In the ever-evolving financial landscape, the need to unlock growth levers and avenues for new sources of revenue is becoming crucial for financial lenders. As lenders quest for effective strategies to provide value to the customer, they have tried a plethora of options – loyalty programs, wellness tools, referral initiatives, etc.

Yet, the most popular argument is that product density (the number of different products a customer buys from your business) per user stays low.

To address this challenge, financial institutes constantly turn to proven methods like cross-selling and upselling to increase product adoption.

This article explores the compelling case of cross-selling and upselling loans and their impact on the financial market.

What Is Cross-Selling And Upselling In The Lending Business?

The process of making your customer buy a parallel product or a higher-end product than the one in question is cross-selling and upselling, respectively. This can happen across products like credit cards, insurance, investment products, or even different types of loans.

For instance, if a user uses their credit card to pay medical bills, the provider may suggest taking a medical loan instead, which would be more comprehensive and cost-effective.

In the case of upselling, imagine a user who applied for an INR 10,00,000 loan. Upon analyzing, the lender identifies the customer’s creditworthiness (responsible borrower), which allows them to avail of a better offer – a bigger loan, lower interest rates, longer repayment terms, and a favorable annual percentage rate. If the customer moved to the upper tier, this would be a successful case of upselling.

Together, cross-selling and upselling not only provide more comprehensive coverage but also often come with discounts for bundling offers. By cross-selling, lenders increase revenue, and customers enjoy convenience and savings.

Let’s double-tap on what makes cross-selling and upselling unique for businesses:

The Power Of Cross-Selling And Upselling

Before we explore how cross-selling and upselling bring value to the lending business, it’s imperative to talk about the role of technology in it. As financial institutes leverage data insights and modeling, they build precision in their recommendations. This unlocks long-term growth and competitive advantage in the lending market.

The truth is people prefer buying from the same vendor and not working with too many service providers simply because of the ease of processes. So when lenders successfully deploy advanced analytics and awareness of the right product, they increase their product density per user (existing) & unlock high growth.

Let’s double-tap on how cross-selling and upselling can benefit businesses:

- Diversified product portfolio: Simply expand the range of loan products offered to existing customers.

- Enhanced customer relationship: Demonstrate dedication and attention towards the borrower via tailor-made solutions.

- Cost-effective: Acquiring new customers is typically more expensive than retaining customers. When lenders cross-sell/upsell to existing bases, it requires less expenditure, making the deal cost-effective.

- Improved Customer Experience: Customers who buy more than one product are hooked on the brand. Clubbed with a solid after-sales service, lending companies can create a loyal base.

- Increased revenue per user: Needless to say, higher product density means increased ARPU (Average Revenue Per User).

- Data insights: When the brand lands on an insight, it can deploy it for the masses for better conversion. For instance, if most home loan users also get homeowner insurance, the brand can create a bundle. This will allow more users to buy without hiccups.

Here’s a quick read to know how you can optimize funnels in the financial sector to boost your post-purchase customer engagement. - Product discovery: Sometimes customers are not aware of new offers or products, bundling through cross-selling can allow awareness of new services.

- Comprehensive coverage: Borrowers have a robust portfolio, covering a wide range of risks and potential financial setbacks.

Real-World ‘Cross-Selling Loan’ Triumphs

Leading BNPL (Buy Now Pay Later) service provider CASHe saw a 300% jump in the value of loan disbursed, a 42% increase in repeat borrowing, and a whopping 75% reduction in man-hours.

The brand uses WebEngage’s dashboard to set up journeys that would send automated, timely communication to existing borrowers to take repeat loans for their needs.

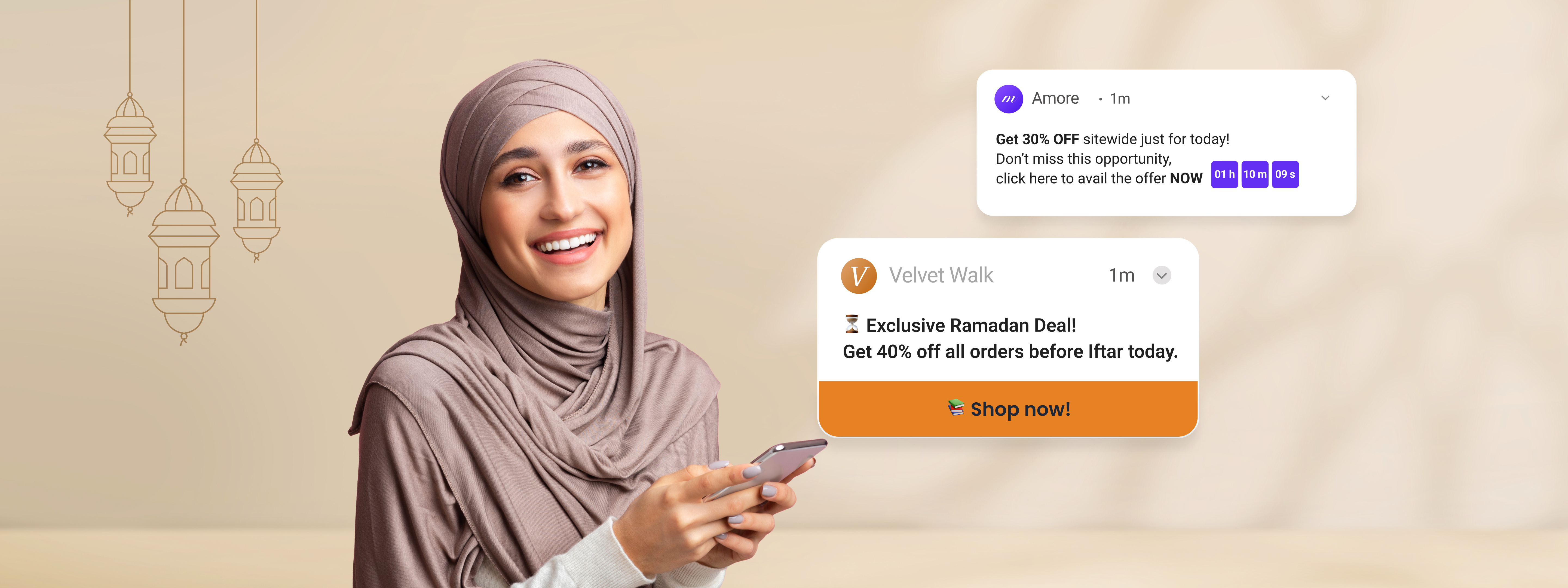

BNPLs thrive on short-term usage. So when a good borrower reaches the end of their lending tenure, BNPL can retarget them with customized offers based on purchase history. This helps them in increasing revenue and product density of their services. Loyal customers also tend to stick around, as their requirements are met through lending.

How to use technology to power cross-selling/upselling

Today, businesses rely on technology to facilitate their scaling efforts. To incorporate cross-selling as part of their growth strategy, there are a few things that companies can do. Let’s explore them below:

-

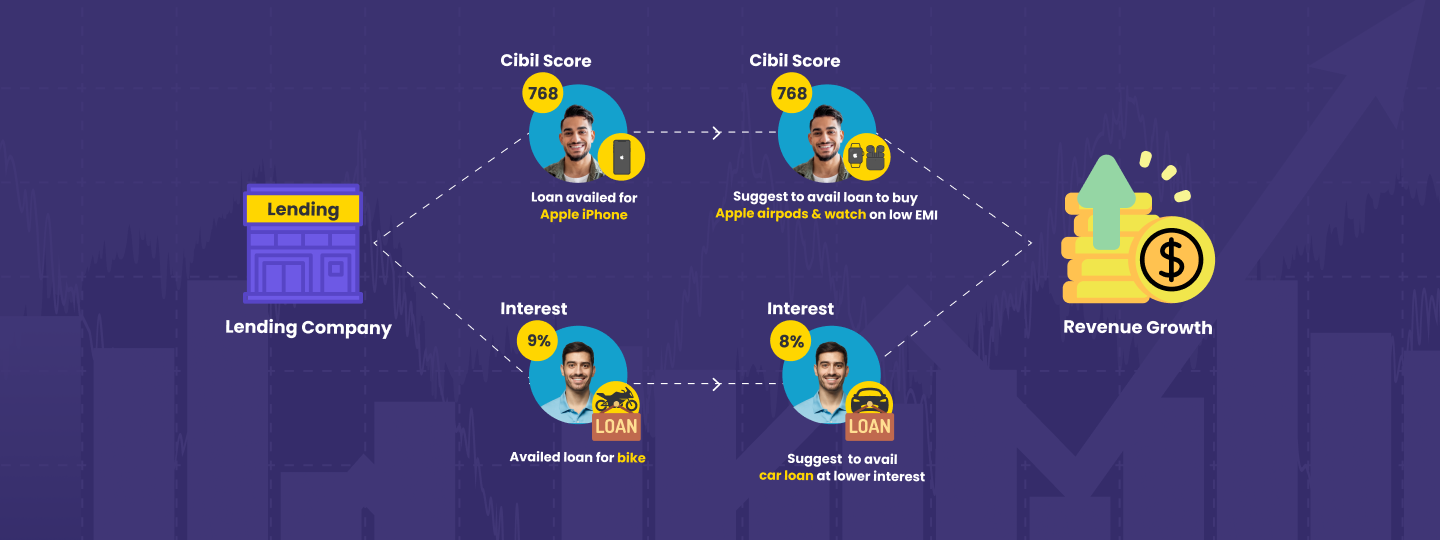

- Data analytics and customer segmentation: Use marketing automation platforms that help you dissect customers based on their preferences, behaviors, needs, and patterns. To further go deeper into creating segmentation, and offer personalized deals, financial institutes can divide cohorts based on their credit card score, payment history, loan type etc.

For example, a customer goes to ICICI Bank to apply for a car loan. The team that is lending the money to the customer knows that anyone who’s buying a vehicle needs a motor insurance too. In this case, the team recommends them or bundles motor insurance (ICICI Prudential), guaranteeing a better deal.

-

- CRM systems: Centralized customer relationship management tools enable lenders to maintain a comprehensive database of customer information, needs, behavior, and history. This directory acts as a foundation for recognizing the scope of cross-selling and upselling products, thus personalizing it at various levels.

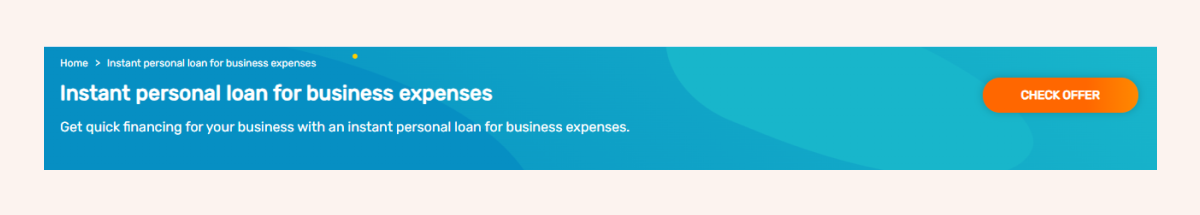

For example, knowing the markets, Bajaj Finance launched personal loans for business owners. This is a great cross-sell for users who do not meet the requirements for a business loan (higher credit score, collaterals, etc).

-

- Recommendation engines: We cannot emphasize enough how critical setting up recommendation engines is for the lending industry. The usual money-borrowing business is overwhelming for a lot of users.

Therefore if recommendations are set in place by lenders on their apps and websites, it can nudge (real-time) users to buy in their capacity. The best way is to utilize machine learning to make real-time product recommendations based on customer data.

For example, Axis bank uses the wealth of insight it gets through its banking app about the user. Imagine user A buys a new iPhone every year when it’s launched through his credit card. Now the bank can easily use this insight, offer personalized loan recommendation via app, simplify the borrowing process and enhance the overall customer experience.

-

- Marketing communication automation: Brands can categorize users based on their needs, CIBIL score, credit history and numerous other parameters to target their communications accordingly. After creating these unique cohorts, a holistic omnichannel campaign can be created targeting users via SMS, email, notification, or push.

For example, sending out emails to users with low CIBIL to encourage them to pay back EMIs on time and improve it. When after repeated nudges their score improves over a period of time, they can be encouraged for a loan.

Here’s an email from ICICIdirect to its user trying to cross-selling to a mutual fund SIP user for a loan.

Also read: Advanced Use Cases for BFSI: Revolutionizing Operations and Maximizing Revenue

Wrapping thoughts

Cross-selling and upselling from a borrower’s perspective offer a wellspring of comprehensive solutions, variety in selection, exposure to new deals, and offers. This strategy isn’t one-sided, generating value only for lenders by boosting revenues: borrowers, too, get to experience customer-centric experience, tailored offers, enhanced value, and pocket-friendly plans.

WebEngage has enabled numerous 800+ brands to build user-first strategies, technologies such as data management, customer segmentation, and automation to streamline marketing efforts and allow lenders to offer tailored loan offers and comprehensive financial solutions.

Curious to understand how cross-selling and upselling can unlock new revenue streams for your lending business? Connect with WebEngage experts today!

Inioluwa Ademuwagun

Inioluwa Ademuwagun

Vanhishikha Bhargava

Vanhishikha Bhargava

Ananya Nigam

Ananya Nigam

Harshita Lal

Harshita Lal

Amit Shinde

Amit Shinde