In the bustling sphere of Banking, Financial Services, and Insurance (BFSI), standing out is no easy task. One crucial metric that can help is the click-through rate (CTR). As a measure of the success of an online marketing campaign, CTR bears a direct impact on the visibility of your marketing messages, and consequently, on your sales and revenue. But how can you ensure that your marketing strategies are capable of engaging the audience effectively enough to drive up your CTR? This is where the power of audience segmentation comes into play.

When your CTR is high, it signifies that a greater number of people who see your marketing messages are clicking through to learn more. This indicates that your advertisements, emails, or other marketing campaigns are resonating with viewers, thus leading to increased conversions.

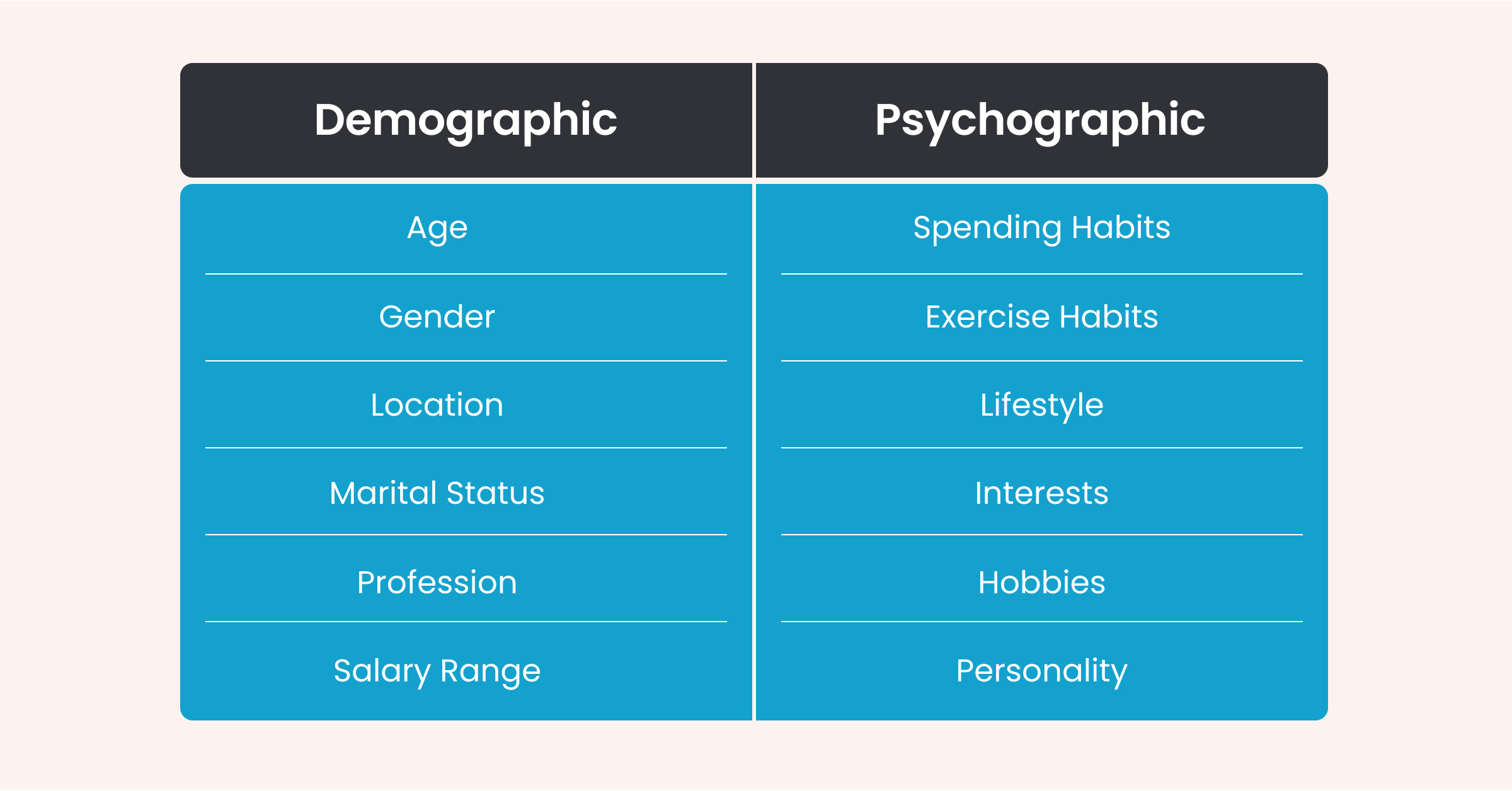

Audience segmentation is when you divide your customer base into distinct groups based on shared traits, characteristics, or behaviors. These could range from demographics such as age, gender, and location, to more complex criteria like purchasing behavior, lifestyle choices, and financial standing. By understanding these groups and their unique needs, you can tailor your marketing messages to address their specific interests and concerns. This personalized approach not only increases the relevance of your marketing efforts but also heightens the possibility of engaging your audience, encouraging them to click through, and effectively boosts your CTR.

In this blog post, we will navigate through the business of audience segmentation to boost CTRs for your BFSI business. Are you ready to make notes?

Strategy 1: Segment audience by financial needs and goals

One of the most effective ways to segment your audience is by financial needs and goals. This will allow you to target your marketing messages to customers who are most likely to be interested in your products and services.

For example, if you offer a financial planning service, you could segment your audience by age, income, and net worth. You could then target your marketing messages to customers who are in a certain age range, have a certain income level, or have a certain net worth.

Each customer is unique, with distinct financial requirements that evolve with time, lifestyle changes, and fluctuating market conditions. By segmenting your audience based on these financial needs and goals, you can tap into a more refined and receptive audience subset that’s likely to resonate with your offerings.

The beauty of this approach lies in its personalization. Instead of a generic message that barely scratches the surface of your customers’ diverse financial needs, you can deliver customized marketing content that addresses their specific goals and requirements. This approach fosters a deeper connection with your customers, making your messages more compelling and increasing the likelihood of a click-through.

The BFSI company that segments its audience by their financial needs and goals is JP Morgan Chase & Co. They achieve success with targeted marketing by using data-driven strategies to better understand customer needs and develop customized products and services for each segment. This allows them to offer more personalized experiences, tailored to specific customer needs, ultimately leading to increased satisfaction and loyalty. Additionally, they use analytics tools such as predictive modeling to anticipate customer preferences and develop targeted campaigns that are more likely to reach the desired results.

Here’s an ad from JP Morgan that offers commission-free trades to, what is apparent, young investors. The tone and the messaging of the advertisement are clearly aspirational, and their credibility of having 200 years of experience only comes as a sub-text.

Strategy 2: Target specific life stages and milestones

Segmenting your audience based on life stages and milestones provides an effective approach to tailoring your marketing messages to the specific circumstances and aspirations of your customers. Life is full of significant events and transitions, and by recognizing and catering to these moments, you can deliver personalized content that truly resonates. This tailored approach demonstrates your understanding of their current priorities, making your marketing messages more compelling and increasing the likelihood of a click-through.

Furthermore, targeting individuals experiencing major life milestones, such as marriage or starting a business, allows you to create campaigns that address their financial concerns and offer relevant solutions. For instance, you can tailor your messages to highlight the benefits of joint financial planning for newlyweds or provide guidance on business financing options for entrepreneurs. By demonstrating your expertise in their particular life stage, you establish a connection and build trust with your audience.

By segmenting your audience based on life stages and milestones, you ensure that your marketing messages reach the right people at the right time. This personalized approach shows that you understand and empathize with their unique circumstances, making them more likely to engage with your content and take desired actions.

Bank of America is the BFSI company that targets customers based on specific life stages and milestones. Bank of America is effective with this kind of targeting by understanding the needs and lifestyles of different customer segments, such as young professionals, parents, retirees and more. They then create targeted product offerings and services tailored to each segment’s unique needs. Additionally, they use digital marketing channels to reach their target audiences in the most efficient way possible.

Watch this cheeky ad by Bank of America called ‘The Road To College’. It’s specifically targeted towards parents of college-going students and takes a dig at the never-ending expenses that they have to bear. What’s a better way than this to introduce their 3% cashback?

Strategy 3: Leverage demographic and psychographic data

To truly optimize your click-through rate in the BFSI industry, it’s crucial to leverage demographic and psychographic data. These valuable insights can help you understand the unique characteristics, preferences, and behaviors of your target customers. Armed with this knowledge, you can customize your marketing campaigns to resonate with specific demographics and psychographics, ultimately driving higher engagement and CTR.

Demographic data encompasses measurable characteristics such as age, gender, income level, education, occupation, and geographic location. Analyzing this information provides a solid foundation for segmenting your audience and tailoring your marketing messages accordingly. For example, if you’re promoting retirement planning services, you may discover that individuals aged 50 and above, nearing retirement age, exhibit specific financial concerns and priorities. By customizing your campaigns to address these concerns, you can capture their attention and motivate them to click through.

Psychographic data, on the other hand, delves into the deeper aspects of individuals’ lifestyles, values, attitudes, interests, and motivations. Understanding the psychographics of your target audience allows you to create more nuanced and compelling marketing campaigns. By aligning your messaging with their values and interests, you increase the likelihood of a higher CTR.

The BFSI company that optimizes its CTRs by segmenting its audience based on demographic and psychographic data is Barclays Bank. Barclays Bank has been successful at this because it allows them to tailor their messaging and targeting to specific audiences, ensuring that they are able to maximize their reach and engagement with the right people. Through this type of segmentation, Barclays Bank is able to understand its customers better and provide them with more relevant content, resulting in higher click-through rates.

This relatable ad by Barclays Bank, ‘Take Control Of Your Money’, targets the population of tech-savvy but forgetful people. Losing one’s debit card can be scary, but with Barclays Bank’s mobile application, you can freeze and un-freeze your card any time you like. It’s quite clear that rather than aiming at a particular demographic, this ad taps into the psychographic segment of ‘convenience’.

Strategy 4: Utilize customer transaction data

Incorporating customer transaction data into your segmentation strategy can provide valuable insights that drive the optimization of your click-through rate. By analyzing past transaction history, you gain a deeper understanding of your customers’ preferences and behaviors, enabling you to adjust your marketing messages accordingly.

The transaction data at your disposal offers a wealth of information about the products and services your customers have previously purchased. By leveraging this data, you can identify patterns and trends that help you segment your audience effectively. This segmentation allows you to target your marketing messages to customers who are most likely to be interested in similar products and services, increasing the relevance and effectiveness of your campaigns.

Capital One, a leading financial institution, leverages customer transaction data to enhance their marketing campaigns and improve CTRs. They prioritize the privacy and security of their customers’ information by implementing stringent data protection measures.

To protect customer privacy, Capital One employs advanced encryption techniques to secure customer transaction data. They adhere to industry best practices and comply with applicable privacy regulations, such as the Gramm-Leach-Bliley Act (GLBA) in the United States.

An important aspect of Capital One’s approach is the aggregation and anonymization of customer transaction data. Individual customer identities are protected by de-identifying and grouping data, enabling Capital One to derive valuable insights without compromising privacy. By analyzing aggregated data, Capital One can identify trends, preferences, and customer segments to tailor their marketing messages effectively.

Strategy 5: Separate Learners from Seasoned Investors

To optimize your click-through rate in the BFSI industry, it’s crucial to recognize the varying levels of financial knowledge and experience among your audience. By segmenting your audience into learners and seasoned investors, you can develop valuable educational resources that cater to their specific needs, thereby driving traffic and engagement.

Recognizing that not all customers possess the same level of financial knowledge, it’s essential to provide educational resources that empower and educate them about your financial products and services. By offering comprehensive guides, tutorials, videos, and interactive tools, you can equip learners with the knowledge they need to make informed decisions. For instance, you could develop beginner’s guides to personal finance, investment basics, or retirement planning. These resources would provide step-by-step explanations, clear examples, and practical tips to help learners navigate the complexities of financial management.

TD Bank recognizes the importance of financial literacy and the varying levels of knowledge among its customers. To cater to different segments of their audience, they have developed a robust financial education platform called “TD Ready Commitment.”

To segment their audience, TD Bank employs various methods, including surveys and customer behavior analysis, to determine the financial literacy levels of their customers. Based on this segmentation, they tailor their financial education resources to address the specific needs and interests of each segment. For example, they may provide simplified explanations and step-by-step guides for beginners while offering more advanced content and tools for experienced investors.

TD Bank’s financial education platform serves as a lead magnet, attracting individuals who are seeking to enhance their financial knowledge and make informed financial decisions. By providing valuable educational resources even for kids and teens, TD Bank establishes itself as a trusted source of financial information and expertise, fostering customer loyalty and engagement.

Strategy 6: Utilize Machine Learning driven customer insights

Utilizing machine learning driven customer insights is an effective strategy to optimize click-through rates. By leveraging advanced machine learning algorithms, businesses can analyze vast amounts of audience data, uncover valuable patterns, and predict customer behavior to enhance their marketing efforts.

Machine learning algorithms have the capability to process and analyze complex customer data sets more efficiently than traditional methods. By feeding these algorithms with relevant customer data, such as demographics, transaction history, online behavior, and interactions with marketing campaigns, businesses can gain deeper insights into customer preferences, interests, and engagement patterns.

One way to optimize CTR using machine learning is by leveraging predictive modeling techniques. By training machine learning models on historical data, businesses can develop predictive models that identify customers who are most likely to respond positively to specific marketing messages or campaigns. For example, by analyzing past click-through rates, conversion rates, and customer attributes, machine learning algorithms can identify patterns and characteristics associated with higher engagement. This enables businesses to target their marketing messages more effectively by focusing on the segments that have a higher likelihood of clicking on the message.

Merolagani is a Nepali investment and financial news platform. It provides live market trading, floorsheet, indices, company announcements and reports, market analysis, online portfolio tracker, watchlist, alerts, and investor forum. Merolagani used Machine Learning driven insights to enhance CTRs by using WebEngage’s Journey Designer and A/B testing features:

- Journey Designer allowed Merolagani to create personalized email and in-app experiences for their users based on their past behavior. This resulted in a 10% increase in CTRs.

- A/B testing allowed Merolagani to test different versions of their emails and in-app messages to see what resonated best with their users. This resulted in a 5% increase in CTRs.

In addition to using Machine Learning driven insights, Merolagani also focused on creating high-quality content that was relevant to their users. This resulted in a 3% increase in CTRs. Merolagani’s use of Machine Learning driven insights, Journey Designer, A/B testing, and high-quality content helped them to increase their CTRs by 21%.

Strategy 7: Partner with relevant influencers and thought leaders

Partnering with relevant influencers and thought leaders can significantly enhance your click-through rates by leveraging their established credibility and broad audience reach. These individuals possess a significant following and influence within the finance industry, making them valuable allies in promoting your products and services to a wider audience.

Collaborating with finance gurus and influencers allows you to tap into their existing audience base, which can be highly relevant to your target market. By choosing influencers who align with your brand values and cater to your desired audience demographics, you can ensure that your marketing messages are effectively delivered to individuals who are more likely to engage with them.

Once you have established partnerships with influencers, there are several ways to leverage their credibility to increase CTR. Firstly, you can collaborate on content creation, such as guest blog posts, interviews, or co-branded videos, where influencers share their knowledge and insights related to your products or services. This not only adds value to your content but also increases the credibility and trustworthiness of your brand in the eyes of the audience.

American Express collaborates with renowned finance experts and influencers to create valuable content, share insights, and promote their products and services. American Express engages influencers across various channels, including social media platforms, blogs, and events, to reach a wider audience and enhance their CTR.

By partnering with influencers who have expertise in personal finance, credit cards, and travel, American Express taps into the influencer’s credibility and existing audience trust. The influencers create content, such as informative blog posts, social media endorsements, and educational videos, that highlight the benefits and features of American Express products and services. This collaboration enhances the trust and credibility associated with American Express and drives higher CTR as their audience engages with the influencers’ content.

Conclusion

In conclusion, optimizing click-through rates (CTR) is crucial for the success of your BFSI marketing efforts. By implementing the seven strategies discussed in this blog post, you can effectively enhance your CTR and drive better results for your business. By implementing these strategies, you can improve your CTR optimization and achieve better engagement with your target audience. Remember to continually analyze and refine your marketing campaigns based on the insights you gather from audience segmentation and data analysis.

We hope this blog post has given you some valuable guidance.

Now it’s time to move forward and book a demo with WebEngage to see how they can supercharge your CTRs.

Prakhya Nair

Prakhya Nair