analyze larger amounts of data and flag patterns or anomalies pointing to suspicious activities.

- KYC APIs Integration: KYC APIs seamlessly integrate with existing systems, automating identity verification and streamlining compliance. This enhances the overall customer experience by reducing friction during onboarding.

Upcoming Trends in KYC and Onboarding

The most prevalent trends related to KYC have been discussed below:

- AI and Machine Learning: Used for risk profiling and automated identity verification systems.

- Biometric Authentication: Facial and voice recognition have become increasingly popular because they offer a higher degree of security and greater user convenience.

- Blockchain Technology: It provides a decentralized and immutable ledger that securely stores all KYC-related information.

- Data Analytics: It is now widely used to gather detailed insights into customers’ risk profiles and behavior.

Summing Up

As more businesses enter the digital arena, the demand for online KYC is witnessing exponential growth. Hence, there is a greater need to automate the onboarding process using AI and data analytics, as it increases efficiency and saves the organization a lot of resources (time and labor) that can be used in other areas of urgency.

Prakhya Nair

Prakhya Nair

Harshita Lal

Harshita Lal

Diksha Dwivedi

Diksha Dwivedi

Sanjay Mishra

Sanjay Mishra