Dear product and growth marketers,

I am Avlesh, a cofounder at WebEngage, and I’m thrilled to share this update with you. We’re on the verge of launching something truly significant – taking composability of our data layer to a whole new dimension. This milestone marks a pivotal moment for WebEngage and the entire MarTech landscape. Before I get to the details, allow me to set the broader context first..

WebEngage – a quick primer

WebEngage is a CDP-led Marketing Automation product suite for consumer businesses which provides solutions spanning CDP, Analytics, Campaign Management, User Journey Orchestration, and Web/App Personalization. Serving over 850 global consumer tech startups and enterprises, WebEngage launched a Journey Designer in 2016, pioneering the now-standard drag-and-drop interface in marketing technology for consumer businesses.

In 2025, WebEngage will unveil a significant advancement on our data layer, transforming the user engagement landscape. I’ll get to that in a minute.

The ingenuity of the new age MarTech stacks

(and, their curse)

Led by Braze in the Americas, there are over two dozen similar customer engagement platforms globally, including WebEngage. Each has its specialization in its product and/or GTM. Some focus on mobile-first businesses, some on large enterprises. Some are built with an analytics-first approach and a campaign-first thesis. Some are more multi-channel than others.

Notwithstanding these distinctions, modern MarTech solutions share one thing in common—a remarkably simple data model centred around the concepts of Users and Events, a structure well-understood by practitioners utilising tools across the Analytics, Customer Data Platform, and Marketing Automation categories.

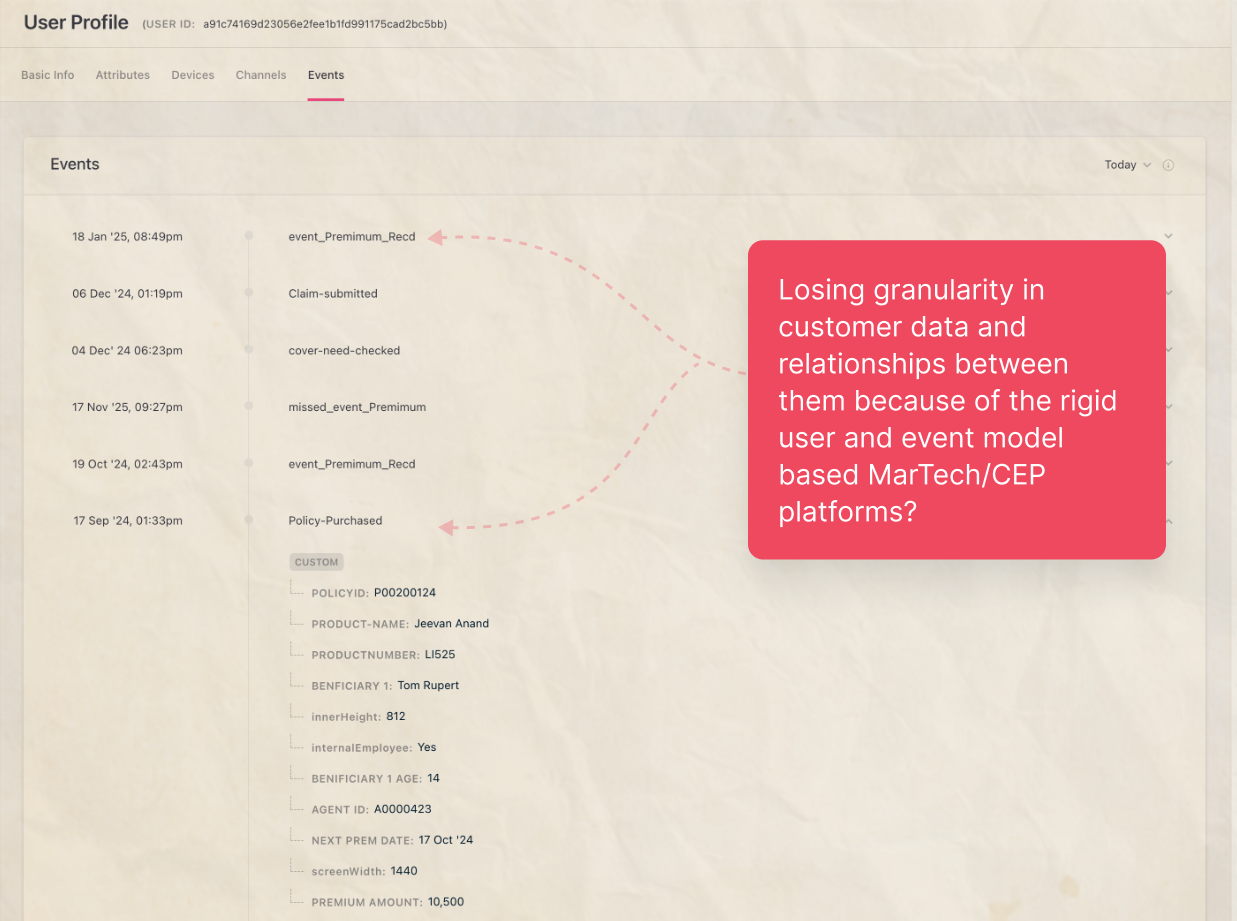

This simplicity allows customers to do quick (and dirty) modelling of behavioural data across platforms, thereby massively reducing the time it takes to track such data and putting it into action to orchestrate campaigns/journeys. However, this simplicity comes with a foundational flaw – the limiting assumption that all demography data and customer interactions can be neatly reduced to attributes of a User or properties of an Event. And, therein lies the problem.

Behavioural and transactional data streams gasping for breath in the FLAT world of CDPs

Behavioural and transactional data streams gasping for breath in the FLAT world of CDPsBusinesses across consumer durables, healthcare, automobile, hospitality, banking and financial services have been forced to cram their rich, multifaceted customer relationships into these flattened data stores, causing agony to customers and marketers alike. Consider a common scenario highlighting this agony – an insurance policyholder receiving four identical birthday emails simply because they hold four different policies.

The unknown side effects of “triggered” communications

The unknown side effects of “triggered” communicationsThis isn’t just poor customer experience; it’s a glaring symptom of how the new age CDPs fail to grasp the true complexity of your business. Your customers aren’t just users in a database. They are individuals with multiple insurance policies, owning several vehicles, managing various bank accounts, or having numerous appointments and lab tests. If your CDP forces you to flatten these rich, interconnected relationships into a handful of vehicle_service_due_date user attributes or ephemeral policy_purchased events, you have lost critical context already. You cannot…

- Track the evolving state of a specific policy (e.g., from active to pending renewal). Without this, flattened data stores unknowingly lead you to alter context in user journeys.

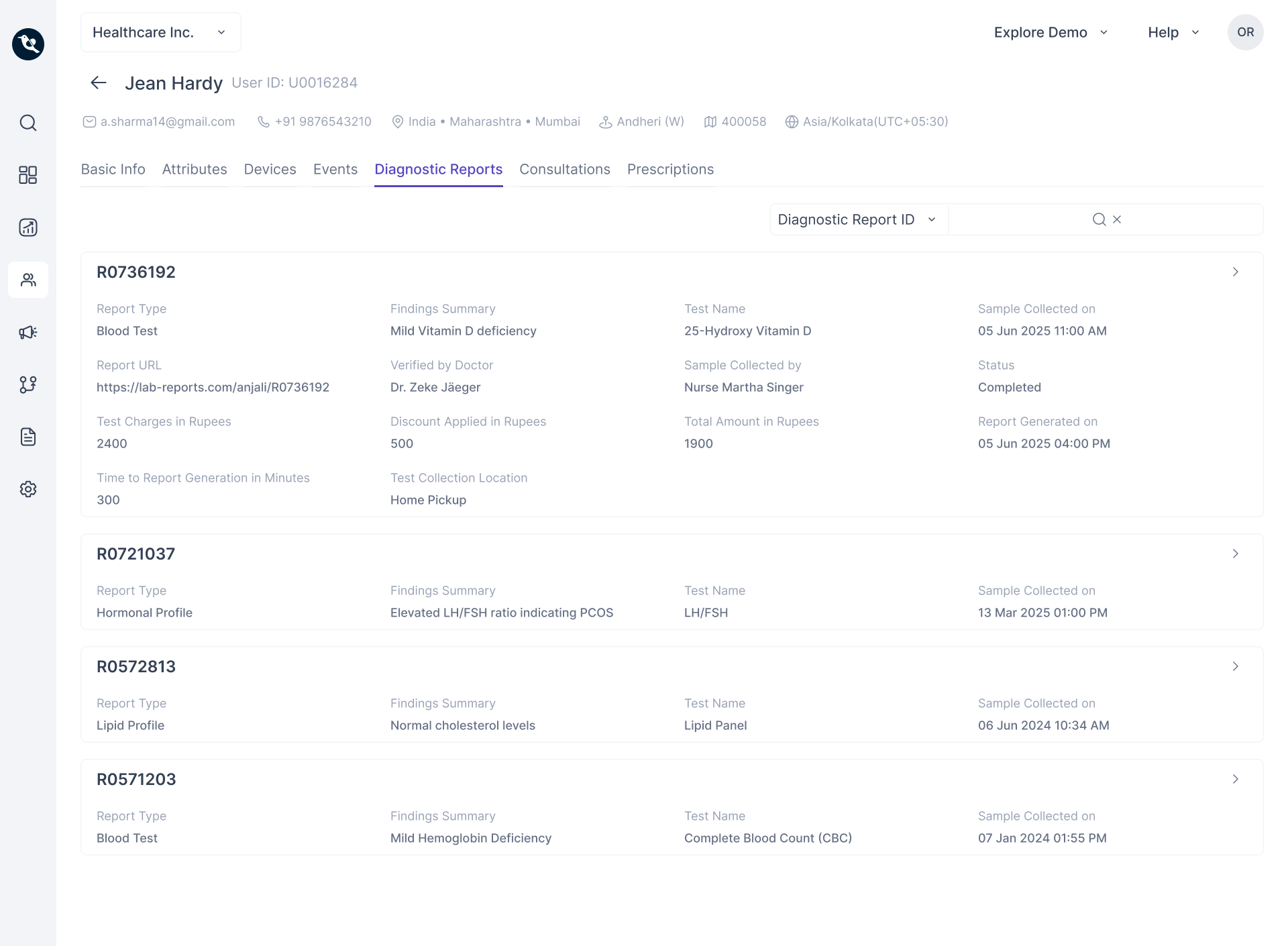

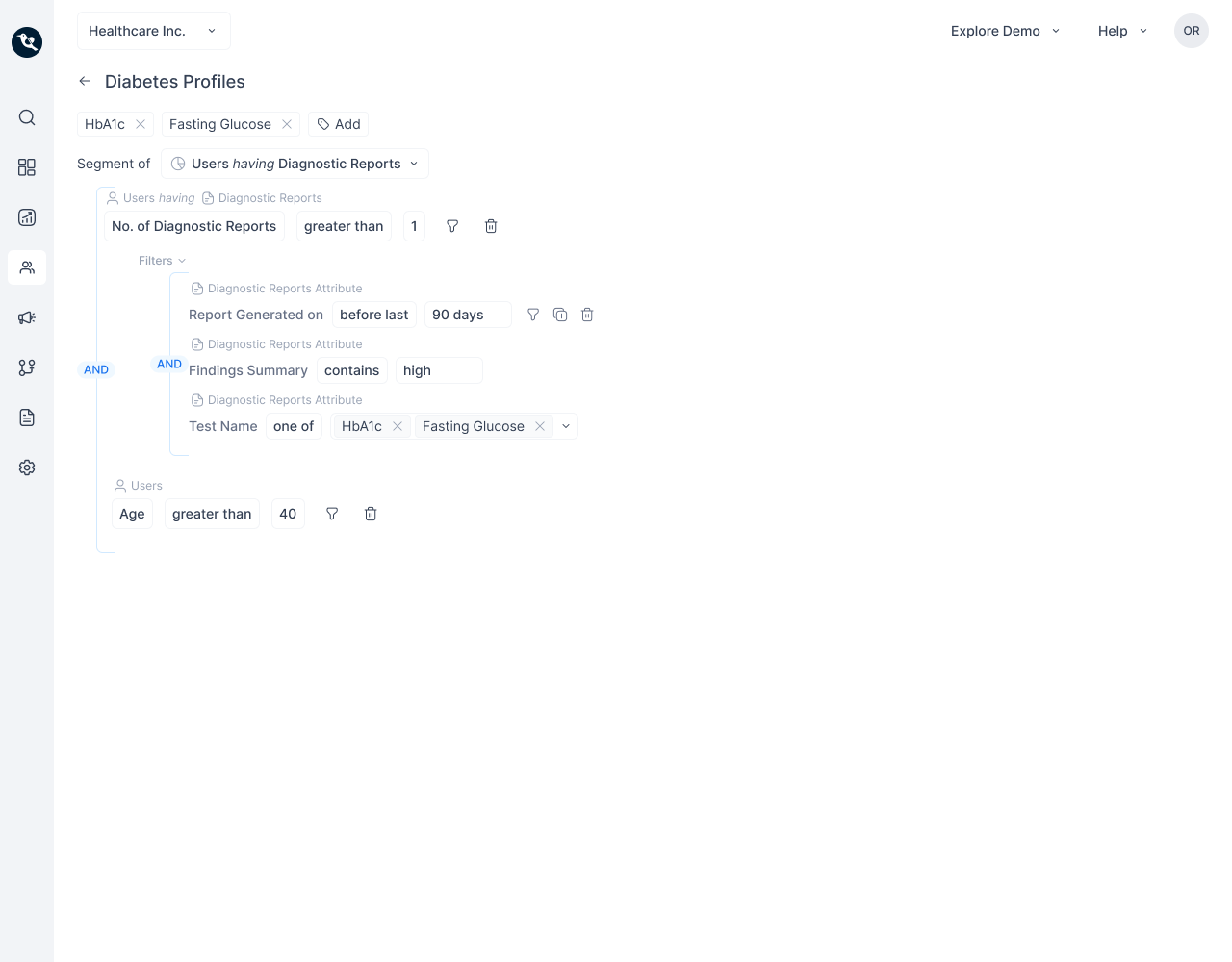

- Understand the relationship between patients, their appointments, and their specific diagnostic test outcomes.

- Segment customers based on complex criteria that span multiple, related entities.

I can go on with these, but you get the drift.

Well, the agony ends here..

Introducing CDPx – say hello to Entities

(Your world of user segmentation, journey orchestration and personalization is about to change.)

Today, we’re introducing Entities, a groundbreaking capability that empowers you to bring your schema to our CDP.

You can now define, store, and manage entities that precisely mirror your real-world business objects – whether they are Orders (e-commerce/retail/marketplaces), Policies (insurers/aggregators), Vehicles (automobile), Ancillary Purchases (airlines), Appointments (healthcare), Loans (banks/nbfc), Investments (securities), Branches (banks), Agents (insurance) or absolutely anything that your business needs to offer integrated customer experiences – we are now a composable CDP, you can bring your Entities and their properties.

Sounds too good to be true? Well, you are in for a treat! Do read further.

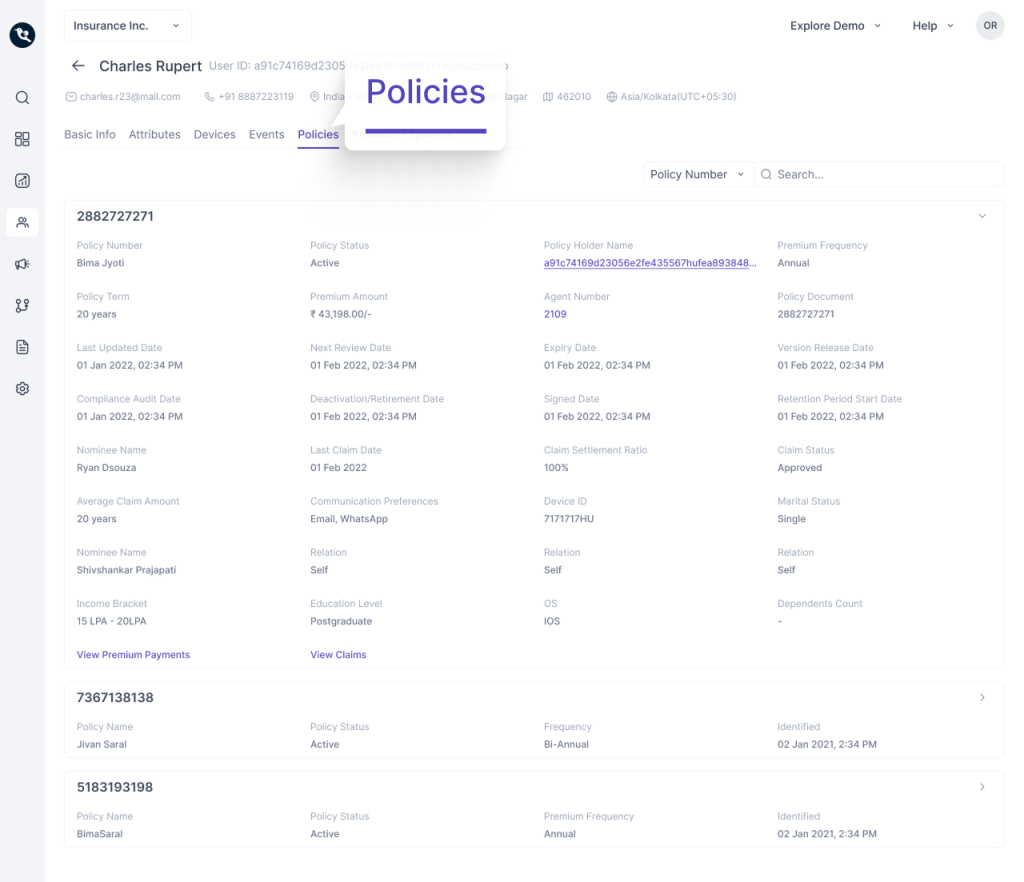

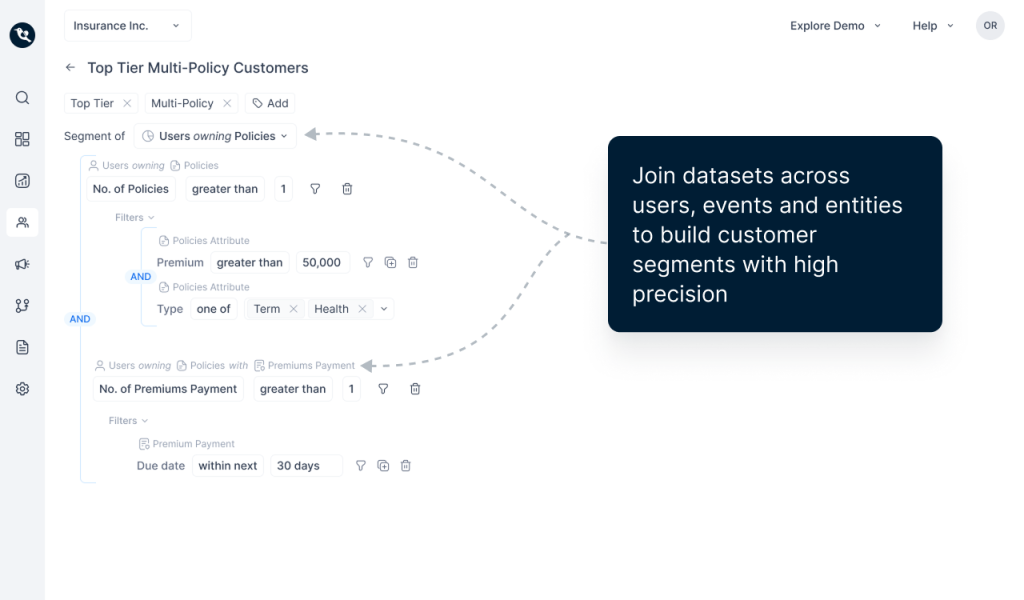

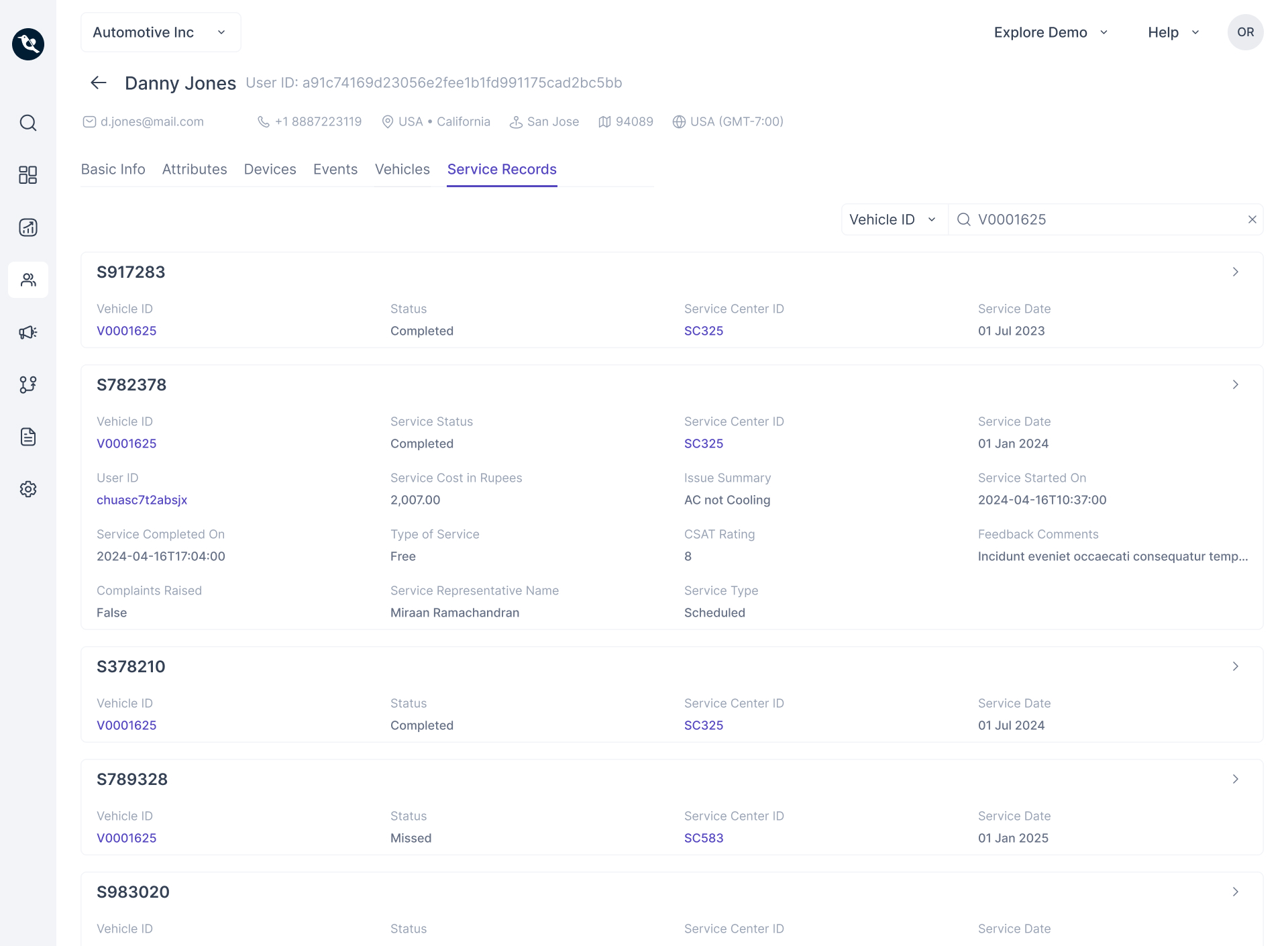

These Entities are mapped with Users and Events, allowing for complex one-to-one, one-to-many, many-to-one, and many-to-many relationships between these objects. This will redefine how you have attempted to build golden customer records on your CDP and, most importantly, how to put all that data to work, starting with the highest segmentation quality. I have two illustrations below for you…

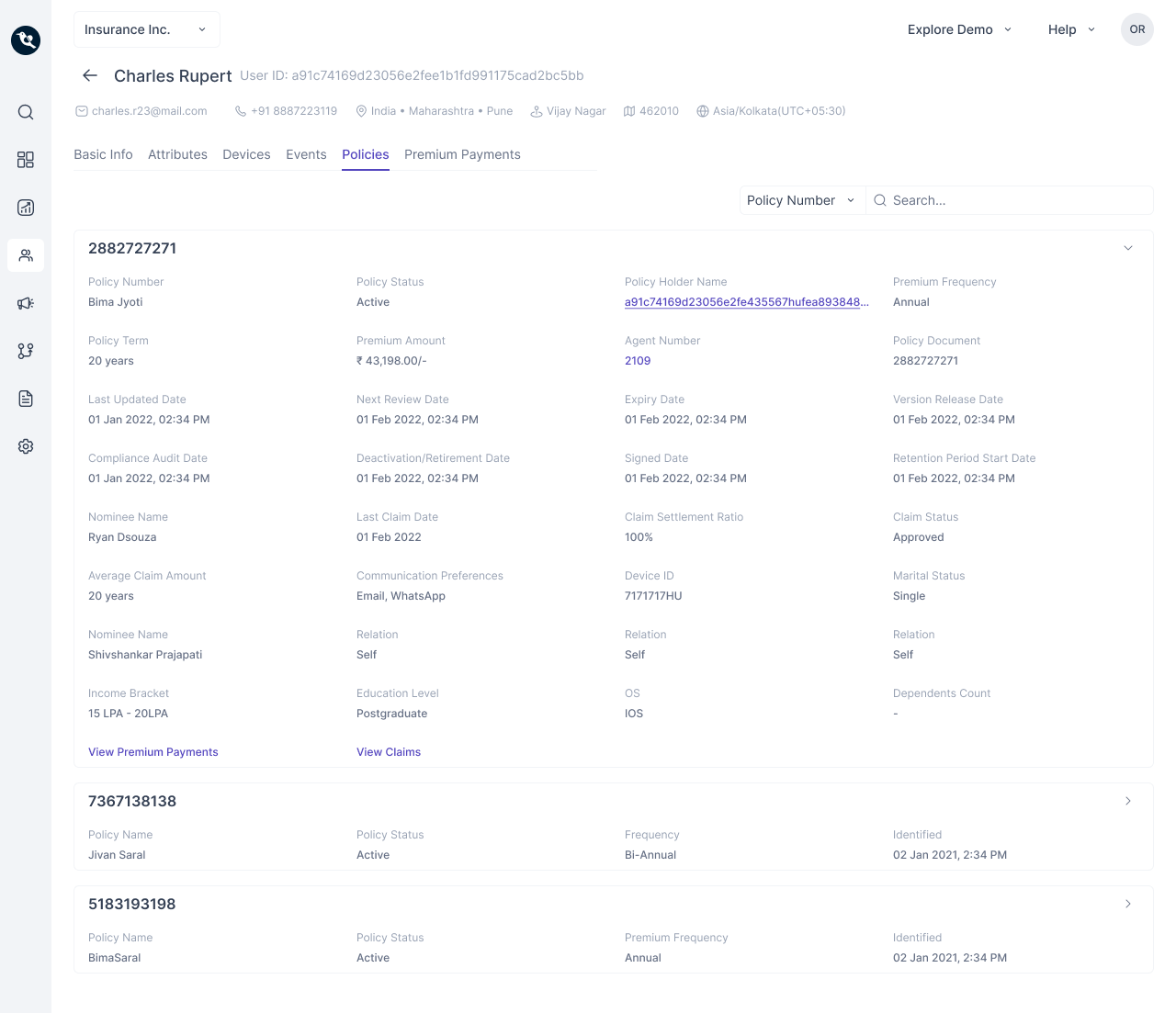

A customer profile on CDPx showing Entities at work – build your golden customer records in the way your business needs to see it – say NO to flattening 😁

A customer profile on CDPx showing Entities at work – build your golden customer records in the way your business needs to see it – say NO to flattening 😁 Navigate Entities with ease – build segments of users or entities or both – say NO to those SQL connectors you’ve been sold under the guise of “bring your own schema” 😏

Navigate Entities with ease – build segments of users or entities or both – say NO to those SQL connectors you’ve been sold under the guise of “bring your own schema” 😏CDPx – lifecycle engagement will now be the art of the possible!

To begin with, we are trying to change two fundamental things.

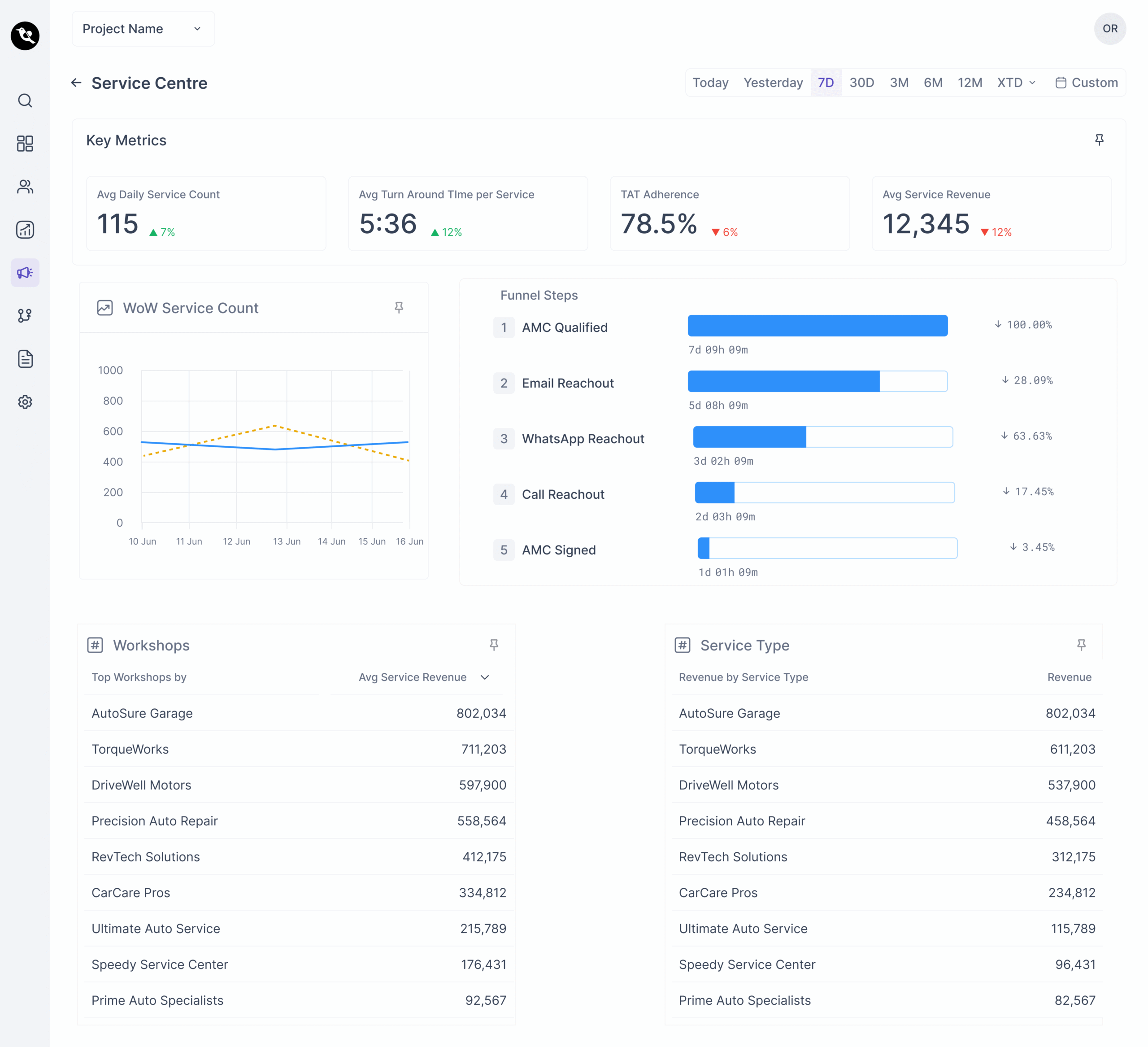

- CDPx will help you engage in high-quality “user lifecycle engagement” and “entity lifecycle engagement.” This means that with WebEngage, you can now run journeys with high-quality personalization-cum-precision for “policies due for renewal,” “appliances due for service,” “cars that might need spare parts or accessories,” “orders for which a refund is to be issued,” etc.

- CDPx will help you orchestrate automation across a customer’s lifespan with your business, whether it’s user journeys for pre-sales or post-sales. You don’t need to run engagement campaigns on different platforms sold to you in the name of “marketing cloud” or “service cloud” or whatever cloud 😬. A truly Integrated Customer Experience for your customers is the core belief on which we have laid the foundation of Entities.

For the insurance example mentioned above, imagine if you could maintain distinct policy entities for each policy your users own. These entities can be updated over time – their status, premium_amount, claim_profile or coverage can evolve. This fundamentally differs from a simple policy_purchased Event with a gazillion attributes, which is merely a snapshot in time. The Policy entity maintains the state, enabling:

Holistic Data Management

Your Policies data, Agent information, and any other connected entities can be synced directly from the source of truth. Our CDP manages their state as your business sees it, eliminating the need to force-fit them into rigid User or Event data stores.

Unrivalled Segmentation Precision

Craft segments with surgical accuracy. Easily identify “Users who currently have more than two active motor policies, bought via Banca agents, that are due for renewal in the next 60 days.”

Hyper-Personalization, Redefined

- Send highly targeted Policy-based communications that leverage policy-specific details, user profile information, and, if needed, agents’ data.

- Even better, club policy-based communications at a user level, sending a personalized digest summarizing all relevant policy updates in a single message instead of a barrage of triggered notifications.

- Deliver user-based communications like birthday greetings – but now, you can ensure they are sent once per user, not once per policy!

- All preference data of a fully integrated user experience – preferred time, channels, opt-ins, etc. – will be derived and stored at the User level. You don’t need to search for those data points at their holdings level.

Intelligent Automation with Concurrent & Contextual Trips

This is where the CDP truly orchestrates engagement.

- Concurrent Trips In User Journeys: A single user can now be in multiple, simultaneous journeys, each tied to a specific entity. Imagine a user in a “60-Day Renewal Reminder Journey” for a Motor insurance policy expiring in 45 days, AND another for a Health policy expiring in 30 days. Each trip runs independently, contextualized by its Policy Number.

- Contextual Trips In User Journeys: If policy_cancelled or policy_renewed events occur, only the corresponding trip for that specific policy is exited, keeping other relevant journeys for the user active. This eliminates irrelevant communication and dramatically elevates customer experience

Deeper Analytics, Clearer Insights

Your Users remain real people, ensuring meaningful individual statistics. Simultaneously, you gain access to Policy stats and distributions for deeper business analysis. Cross-tabulation across different entities (e.g., how policy type correlates with agent performance) reveals richer, actionable insights.

The future of customer data platforms is here – it’s personalized, contextual, secure, and infinitely flexible. Unlike all others, WebEngage CDPx understands and adapts to your business. Do take a look at the slideshow below to discover the world of possibilities that Entities could open up for you – leading to integrated and precise user communications that bring true delight for your customers…

Diksha Dwivedi

Diksha Dwivedi

Tanya Chhateja

Tanya Chhateja

Vanhishikha Bhargava

Vanhishikha Bhargava