As the BFSI industry continues to evolve, so do the demands for its services. And there comes a point where you need to go beyond implementing basic use cases like KYC completion and onboarding. This is where we come in, with advanced use cases for BFSI, that’ll enable you not only increase efficiency, but also boost revenue.

In this blog, we explore the complexities of use cases in BFSI and how companies are utilizing technology to stay ahead. Whether you’re a financial institution, fintech start-up, C-level executive, or manager/operator, this article is for you.

We also demonstrate the ease of implementing them on the WebEngage dashboard so you boost sales faster, smoother, and more efficiently.

Here we go.

1. NURTURE LEADS TO BOOST SALES & REVENUE

APPROACH

- Track multiple user touchpoints through a CRM or an LMS application, and assign disposition status/score, such as interested, callback, inactive, insurance renewal reminder, DND, etc., based on user activity.

- Decide the logical next step for each disposition status.

- For instance, if your user interacted with the platform via email, and requested a callback, update this user attribute on the CRM/LMS.

- Integrate the CRM application with WebEngage and create a journey on the dashboard based on each segment.

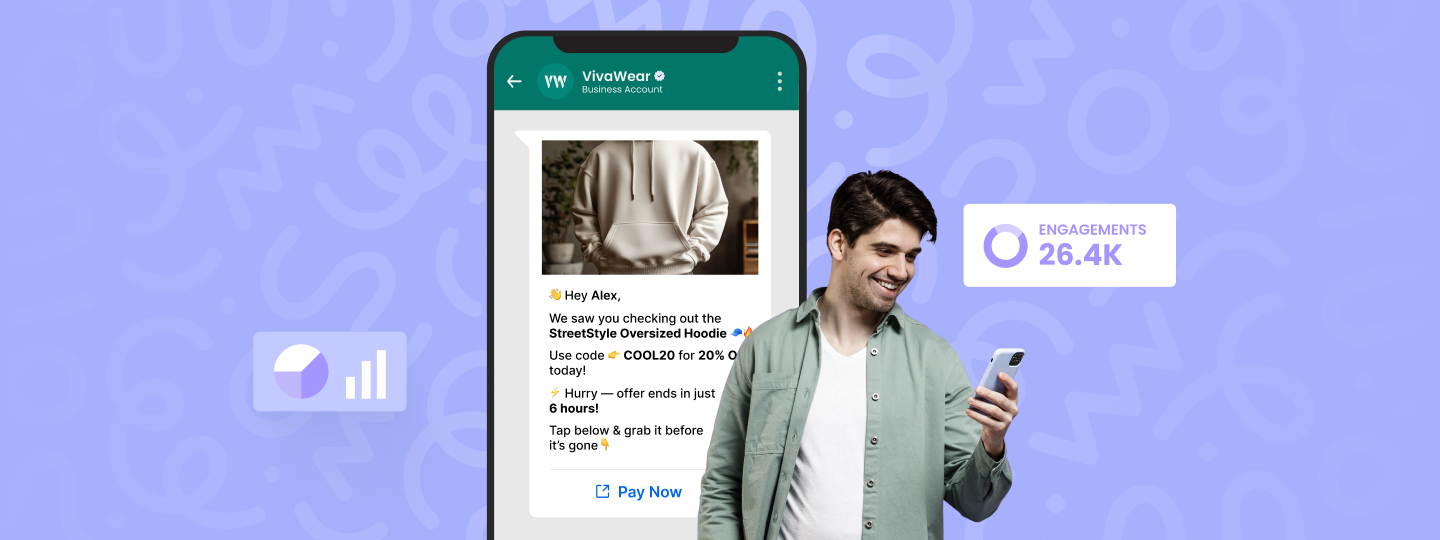

- Hyper-personalize your messages with the help of the Recommendation and Catalog engine. Incorporate relationship manager details (if any) with Catalog and suggest different insurances based on their last purchase with Recommendation.

PRO TIP

Replicate the same process for other disposition statuses like dropped off, refund, sales closed, etc., to increase user retention and boost sales.

EASE OF IMPLEMENTATION

★★★★★

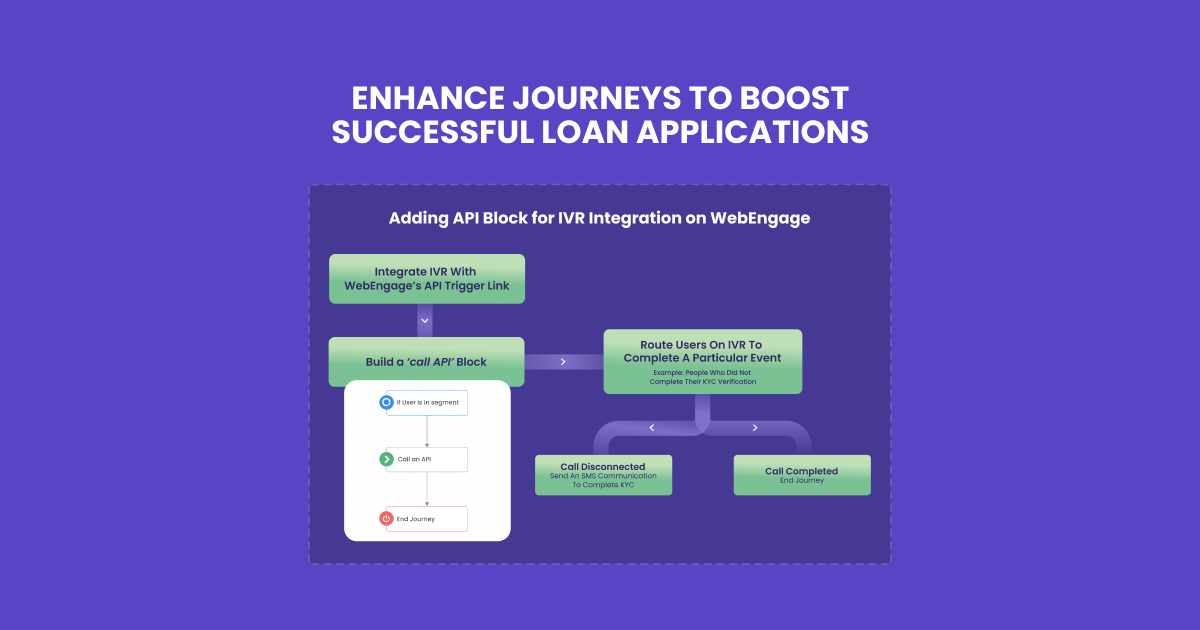

2. BOOST SUCCESSFUL LOAN APPLICATIONS WITH THE HELP OF IVR

APPROACH

- Identify leakage in the user’s journey (through funnel analysis) and set up an automated trigger to counter said leakages and reduce drop-offs.

- For example, to counter abandoned loan applications, trigger a journey based on the user’s loan application status and leverage communication channels such as email, SMS, WhatsApp, and web personalization to nudge users.

- Incorporate additional outreach channels such as IVR through the ‘Call an API’ block on the Journey Designer to complete events like loan applications and activation of cards and to offer incentives like ‘Buy now, pay later’ and more.

PRO TIP:

Cross-sell and upsell different financial services based on user attributes collected on the IVR—for example, target users investing in tax-saving funds with equally low-risk investments and policies.

EASE OF IMPLEMENTATION

★★★★

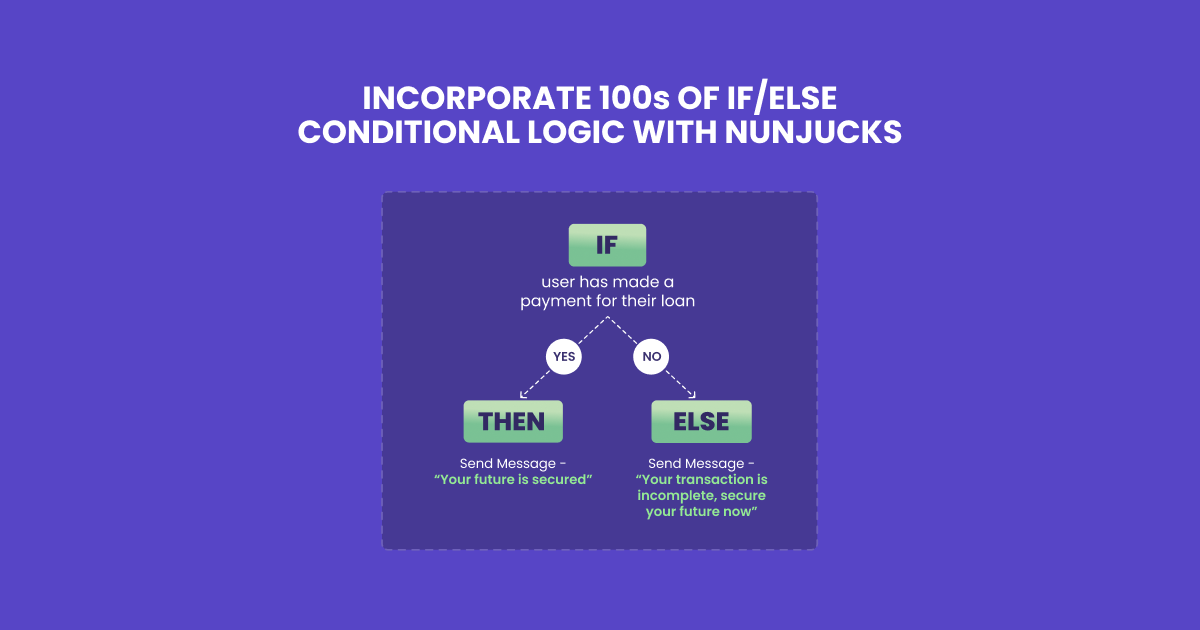

3. USE NUNJUCKS TO INCORPORATE IF/ELSE CONDITIONS WITH EASE

APPROACH

- Nunjucks-based personalization can help you run if/else conditions with ease across channels like email, mobile, and web push channels.

- Nunjucks are similar to adding conditional logic blocks in your journeys to communicate with users based on their actions.

- Create a logic sheet to define rules for users, basis attributes like portfolio numbers, investment status, risk assessment, credit score, etc.

- Here are a few instances of how you can use if/else conditions for your users: If your user has made a payment for their loan, use a body copy like, ‘Your future is secured.’ Else, if incomplete, use ‘Your transaction is incomplete. Secure your future now’. If a user is purchasing insurance worth ₹10,000, show policies worth a similar value, else show policies worth a lower value.

PRO TIP:

You can also leverage ‘if/else’ logic beyond just 2 outcomes to also include ‘if Condition X’, then implement ‘Condition Y’, else show ‘Condition Z’ format logic as well.

EASE OF IMPLEMENTATION

★★

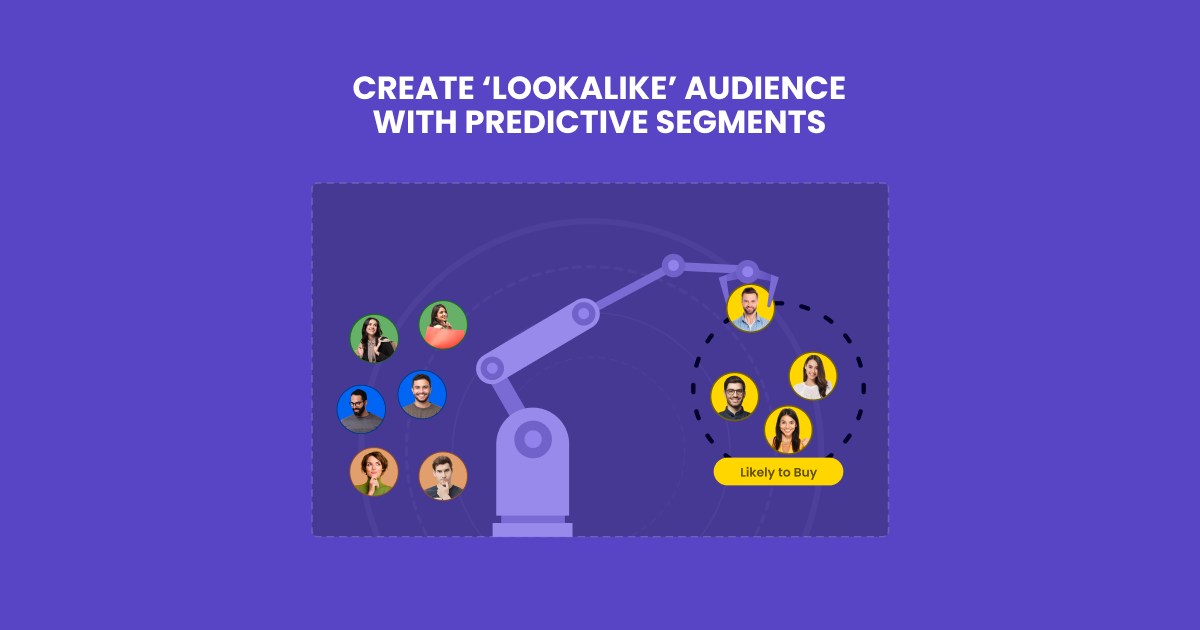

4. USE PREDICTIVE SEGMENTS TO ENABLE BUSINESS GROWTH

APPROACH:

- Create predictive segments based on a business goal, such as ‘users likely to purchase insurance.’

- Our machine learning engine predicts the most, moderate, and least likely users for the business event and saves them as lists in your dashboard.

- Based on these lists, you can increase your loyal customer base by identifying customers likely to spend more than a certain amount.

- Leverage these segments to send contextual messages and nudge users towards a specific path or action.

- These lists can be leveraged in standalone campaigns and journeys to hyper-personalize communication.

- For instance, reach out to potential customers who are likely to raise a loan request, get them to submit a call-back, and assign a relationship manager to help them raise a loan request successfully. Business goal used: loan_request_made

PRO TIP:

Predictive segmentation can also help identify users likely to churn by creating a least likely list for business event: purchase_made.

EASE OF IMPLEMENTATION

★★★★★

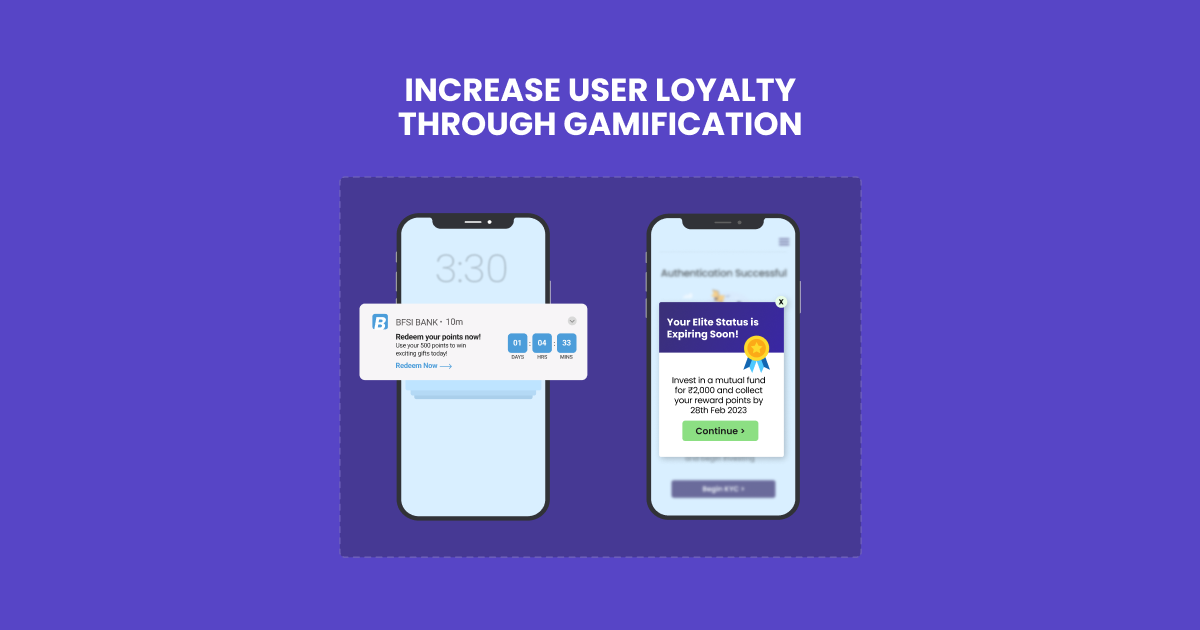

5. INCREASE USER LOYALTY THROUGH GAMIFICATION

APPROACH:

- Use WebEngage’s engagement scoring algorithm to segment users based on purchase and engagement behavior.

- For instance, email opens can be assigned a weightage of 3. An email click can be given a weightage of 5, as clicks represent a deeper engagement than opens.

- Incentivize and nudge users to increase their engagement score to further win prizes, increase credit, get brand/bank offers, get good returns on their purchases, etc.

- Send targeted communications based on engagement score/credit score, with attributes like signed up on platform, transacted beyond XYZ amount, exceeded minimum cart amount, used a brand/bank collaborative card, etc.

PRO TIP:

You can also motivate users to cash in their scores/points on rewards like new credit cards, loan offers, discounts on fees, clothing, eatables, footwear, etc., by mapping your collaborative/brand catalog with user engagement score.

EASE OF IMPLEMENTATION

★★★

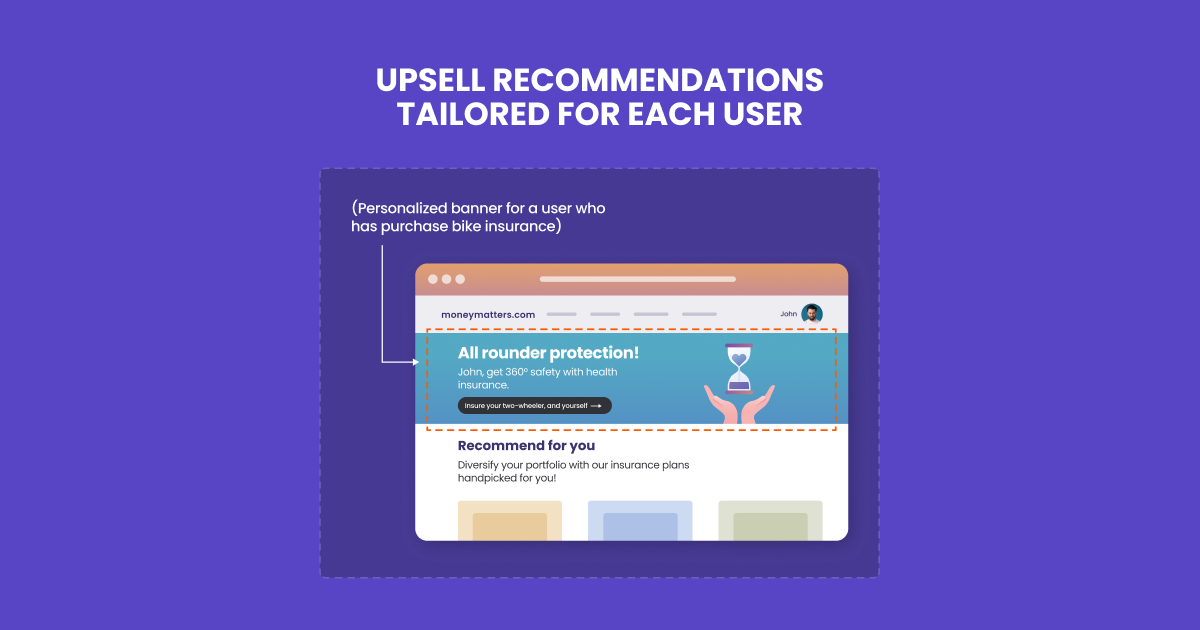

6. UPSELL RECOMMENDATIONS TAILORED FOR EACH USER

APPROACH:

- Enhance communication with upsell strategies, based on user attributes like policy details, with the recommendation engine.

- Attune user attributes like a check for multiple insurance policies, insurance type, and expiry date, and create more segments.

- Incentivize users to purchase higher-end policies than the ones they already hold based on their risk appetite and purchasing power.

- Replicate the process for the type of insurance, amount invested, risk appetite, etc.

PRO TIP:

If a user holds more than one policy to their name, personalize communication based on individual policy end dates.

EASE OF IMPLEMENTATION

★★★★★

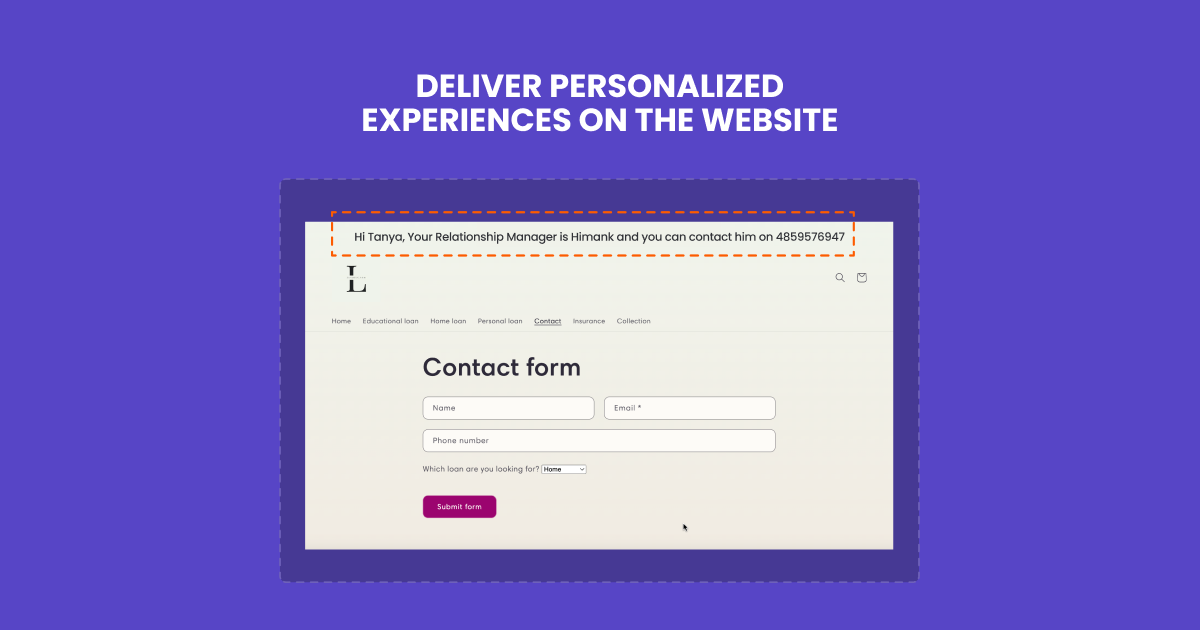

7. DELIVER PERSONALIZED EXPERIENCES ON THE WEBSITE

APPROACH:

- Collect required user attributes and custom events like name, location, loan status, relationship manager assigned/pending, amount invested, etc., to personalize website content for users.

- For example, if a user has an active loan request, personalize their website experience by providing easy access to information such as relationship manager details and more. You can also incorporate chatbots, leave intent pop-ups, and location-based offers & recommendations into the website.

- This can also be used to remind users of their upcoming insurance payments in the form of a drip campaign or can also be used to nudge users who’ve abandoned insurance application processes mid-way.

PRO TIP:

Use any custom event or user attribute to personalize communication on your website, such as providing recommendations based on the type of insurance last purchased.

EASE OF IMPLEMENTATION

★★★★

8. OPTIMIZE SELF-SERVE THROUGH THE JOURNEY DESIGNER

APPROACH:

- Help next-step discovery for users on your platform. For example, if a user reaches the first step in applying for a loan (adding basic contact details), drive the user towards the next step – filling out an application.

- Send contextual nudges based on which step in the loan application funnel the user is in.

- For example, nudge users to complete their loan application at the final step.

- Hyper-personalize communication to said users based on the loan type, employment status, loan duration, amount, eligibility criteria, and more.

- Moreover, keep users informed of their loan application status. In case of loan rejection, nudge them with recommendations for similar loans.

PRO TIP:

Suppose a preferred language option is presented on the platform. In that case, you can further encourage users to complete filing their documents and leverage that detail to localize user communication through emails, push notifications, and more.

EASE OF IMPLEMENTATION

★★★

IMPACT STORIES:

Here are a few BFSI Impact Stories you can check out:

- Edelweiss Tokio – Check Out How Edelweiss Tokio Life Used A Personalized Approach To Lead Nurturing With WebEngage’s Journey Designer And Built A Truly Omnichannel Business

- CASHe – Learn How CASHe, India’s Online Credit Lending App, Magnified Its Repeat User Base By 75% Using IVR Integration On WebEngage’s Platform

- DSP Blackrock – Learn More About How DSP BlackRock, A Large Mutual Funds Company, Used WebEngage’s Personalization Engine To Increase Engagement Through Emails

CONCLUSION:

In conclusion, BFSI is a rapidly evolving industry with a plethora of use cases that require complex solutions. As technology advances, businesses need to stay up to date with the latest developments to remain competitive.

By exploring the use cases highlighted in this blog, BFSI companies can gain insights into leveraging technology to improve operations, enhance customer experience, and drive business growth. Ultimately, the key to success in this industry lies in staying ahead of the curve and embracing innovation to meet customers’ ever-changing needs.

Diksha Dwivedi

Diksha Dwivedi