How Financial Services companies can master Post-Purchase Customer Engagement with Marketing Automation

Conversion Funnel Optimization 101 is an all-inclusive Marketing Automation Guide for Financial Services Companies. In this post, we’ll discuss how they can engage with their customers post-purchase by using Marketing Automation.

In our previous post, we revealed the hacks for reducing pre-purchase drop-offs with marketing automation.

Now let’s discuss how Financial Services Companies (FSCs) such as Banks, Micro-Lending Firms, Insurance Companies, etc. can engage and retain their customers post-purchase. And that too with our favorite marketing automation.

WHY marketing automation for post-purchase communication, you ask?

Here’s why.

Why Financial Services companies need Marketing Automation for post-purchase engagement

- As FSCs have both click-&-brick presence, their customers engage with them via a great many touchpoints. And these customers expect a seamless experience throughout their lifecycle. To ensure a cohesive communication at every touchpoint, a marketing automation tool is required for omni-channel engagement.

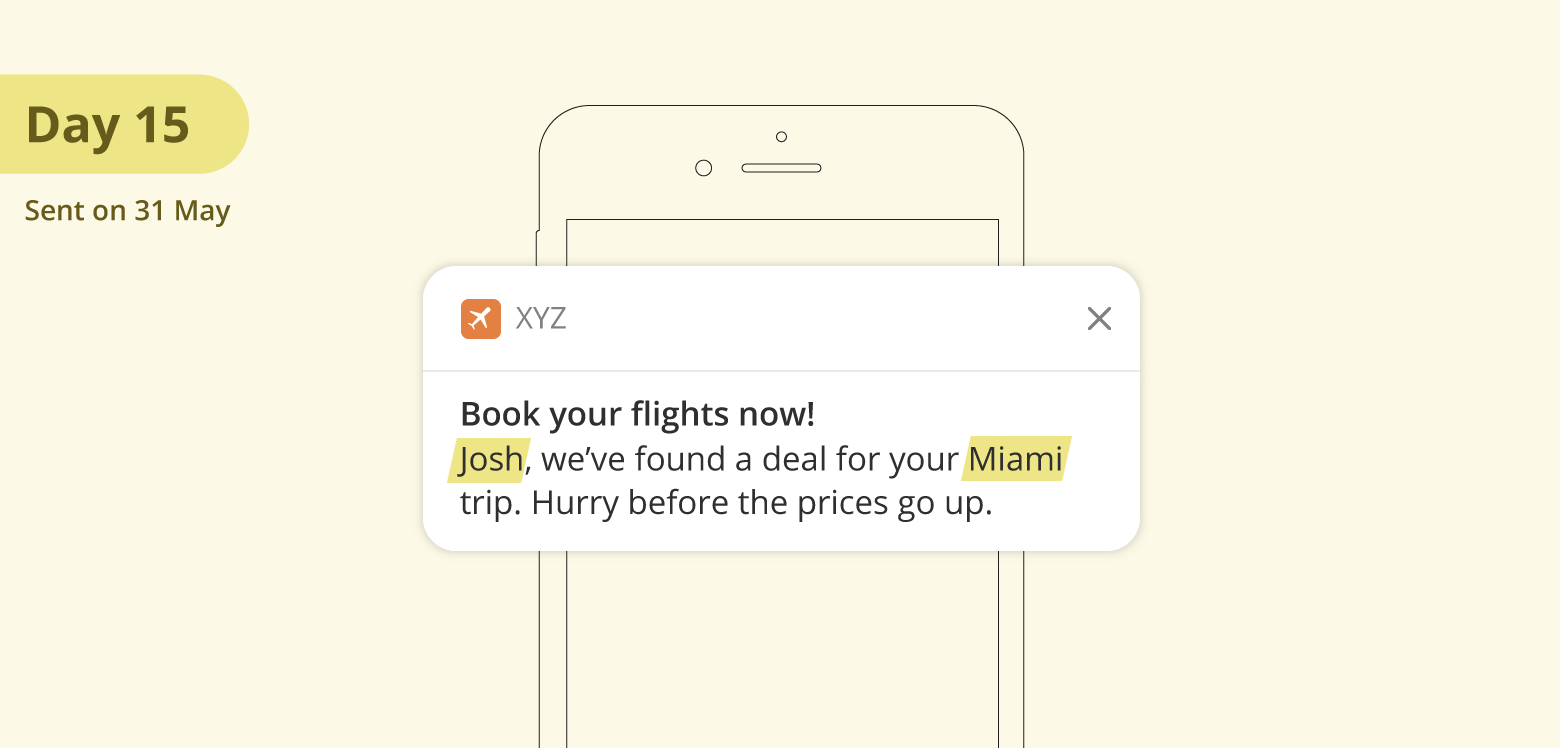

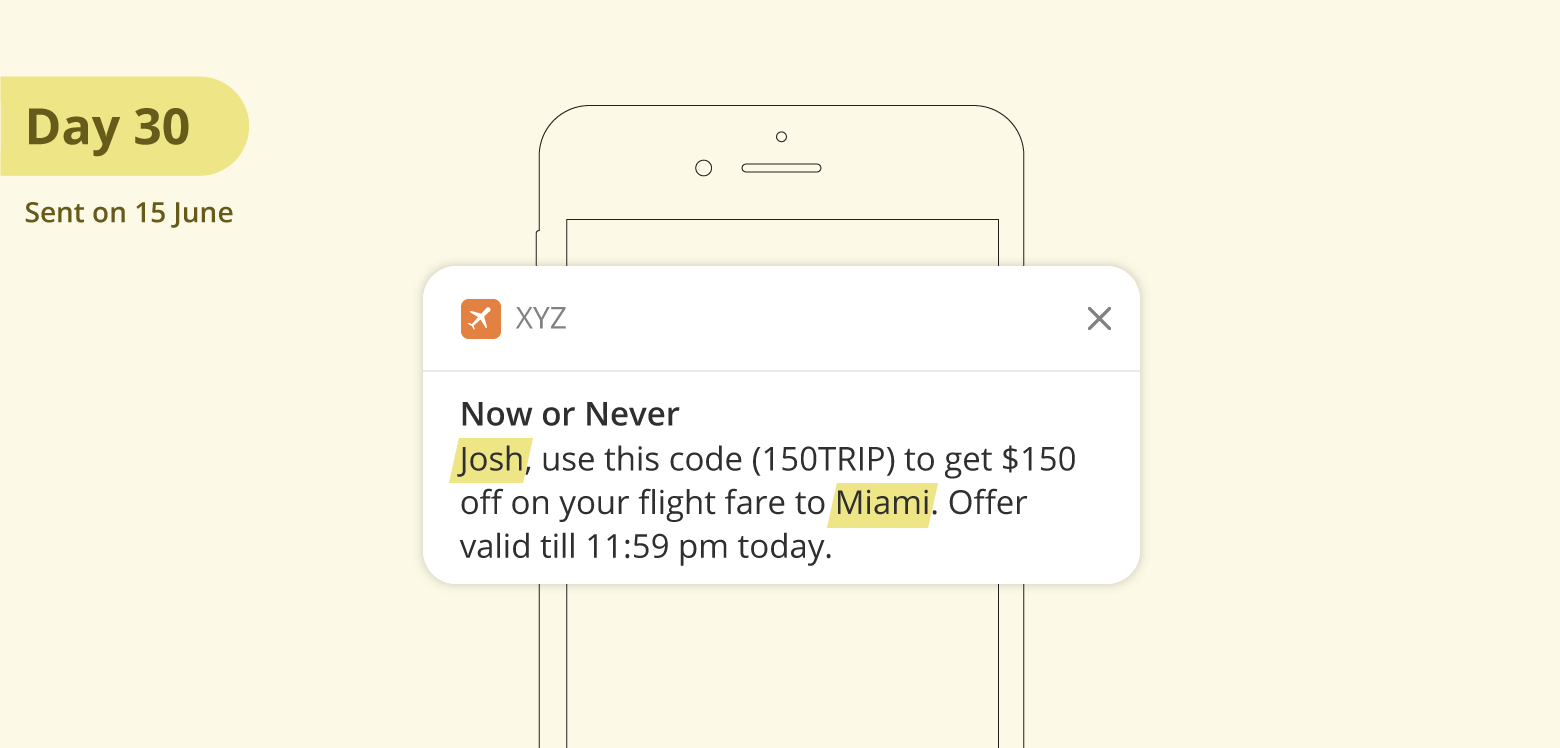

- Post-purchase education of financial products can be successful if it’s relevant and contextual. And a rightly-timed message triggered using marketing automation can ensure that.

- To cross-sell and/or upsell, FSCs need to forecast their customers’ behavior and future activities. And marketing automation streamlines this process by tracking every customer’s actions (a.k.a. events).

- You can stay ahead of your competition by adapting to changing customer preferences as well as attributes, and interacting with them with highly personalized and coherent messages.

Now that you are convinced, let’s get to the basic requirements for enabling a multi-channel customer engagement and retention workflow.

Marketing Automation checklist for Financial Services companies

- User Profile with data like:

- Personal Identifiable Information (PII): name, email id, contact number, etc.

- Demographic Attributes: age, income, gender, employment status etc.

- Product Preferences: current portfolio, service quote amount, etc.

- Events Tracker which can trace user activities such as:

- Monthly instalment paid successfully

- Post-sale service inquiry form filled

- Promotional content viewed on mobile / desktop, etc.

- Segments Builder to create segments using both user persona and behavioural attributes. For example:

- All customers with annual income of more than $1,000,000

- All customers who haven’t paid interest in the last 3 months, etc.

- Multi-Channel Campaign Tool which can manage multiple channels such as on-site notification, mobile push, web push, in-app notification, SMS and email.

- Customer Journey Workflow Designer (eg: WebEngage Journey Designer) to integrate different data stacks and orchestrate cross-channel user engagement from a common dashboard.

How Financial Services companies can use WebEngage Journey Designer for post-purchase engagement and retention campaigns

For your better understanding, let’s take the help of these 3 use-cases.

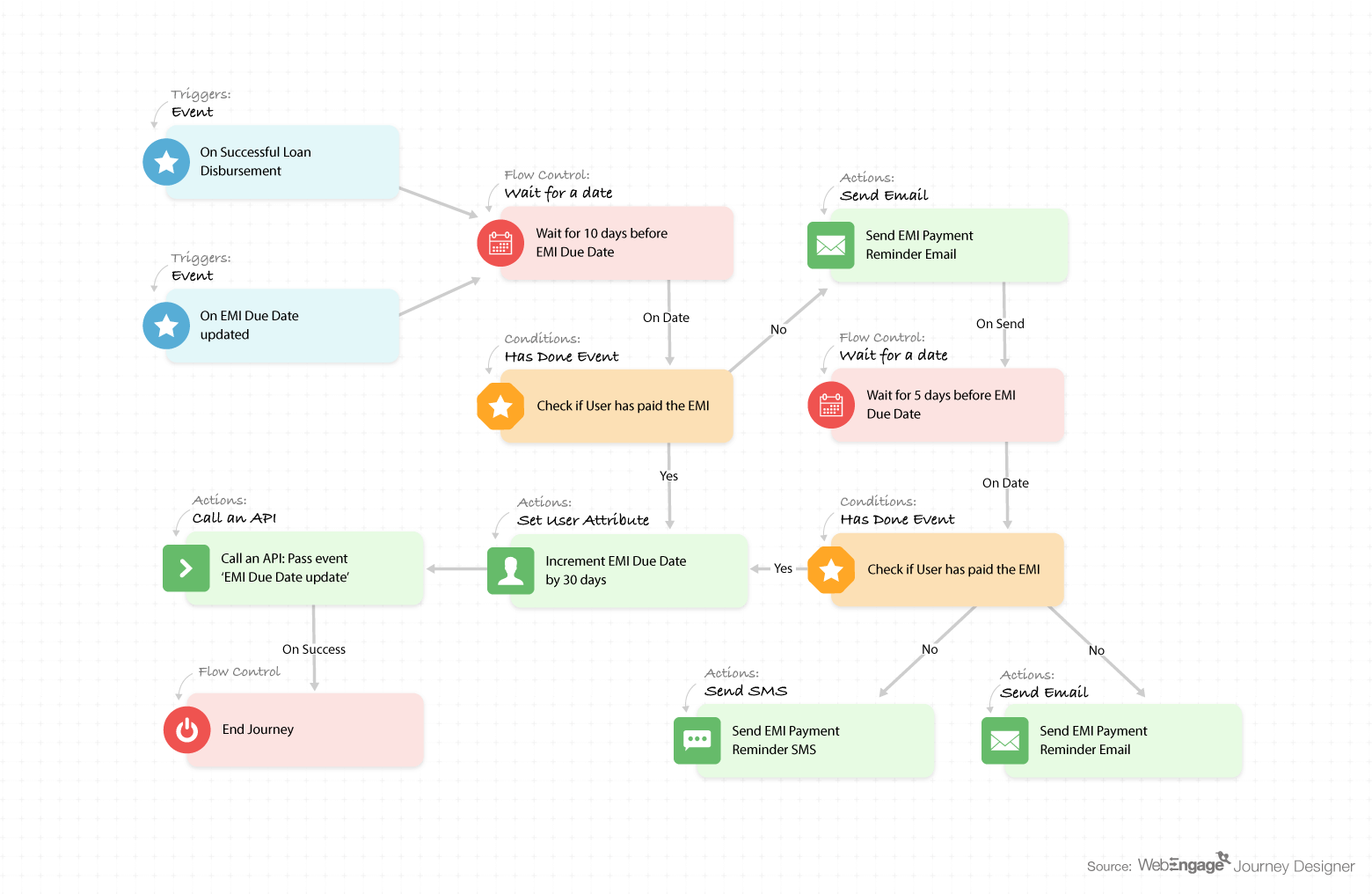

Use-Case #1: Payment reminder

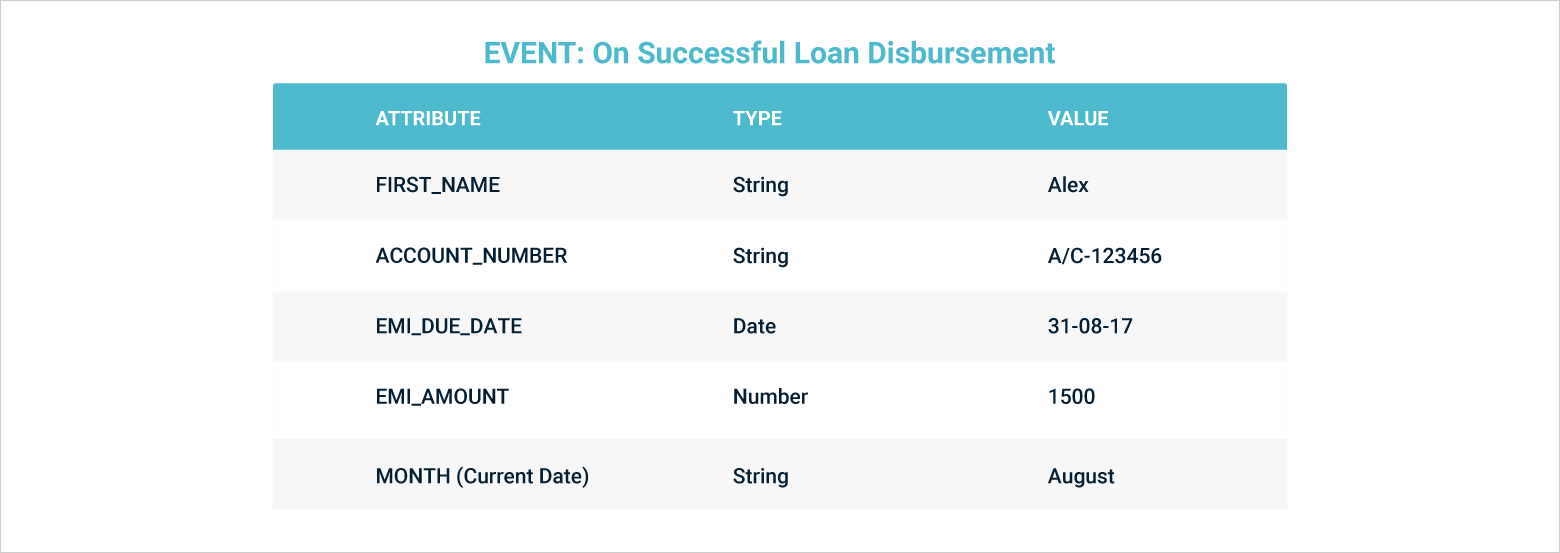

Suppose XYZ Bank wants to send EMI payment reminders to their customers via email and SMS. And they want to automate the process for every month. This workflow can do the needful.

(To know more about WebEngage Journey Designer, click here)

As soon as XYZ disburses a loan to a user (Trigger Event: On Successful Loan Disbursement), the user enters this journey. Furthermore, an attribute ‘EMI Due Date (Type = Date)’ is set in his/her user profile along with other attributes like name, product id, principal amount, EMI amount, etc. When the due date is near and the user has not paid the EMI, he/she is sent a personalized reminder accordingly.

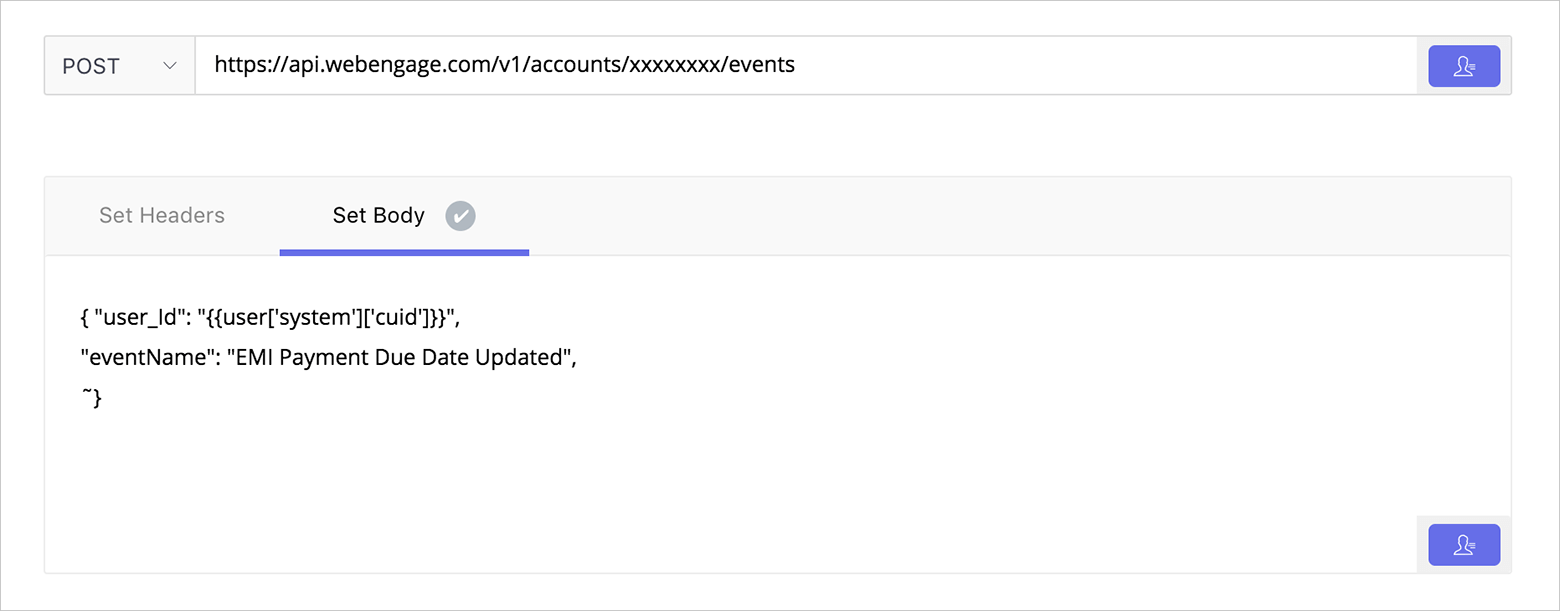

Once the user makes his/her EMI payment, ‘EMI Payment Due Date’ attribute is updated to the new due date. Then, event ‘EMI Due Date Updated’ is fired using our Rest APIs. This is done by ‘Call an API’ block to update the user profile and re-enter the user into the journey (Trigger Event: On EMI Due Date Updated). And the cycle continues.

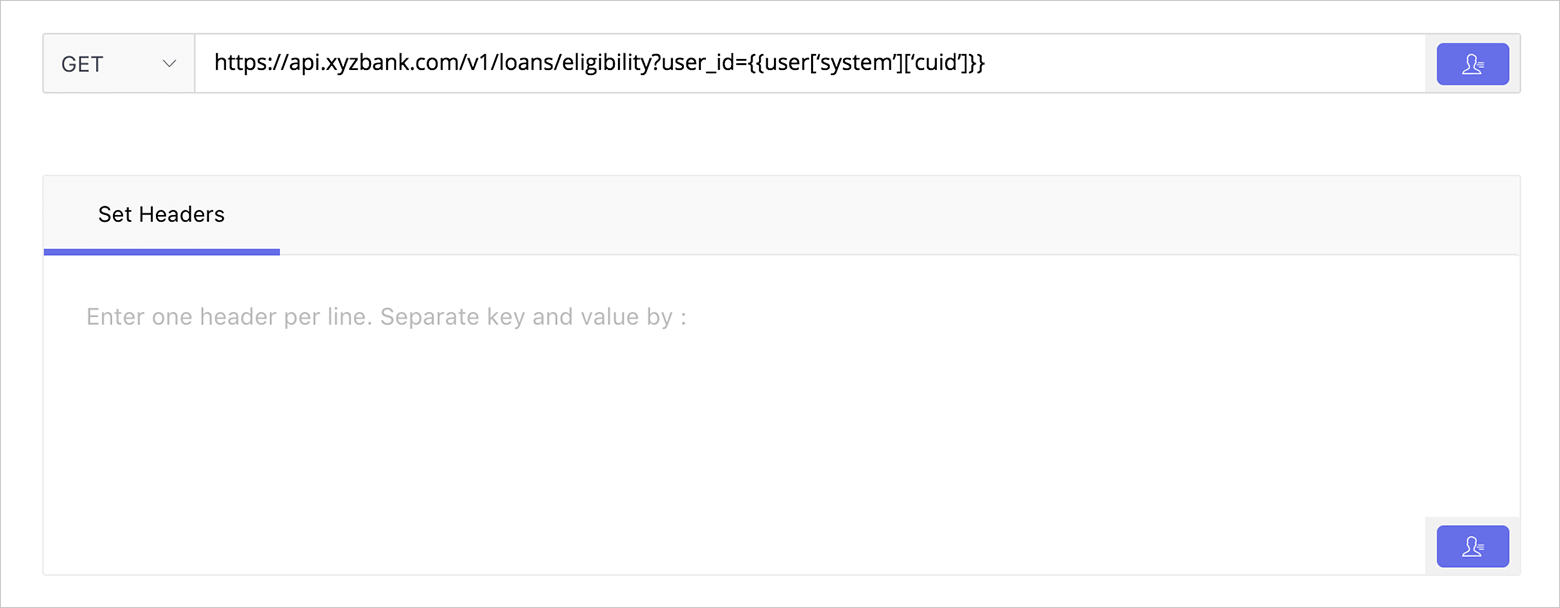

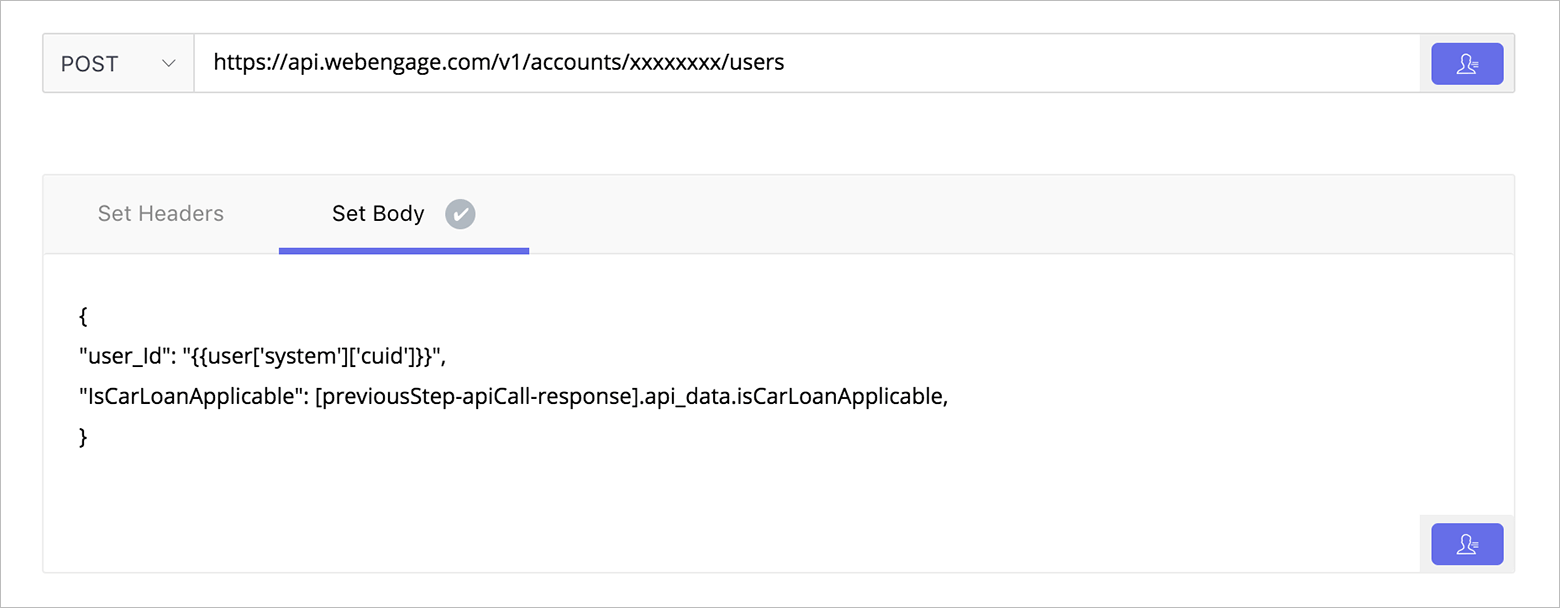

Here’s the snapshot of the ‘Call an API’ block:

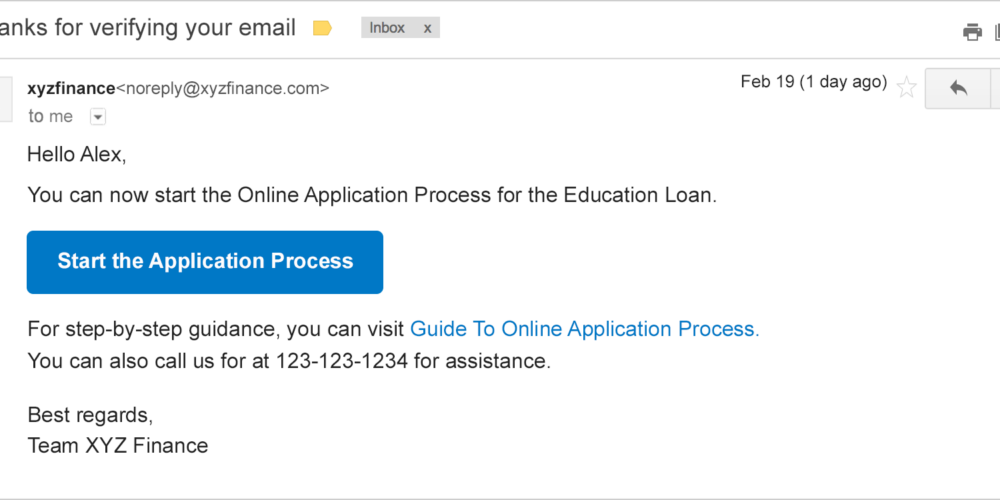

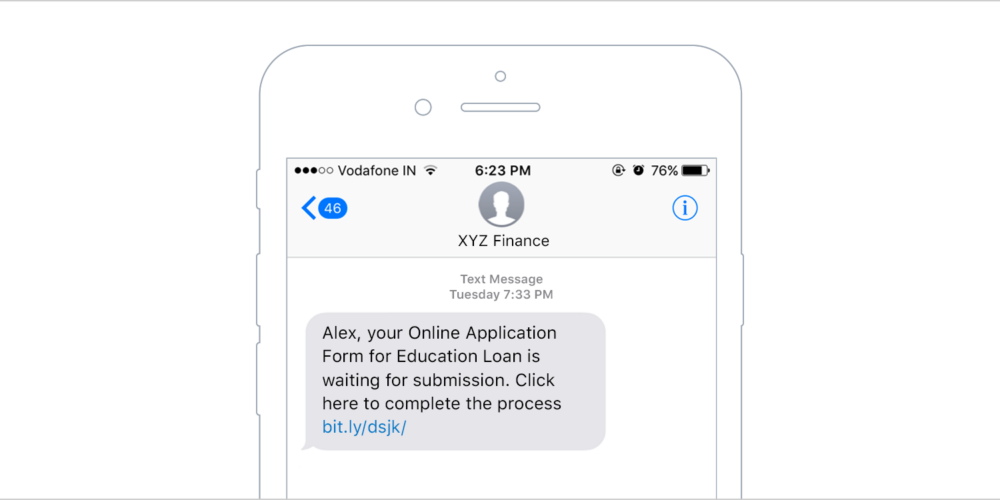

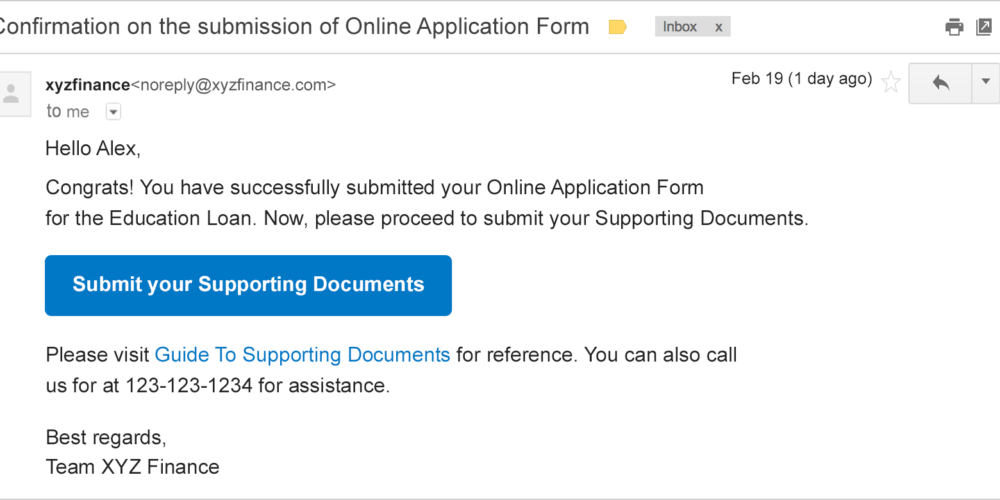

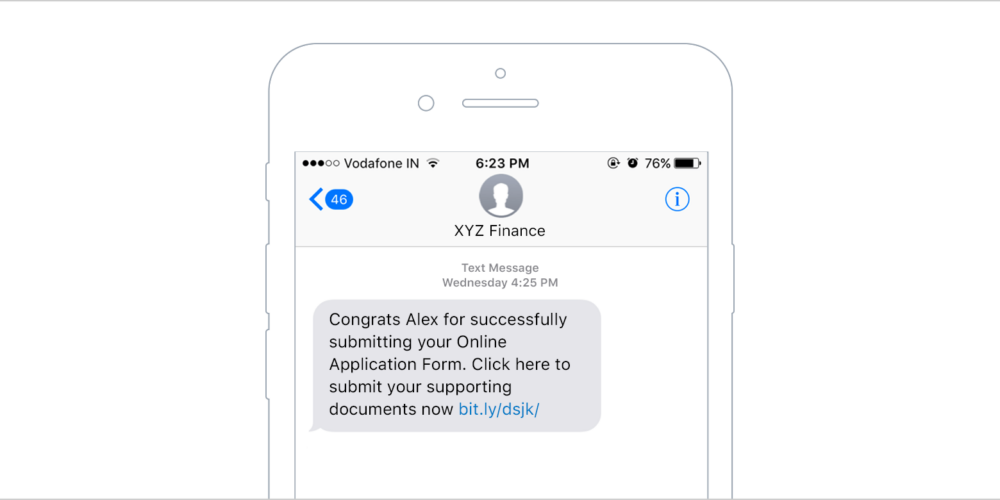

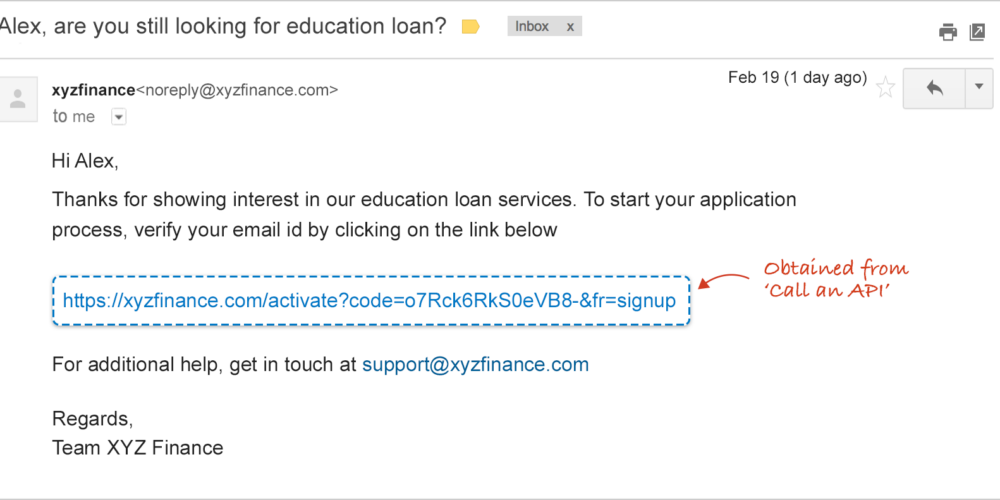

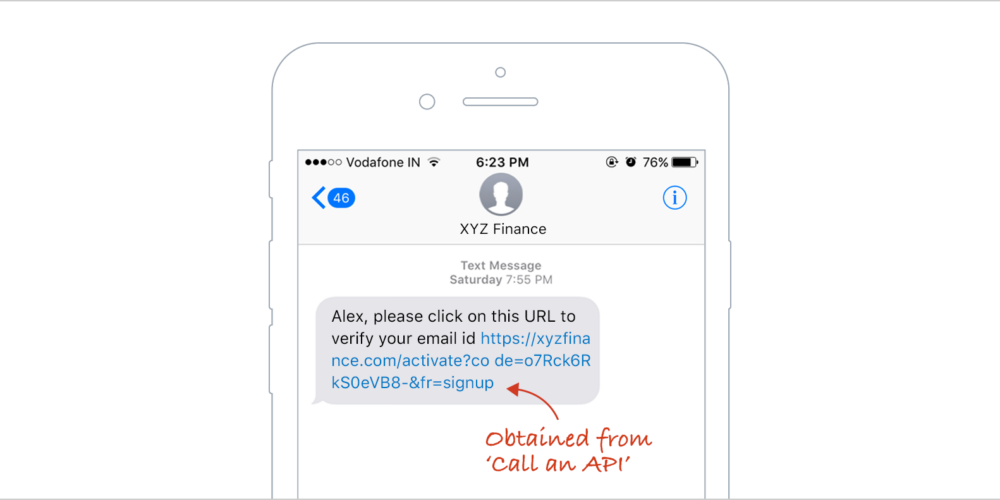

And here are the samples of EMI Payment Reminder Email and SMS:

Use-Case #2: Cross-selling

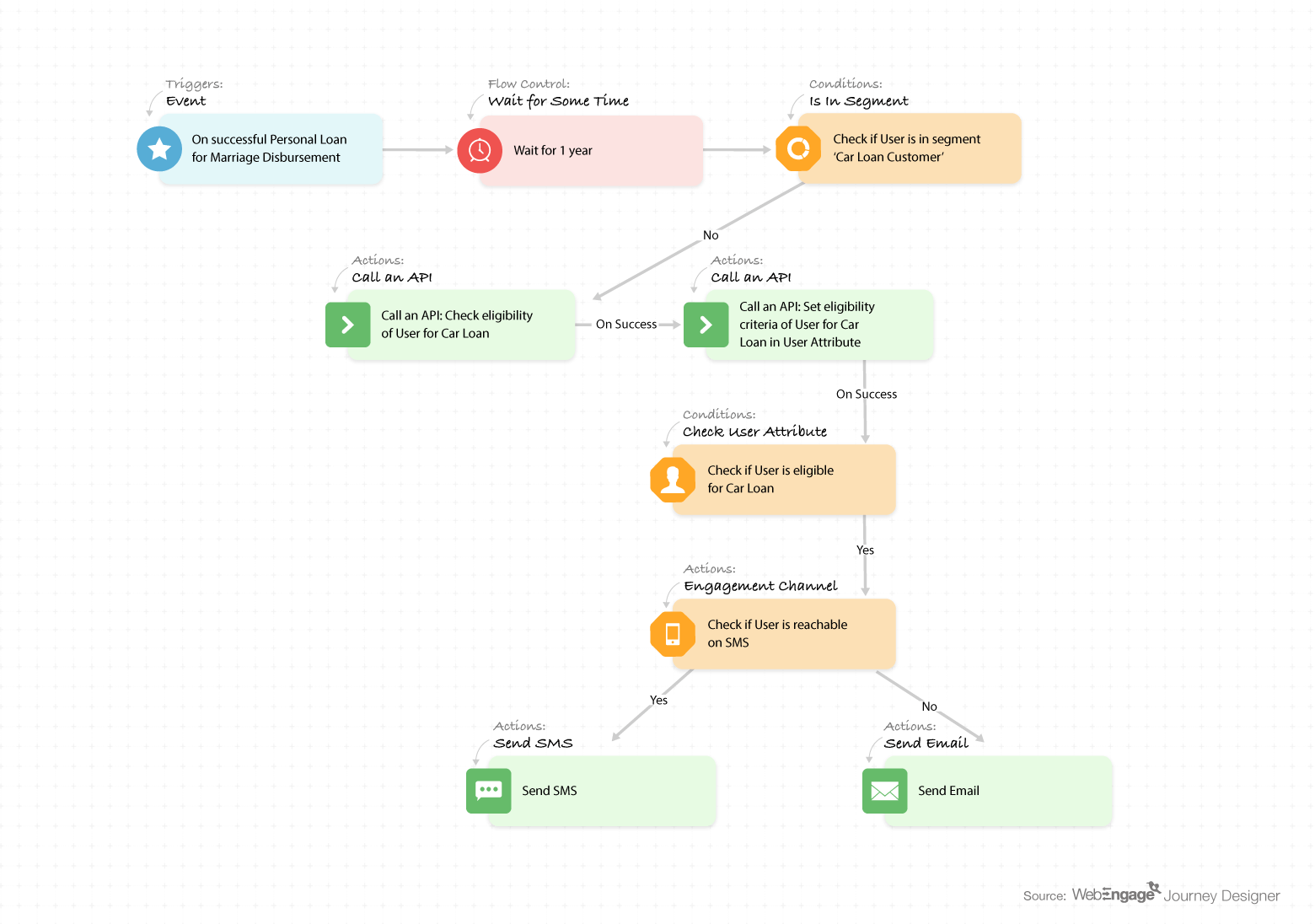

Suppose XYZ Bank wants to cross-sell Car Loan to all their customers who took Personal Loan for marriage purposes 1 year back. This journey workflow can help XYZ cross-sell to just the right users.

(To know more about WebEngage Journey Designer, click here)

To ensure that only users who are eligible for the Car Loan are sent the communication, we’ve included two ‘Call an API’ blocks. The first one checks the eligibility of users for Car Loan.

The second one uses WebEngage’s Rest APIs to update the user profile with user attribute ‘IsCarLoanApplicable’ (Attribute values: True / False).

Here are the sample email and SMS for you:

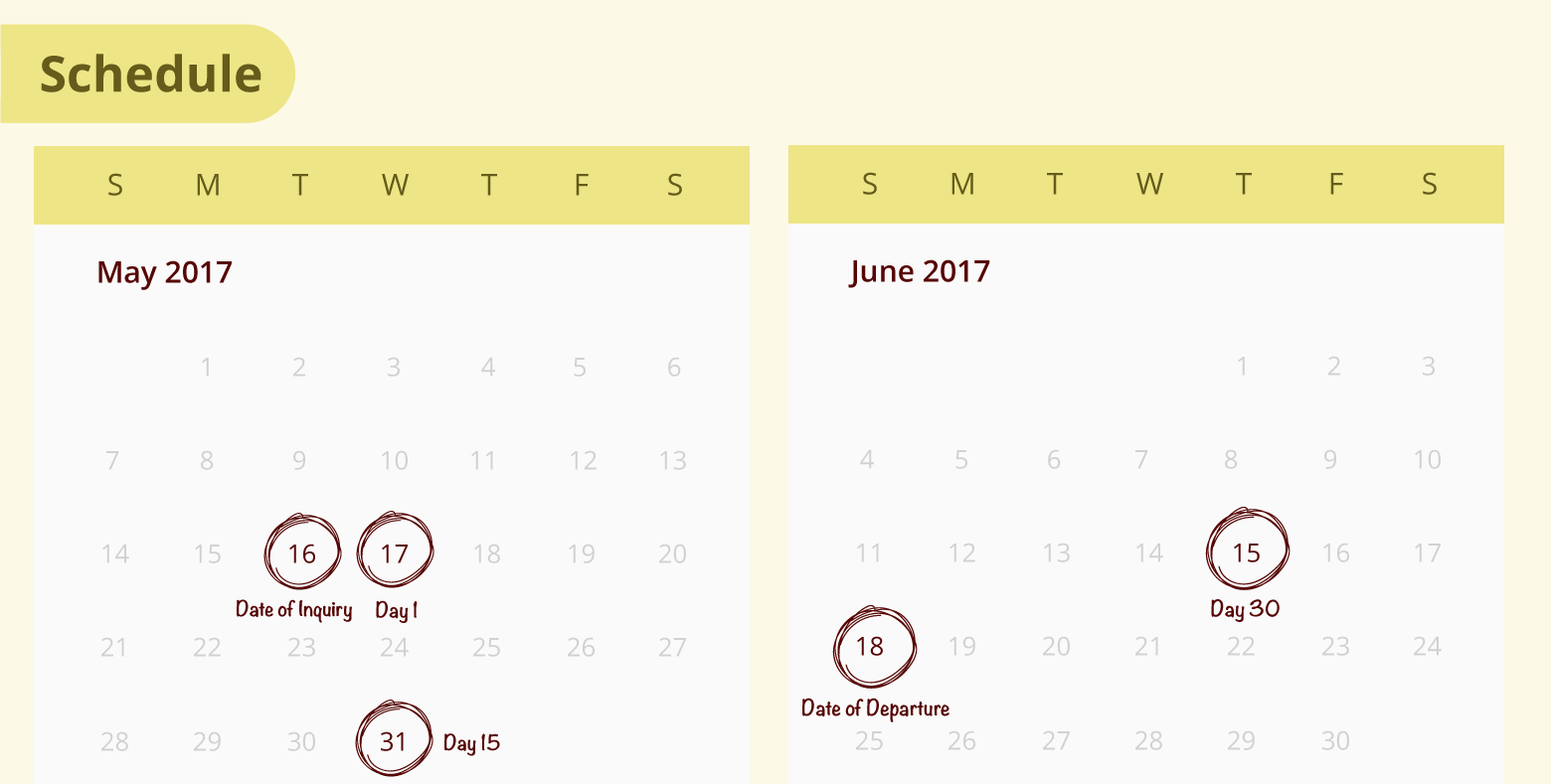

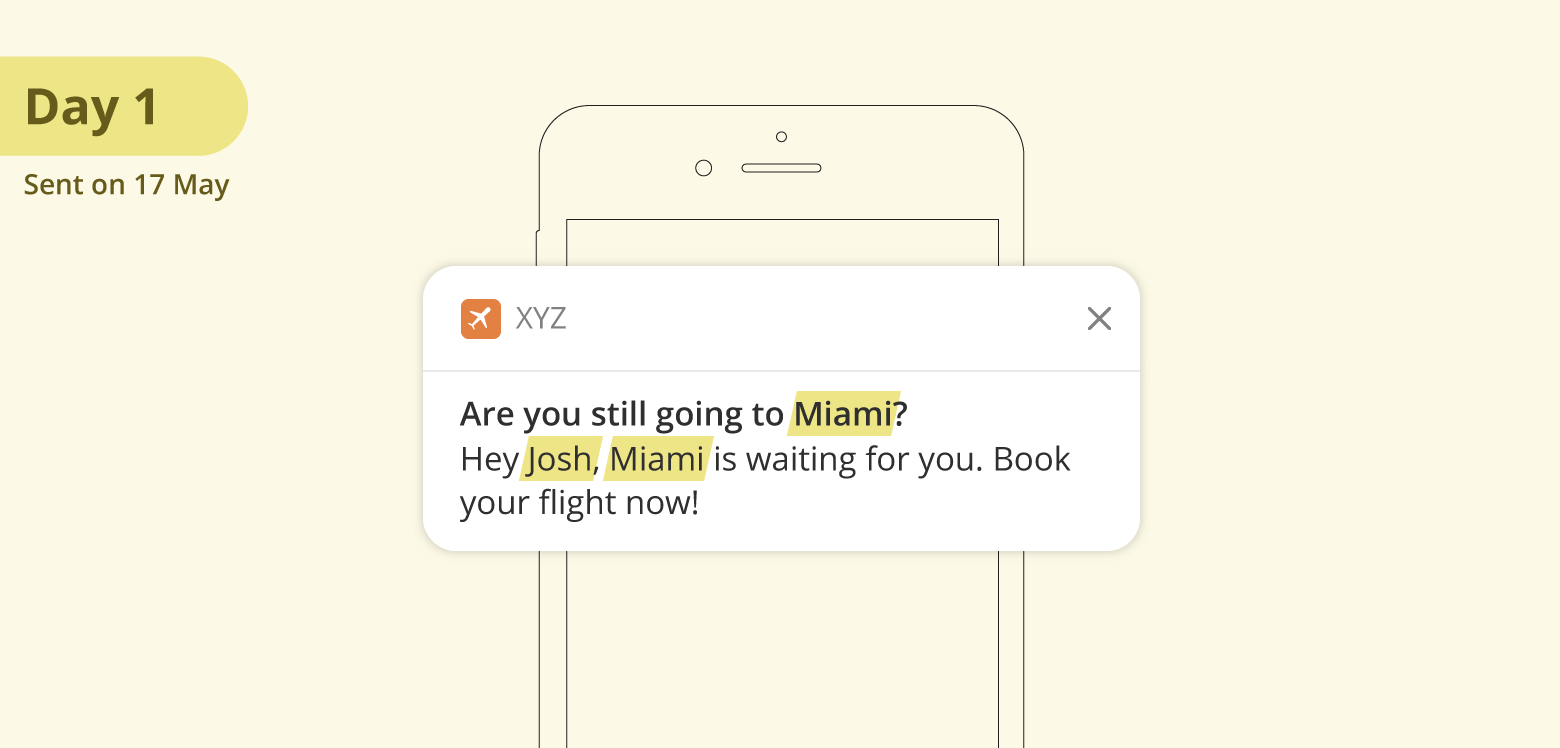

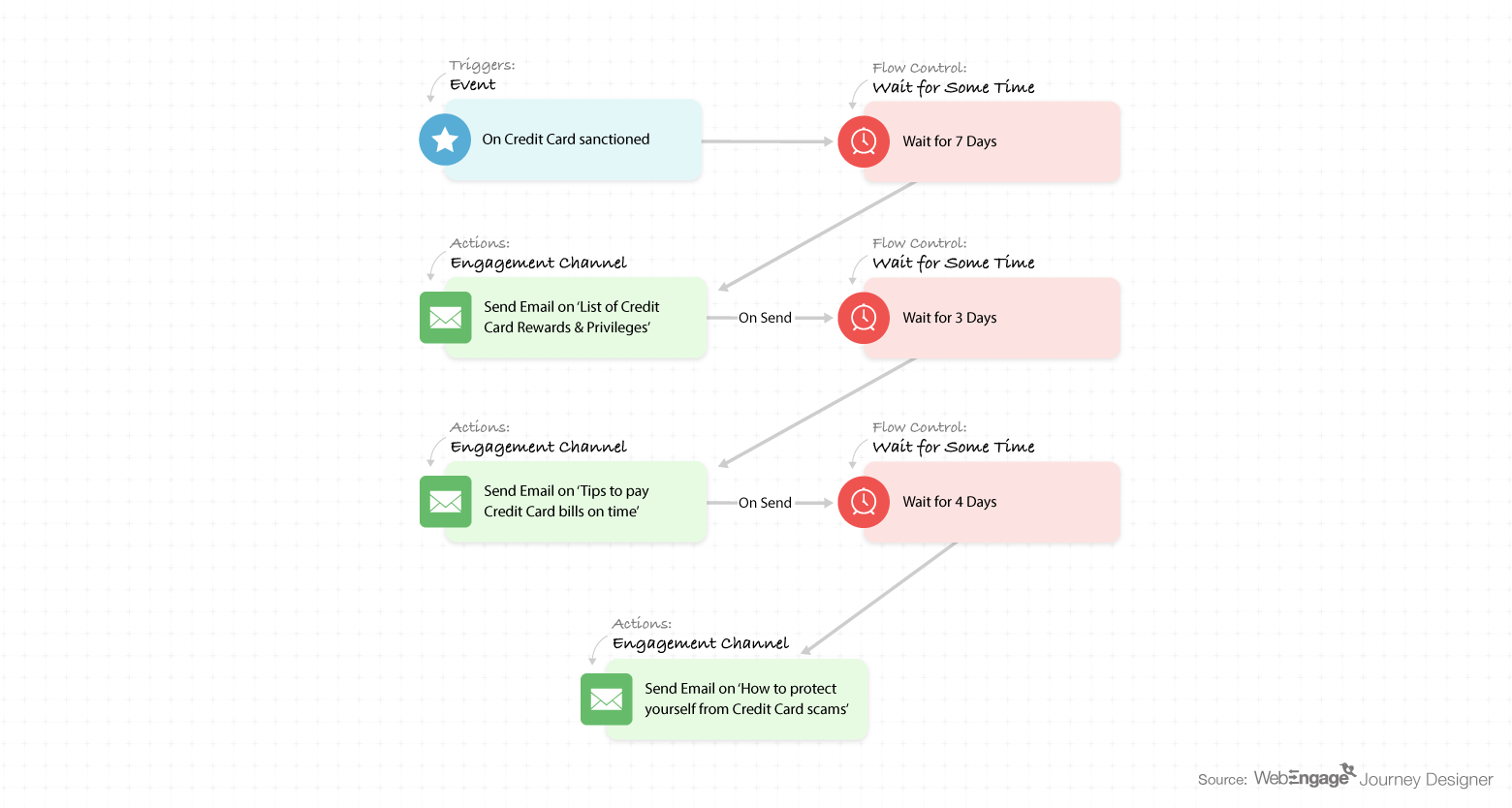

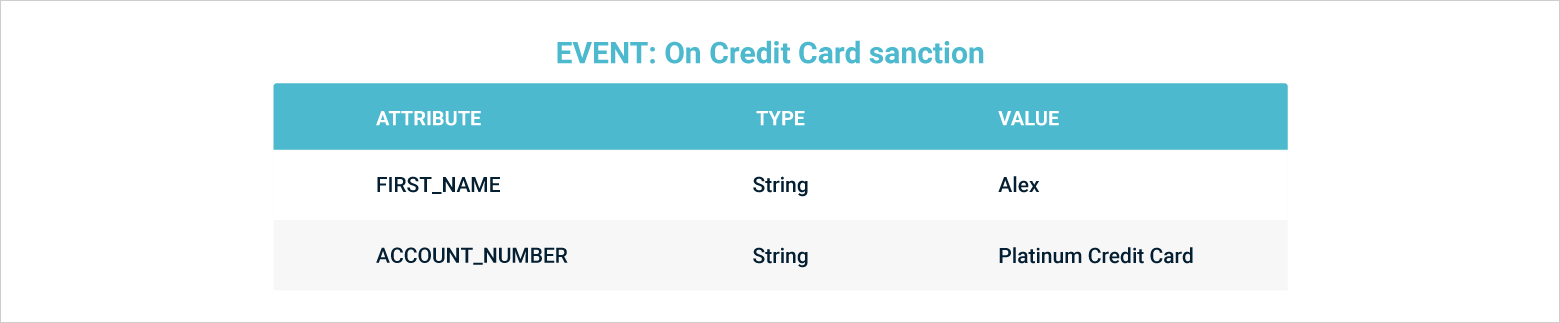

Use-Case #3: Drip email campaign

Suppose XYZ Bank offers 4 types of credit cards: Silver, Gold, Diamond, and Platinum. And it wants to provide post-purchase education to all its credit card users by sharing relevant articles. They can do this though a personalized drip-email campaign. And this workflow can enable that.

(To know more about WebEngage Journey Designer, click here)

And here are the sample emails.

The most amazing thing about customer journey mapping is that it can be adopted by any industry. To know more about WebEngage Journey Designer, check out this Blog Post or this Explainer Video. If you want to learn how this Journey Designer will compliment your B2C business, schedule a free demo now. We would love to have a chat with you.

Bonus Read – Conversion Funnel Optimization for Financial Services Companies – Part 3

Vanhishikha Bhargava

Vanhishikha Bhargava

Diksha Dwivedi

Diksha Dwivedi

Kasturi Patra

Kasturi Patra