How can a Financial Service Provider fix leakages in a purchase cycle to reduce drop-Offs

Conversion Funnel Optimization 101 is an all-inclusive Marketing Automation Guide for Financial Services Companies. In this post, we’ll discuss how Financial Businesses can optimize their Purchase Cycle with Marketing Automation.

Financial Services Companies like Banks, Micro-Lending Firms, Insurance Companies, etc. possess gold mines of customer data. They gather prolific amount of micro-data like personal identifiable information (PII), demography, employment, financial background, etc. at every stage of their sales funnel.

However, their inability to utilize such data to their advantage often results in hampered customer experience and high drop-off rate throughout the pre-purchase cycle of their financial product.

This blog will identify potential leakages, and explain HOW Financial Services Companies can employ a marketing cloud to reduce drop-offs, improve conversion, and enhance their customer’s experience.

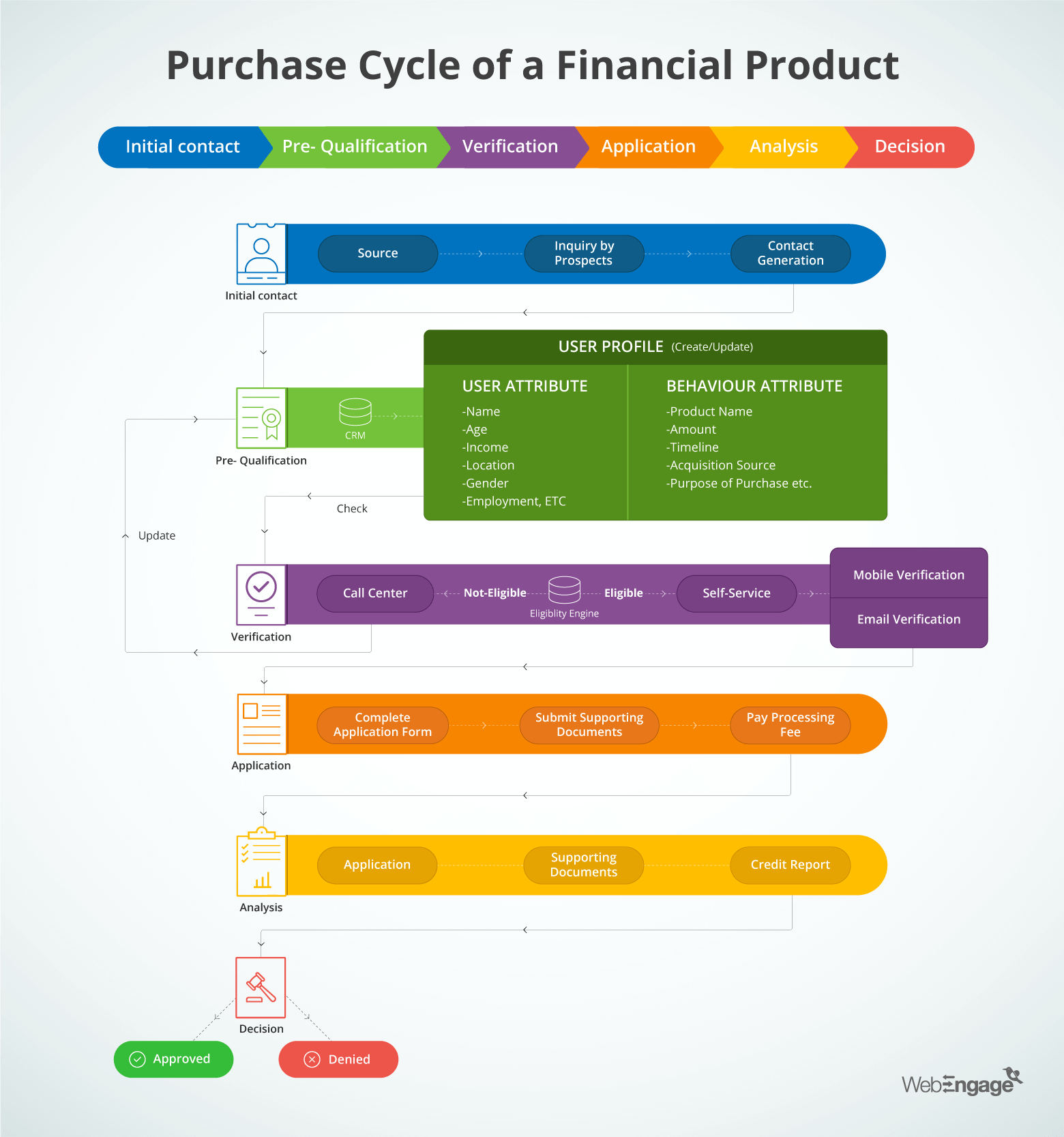

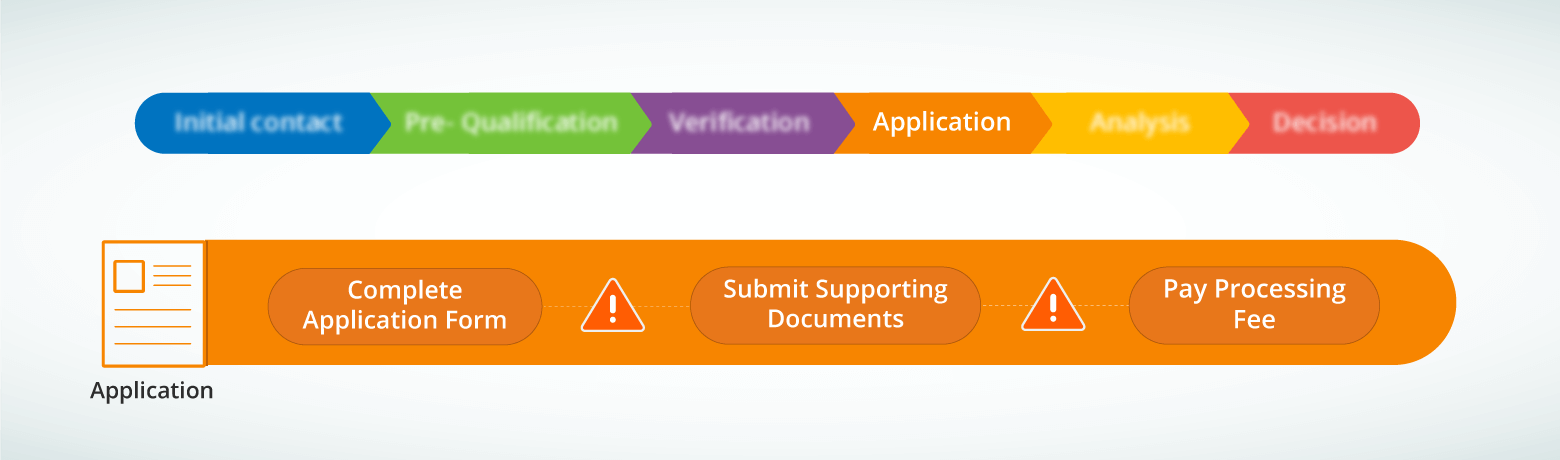

Purchase cycle of a financial product

Suppose this is a typical user flow within the purchase cycle of a basic financial product.

- Stage 1: Initial Contact:

An anonymous or existing user gets in touch via sources such as online (website, display ads, social media, etc.), offline (branch, call centre, print advertising, etc.) or channel partner (affiliate websites, direct selling agents, etc.). - Stage 2: Pre-Qualification

Information provided by the user is synced or updated on the marketing/sales CRM tool in form of User persona values (Eg: name, email id, mobile number), and User behaviour values (Eg: keyword searched, product viewed, etc) - Stage 3: Verification

User Profiles are validated by an Eligibility Engine. Eligible Users are asked to authenticate their email id and/or mobile number via Self Service mode of verification. On the other hand, details of Non-Eligible Users are forwarded to the Call Center. - Stage 4: Application

Verified User completes the application form, submits necessary supporting documents, and pays the processing fee. - Stage 5: Review and Analysis

Authorities of Financial Service Provider scrutinize the submitted application along with the supporting documents and the credit report to ensure that the user is a deserving candidate. - Stage 6: Decision

User’s application is either approved or rejected based on the analysis.

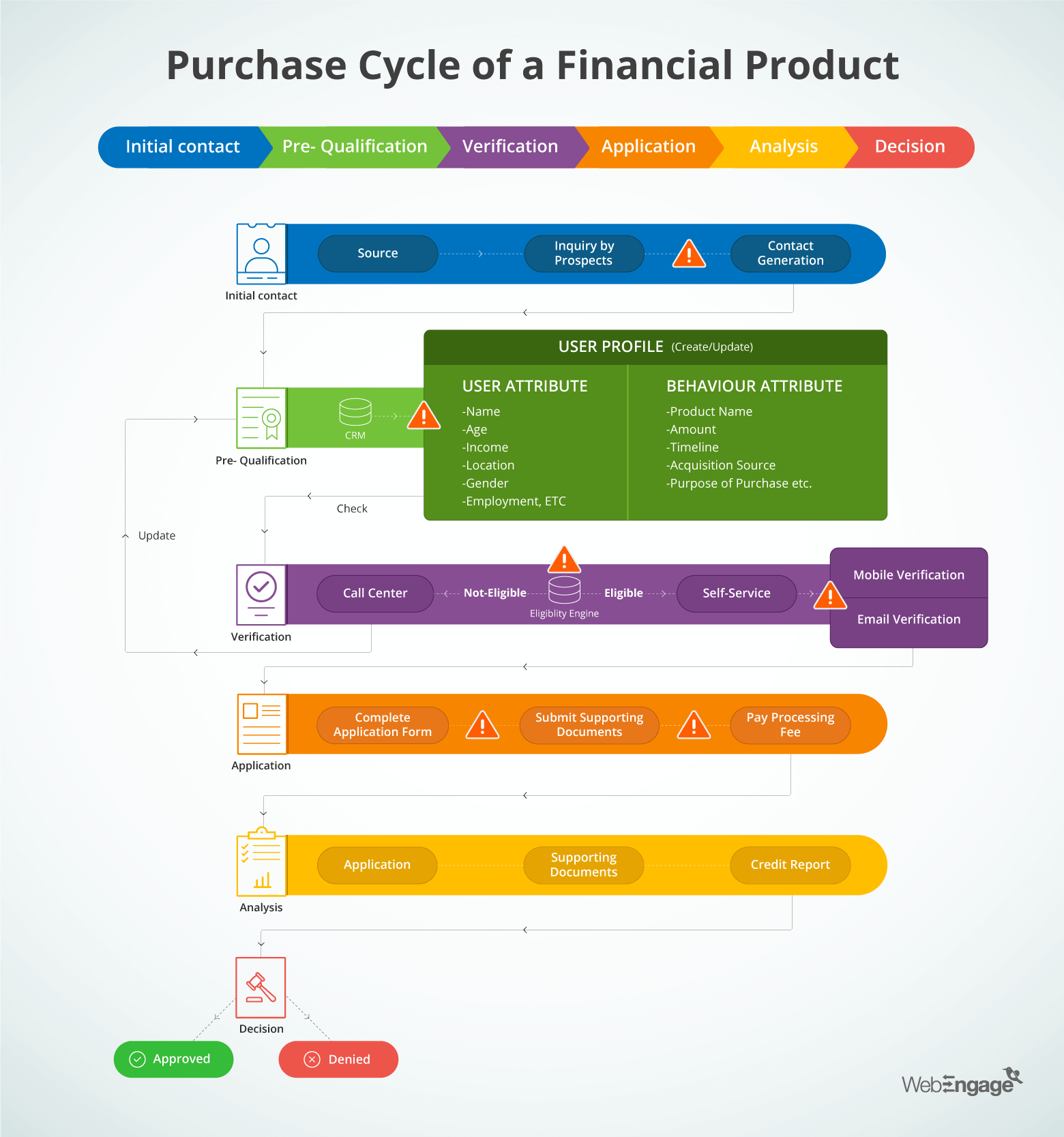

Pre-purchase stages of this cycle are not leak-proof. Let’s identify these potential drop-off points, and find a solution minimize the leakages.

(Hint: these solutions are triggered and contextual)

Bonus Read – Conversion Funnel Optimization 101 For Financial Services Companies [Part 2]

How to spot leakages in the pre-purchase cycle of a financial product and fix them with WebEngage Journey Designer

If we take a bird’s eye view of the purchase cycle, we can spot all these potential leakages:

Let’s fix them one-by-one.

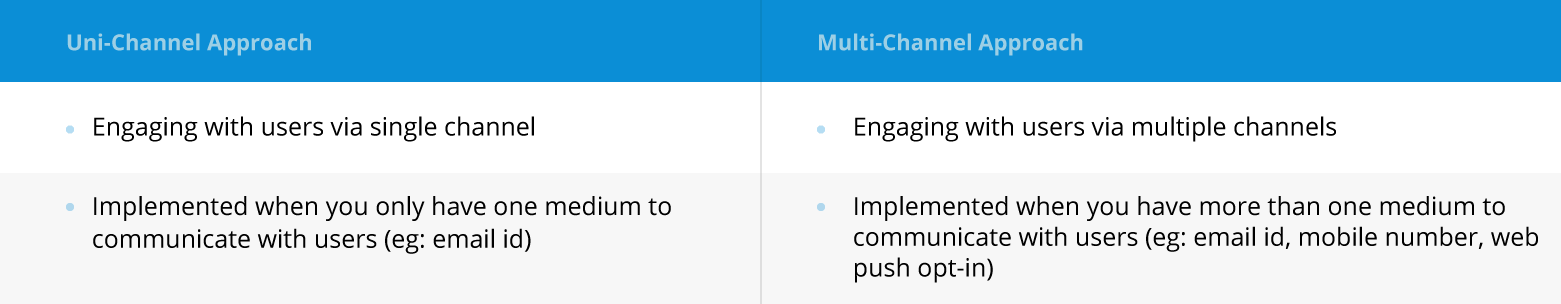

But before we proceed, spare few seconds to understand the two types of campaign approaches:

At this day and age, users are reachable on multiple channels like mobile, desktop, etc. Hence, a multi-channel approach is the best bet for you. It guarantees successful delivery of the message, channel optimization, and cost reduction.

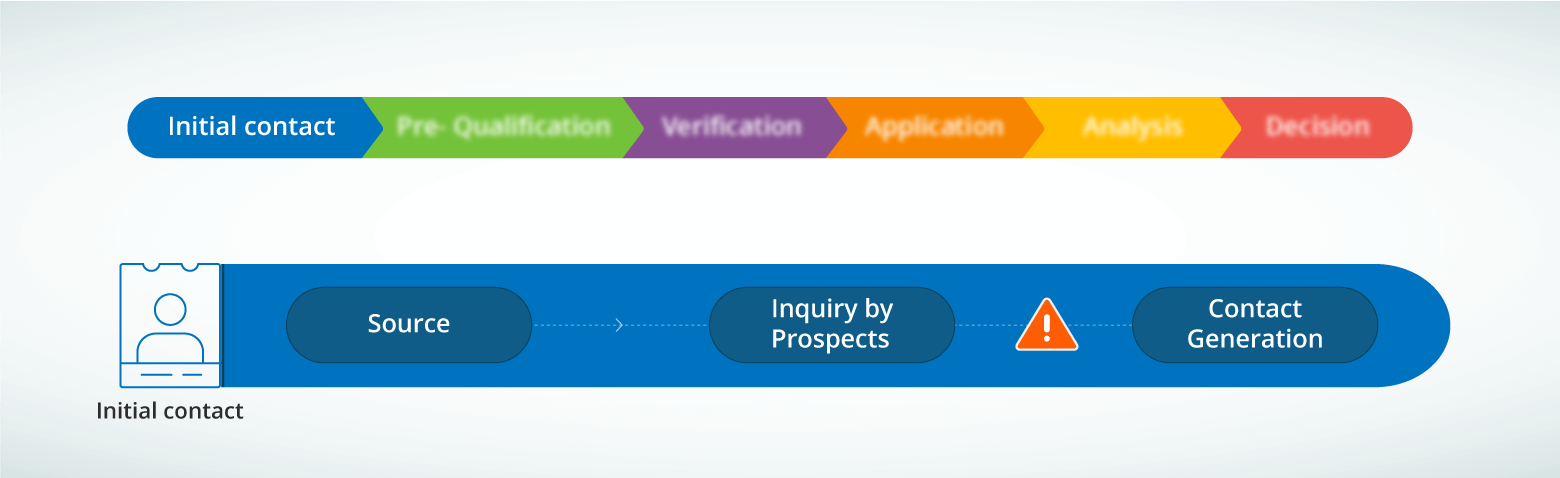

Stage 1: Initial contact

POTENTIAL LEAKAGE

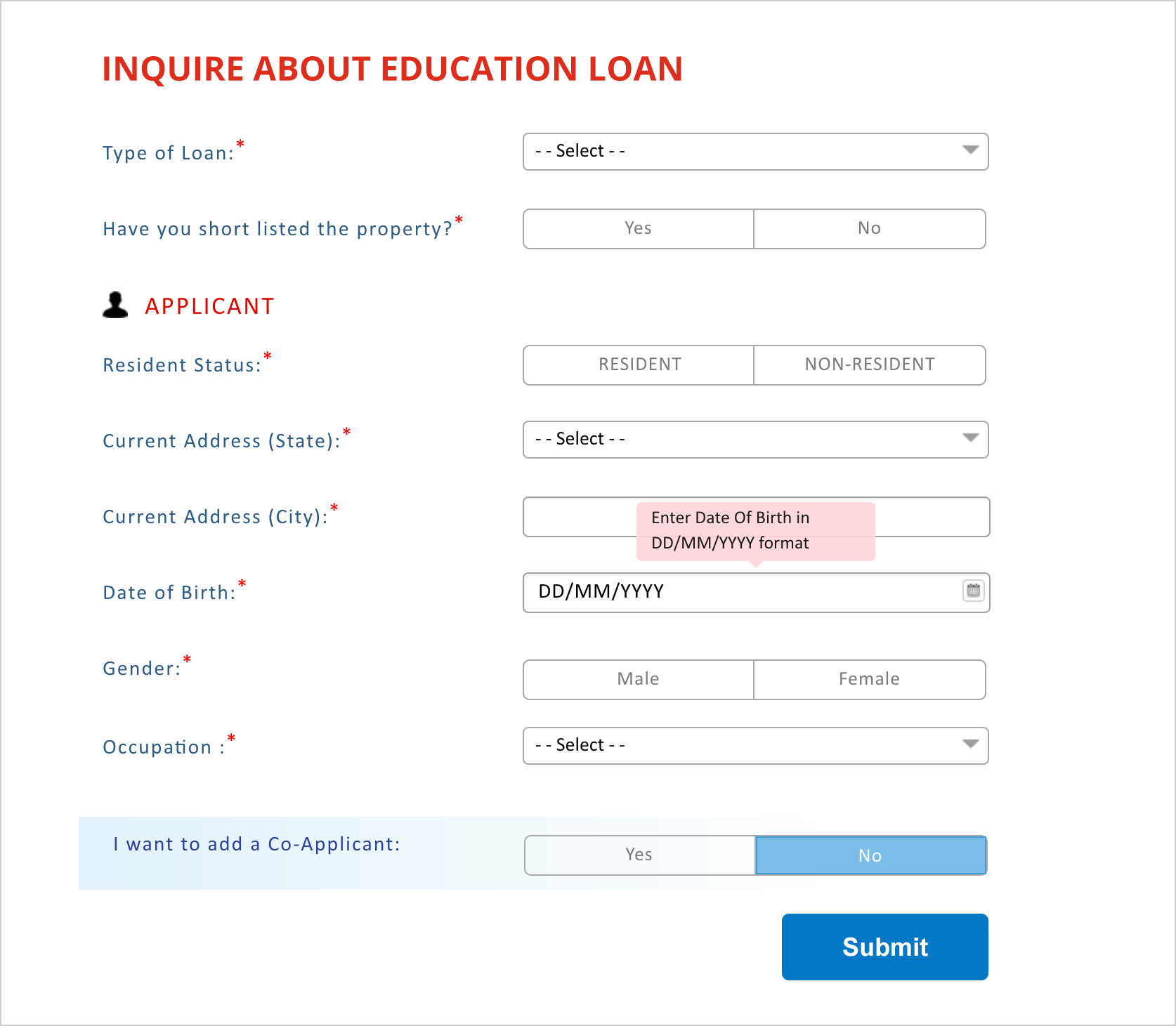

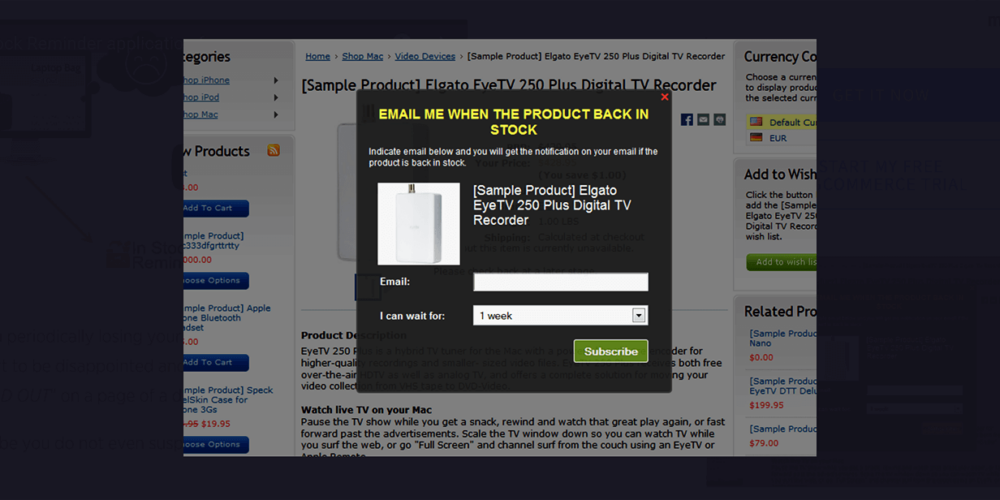

There are two types of lead generation forms:

- Single-step Lead Gen Form

- Multi-step Lead Gen Form

An anonymous visitor or an existing user can abandon the form due to the following reasons:

- Confusing and overwhelming UI of the product page

- Lack of time

- Lack of knowledge about given fields

- Comparing the prices or deals

- Just browsing, etc.

SOLUTION

When using a uni-channel approach,

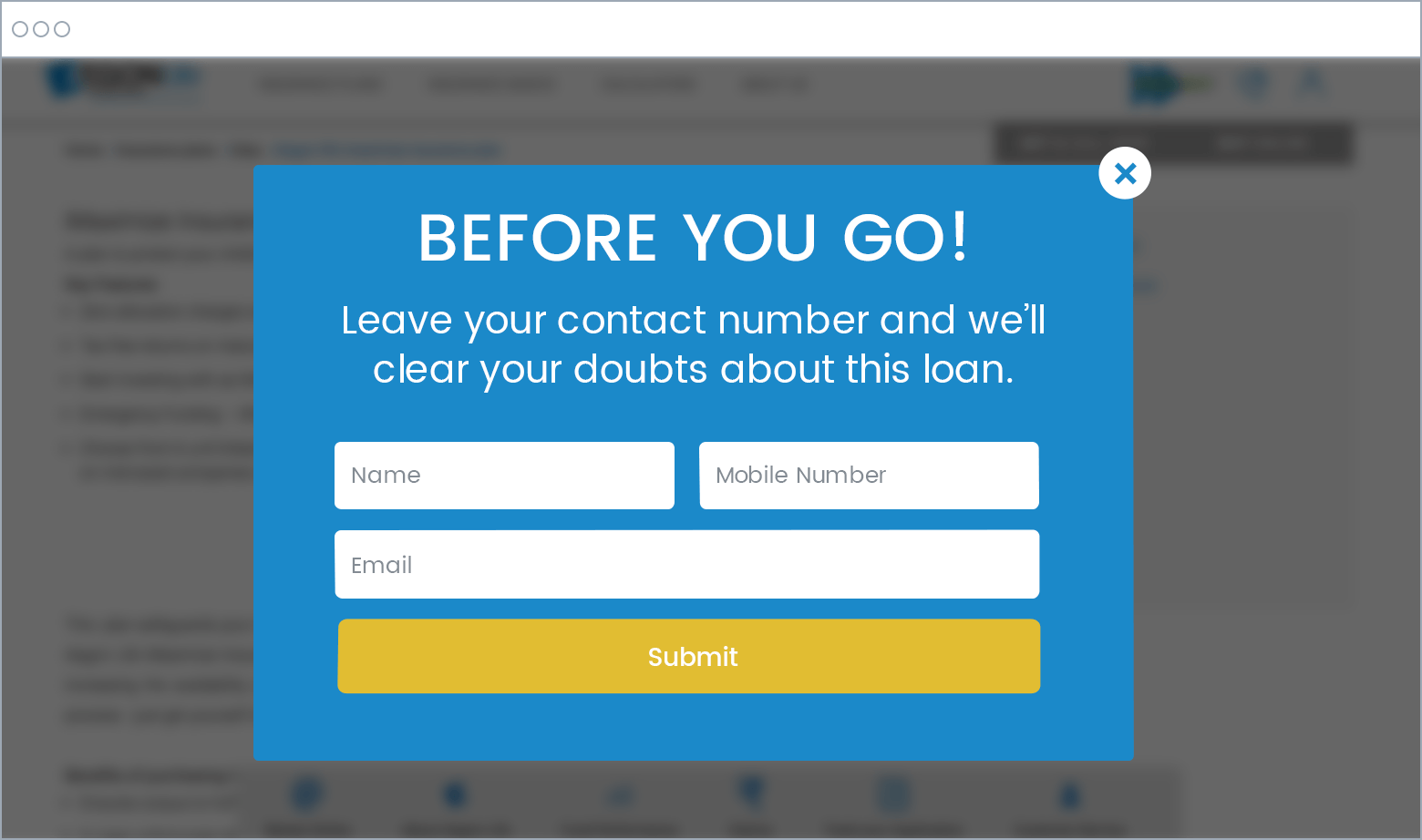

- For anonymous visitors, you can run an on-site Leave intent Survey which will trigger when they are about to leave the site.

- For the existing users, you can nudge him/her with periodic updates about the searched product and/or abandoned form using any one of the following: email, SMS, web push, etc.

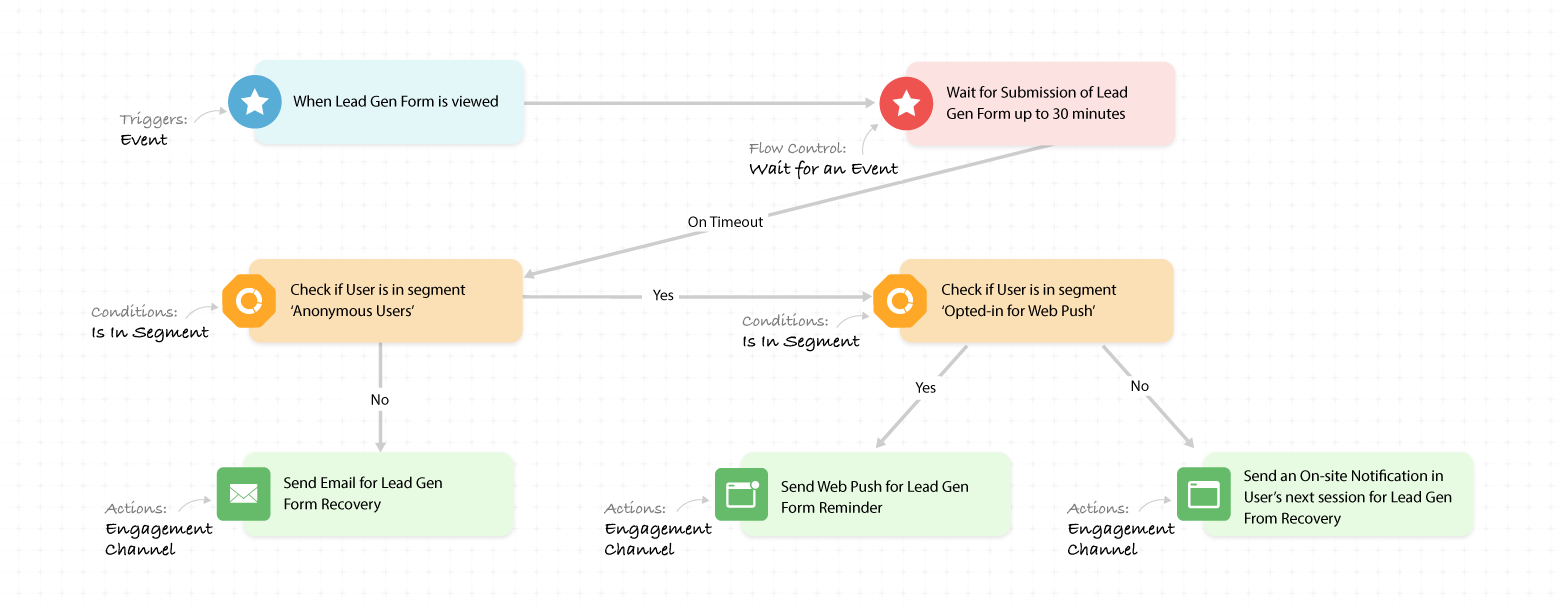

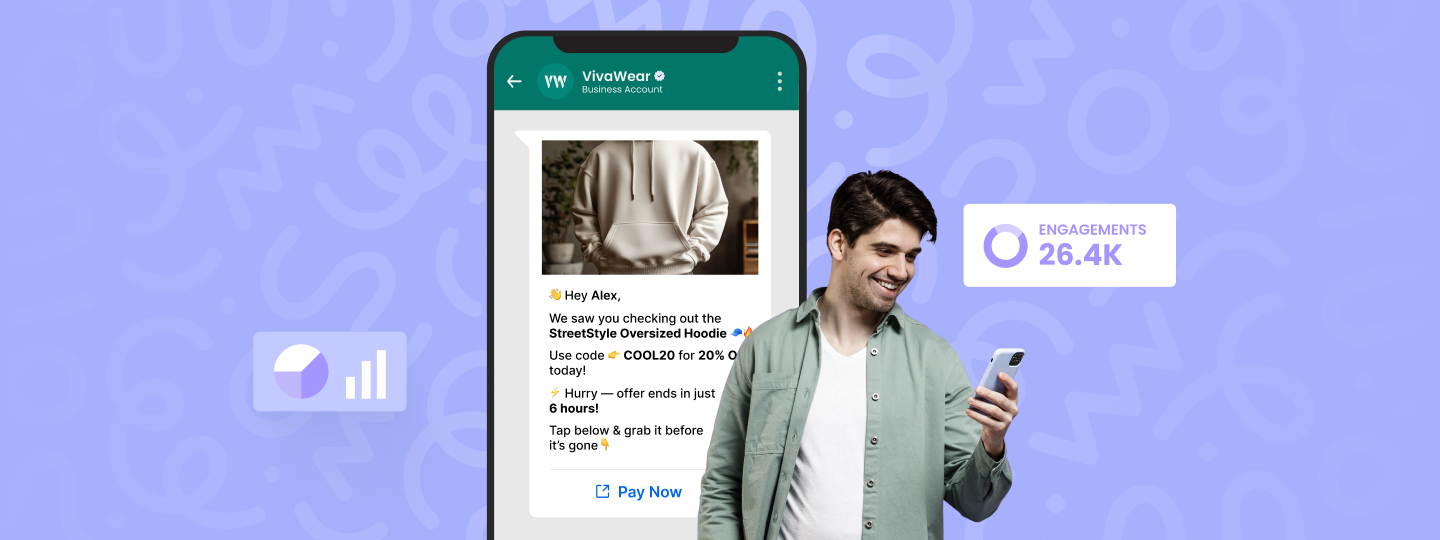

If you are going for a multi-channel approach, this workflow can help you recover the lead gen form abandoners.

(You can know more about the Journey Designer elements here)

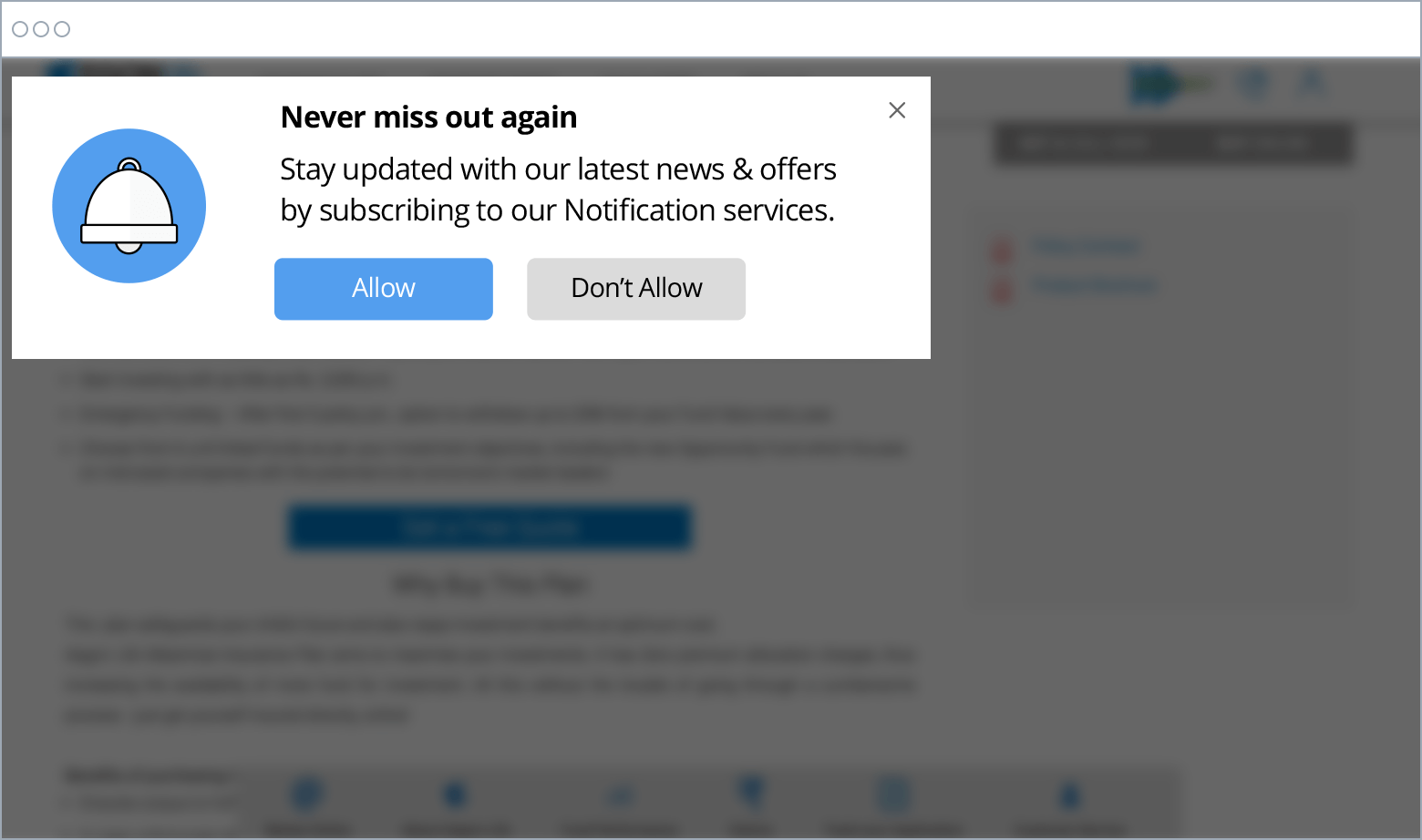

While Anonymous Users will receive this Web Push Opt-in Prompt….

…. Existing Users will receive this Lead Gen Form Recovery Email.

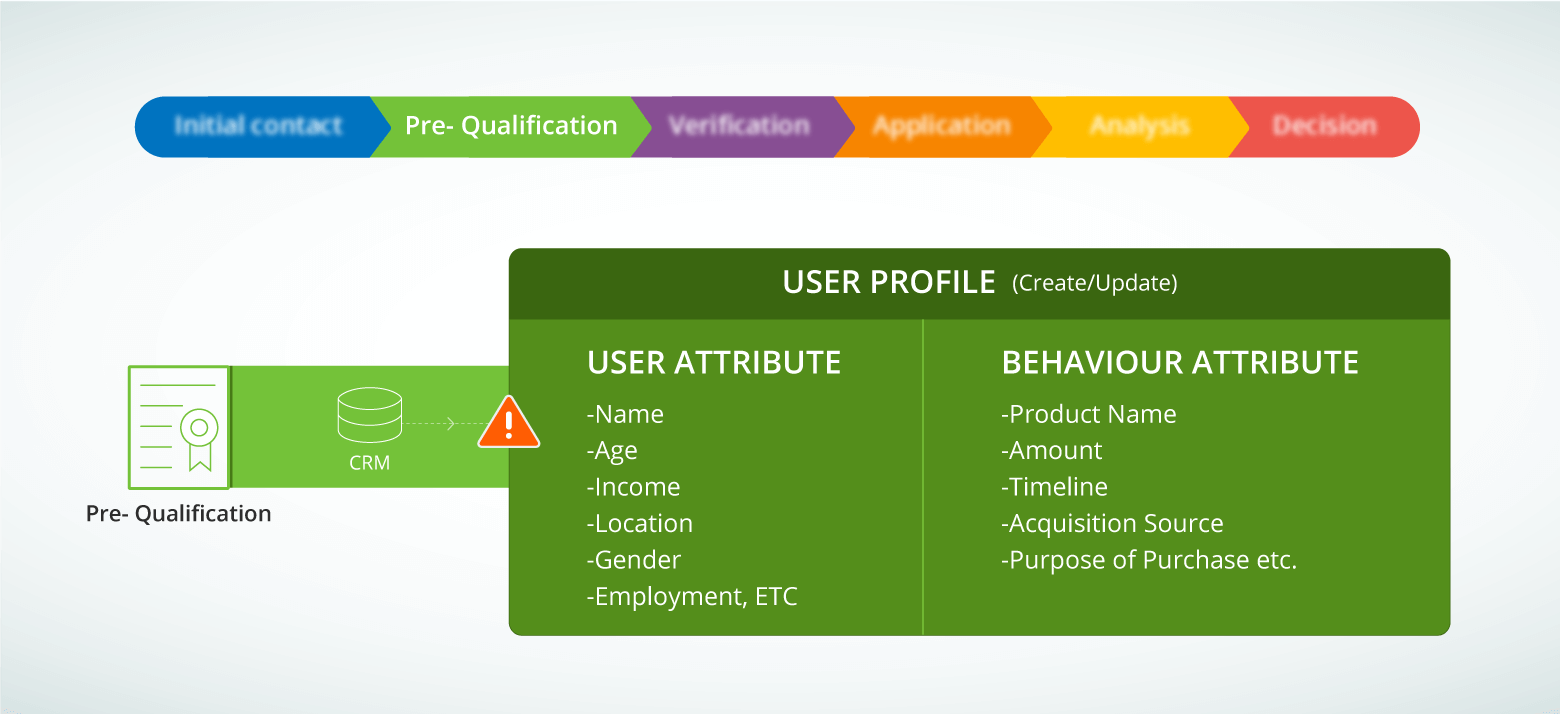

Stage 2: Pre-Qualification

POTENTIAL LEAKAGE

A visitor can interact with a financial service provider via multiple platforms (given below), and leave a trail of user and behaviour data behind him:

- Devices: office desktop, personal tablet, mobile

- Browser: Internet Explorer (office PC), Safari (personal laptop), Google Chrome (mobile)

- Channels: website, mobile app, mobile site

- Acquisition: affiliate, paid, offline

If the CRM database fails to stitch all the data to a single user profile, you won’t be able to:

- Personalize communications

- Run contextual marketing campaigns for the user

- Improve the functionality of the Eligibility Engine

SOLUTIONS

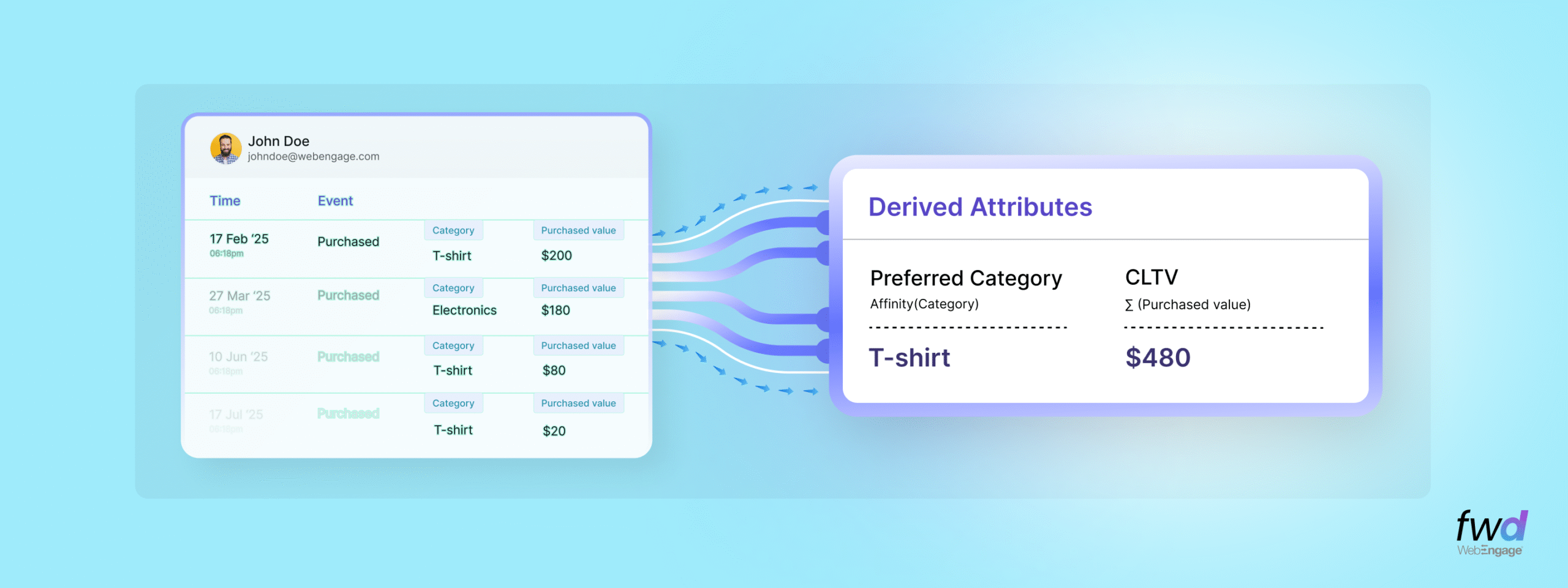

In order to have a 360-degree view of a customer at any lifecycle stage along with his/her behavior across channels, you need to merge your CRM tool with a Data Management Platform (DMP). When integrated, they enable you to create micro-segments (example: unknown visitors who came to the website from Google using mobile) and target them with a contextual campaign.

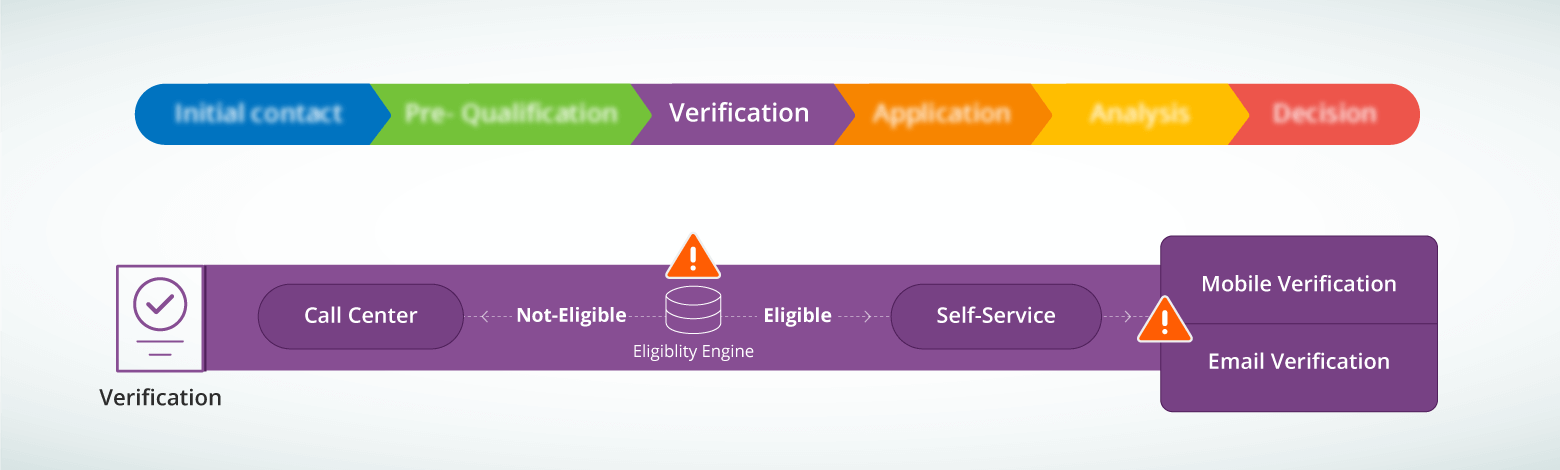

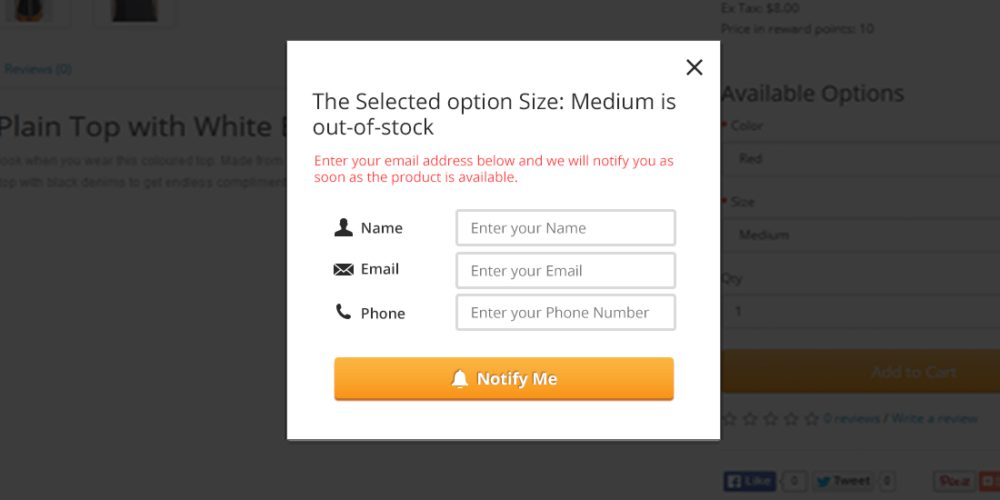

Stage 3: Verification

POTENTIAL LEAKAGE

A proper Eligibility Engine, which bifurcates user profiles into Eligible and Not Eligible categories, should have granular-level filters like income cap, location, job profile, etc.

Moreover, successful verification of eligible users should require:

- A valid email id and/or mobile number

- Real-time trigger of a One-Time-Password (OTP) and/or email verification link

- A personalized and contextual message

Failure to accomplish any of the above will result in a drop-off at this stage.

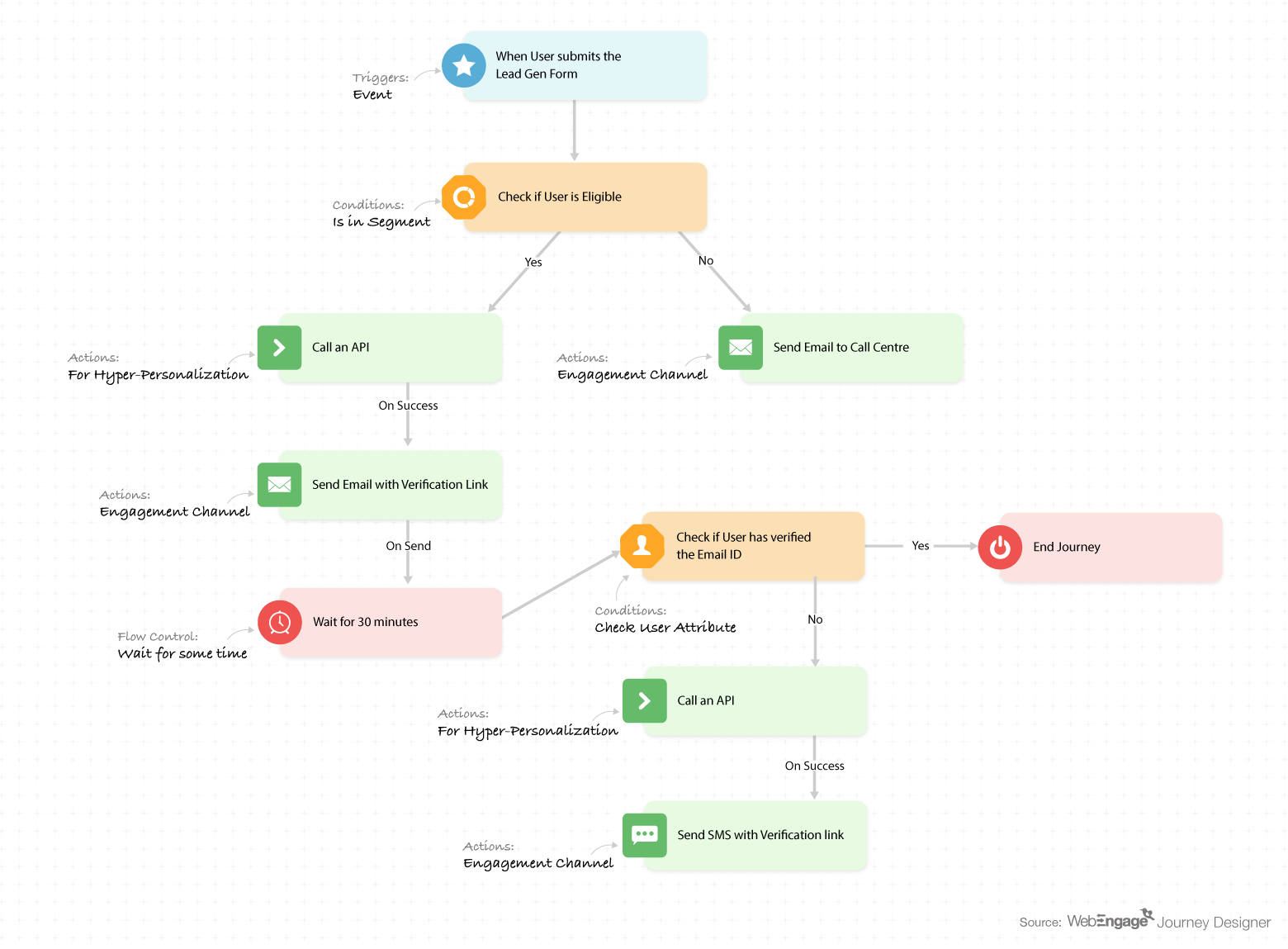

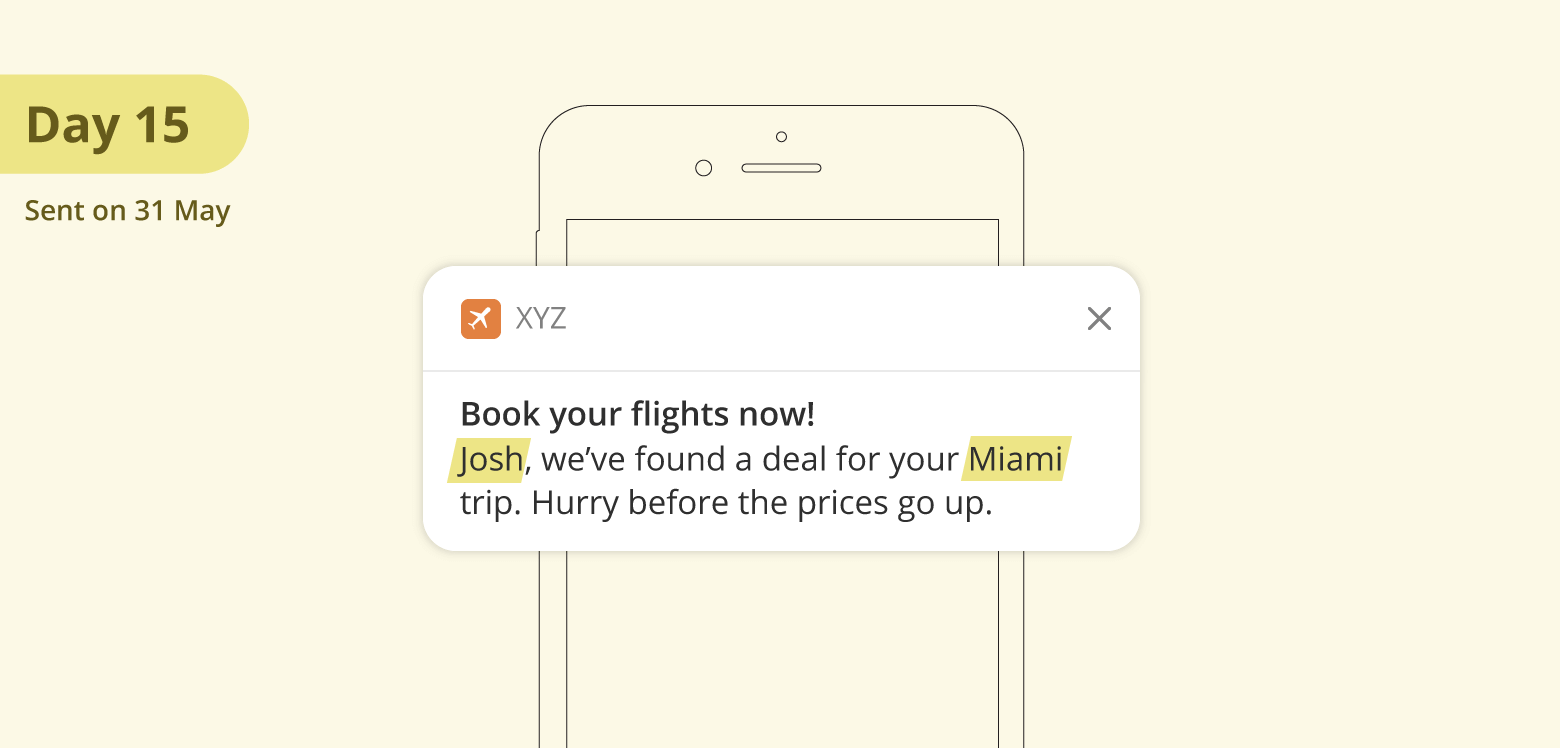

SOLUTIONS

Marketing Cloud Tools enable you to store both user and his/her behaviour data for anonymous visitors as well as existing customers. Its granular-level segmentation is a substitute for an external Eligibility Engine.

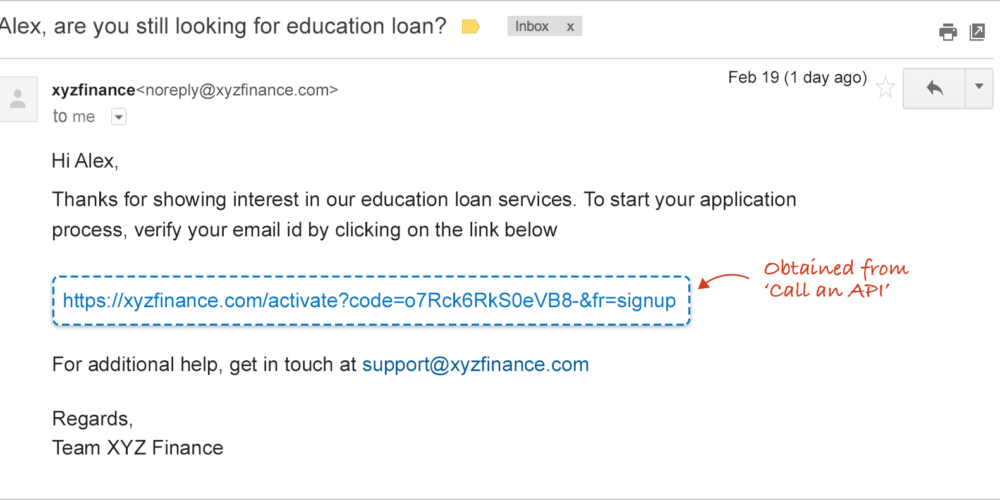

This automated User Verification workflow is the best solution to minimize drop-offs at this stage. It enables:

- Thorough eligibility check and bifurcation

- If eligible, real-time trigger of verification email to user

- If not eligible, real-time trigger of alert email to the Call Centre

- Hyper-personalised and contextual email content

- Multiple nudges

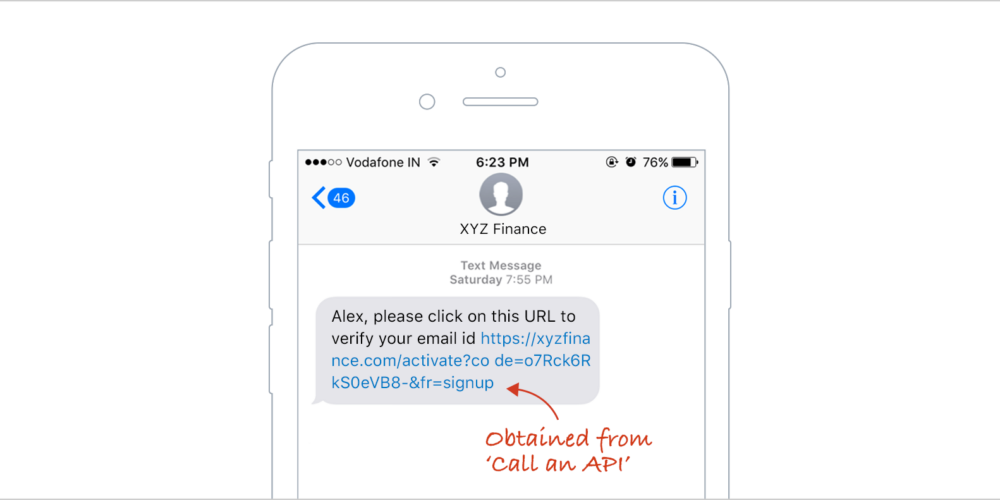

This workflow can be adapted for mobile number verification process as well by replacing ‘Send Email’ with ‘Send SMS’.

(You can know more about the Journey Designer elements here)

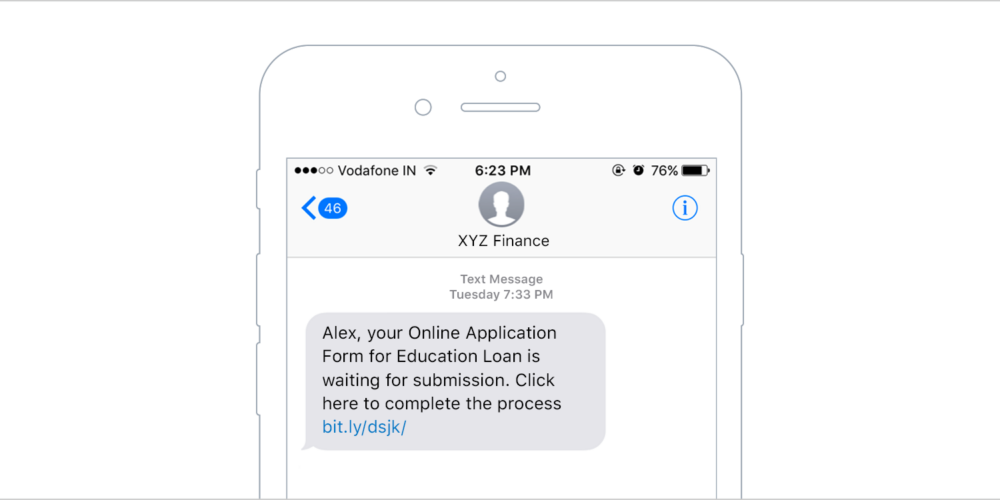

Here are the sample Email and SMS with the verification link, which is obtained from the third-party via API.

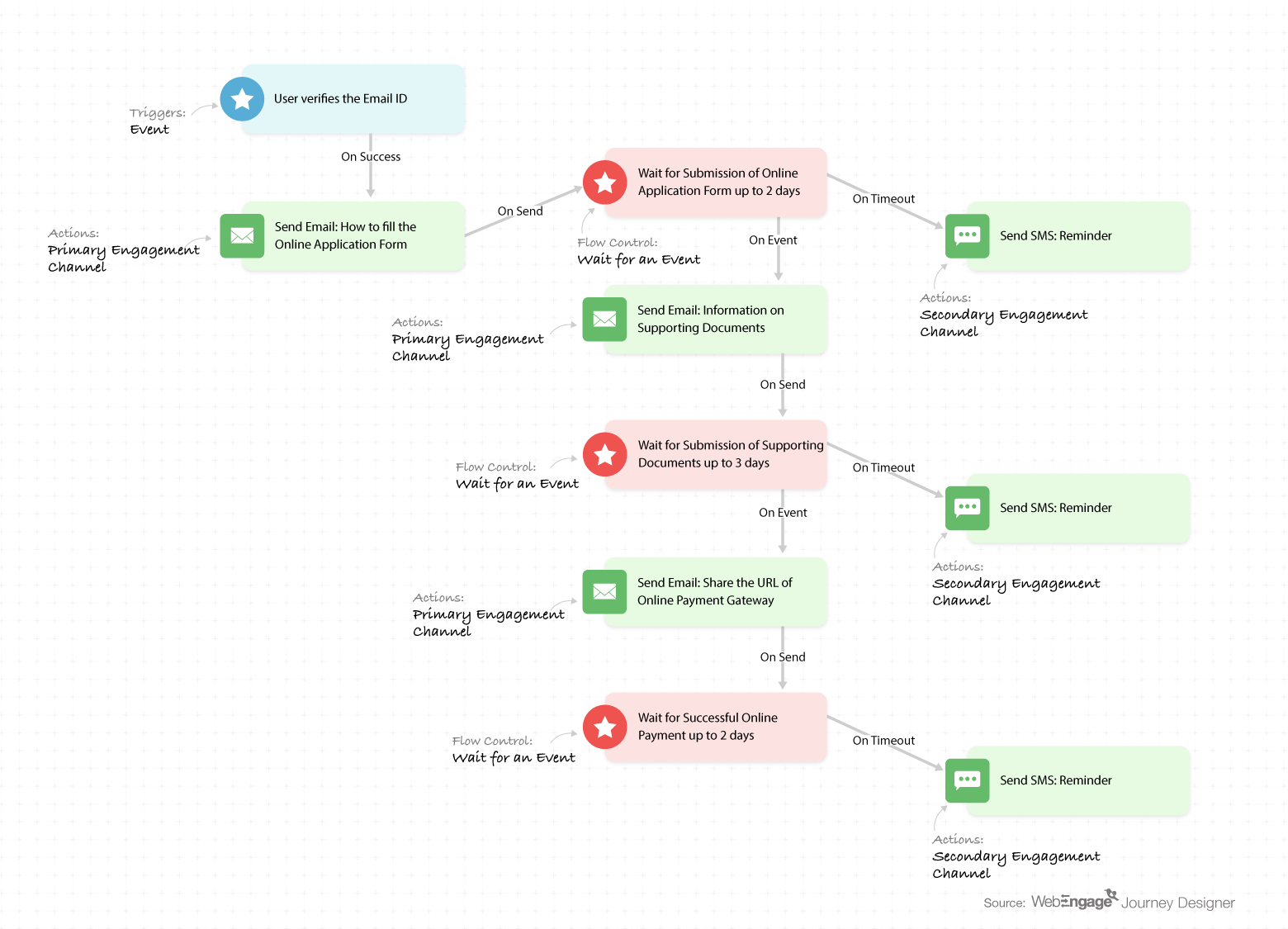

Stage 4: Application

POTENTIAL LEAKAGE

This is a critical stage where both conversion and abandonment hold a 50-50 chance. Conversion because the prospect, after investing time and research into the product, could be all set to start the application process. And abandonment because he/she could be keen to go ahead with a competitor’s product or to drop the idea altogether.

SOLUTIONS

Through this triggered, cross-channel workflow with personalized content, you can share information on documents needed, collection agent details, drop-point details, processing fee payment details etc. Besides, you can also add triggered nudges or reminders wherever needed. All this can drastically improve your conversion numbers, be rest assured.

(You can know more about the Journey Designer elements here)

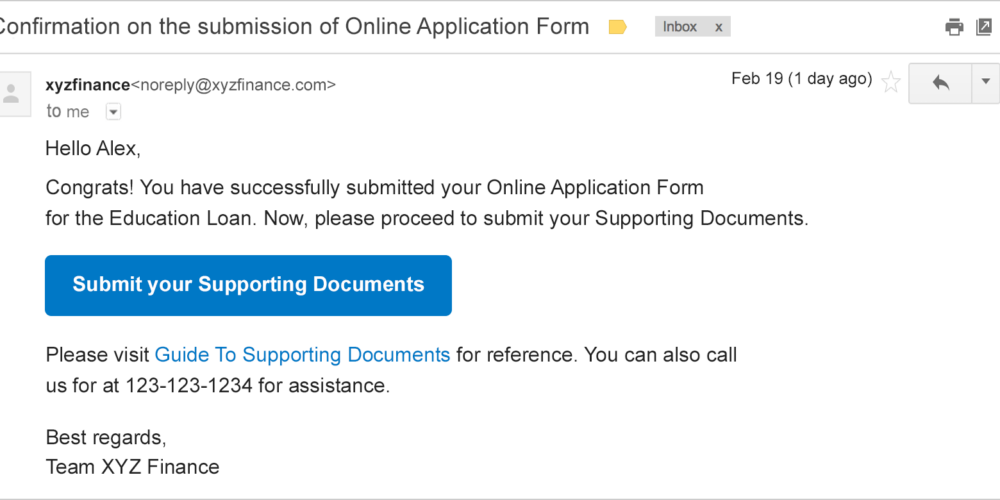

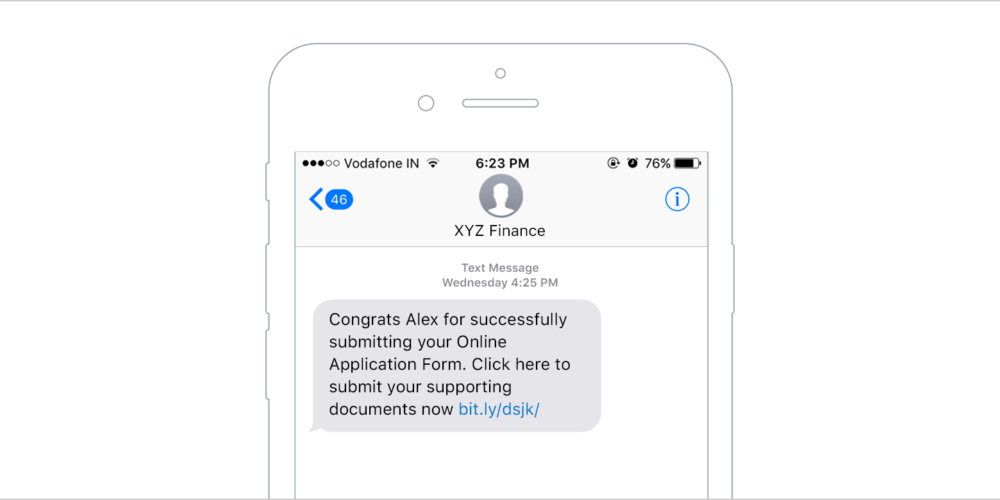

Here are the sample Email and SMS Reminders for the following stages:

1) Complete application form

2) Submit supporting documents

3) Pay processing fees

The most amazing thing about customer journey mapping is that it can be adopted by any industry. To know more about WebEngage Journey Designer, check out this Blog Post or this Explainer Video.

Now let’s discuss how Financial Services Companies (FSCs) such as Banks, Micro-Lending Firms, Insurance Companies, etc. can engage and retain their customers post-purchase. And that too with our favorite marketing automation.

WHY marketing automation for post-purchase communication, you ask?

Here’s why.

Why Financial Services companies need Marketing Automation for post-purchase engagement

- As FSCs have both click-&-brick presence, their customers engage with them via a great many touchpoints. And these customers expect a seamless experience throughout their lifecycle. To ensure a cohesive communication at every touchpoint, a marketing automation tool is required for omni-channel engagement.

- Post-purchase education of financial products can be successful if it’s relevant and contextual. And a rightly-timed message triggered using marketing automation can ensure that.

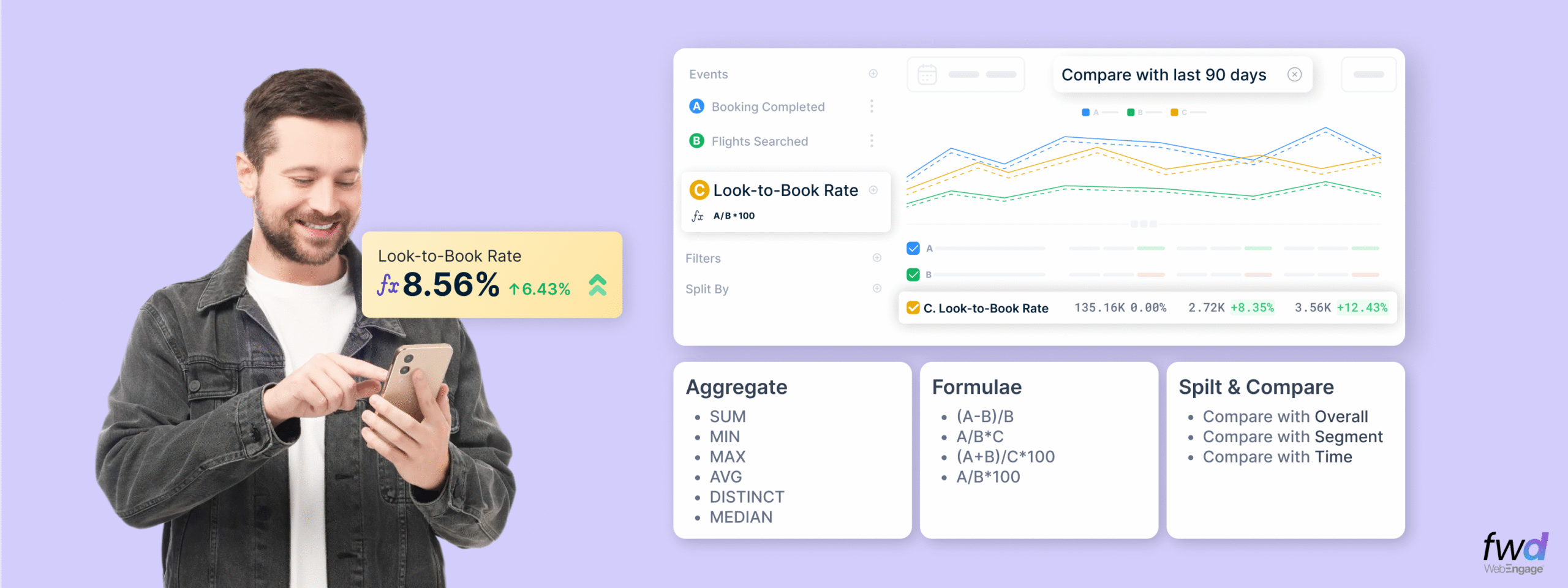

- To cross-sell and/or upsell, FSCs need to forecast their customers’ behavior and future activities. And marketing automation streamlines this process by tracking every customer’s actions (a.k.a. events).

- You can stay ahead of your competition by adapting to changing customer preferences as well as attributes, and interacting with them with highly personalized and coherent messages.

Now that you are convinced, let’s get to the basic requirements for enabling a multi-channel customer engagement and retention workflow.

Marketing Automation checklist for Financial Services companies

- User Profile with data like:

- Personal Identifiable Information (PII): name, email id, contact number, etc.

- Demographic Attributes: age, income, gender, employment status etc.

- Product Preferences: current portfolio, service quote amount, etc.

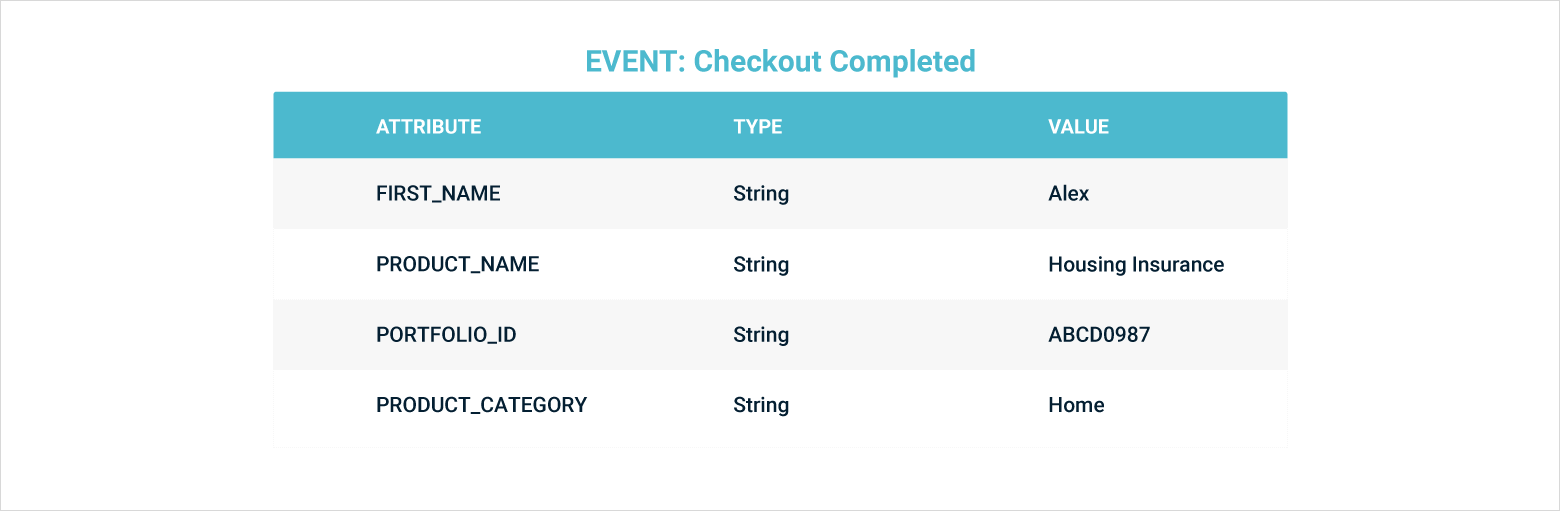

- Events Tracker which can trace user activities such as:

- Monthly instalment paid successfully

- Post-sale service inquiry form filled

- Promotional content viewed on mobile / desktop, etc.

- Segments Builder to create segments using both user persona and behavioural attributes. For example:

- All customers with annual income of more than $1,000,000

- All customers who haven’t paid interest in the last 3 months, etc.

- Multi-Channel Campaign Tool which can manage multiple channels such as on-site notification, mobile push, web push, in-app notification, SMS and email.

- Customer Journey Workflow Designer (eg: WebEngage Journey Designer) to integrate different data stacks and orchestrate cross-channel user engagement from a common dashboard.

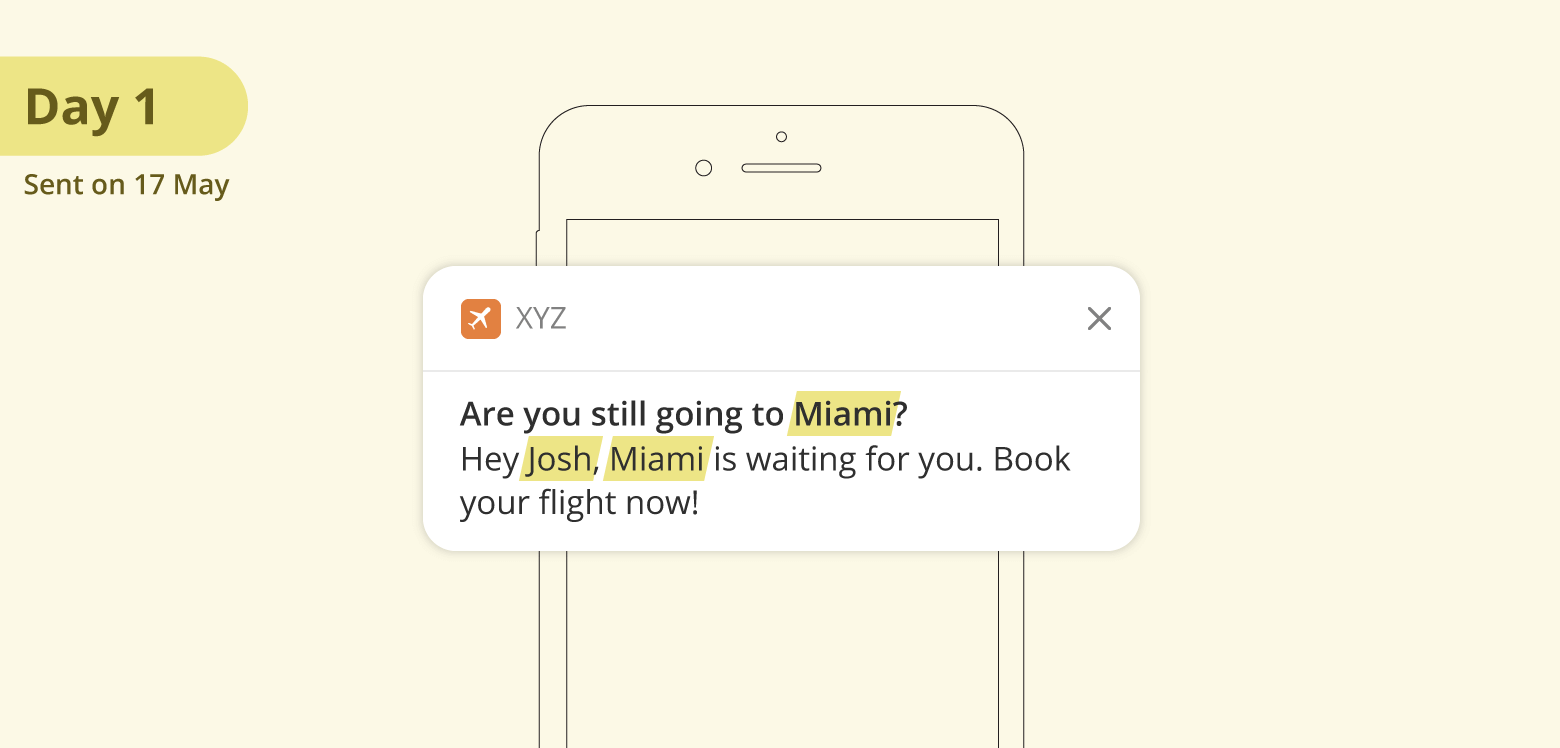

How Financial Services companies can use WebEngage Journey Designer for post-purchase engagement and retention campaigns

For your better understanding, let’s take the help of these 3 use-cases.

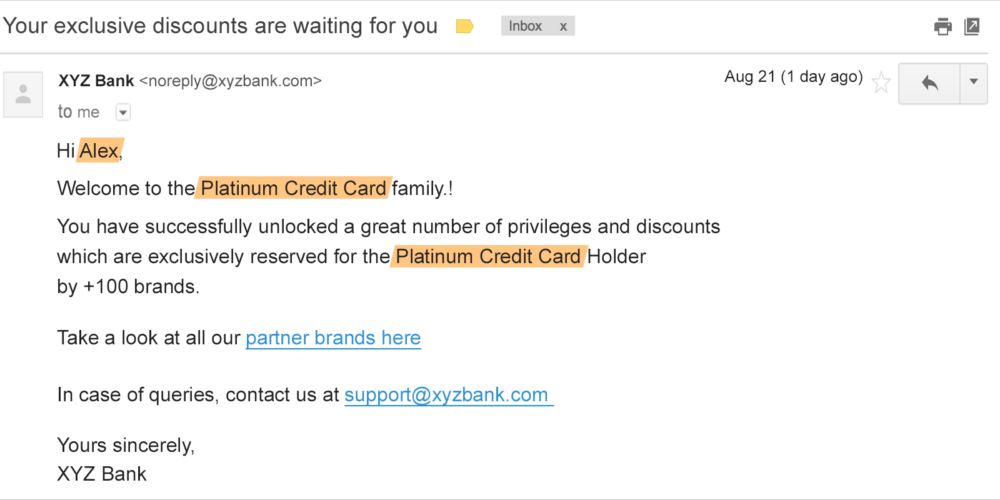

Use-Case #1: Payment reminder

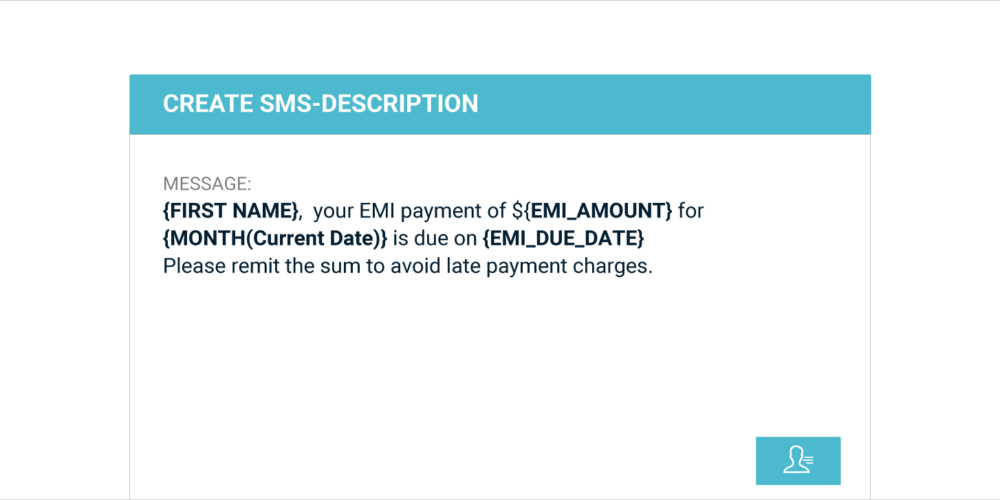

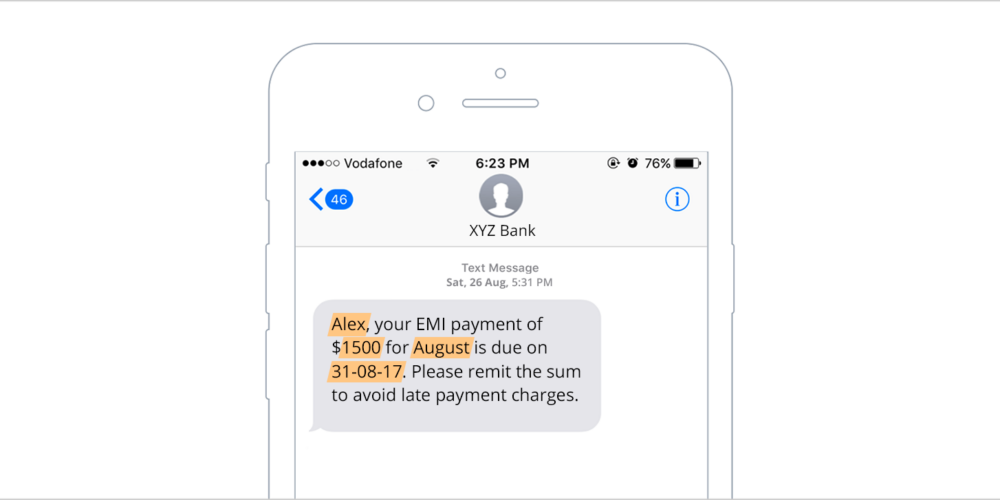

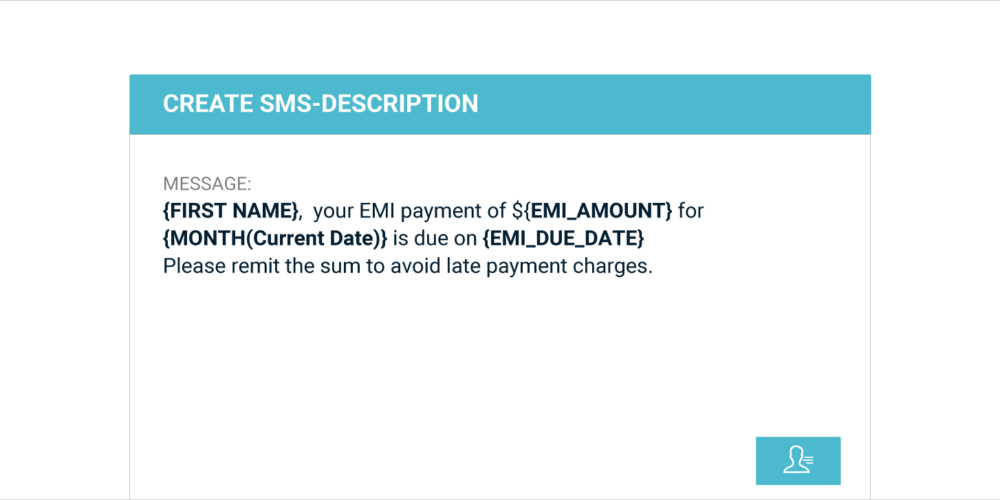

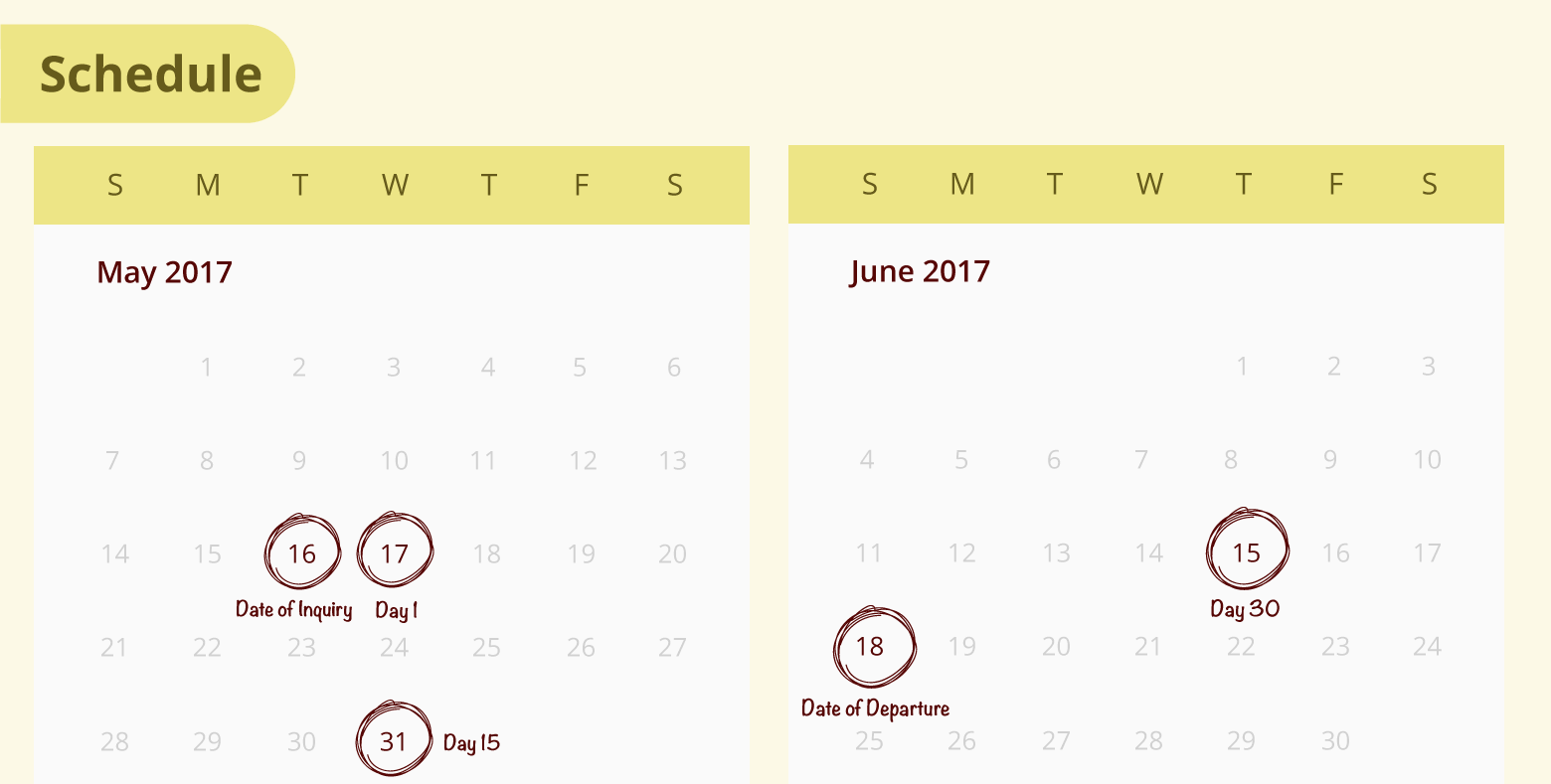

Suppose XYZ Bank wants to send EMI payment reminders to their customers via email and SMS. And they want to automate the process for every month. This workflow can do the needful.

(To know more about WebEngage Journey Designer, click here)

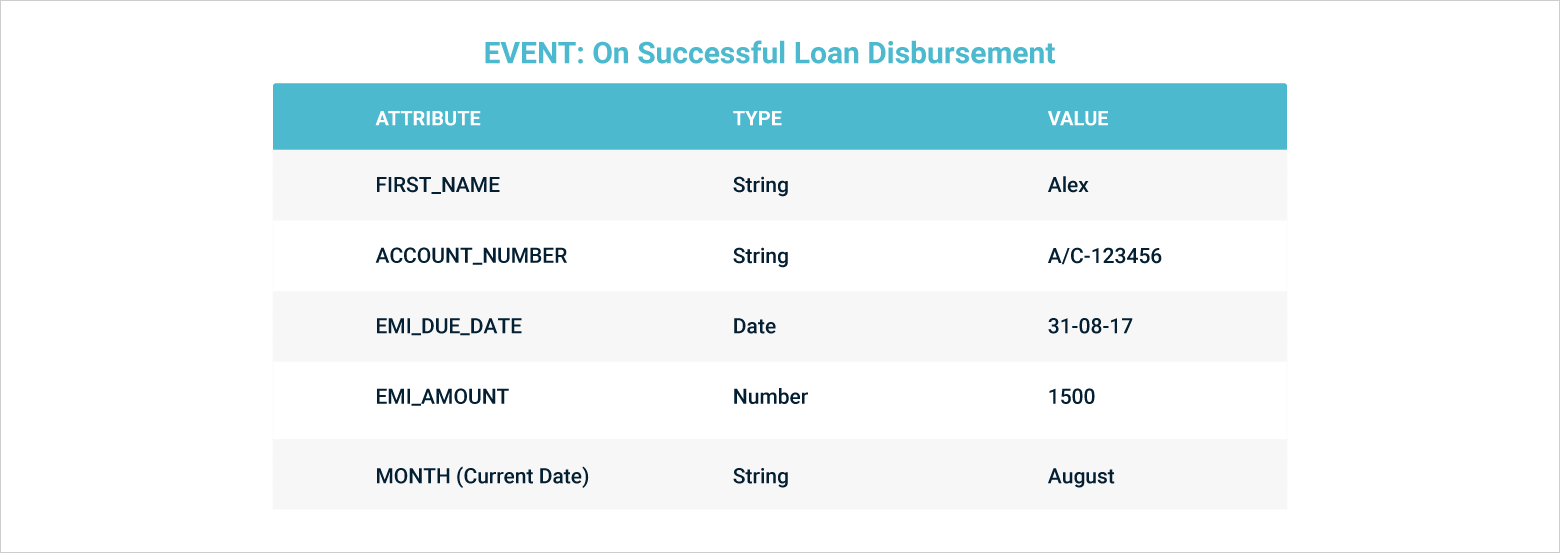

As soon as XYZ disburses a loan to a user (Trigger Event: On Successful Loan Disbursement), the user enters this journey. Furthermore, an attribute ‘EMI Due Date (Type = Date)’ is set in his/her user profile along with other attributes like name, product id, principal amount, EMI amount, etc. When the due date is near and the user has not paid the EMI, he/she is sent a personalized reminder accordingly.

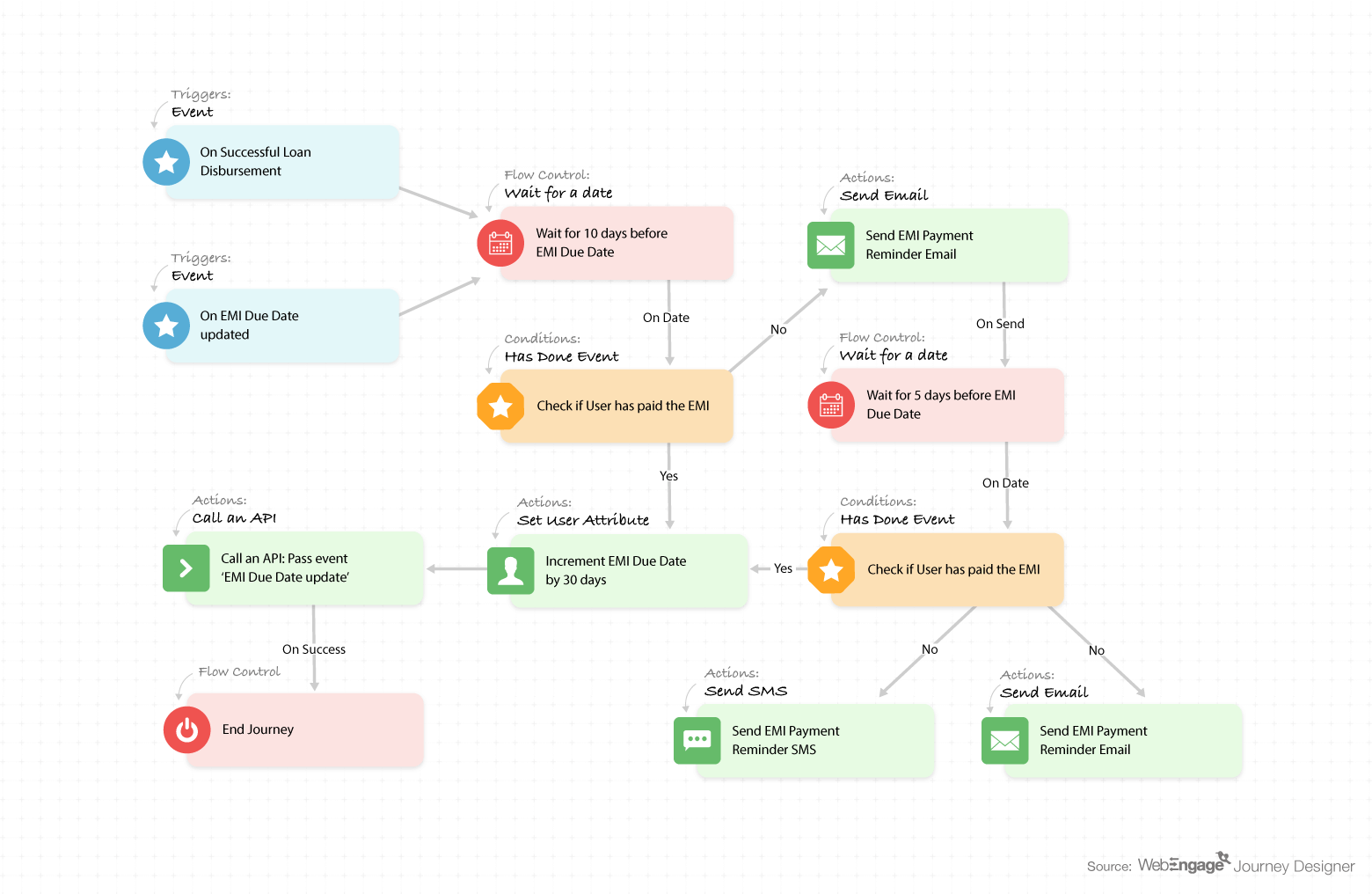

Once the user makes his/her EMI payment, ‘EMI Payment Due Date’ attribute is updated to the new due date. Then, event ‘EMI Due Date Updated’ is fired using our Rest APIs. This is done by ‘Call an API’ block to update the user profile and re-enter the user into the journey (Trigger Event: On EMI Due Date Updated). And the cycle continues.

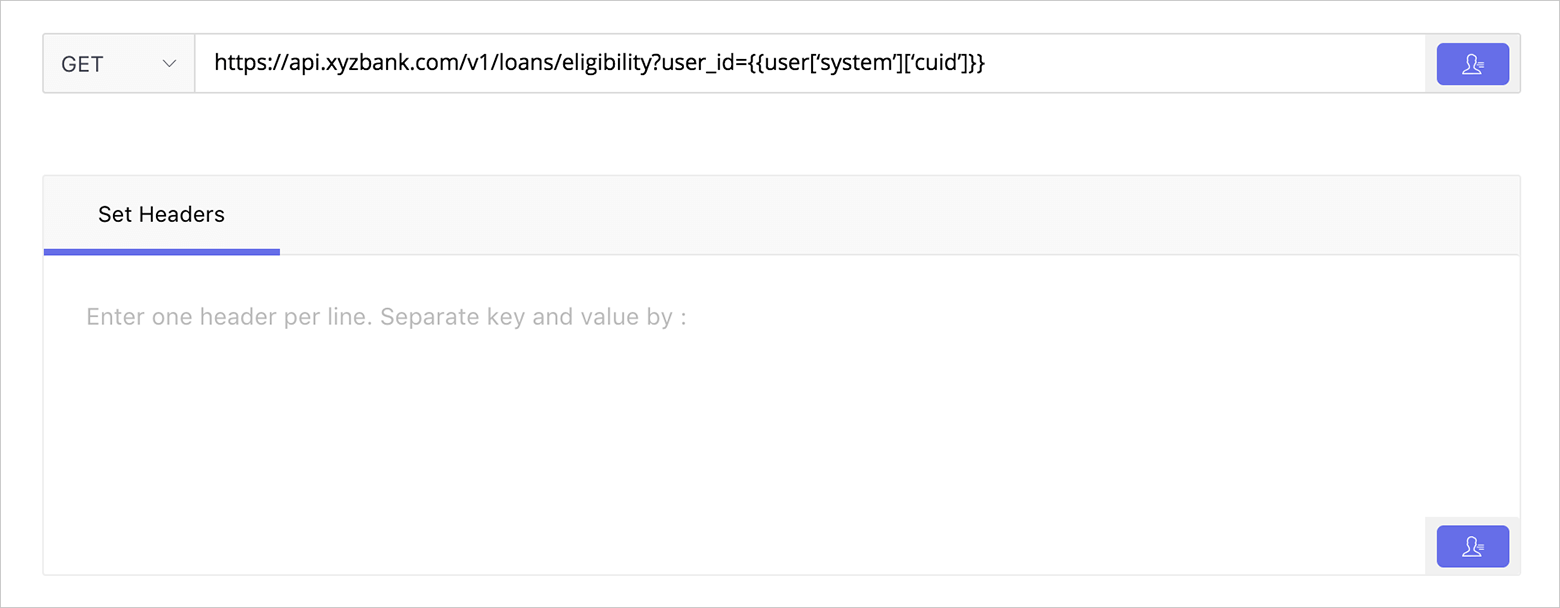

Here’s the snapshot of the ‘Call an API’ block:

And here are the samples of EMI Payment Reminder Email and SMS:

Use-Case #2: Cross-selling

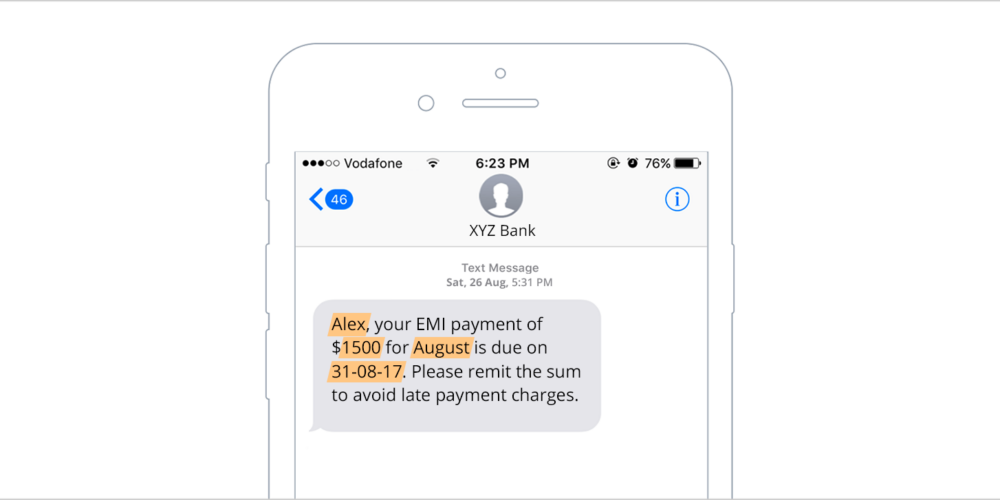

Suppose XYZ Bank wants to cross-sell Car Loan to all their customers who took Personal Loan for marriage purposes 1 year back. This journey workflow can help XYZ cross-sell to just the right users.

(To know more about WebEngage Journey Designer, click here)

To ensure that only users who are eligible for the Car Loan are sent the communication, we’ve included two ‘Call an API’ blocks. The first one checks the eligibility of users for Car Loan.

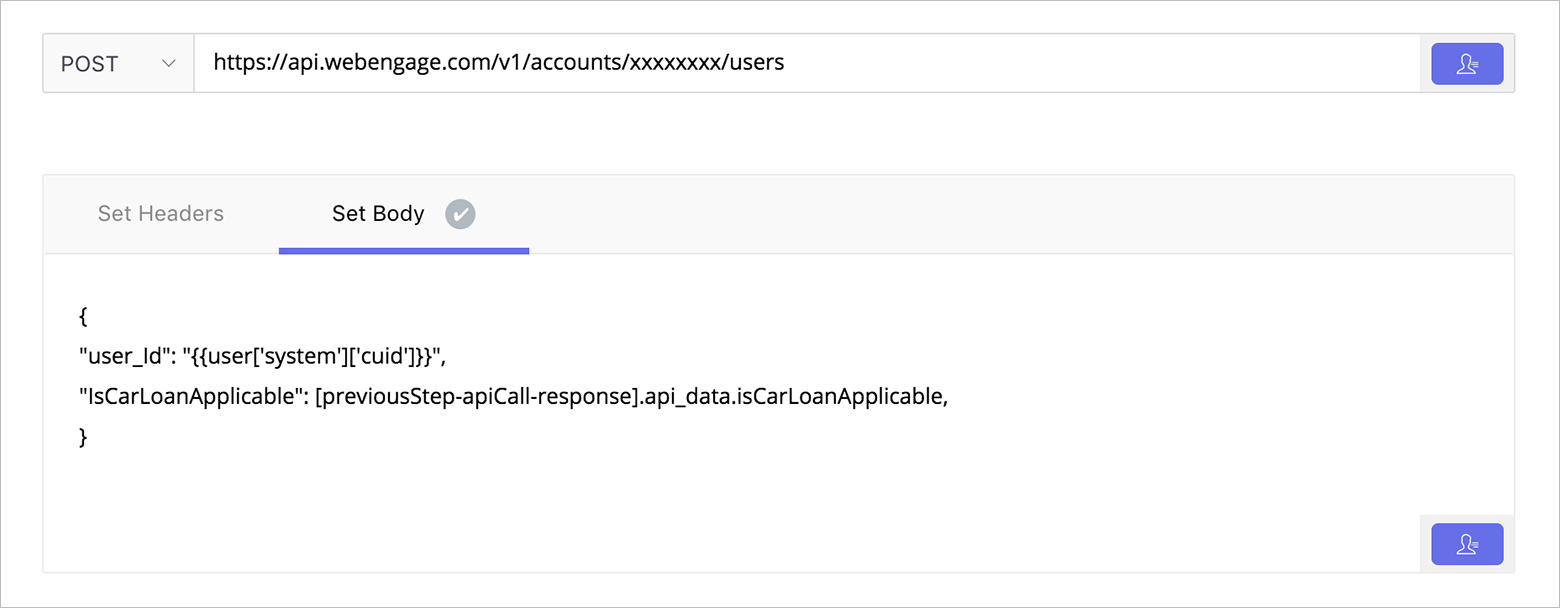

The second one uses WebEngage’s Rest APIs to update the user profile with user attribute ‘IsCarLoanApplicable’ (Attribute values: True / False).

Here are the sample email and SMS for you:

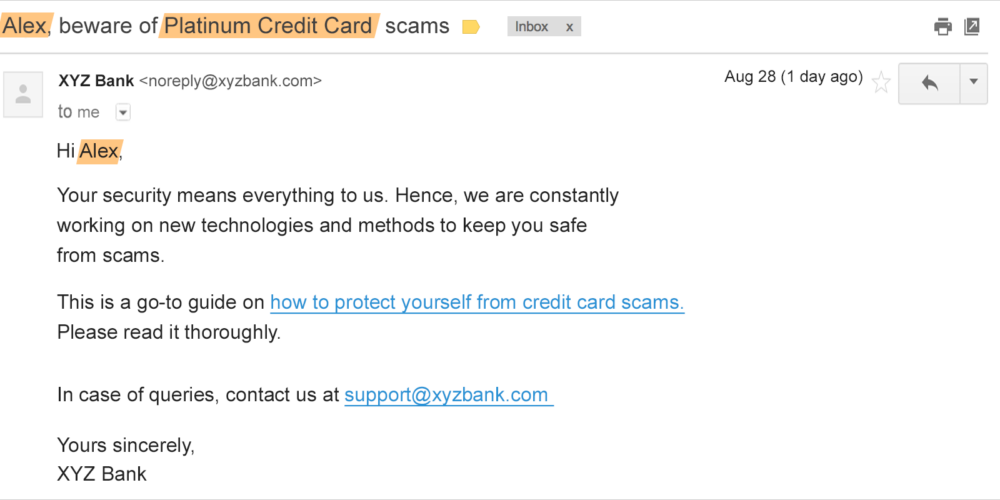

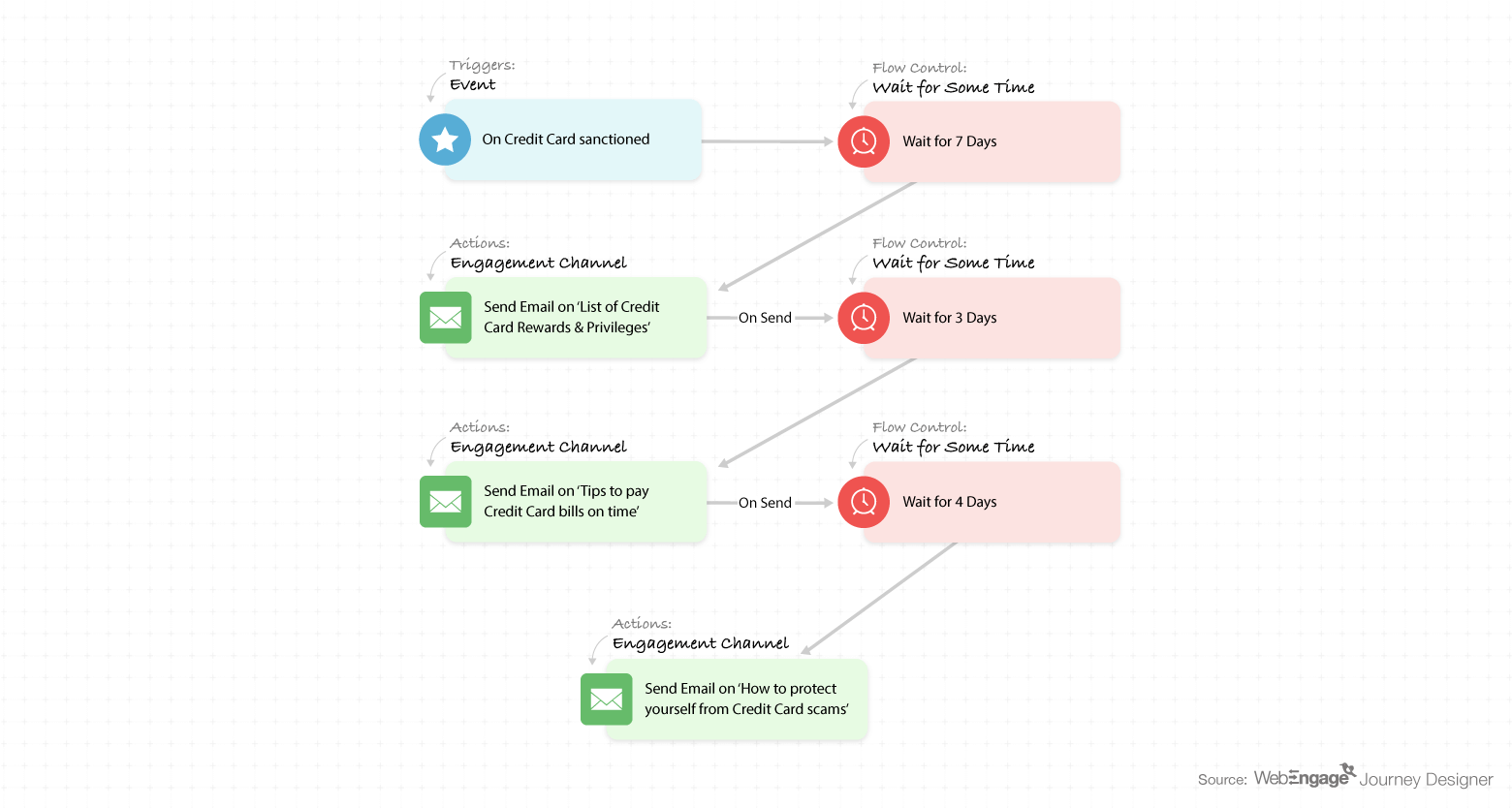

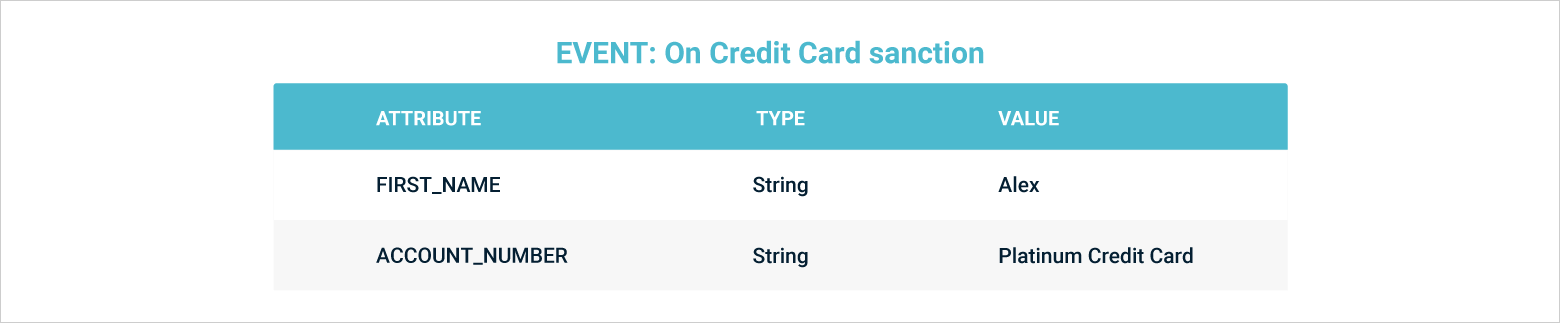

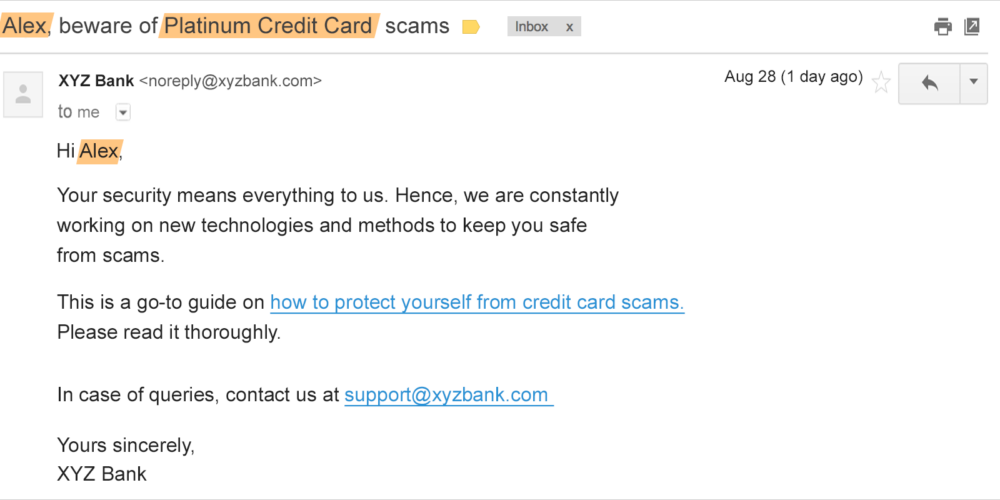

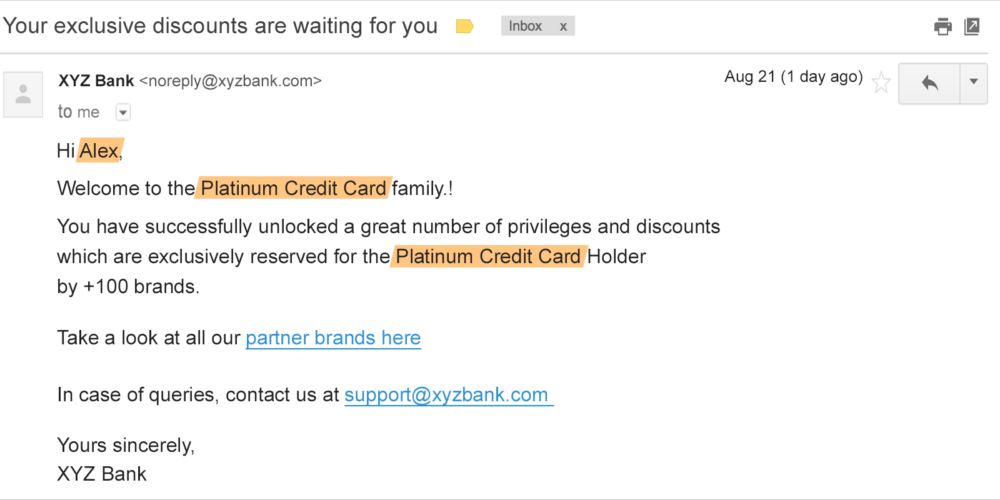

Use-Case #3: Drip email campaign

Suppose XYZ Bank offers 4 types of credit cards: Silver, Gold, Diamond, and Platinum. And it wants to provide post-purchase education to all its credit card users by sharing relevant articles. They can do this though a personalized drip-email campaign. And this workflow can enable that.

(To know more about WebEngage Journey Designer, click here)

And here are the sample emails.

The most amazing thing about customer journey mapping is that it can be adopted by any industry. To know more about WebEngage Journey Designer, check out this Blog Post or this Explainer Video. If you want to learn how this Journey Designer will compliment your B2C business, schedule a free demo now. We would love to have a chat with you.

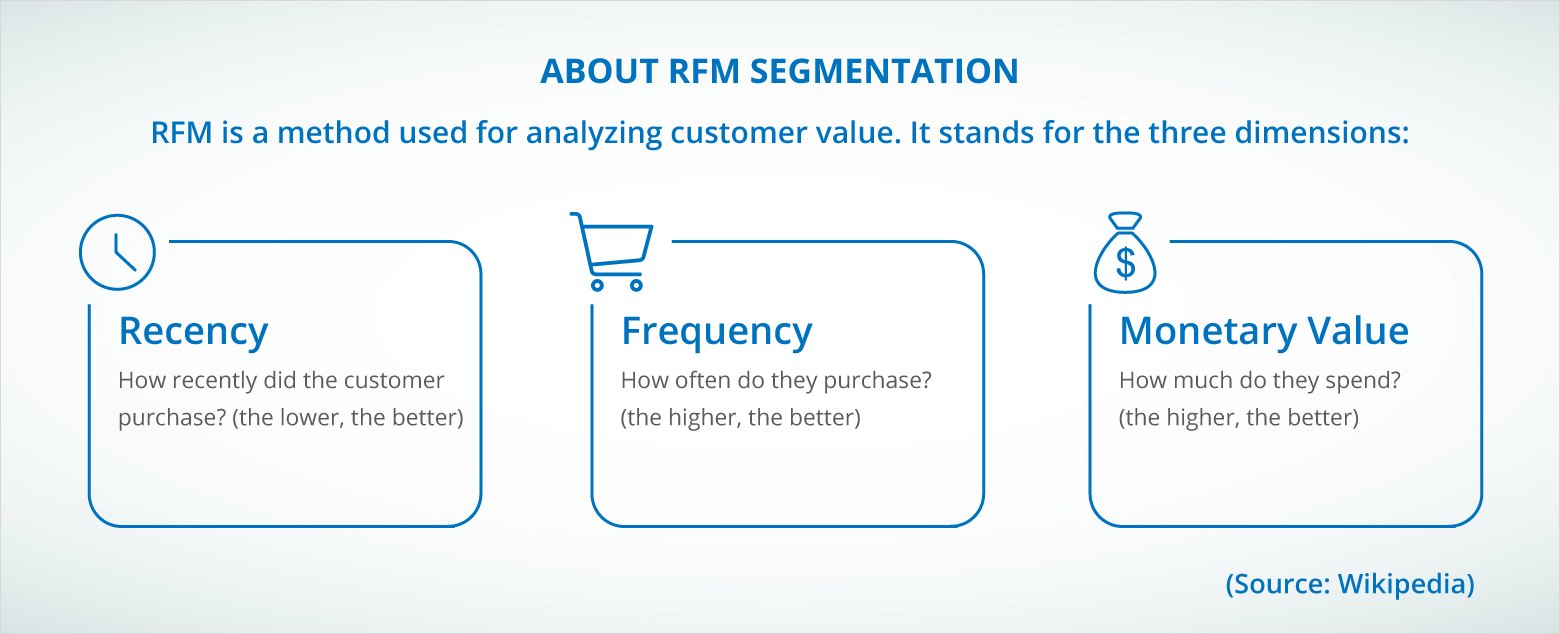

Now we’ll talk about how companies in the finance sector can identify inactive users with the help of RFM segmentation. Furthermore, we’ll discuss how they can use marketing automation to reactivate them.

But before we proceed further, let’s touch upon the basics of the RFM Model.

To learn more about RFM Model and analysis, you can check out this post by Putler.com.

ALSO READ: How To Use RFM Segmentation for Customer Lifecycle Marketing

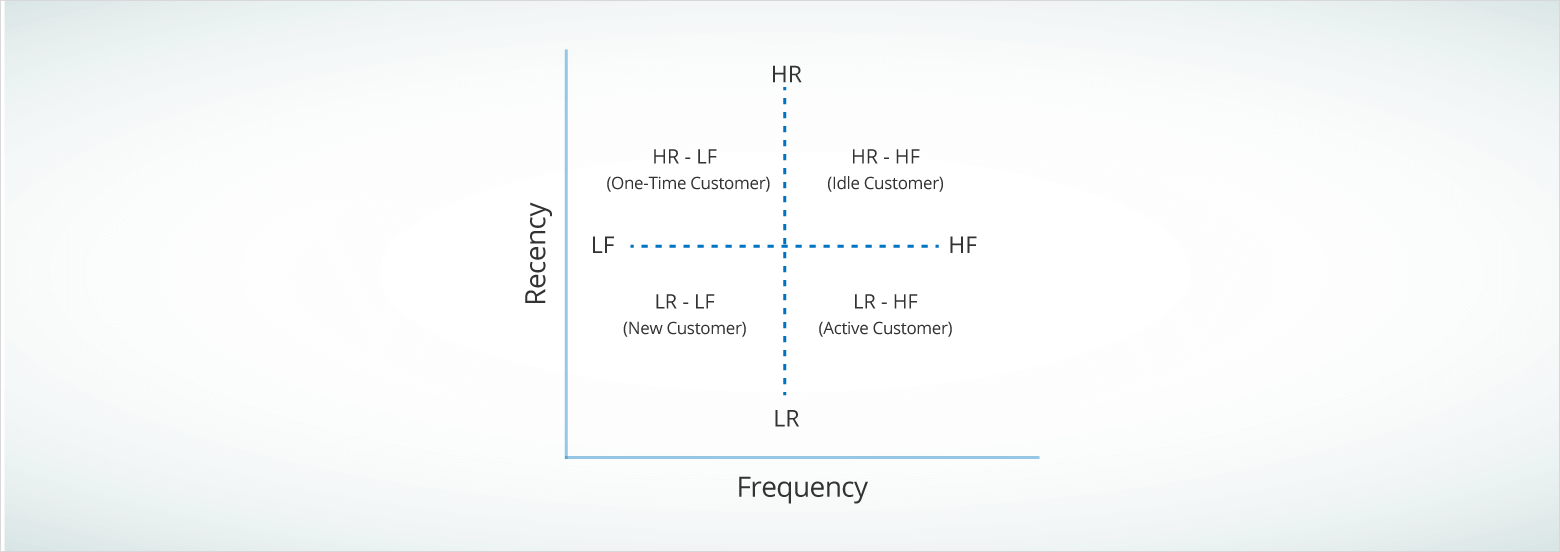

RFM Analysis by Financial Services Companies (FSCs)

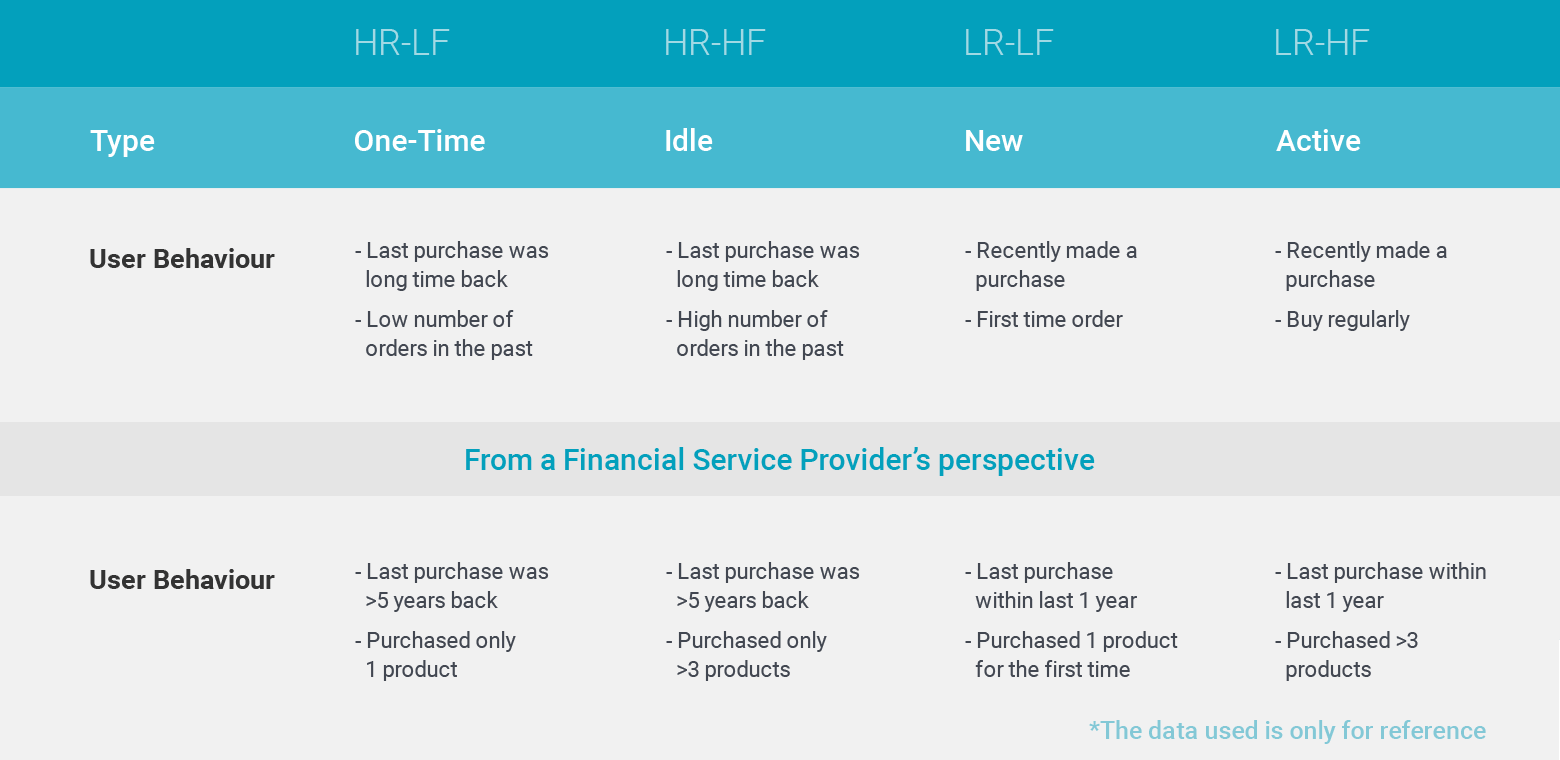

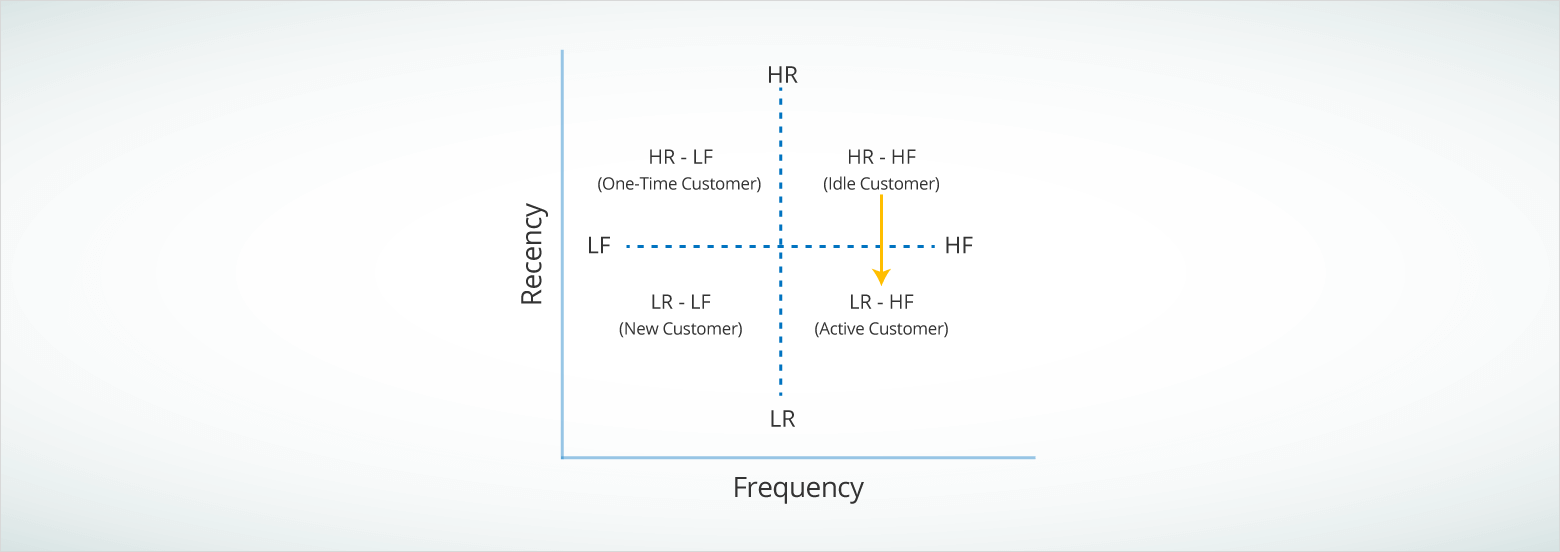

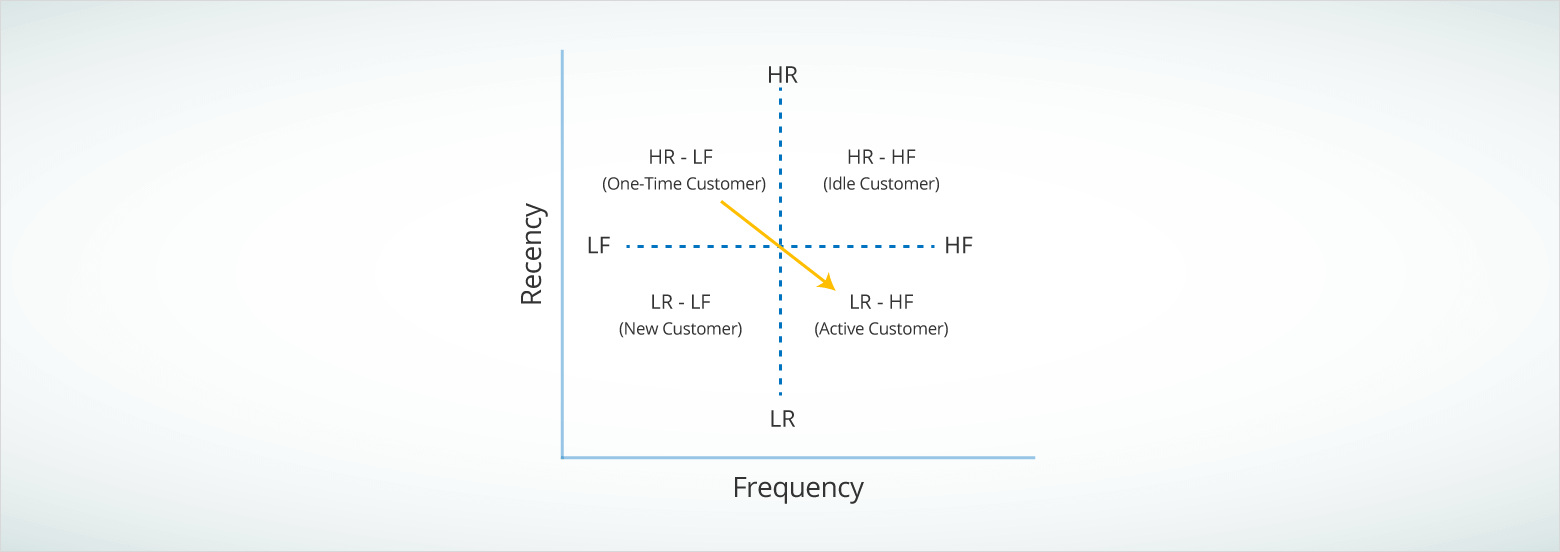

For the simplicity of this post, let’s keep the RFM segmentation model two-dimensional and use Recency and Frequency only.

Here’s how the 2D RFM Model for a financial services company would look like:

Each quadrant of this model represents a customer segment. From a financial service company, these segments can be broadly defined in the following manner:

By segregating customers into 4 groups, financial services companies can identify which customer is turning idle (HR-HF) and/or is at the risk of getting lost (LR-HF). And they can implement reactivation campaigns to recover the lot with the WebEngage Journey Designer.

For those who don’t know, it’s a drag-and-drop automated workflow builder for creating intuitive customer journeys. You can orchestrate multi-channel/multi-device marketing campaigns without breaking into a sweat. To know more about, check out this Blog Post or this Explainer Video.

Reactivating Idle/One-Time Users with WebEngage Journey Designer

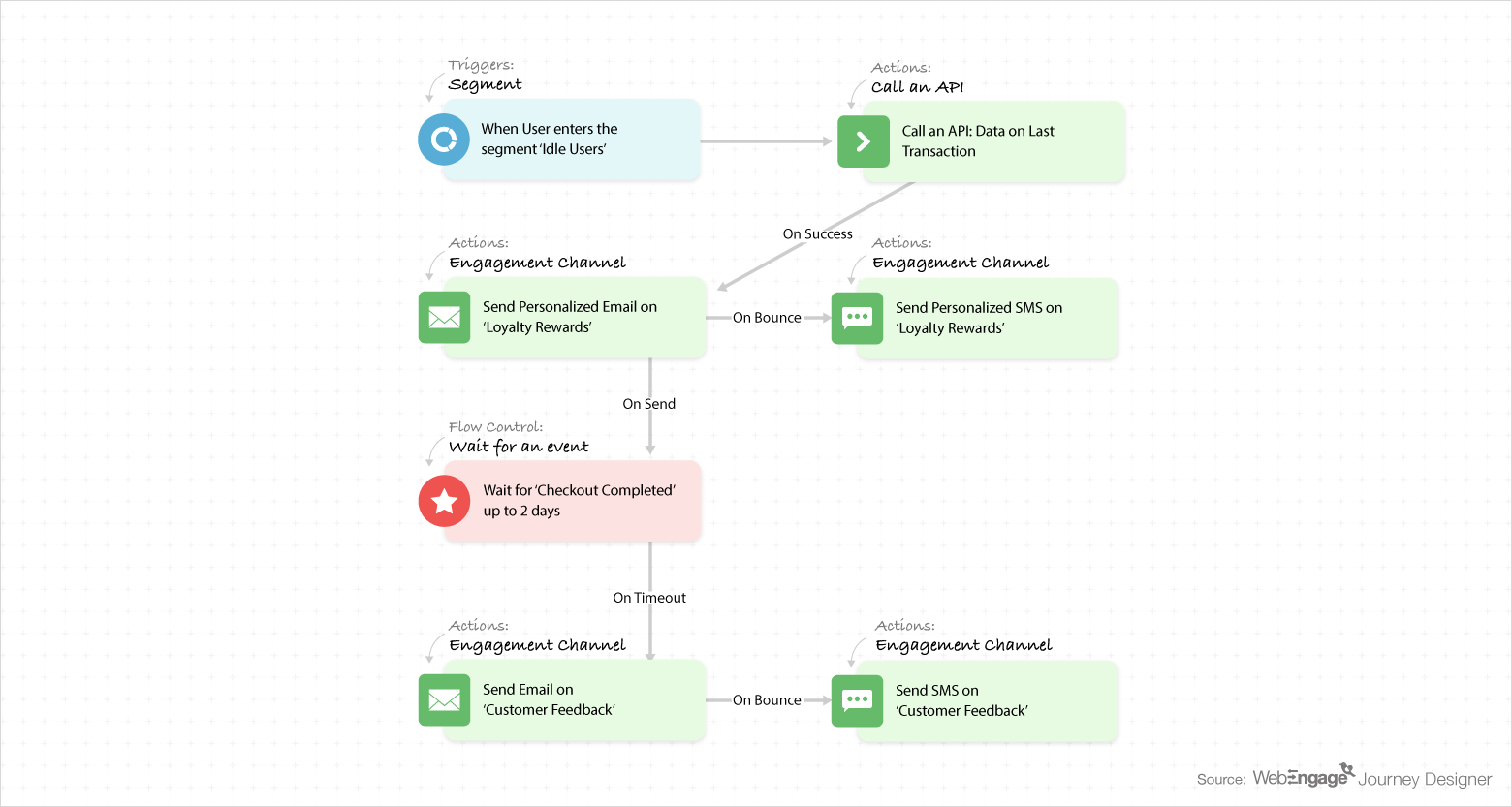

Use Case #1: HR-HF (Idle) → LR-HF (Active)

As idle customers are the ones who used to be active but haven’t transacted in recent times, one can infer that these customers have either stopped using the product/service altogether or have switched to a competitor.

In order to nudge them to reconsider and reactivate, financial services companies can design a workflow around loyalty rewards and customer feedback like this:

(You can know more about the Journey Designer elements here)

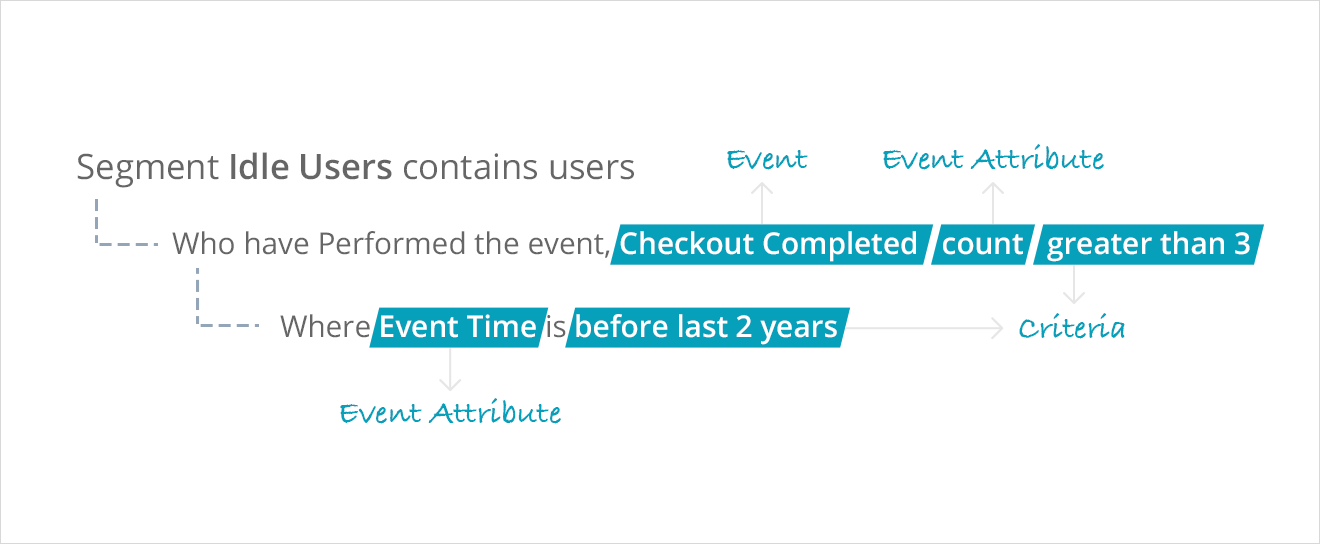

As you can see, this journey will trigger for users who enter the following segment:

And they will receive the following messages via (personalized!) Email and SMS for the loyalty program…

…..and this Email and SMS for receiving customer feedback:

Use Case #2: HR-LF (One-Time) → LR-HF (Active)

One-Time Users, who had transacted only once or twice (with additive incentives like discount coupons) long time back before going inactive, are the ones who are lost. They are non-brand loyalists and/or deal seekers. Similar to lazy users, they might have either discontinued using the product/ service or might have gone ahead with a competitor’s offering.

To reactivate One-Time Users, a financial service company could explore the following marketing tactics:

- Cross-selling

- Offering cashbacks

- Giving incentives for higher value or higher frequency transactions.

Remember: the key is to be relevant and personalized for higher impact.

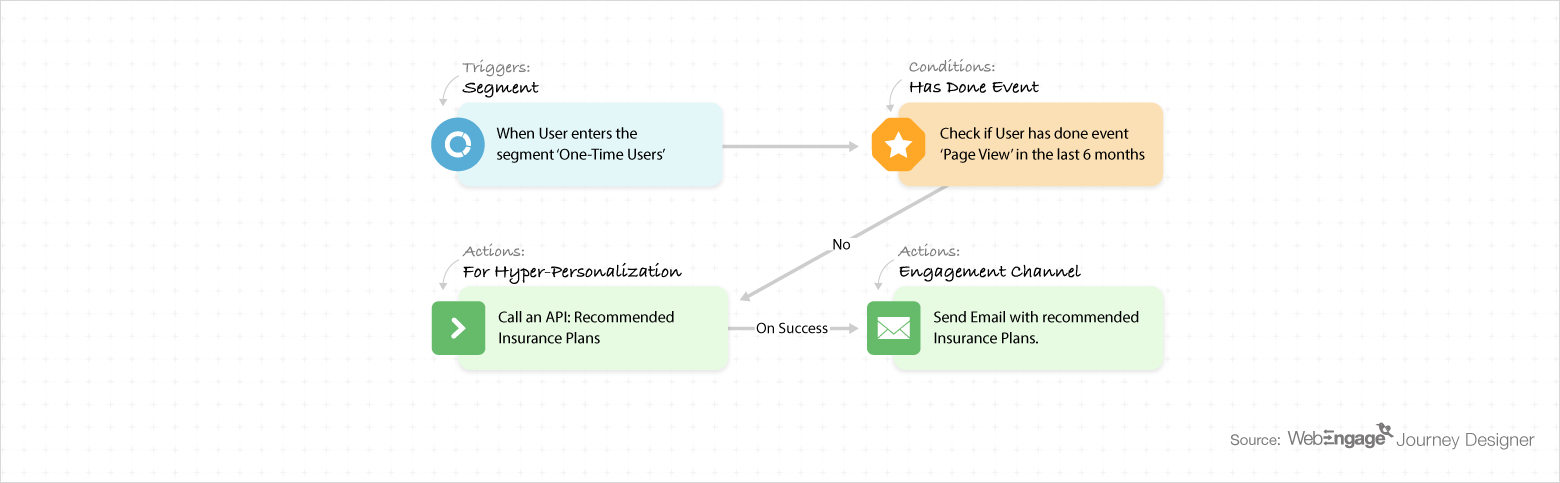

For instance: suppose XYZ Insurance wants to cross-sell related insurance plans recommendations to all its inactive users who purchased an insurance plan 2 years back. This workflow will help them do the needful:

(You can know more about the Journey Designer elements here)

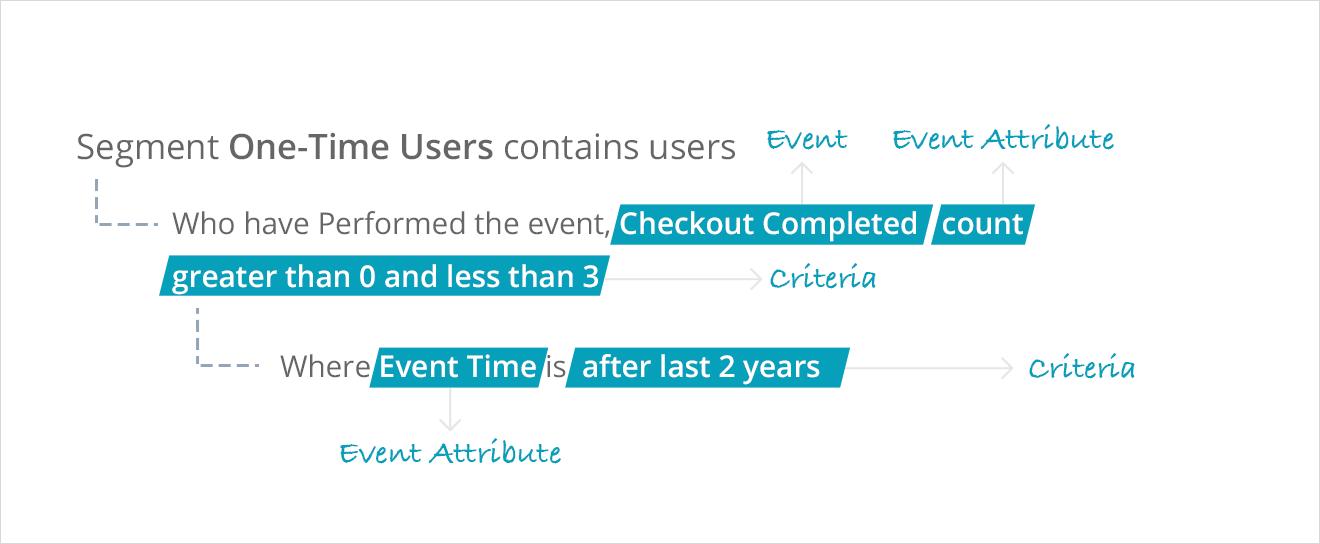

The journey will start for all the users in this segment:

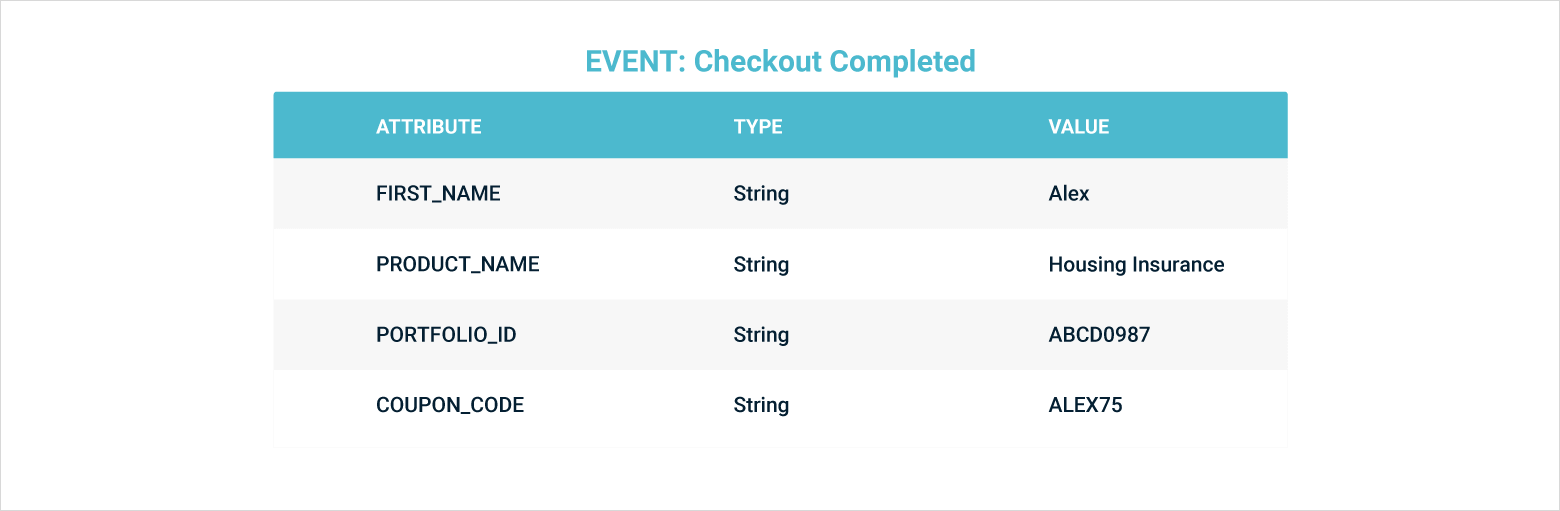

After ensuring the user has been inactive and uninterested since the first purchase, we’ll use ‘Call an API’ block to fetch recommendations from XYZ Insurance’s platform. For example, if one of the users, Alex, bought a Home Insurance Plan 5 years back, he’ll be recommended the following plans: Theft Insurance, Renters’ Insurance, Family Health Insurance, and Pet Insurance.

And this is how the hyper-personalized email would look like:

ALSO READ: How Goibibo used Hyper Personalization in Emails to Increase Conversions by 11%

With this, we come to the end of our blog series on Conversion Funnel Optimization 101 for Financial Services Companies. As you learned, the WebEngage Journey Designer can be used in a plethora of ways throughout a customer’s lifecycle. This drag-and-drop tool uses a fraction of your time to set up a fully-functioning personalized, timely, and contextual multi-channel campaign.

Confused About How Journey Designer Can Complement Your Business? Talk to us now

Harshita Lal

Harshita Lal

Prakhya Nair

Prakhya Nair

Ananya Nigam

Ananya Nigam

Inioluwa Ademuwagun

Inioluwa Ademuwagun

Ajit Singh

Ajit Singh

Amit Shinde

Amit Shinde