Introduction

Customer retention refers to the activities and measures businesses and organizations employ to lower the rate of customer churn. By promoting customer loyalty and brand loyalty, customer retention programs frequently aim to assist companies in keeping as many customers as possible. Customer retention starts with a customer’s initial interaction with a business and lasts the duration of the relationship.

However, churn management is spotting the valuable clients who are most likely to leave a business and taking preventive measures to make them continue doing business with the brand.

Both customer retention and churn management are crucial for the success of any business since they demonstrate how successful a company is at keeping its current customers satisfied. Additionally, they enhance customer loyalty, increase ROI, and attract new clients.

This blog covers the importance of customer retention and churn management strategies across industries like D2C, E-commerce, BFSI, Edtech, and Gaming, Media & Entertainment.

- Table of contents:

- Defining Customer Retention

- Defining Churn Management

- D2C

- E-commerce

- BFSI

- Gaming, Media, and Entertainment

- Conclusion

Customer Retention

- Customer retention rate is the number of users who continue to use your product or service over time. This indicator shows how well your company can keep customers from switching to rival brands, entice them to buy more products from you in the future, or keep using your product regularly, all of which help your company grow over the long term.

- Customer retention starts with a customer’s initial interaction with a business and lasts the duration of the relationship.

Churn Management

- Churn management is the art of spotting the valuable clients who are most likely to leave a business and taking preventive measures to keep them.

- Customer churn is the proportion of customers that stopped using your business’s goods or services over a predetermined period. It is usually determined by dividing the number of consumers you lost during a particular period (for example, the preceding quarter) by the total number of customers you had at the beginning.

Let’s Understand How Customer Retention And Churn Management Take Place Across Industries

1. D2C

The phrase ‘direct-to-consumer,’ commonly D2C, is a business that manufactures and sells a specific product. A vertical business model that, with the aid of a well-thought-out strategy, including digital marketplaces, subscription services, and e-commerce platforms, may be effective for practically any industry.

However, the true beauty of Direct-to-Consumer (D2C) lies in the fact that there is no requirement to use a distributor or middleman to reach the final consumer.

Due to the fierce competition, D2C businesses must establish enduring relationships with their clients. A strong client retention strategy could set you apart from other e-Commerce marketplaces and your rivals.

Now let’s understand the benefits of customer retention and how customer retention works under the D2C model-

- ROI on client retention is three times higher than ROI on customer acquisition.

- There is no need to expand aggressively when you can enhance sales and profit even with a small customer base.

- Reaching out to current customers is extremely simple and cost-free; recruiting new customers can exhaust your marketing budget.

Improving Customer Loyalty:

1. Measure First, Then Improve:

Before moving deep into the water, we need to know how deep in the water we are. Therefore, we need to answer some questions before measuring our current efforts:

- What’s our repeat purchase rate?

- Are there any campaigns to encourage people to stay or return?

- When do higher income cohorts appear?

- What is the average customer lifecycle timeline, and how does our customer lifetime value appear?

2. Customize ongoing user engagement:

We must engage with the customers on a personalized approach so that it repeats the frequency of visiting your store/website. Since customers are everywhere, it’s essential to identify which channel your customer is most active on and thereby use that channel to target them accordingly.

3. Utilize digital channels:

Giving the advantage to your customer to shop from any channel (online or offline) they want for their ease and convenience.

4. Create dedicated marketing campaigns:

Create targeted marketing efforts launched in response to past purchases and behavior history, particularly for perishable goods. If you sell a monthly bag of tea leaves, you might send a 20-day reminder to customers to let them know their supply of tea is about to run out.

Reduce Churn:

1. Identify your right customers:

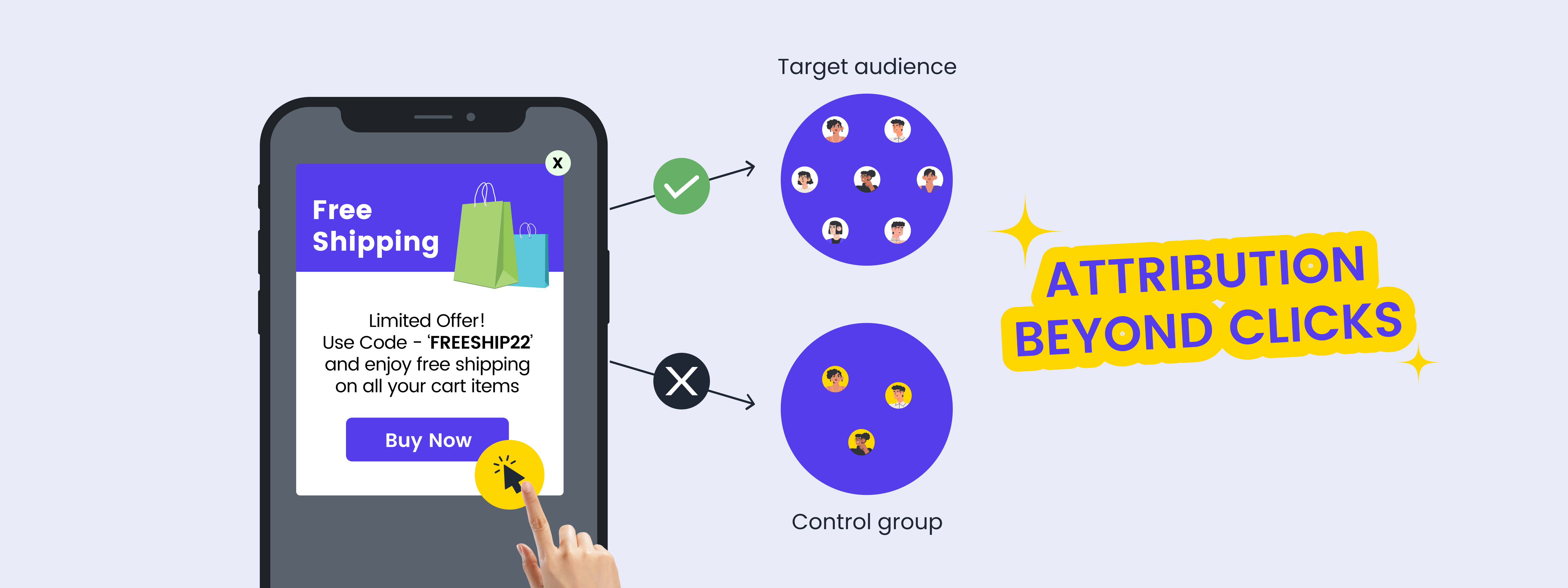

The business needs to identify the right customer base. Rather than putting incentives and strategies to those customers who are likely to churn, it’s crucial to identify long-term customers who are likely to stay longer.

2. Use customer segmentation:

To increase sales, we need to identify the customers that frequent our store. For instance, there may be customers who purchase items infrequently or regularly and those who do not intend on making any further purchases. To gain the trust of our customers, we must refrain from presenting them with a product they do not want in hopes of an eventual purchase.

Through specific marketing campaigns like email, push, and others, we can narrow down the customer base, and thus that will help in reducing churn.

3. Offer incentives and asking for discounts:

Offering timely incentives, discounts, and promo codes aid in customer retention and ultimately reduces customer churn. At the same time, companies must ask for timely feedback from their customers to express where they can improve and what is not working out. This helps in building trust with the customers and thereby reducing customer churn.

The image below shows a great example from Amazon.

2. E-commerce

Improve Customer Retention

1. Create a fantastic onboarding experience:

Welcome messages, video guides, and live training significantly impact the customer in gaining a positive first impression of the company.

2. Provide personalized recommendations:

Analyzing customers’ past purchase data and providing personalized recommendations based on their choices of what they can buy according to their interests.

3. Add subscription plans:

For the customers who make regular purchases, providing them with yearly or monthly subscription plans with unique benefits will help maintain long-term relationships for you and make their purchase process earlier.

Reduce Churn

1. Identify the causes of customer churn:

Asking the consumers to explain their decision to quit their membership or sending them automatically generated, personalized exit emails are two ways to handle the customer churn rate statistics for your e-commerce business.

2. Maintain transparency with consumers:

Being open and honest about the process is one of the most critical steps to maintaining its customers’ trust. When a consumer files a problem, you should note it and keep them informed at every stage of the complaint-resolution procedure.

3. Banking, Financial Services, and Insurance (BFSI)

Improve Customer Retention

1. Decrease costs:

A bank’s overall efficiency can be improved in several ways by enabling customers to conduct transactions effortlessly via a mobile app rather than in person, including:

- Going paperless aids banks in being more ecologically friendly.

- It costs less to print and distribute.

- It lessens the need to bring on new personnel.

2. Improve customer experience:

The capacity to provide a great customer experience is a key factor in every business’ success, especially when talking about customer loyalty. The following factors, for example, play an important role in influencing customer preference for mobile banking:

- More accessibility: Customers can use a bank’s mobile app 24/7 to see their accounts, deposit checks, and more, as opposed to visiting a branch, which is only available during business hours.

- Instant services: Another reason clients favor mobile banking is to satisfy their needs, which promotes bank loyalty quickly.

- Personalization: By giving users access to a mobile app, banks can offer a more tailored experience, which is something that all apps and companies value.

Reduce Churn

1. Understand your customer via utilizing clever insights:

Financial organizations must examine their current data ecosystems before making sizable investments in Machine Learning (ML) or Artificial Intelligence (AI) techniques. To enable quick and precise data analytics, data transformation is necessary to prepare the underlying datasets for analysis.

2. Add product variety:

When shopping for expensive things that need financing, customers want options and to feel like they got the most excellent deal. According to a study by Qualtrics, many customers keep their current and savings accounts at their primary bank. Still, they continue browsing for better deals on credit cards, mortgages, auto loans, investments, and mortgages. As was already indicated, by implementing a plan to provide competitive rates on long-term, higher-profit investment vehicles, your close relationship with your customers can keep their money in-house.

3. Improve quality of digital tools:

According to a poll of banking clients, 69% spend their time banking online and in-app — of which 79% constituted of millennials. You must ensure your online and mobile experiences are seamless, simple, secure, and pleasurable for managing your funds since more of our daily demands are satisfied with a smartphone. Adding educational materials on financial investments and other unconventional services is also a worthwhile alternative for digital users.

4. Gaming, Media, and Entertainment

Improve Customer Retention

1. Know your customers and their frequency of return visits:

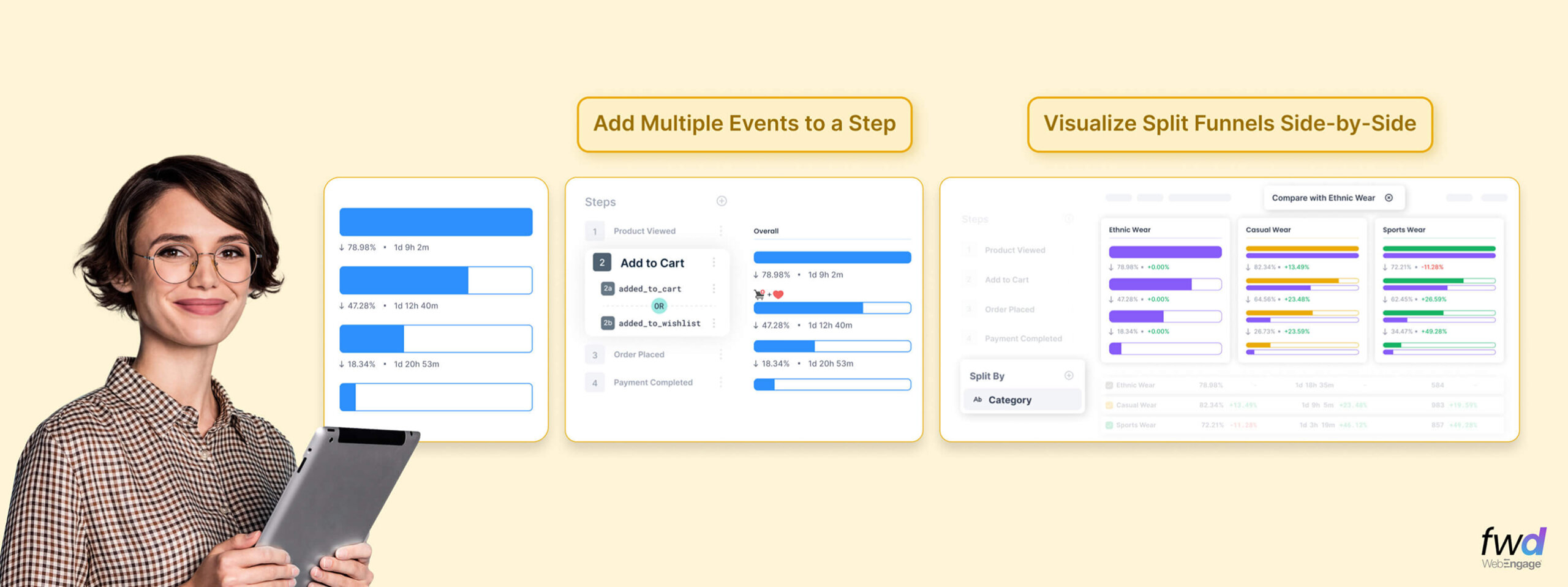

Whether it is gaming or the world of media and entertainment, it is vital to understand audience loyalty which requires analyzing visitor behavior and to do a complete analysis, you need ideal and high-quality data. Retention graphs are a valuable tool for visualizing returning visits. Schedule a demo with WebEngage to explore how the platform can assist your e-commerce business in obtaining customer analytics.

2. Segment users:

With digital analytics and segmentation, you can predict Customer Lifetime Value (CLTV), deepen brand engagement, enhance visitor spending, generate brand ambassadors, and more, to attain your goal of increasing customer loyalty. Finally, it is crucial to divide populations that are vulnerable to churn. You can create segments based on subscribers who use your website less frequently for media publications and subscriptions (churn indicators vary between companies).

3. Bring motivation comes from incentives:

As previously discussed, you must give users a compelling incentive to participate in your promotion. At this point, prizes and exclusive deals can be offered when it comes to gaming, media, and entertainment.

Reduce Churn

1. Pay attention and engage:

With gaming/movies, ask your participants/viewers for their honest feedback about the game. The most crucial thing is not to dismiss the positive or negative input. Respond to their questions and, if you can, offer solutions to the best of your capacity. As a result of that perception (that you are trying your best to address their issues), you may retain more players/viewers.

2. Be Patient with offers and ads:

Every developer wants to make money from their game, through in-app advertisements, in-app purchases, or both. However, many people make the error of being overly pushy with several offers and ads that are displayed too frequently and interfere with the gameplay. For precisely those reasons, many players change teams. If you suspect that’s the case with your game, reduce the intensity and reconsider your monetization plan.

3. Activate users with relevant content:

Focus on aligning the content you stream with the preferences of your target market if users of the platform appear not to be enjoying the content there. It’s best to inform clients of upcoming content updates to give them a reason to stick around. Similarly, viewers whose participation has lately decreased may be reactivated through social media or email campaigns that extend an invitation to watch once again.

Conclusion

To maximize success and profitability, it’s essential for businesses not to forget about the valuable customers they already have. Investing time in strengthening customer relationships can lead to many advantages, from enhanced reputation and reduced costs due to decreased advertising investments when retaining current clients.

Enhancing customer loyalty is a vital factor in sustaining business success. By focusing on client retention and ensuring current customers are satisfied, you can maximize growth opportunities while expanding our reach to new ones.

You can do a lot to reduce customer churn and ensure customers don’t leave your platform. Take a demo with WebEngage and boost your revenue, sales and business today.

Prakhya Nair

Prakhya Nair

Inioluwa Ademuwagun

Inioluwa Ademuwagun

Harshita Lal

Harshita Lal

Vanhishikha Bhargava

Vanhishikha Bhargava

Priyam Jha

Priyam Jha

Manoj Chawda

Manoj Chawda