By 2025, the Indian fintech market is expected to touch $1.3 trillion.

Lending tech firms have the potential to claim a massive chunk of this pie – a whopping 47% that translates to $616 billion. However, with all the tech and digital-first initiatives to leverage this tremendous growth, one of the biggest challenges faced by the fintech industry today is – funnel leakage.

Much of this leakage stems from intangibles like a lack of trust and transparency. Customers are cautious about sharing personal financial information online and borrowing money through digital platforms. Valuing their caution is where secure transactions, transparent terms, clear communication, and a smooth customer journey become the pillars of trust and better user engagement. Strung together, they can optimize your funnel and fix the leakage.

What’s the fuss about funnel optimization?

Brands fuss over it because it paints a vivid picture of where potential borrowers drop off, where they’re most engaged, and which stages require extra marketing efforts. It’s like having an x-ray vision that reveals your customers’ pain points, desires, and behaviors. This knowledge is instrumental in crafting strategies that resonate with the target audience and drive them further down the funnel, and thereby drive funnel optimization.

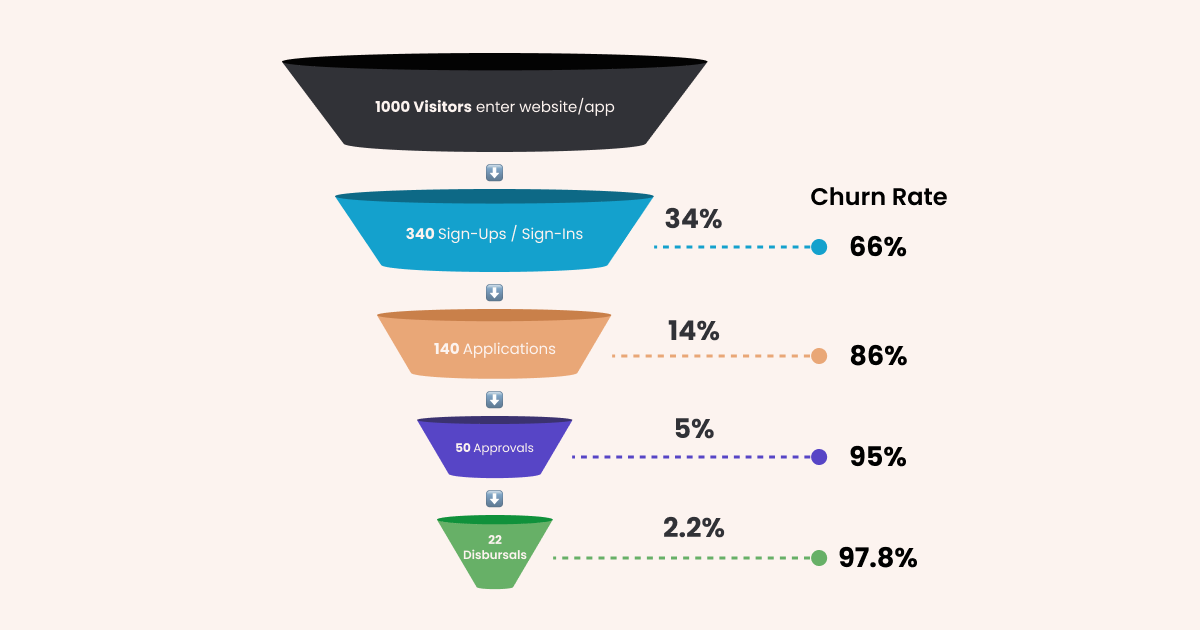

A typical user journey in a lending website/app looks something like this.

The funnel-optimization strategies you are about to learn will be applied across the above 5 funnel stages.

How do you go about funnel optimization?

It’s more than just pushing a few buttons. To get you started, here are five ways to dissect your funnels for insights that will result in elevated user engagement. The funnel-optimization strategies you are about to learn will be applied across the below 5 funnel stages.

1. 🔬 Keep a close watch.

A whopping 73% of new fintech users churn within just 7 days. When a major chunk of your audience drops off almost immediately after interacting with your platform, it indicates underlying friction points. These drop-off points could emerge from various issues, namely a complex application process, unclear terms, or a dull user interface.

To counter this, dissecting your funnel analytics and identifying stages where users typically leave is essential. Is it during the onboarding process? Or perhaps during the initial product exploration? Highlighting these stages allows you to pinpoint areas that need finessing.

Once you’ve got a handle on where these drop-offs occur, you can start targeted improvements for a frictionless experience.

Onboarding communication:

Outline the user journey for your users with crisp onboarding communication. Simplifying these segments can keep users engaged longer and set the right expectations.

Clarify Offerings:

Ensure product and service descriptions are clear, compelling, and tailored to the user’s immediate needs.

Enhance Engagement:

Introduce interactive elements or tutorials to guide new users, making them feel supported through every step. Incorporate additional outreach channels to boost engagement.

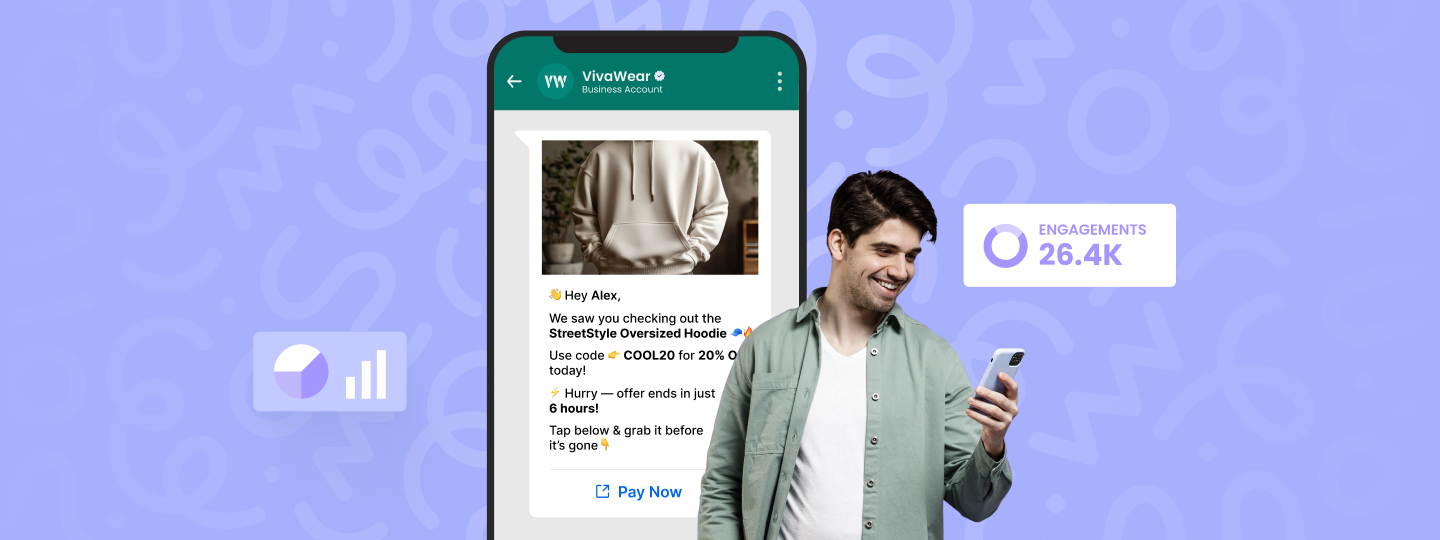

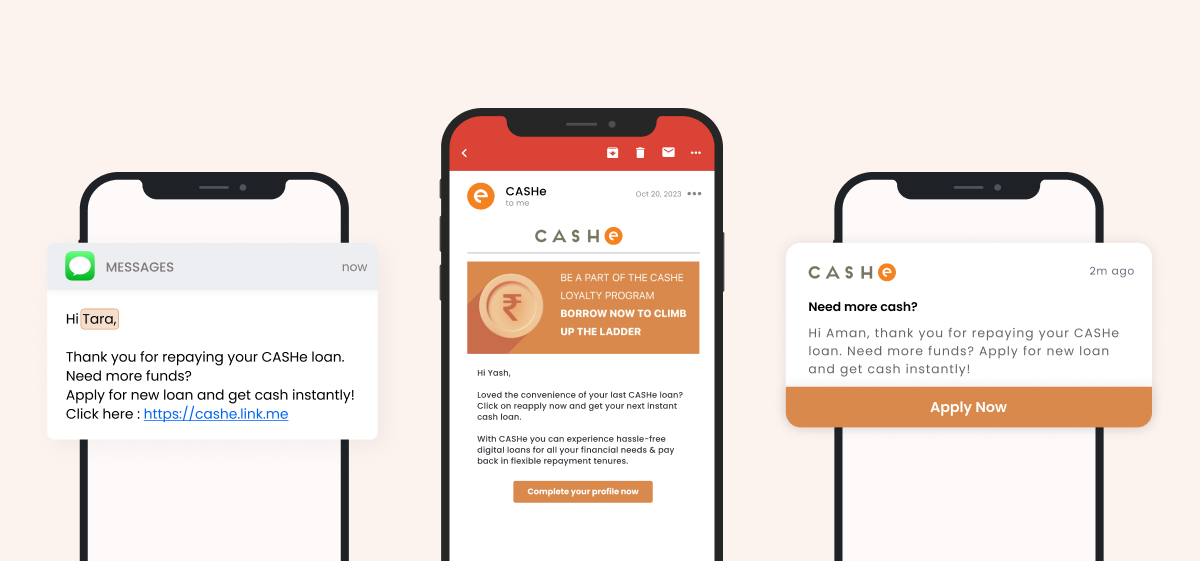

Below is an example of CASHe, a lending platform. They wanted to encourage existing borrowers to take repeat loans because an increased percentage of repeat loans directly would translate into more revenue, thus fueling business growth for them.

As a result of event-based, timely communication with borrowers, 42% of CASHe’s borrowers applied for a repeat loan within 4 days of repaying the initial loan, and the value of loans disbursed spiked by 300%. If you are curious to understand CASHe’s approach, it’s outlined in this Impact Story.

2. 👁️🗨️ Look for a 360-degree view.

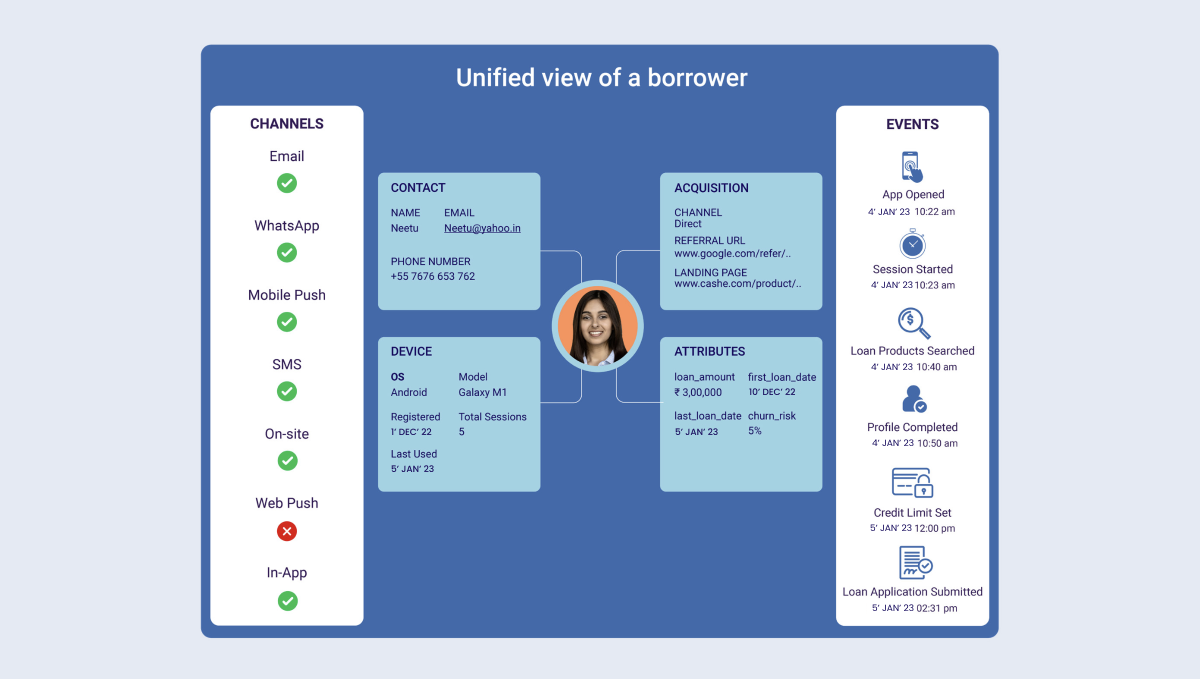

When leads drop off at any stage in their lifecycle, they leave traces of data and behavior behind them. These data breadcrumbs are in the form of attributes like

- Device & Browser used

- Acquisition channel

- Events performed on the website/app

- Contact details

- Offline events, and so on.

CASHe, the same brand mentioned earlier, had the leads’ data, but it wasn’t consolidated on one platform for a 360-degree view of each lead. To set up an effective process for converting leads into borrowers, CASHe had to solve this complexity by

• Drawing up a unified view of the dropped leads

• Hyper-personalizing the communication for each lead

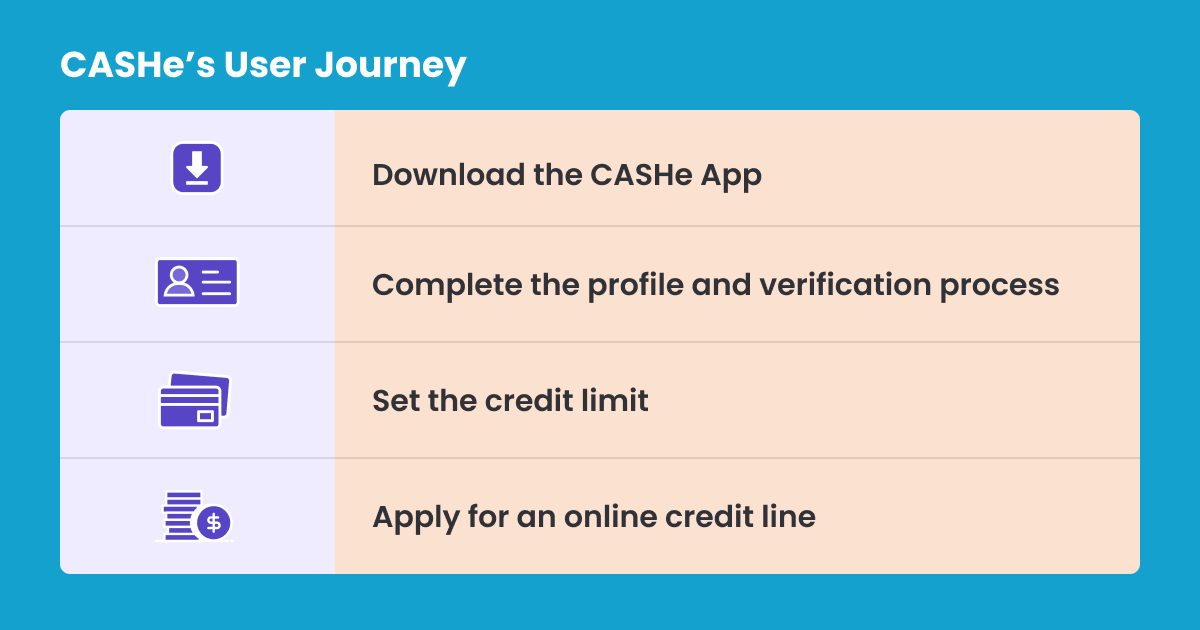

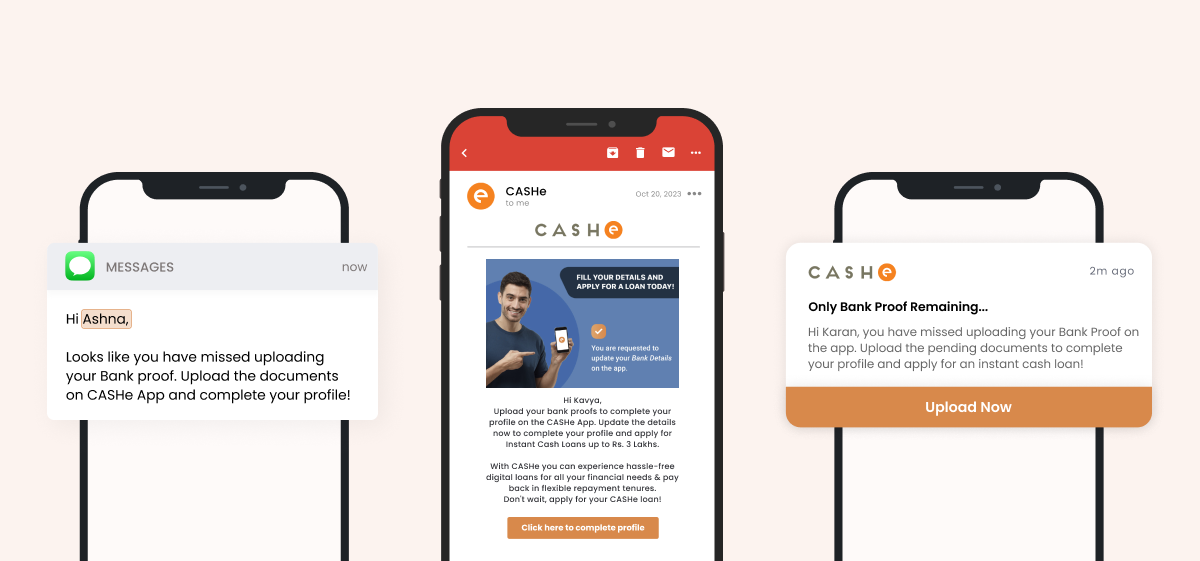

After installing the CASHe app, leads were asked to complete their profile by uploading relevant identity proofs and documents. Through this unified view, CASHe knew who completed their profiles and who didn’t.

Leads who didn’t complete their profiles were nudged to do so across channels like SMS, Email, Mobile Push Notifications, and Interactive Voice Response (IVR) to avail of instant cash loans as an incentive.

Here’s a step-by-step walkthrough of the process:

Step 1: Users install your app on their device and sign up

Step 2: Users complete their profile by submitting relevant information (Educational qualifications, employment details, purpose of loan etc.) and documents like- identity proof, address proof, income proof, etc.

Step 3: All the user documents are verified to assess loan eligibility and provide the befitting loan as per individual needs.

Step 4: An incentive-based campaign is launched across channels- SMS, Email, Mobile Push Notifications, and IVR to motivate users who haven’t completed their profiles.

These steps help you simplify borrowers journey. You can introduce these steps progressively on the app to minimize cognitive overload.

By having a unified view of each lead and engaging them contextually, CASHe caused 47.14% of leads to apply for a loan, along with a 75% reduction in man-hours. CASHe’s journey is broken down in this Impact Story. Give it a read to learn more about funnel optimization.

3. 👥 Our next segment is…

Understanding the different segments of your audience. It allows you to tailor your messages, offers, and content in a way that resonates with each group uniquely. Let’s break down how customer segmentation looks for a lending company.

Demographic:

Based on age, income, education, and more, this is where you target specific loan offers to enable funnel analytics.

For instance, student loans might be aimed at younger demographics, while premium loan products might cater to those in a higher income bracket.

Bank of America brilliantly segments its customers into distinct categories like young adults, families, retirees, small business owners, and high-net-worth individuals.

Behavioral:

This dives into how customers interact with your platform – Where in the funnel do they spend the most time? Are they first-time or repeat borrowers?

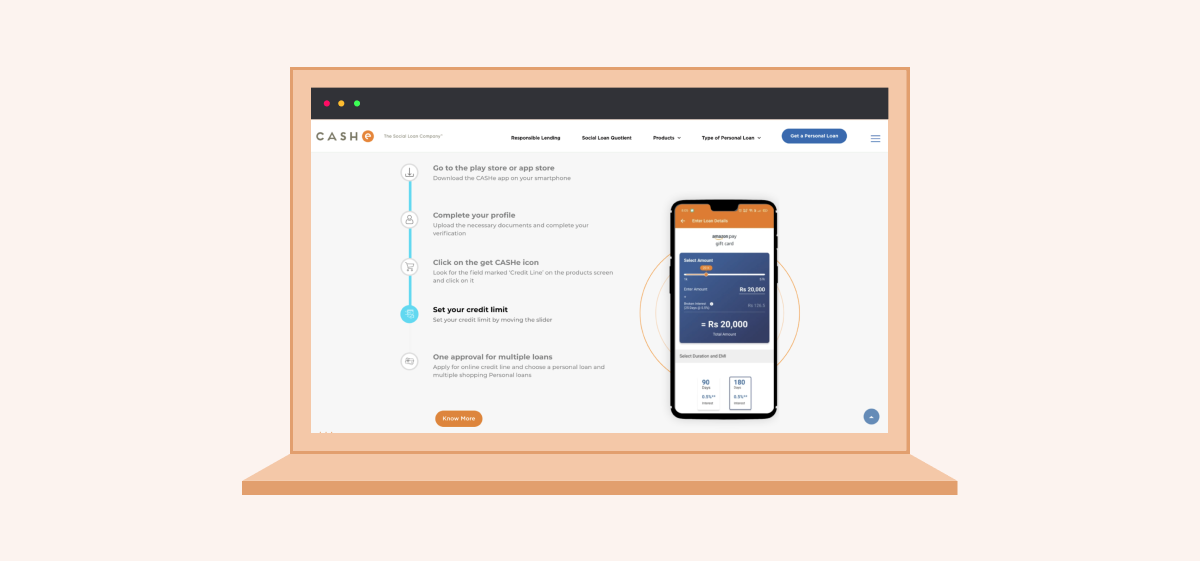

Behavior is chiefly influenced by UI/UX. People do judge a book by its cover. The UI on your platform can make or break your user journey. Placing CTAs and placing them where users are likelier to click can make a world of difference. Note how CASHe has a distinct CTA called ‘Get a Personal Loan’ and an entire fold on its landing page for detailing the process to get a credit line and get multiple loans with a single approval because they deduced it could be a focal point for website visitors.

By gauging these behaviors, you can adapt your approach to guide them seamlessly down the funnel.

Geographic:

Geographical segmentation allows you to design location-specific offers and strategies. Segmentation can happen by states, cities, neighborhoods, and even township-specific.

Notably, people living in cities with solid roads will be enticed by specific offerings like high-end vehicles, whereas people in towns with rocky roads might be recommended two-wheelers or all-terrain vehicles.

The general consensus is that, for example, people in cities tend to have a rather structured credit history as opposed to other places. Smart marketers tweak their messaging to fit the desired audience.

Technographic:

Understanding the devices, software, and platforms your customers are using is vital. Are they mobile-first users or desktop enthusiasts? This data helps in optimizing user experience across different platforms.

Risk-based:

Risk forms the backbone of the lending industry. Segmenting customers based on their risk appetites ensures that you’re recommending products that align with their comfort zones. Whether they’re risk-averse or more adventurous in their financial pursuits, curating products that fit these profiles enriches the user experience.

Pro-Tip: Predictive segmentation can help lending businesses like yours to segment users based on their likelihood of taking risks.

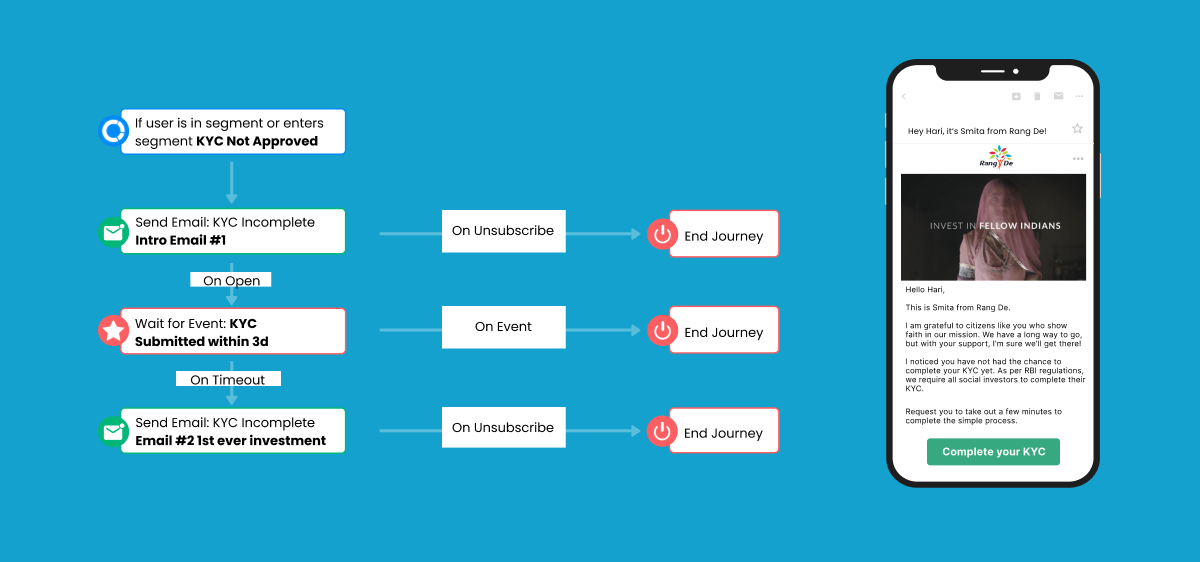

RangDe, India’s first social peer-to-peer lending platform, uses WebEngage’s journey designer to orchestrate a user journey to send event-triggered emails to users when they abandon their KYC applications.

With this tactic, RangDe managed a 7.7% increase in Signup to KYC conversions. To learn more about RangDe’s journey, check out their Impact Story. This was their strategy for funnel optimization.

4. 👔 UX is like a suit. Better if it’s bespoke.

No matter where the user is on the platform, what they see is what they perceive, and what they perceive is your responsibility.

We spoke about how valuable UI is, but the User Experience (UX) you offer will decide whether they apply or abandon, and a large chunk of UX hinges on hyper-personalization. By offering individualized content, you can guide potential borrowers more effectively. This includes providing insights about document requirements, agent details, processing fee payment modalities, and more. You can also add triggered nudges or reminders to ensure that they stay the course.

Nidhi Saraswat, Head of Digital Marketing, Strategy & Growth at Tata Capital, in her masterclass titled The Metric Obsessed Conversion Playbook, offers an intriguing solution: pre-filling application forms based on obtained data. Such intuitive steps can significantly ease the application process by reducing friction making users feel valued and understood, hence boosting conversion chances.

5. 🙋🏼♂️ Ask Where, When & How Likely?

There’s a lot of chatter around AI/ML, but their practical marketing applications are seldom talked about. In truth and theory, the applications are exciting. Take a look at WebEngage’s AI/ML features, which are reshaping user engagement not just in lending but across the board.

Where?

Lending businesses can identify the preferred channel of the user by studying their behavior. WebEngage’s Best Channel Selection effortlessly informs brands which channel/s the user would prefer by evaluating their browsing habits and preferences.

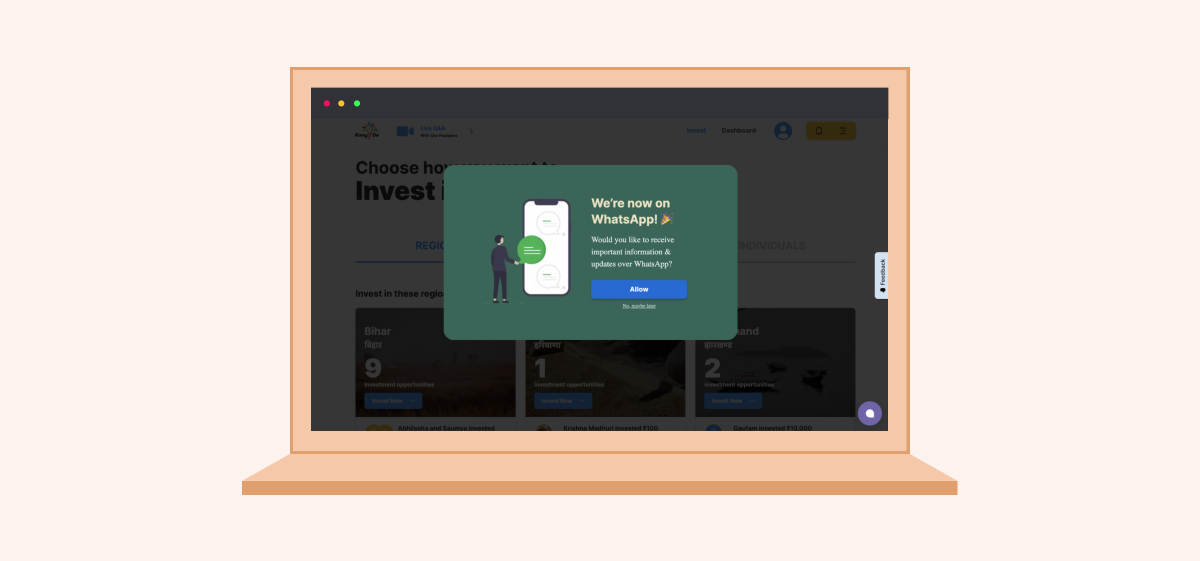

Alternatively, you may explicitly ask users whether they’d prefer a certain channel.

In the screenshot below, RangDe asks users if they’d prefer WhatsApp as a channel. Should they opt in, they’d be engaged on WhatsApp.

Features like Best Channel Selection lets you engage users where they’re available.

For example: If a user is active on WhatsApp, it makes little sense to engage them with SMSes or push notifications. Connecting with them on their preferred channel mitigates missed opportunities, saves costs, and avoids spam.

When?

You know the ‘where’. Now, it’s time to figure out the ‘when.’

WebEngage’s Send Intelligently helps you discover and leverage the ideal send-time for each user. It decides the best time to send communications based on a user’s interactions with past campaigns of each channel.

How Likely?

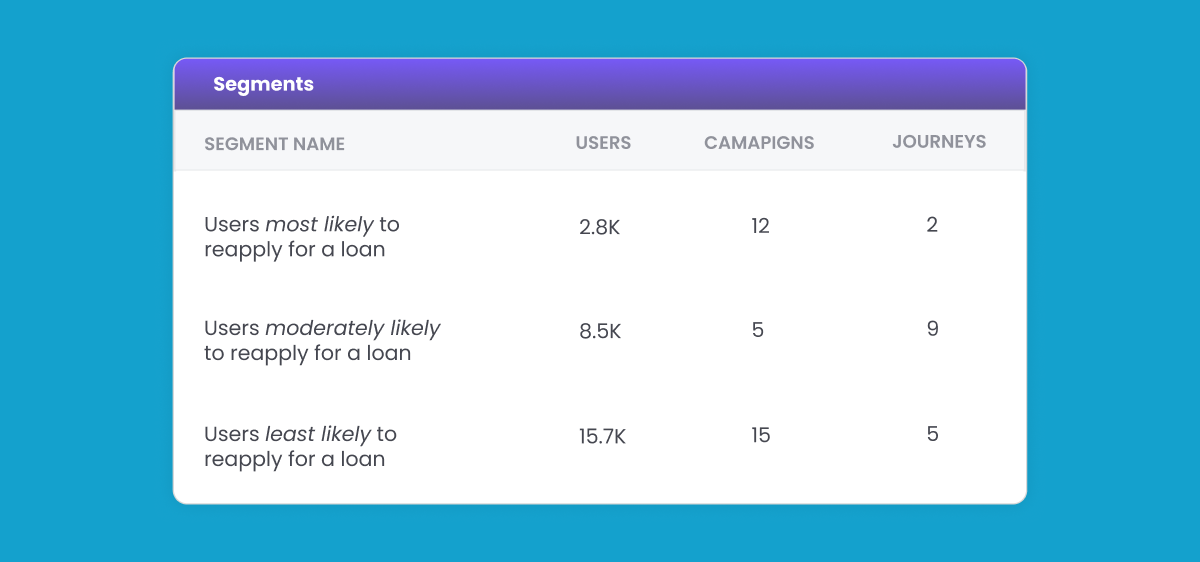

Predictive segmentation is a technique that allows you to create segments based on the user’s propensity for a defined action, such as the likelihood of purchase.

Like creating lookalike audiences, predictive segments leverage machine learning to create a list of users with a ‘likeliness to’ perform a certain action, such as likely to purchase or churn, and will then create 3 lists – most likely, moderately likely, and least likely – for the selected business goal.

-

Example of a predictive segment for a lending platform:

This is how you can use predictive segmentation to further enable funnel optimization.

🤝🏻 What’s next?

Funnel optimization has been distilled down to a science, and considering the arsenal of available tools, there is no excuse to shy away from fixing your funnel leakages. Having said that, there are additional nuances that come to light when you sit on the workbench and do the heavy lifting yourself.

Fortunately, WebEngage has been doing the heavy lifting for brands like yours and helping them fill in the missing pieces of the puzzle. Be it drop-offs, CRO or segmentation, our marketing minds are adept at hand-holding both new-age and legacy brands.

If you are curious to know how we can perfect your funnel optimization strategy, we offer a free demo. Schedule one with us, and let’s explore how we can help each other grow.

Diksha Dwivedi

Diksha Dwivedi

Prakhya Nair

Prakhya Nair

Vanhishikha Bhargava

Vanhishikha Bhargava