If you’re from finance, you’re no stranger to the dramatically complex and long sales cycles in banking than in other industries.

And no matter how good the offers are, a high number of user drop-offs are inevitable. The reason?

Banking and financial service purchases are well thought through by prospects before putting their money on the table. So in most cases, they spend more time analyzing the offerings before engaging with a brand. Also, don’t forget the several alternative solutions across competitors laid out for them.

So what can banks and financial services companies do to overcome these barriers? Understanding how their audience interacts with them across various stages of the sales cycle can help you with the necessary insights to engage potential customers.

And that’s where funnel analytics step in.

What are funnel analytics?

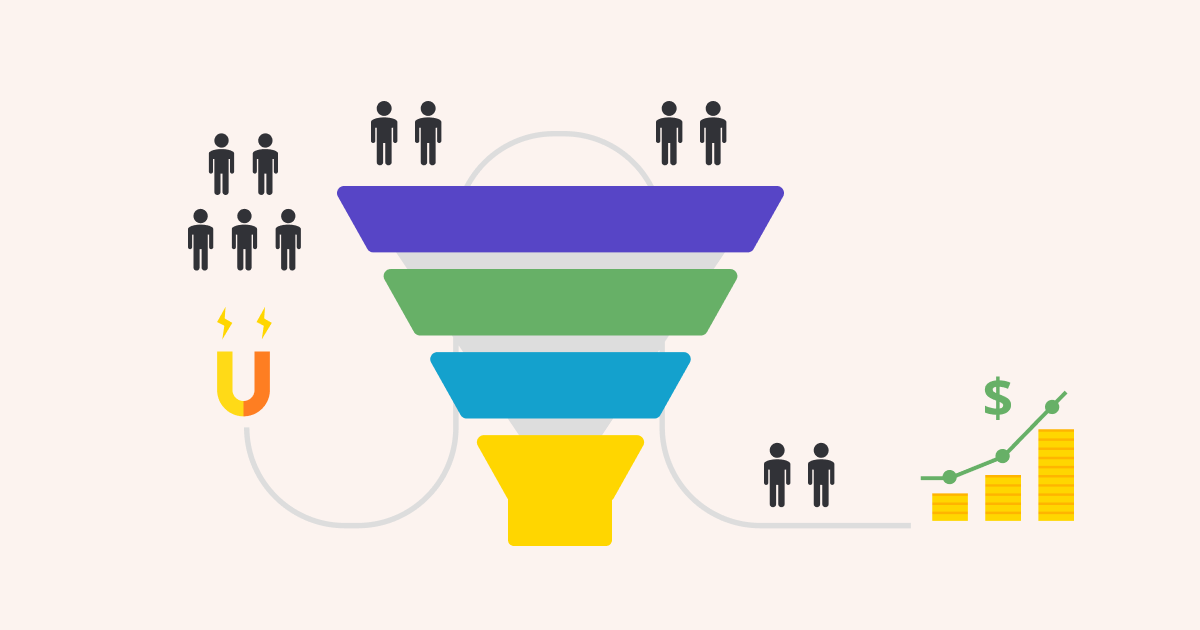

Funnel analytics is a process used to analyze the sequence of user events or actions leading to conversions. User events and actions for banks happen across your website, mobile app, products, promotional emails, paid advertisements, and other user engagement channels. It lets internal teams visualize, measure, and learn key user behaviors and tendencies across the customer journey.

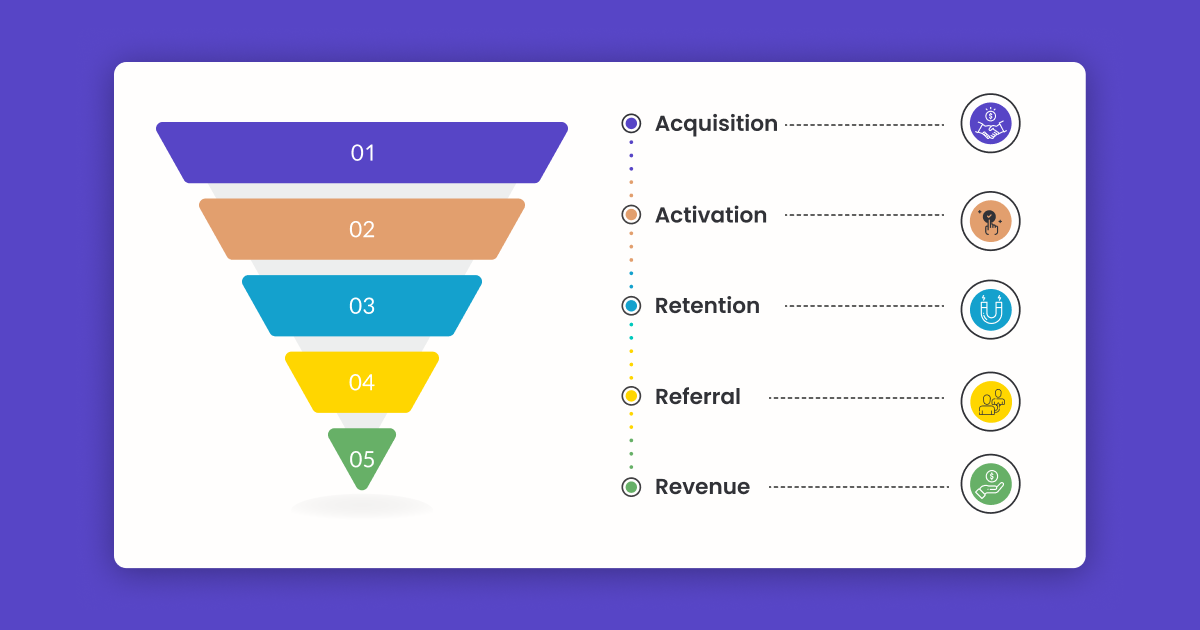

A typical funnel has the following key stages:

- Acquisition – Users engage with the brand through their preferred digital channels – this is the point at which the consumer discovers the products/ services of the bank and visits their website.

- Activation – Users activate their account or finish a purchase – this is the stage at which the interested consumer takes the next step to engage with the bank and can include things like filling out an interest form, registering for a banking account, and similar actions.

- Retention – Active users who are repeat customers and engage continuously with the brand – this is the stage that includes how the registered user now chooses to engage with the bank, including the services they avail or the products they purchase thereafter; for example, applying for a credit card after opening a bank account.

- Referral – Happy clients recommend the brand’s products or services to their circle – this stage includes the customer recommending the bank’s services/ products to their network, and making introductions.

- Revenue – The stage where you generate revenue from current customers – this is the stage at which your bank starts to generate recurring revenue for customers; be it through their existing purchases or the ones they buy after converting. For example, a credit card upgrade that they avail for a year.

What does funnel analytics mean for banking firms?

Funnel analytics, in banking, refers to the process of analyzing and tracking the customer journey at various stages, from initial interest to conversion (e.g., account opening, loan application, etc.) and beyond. The term “funnel” is used because the customer journey is often visualized as a funnel, representing the gradual narrowing down of potential customers as they progress through different stages of engagement with the bank’s products or services.

For example, funnel analytics for a bank means mapping out and exploring channels a potential client uses to engage with the bank, the time taken to move across the funnel, and when and where the conversions take place.

This could include measuring the performance and engagement on campaigns across email, SMS, web push, WhatsApp, and other channels.

8 ways to dissect your funnel for insights on user engagement

Extracting insights from funnels is not limited to one particular method. You can implement several methods to dissect your funnel and uncover insights.

Here are eight different customer-centric ways for you to use funnel analytics as a banking firm:

1. Analyze based on events

Analyze based on the prospect or customer interactions, aka events across the funnel. User events could result from your mobile app, website, and marketing campaigns like emails or paid ads.

For example, what’s the most common event performed by the users? It could be clicking on offers, viewing landing pages, filling an inquiry form, downloading brochures, using your web calculator to check loan eligibility, etc.

Similarly, campaign-generated user events could be interactions like web push clicks, SMS sent, emails opened, and so on.

Analyzing user events puts you in your prospect’s shoes and helps visualize their typical behaviors and specific actions they take across their journey interacting with your brand. It could be visiting or dropping off your site, installing/uninstalling the app, signing up for your services, etc.

By mapping out and analyzing these events, businesses can gain insights into the effectiveness of their marketing and product strategies and identify areas for improvement.

For instance, let’s consider an online banking platform.

The funnel analysis based on events could start with the event “User visits the website,” followed by “User clicks on ‘Open New Account’ button,” then “User fills out the account application form,” and finally, “User successfully submits the application.”

By analyzing the data, the bank can determine the drop-off rates at each stage, identify potential pain points (e.g., a high drop-off during the account application form), and optimize the user experience to increase conversion rates.

Furthermore, funnel analysis based on events can help the bank understand which marketing channels or campaigns are driving the most engaged users and, as a result, allocate resources more effectively to achieve their conversion goals.

2. Analyze based on the time between engagement

Marketers can use this method to analyze the time a user takes to first engage with your marketing campaign and move on to the successive stages. This approach provides valuable insights into the efficiency of the customer journey and helps businesses understand how quickly or slowly users are progressing through different stages. By studying these time intervals, companies can identify potential bottlenecks, areas for improvement, and opportunities to enhance customer engagement and retention.

Calculating the time prospects take between two points of engagement helps you understand:

- How long does a prospect take to evaluate their options before deciding to proceed or drop off?

- If the user dropped off, what was the decision-making window?

- If the user proceeded, what was the decision-making window? Total average time prospects took to drop-off

- Total average time prospects took to step into the next engagement stage.

- How effective were the campaigns in reducing drop-offs and encouraging engagement?

Here’s an example:

As a BFSI company, you can calculate the time between a potential client reaching out to enquire about a credit card to actually applying for the card to avail of the service.

This analysis helps banks streamline credit card service request processes, identify potential bottlenecks, and improve customer experience.

3. Analyze based on the time to convert

Analyze funnels based on the time taken to move from an engagement stage to conversion. For example, the total time to convert a user right from initial awareness about a savings account to become a customer is approximately one week and a few days.

This step is essential because it can:

- Indicate the prospect’s time taken to evaluate their decision and choices.

- Highlights the effectiveness of your campaign setup and placement and if they helped prospects take the final call.

- Can impact how you compensate your sales team responsible for winning new clients.

- Can impact the length of your sales cycle and bottom-line revenue as it helps you identify what engagement step causes the most drop-offs, so you can work to fix the root cause.

By tracking the time to convert, the bank can identify opportunities to streamline the application process, potentially enabling more customers to convert faster. For instance, they could optimize the online application form, offer online verification options, or provide instant account activation for certain eligible customers to reduce the overall conversion time.

4. Analyze channel-wise campaigns

Where are your best customers from? SEO, search ads, social media, emails, SMS, WhatsApp, web push, and direct mail – finance companies have high-intent customers coming through multiple touchpoints.

And this calls for a multichannel marketing strategy.

Multichannel marketing makes it possible to reach audiences through their preferred channels, boost engagement, and streamline client journeys.

However, knowing which channel drives the most engagement to move a prospect to the next stage of the funnel is equally essential.

By understanding which channels perform best at each stage of the customer journey, banking firms can create tailored content and offers for each platform, enhance customer experience, and ultimately boost conversions. Additionally, this analysis enables companies to optimize their marketing budgets, focusing more on the channels that deliver the highest ROI and maximizing their overall marketing effectiveness.

Furthermore, combining data from different channels can provide a holistic view of customer behavior, helping finance companies create cohesive and seamless experiences across touchpoints.

For example, a prospect who first engages with a search ad might later convert after receiving a personalized email or SMS offer.

So analyze campaigns channel-wise to identify the top acquisition channels that trigger more engagement.

5. Analyze to segment prospects

User segmentation helps create hyper-personalized messaging and campaigns, which can directly impact your bank’s success. That’s because segmenting users based on shared characteristics lets you address each group’s pain points and customize your offering.

Analyzing funnels to segment prospects using RFM analysis – Recency, Frequency, Monetary, and grouping customers into active and inactive users is a powerful approach to understanding engagement levels and prospect behavior at different stages.

The RFM analysis is basically a method that evaluates a customer’s recent interaction, purchase, frequency of purchases, and the monetary value of purchases, helping businesses segment customers in a much similar fashion as warm and hot leads.

Based on the RFM analysis and funnel segmentation, businesses can create tailored marketing strategies for each customer segment.

For example, the active segment of customers can be offered added benefits on their credit cards, loyalty points for online purchases, or a free upgrade on their bank account.

Similarly, for the inactive segment of customers, banking institutions can use reactivation campaigns that are focused on offering competitive service rates on credit cards or discounts on banking services.

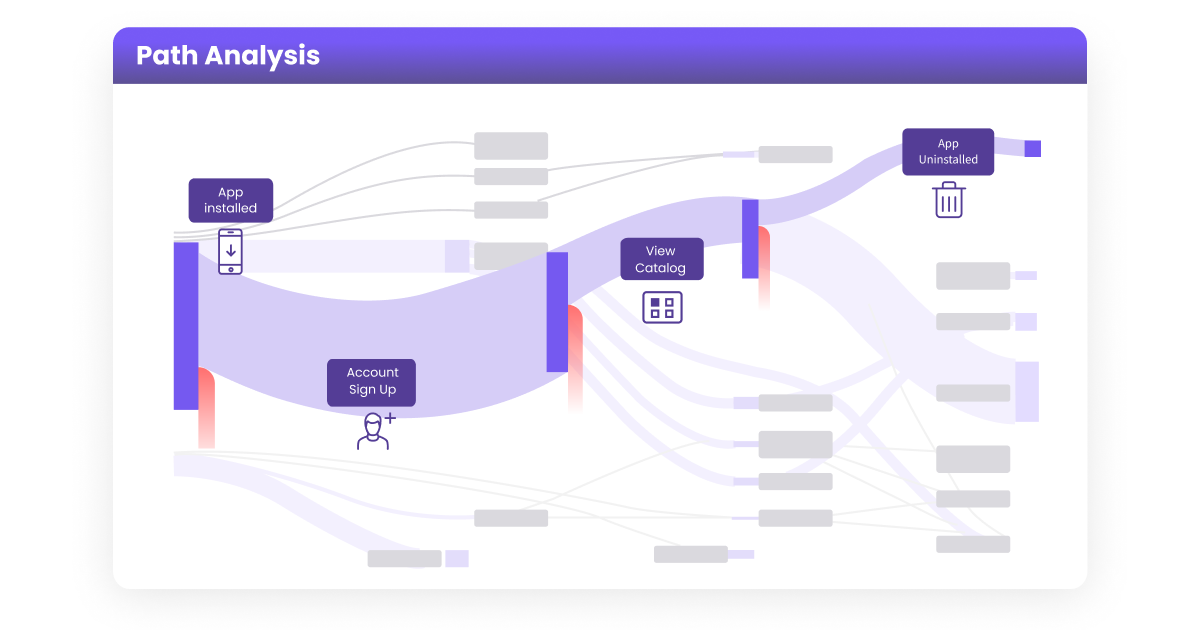

6. Analyze the journey

Want to find the most optimal path to conversions? Analyzing your audience’s journey can help.

Analyze your target audience’s journey, from learning about your banking services to becoming a customer. Analyzing their path can help you see how most prospects start their journey with your bank, what their favorite channels of interaction are, and what stage they are at in each channel.

Path Analytics by WebEngage helps you analyze how users prefer to interact with your digital touchpoints and what path drives them to the most optimal flow, for example, right from visiting your website to calling an agent to probe about the different types of credit cards available.

7. Analyze based on revenue

Funnel analytics can also be used to track the revenue generated from different products, services or customer segments that the banking institution addresses. This can help identify which products or services are a hit amongst which segments, and which of them are slower-selling due to complex customer journeys or inadequate resources.

Analyzing the funnel based on revenue can help banking institutions identify trends and patterns that impact their revenue growth. This helps them focus on growing the right arm with optimized resources to fuel marketing, sales and support to customers.

For example, if a zero-balance bank account helps attract a younger segment of customers, the bank can evaluate if the customer’s savings add enough value or hold the potential for service upgrades that can add to the revenue.

8. Analyze to identify qualified leads

Lead quality is quintessential for your banking firm’s success.

So how can you start analyzing funnels based on the quality of leads your sales teams generate? Here are some ways to do this:

- Visualize your funnel’s digital channels and analyze which of them drive various types of leads. For example, hot leads, cold leads, marketing-qualified leads, sales-qualified leads, etc.

- Note what’s common amongst your hot marketing or sales-qualified (high-quality) leads.

- Calculate the time taken by high-quality leads to move down the sales funnel to a point of conversion.

- Calculate how much revenue each type of lead adds to your business.

Let’s explain this way of analyzing the funnel with a more specific example or instance of a banking institution:

- Define the criteria that signify a qualified lead for the bank – this can include factors like financial needs, level of income, credit score, and the potential length of the relationship with the bank.

- Using the lead scoring system and qualification criteria, identify leads who meet the threshold of being qualified prospects – these are consumers who are more likely to benefit from the bank’s products and services and have a higher potential for conversion.

- Identify the nurture path for these leads – nurturing qualified leads with relevant and valuable content can help build trust and increase the likelihood of conversion.

- Create an engaging customer journey – focus on converting qualified leads into customers and providing excellent customer service to drive retention and repeat business.

Conclusion

Banking is one industry that sees the most drop-offs in the buyer journey on account of long and overly complex sales cycles.

Funnel analytics. help you uncover how a prospect moves through your funnel and the optimal conversion path.

Analyze funnels based on prospects’ events, time between engagement, conversion time, channel-wise campaigns, user segmentation, buyer journeys, channel-wise revenue, and the quality of leads generated.

With a complete channel overview and funnel performance, banks can identify areas of improvement, streamline user journeys, and optimize marketing efforts to attract and retain high-quality customers.

Having a complete channel overview and funnel performance plays a major role in breaking the long and tedious sales cycles.

WebEngage can help your bank get a hold of in-depth data-backed insights, optimize user journeys, identify top channels to acquire customers, and so much more.

Sharath Byloli

Sharath Byloli

Kasturi Patra

Kasturi Patra

Dev Iyer

Dev Iyer