Have you ever wondered what transforms a BFSI (Banking, Financial Services, and Insurance) company from just another service provider to a trusted financial partner that customers have stuck with for decades? The difference is not in excellent infrastructure, best hires, solid technology, or even branding or marketing. It lies in how the company treats its customers. It lies in the customers’ experience with the company.

Today, we’ll explore the art and science of customer experience in the BFSI sector. Let’s walk through what makes the customer experience non-negotiable and, most importantly, how your organization can master it to build lasting customer relationships.

Let’s cut to the chase.

What is BFSI Customer Experience (CX)?

In the BFSI sector, customer experience refers to the overall perception that customers develop through their journey with banking, financial services, and insurance companies. Imagine opening a new bank account–your experience isn’t just about the final outcome but every step along the way. From browsing the website and filling out forms to interacting with staff and making your first deposit, each touchpoint shapes your impression of the bank.

These touchpoints include:

While excellent customer service in BFSI is crucial, it’s just one piece of the CX puzzle. Think of customer experience as the entire journey, while customer service is like a helpful guide you meet along the way. For instance, a bank might offer outstanding customer service, but if their mobile app is clunky or their ATMs are frequently out of service, the overall customer experience suffers.

When done right, superior customer experience becomes a powerful competitive advantage. Consider how fintech companies like PhonePe have disrupted traditional banking by focusing on seamless digital experiences and rapid problem resolution, earning loyal customers in the process.

To know more:

Common Customer Engagement Mistakes in BFSI

Web Push Notification Mistakes to Avoid in BFSI

How to use WhatsApp in the BFSI industry?

Why is BFSI CX Important?

A study has revealed that even a modest 5% improvement in customer retention in financial institutions can lead to an impressive 95% increase in profits. This striking statistic makes sense when you consider the nature of financial services–after all, we’re talking about people’s life savings, retirement funds, and financial security.

Think about it: while customers might forgive a restaurant for a slightly delayed meal or a retail store for being out of stock, they’re far less forgiving when it comes to financial matters. A single mishandled transaction, delayed insurance claim, or security breach can permanently damage trust and end a customer relationship that took years to build.

However, this high-stakes environment also presents a unique opportunity. When BFSI companies get the customer experience right, it creates a powerful ripple effect:

- Increased customer trust leads to longer relationships

- Satisfied customers are more likely to purchase additional services (like adding investment accounts to their existing banking relationship)

- Happy customers become brand advocates, bringing in valuable referrals

- Lower customer acquisition costs due to better retention

- Reduced customer service costs as satisfied customers have fewer complaints

For example, HDFC Bank saw a significant boost in customer satisfaction and digital adoption after redesigning their mobile banking app based on customer feedback, proving that focused CX improvements can yield tangible results.

How Customers Respond to Excellent BFSI CX

Investing in customer experience isn’t just good service—it’s good business. Studies show that companies that prioritize customer experience can generate up to 60% higher profits than their competitors. This impact is particularly visible in the BFSI sector, where trust and relationships are paramount.

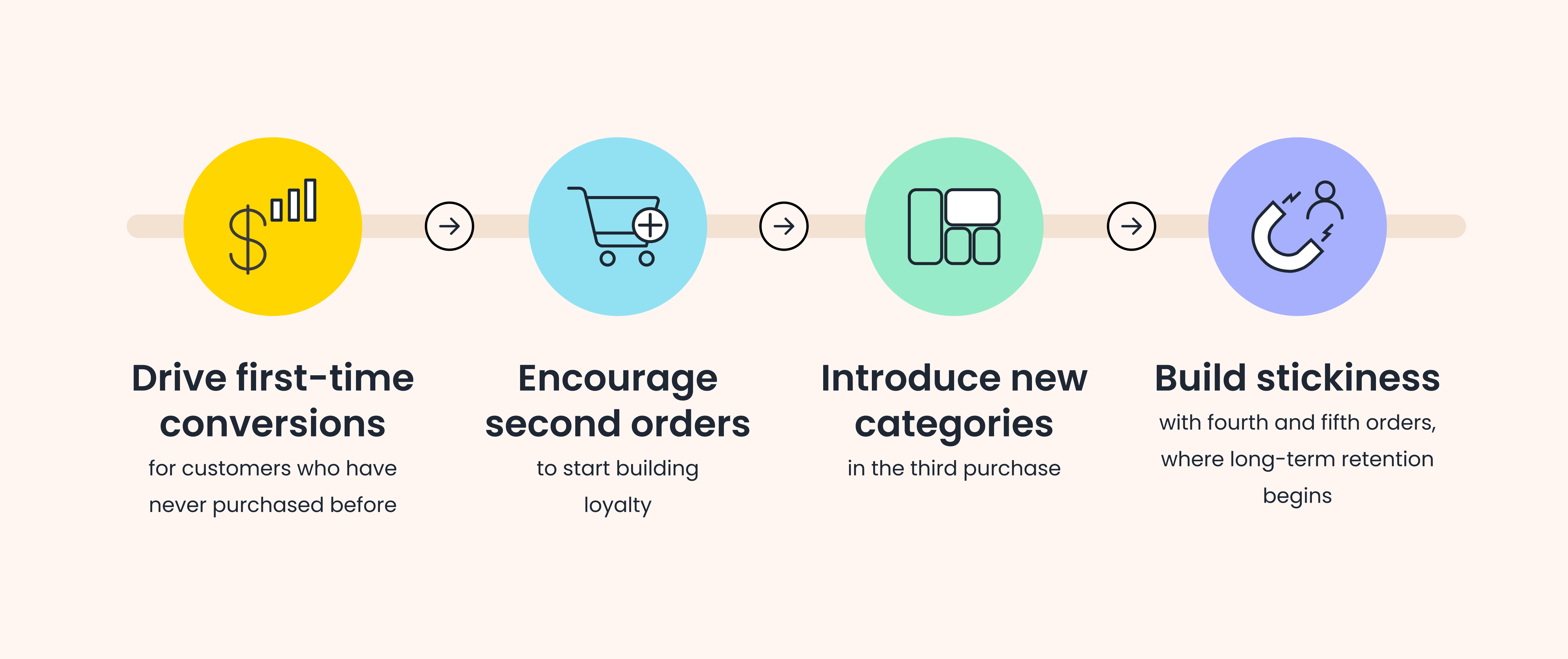

Let’s break down how customers respond to outstanding BFSI CX:

Increased loyalty and advocacy

Customers who experience exceptional service become more than just clients – they become brand ambassadors. Take Marcus by Goldman Sachs, for instance. Their focus on transparent pricing and user-friendly digital experience has led to impressive customer retention rates and organic growth through referrals.

Enhanced trust in financial institutions

Trust is the currency of banking, and excellent CX is its best builder. When customers trust their financial institution:

- They’re more likely to consolidate their financial portfolio (adding mortgages to existing accounts)

- They feel more secure sharing financial data for personalized services

- They’re more receptive to financial advice and new product recommendations

Willingness to pay for premium services

When customers trust their financial provider, price becomes secondary to value. For example, American Express cardholders often willingly pay higher annual fees because they value the superior customer experience and concierge services.

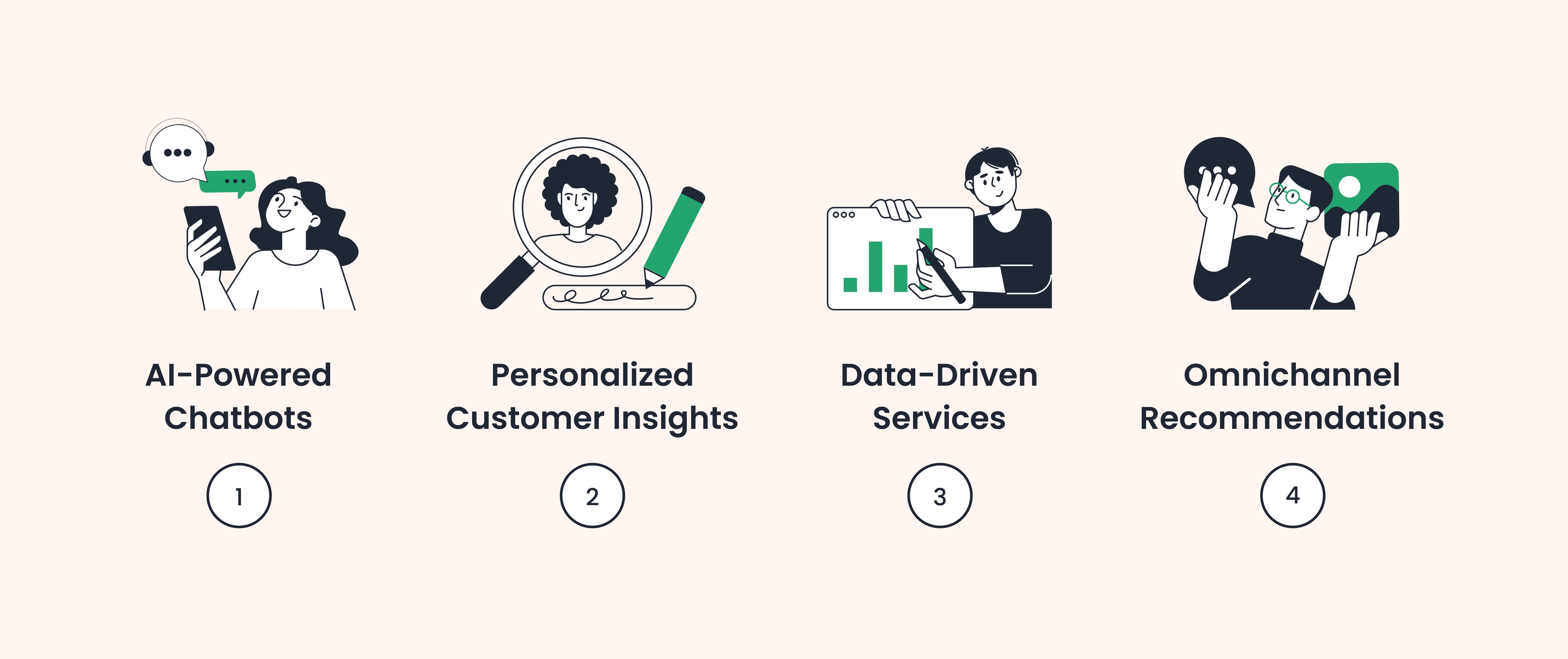

To capitalize on these responses, forward-thinking BFSI institutions are investing in modern CX platforms that enable:

How to Inculcate Excellent BFSI Customer Experience

BFSI-based companies are always trying to establish or enhance their CX models. The challenge lies in the subjective nature of customer experience. A service that delights one customer might frustrate another, and often, dissatisfied customers struggle to articulate exactly what went wrong.

Industry veterans often share this golden rule: “On a bad day, a customer should have a great day.” Take, for example, when a customer visits a bank branch after receiving difficult personal news. While the bank isn’t responsible for the customer’s emotional state, exceptional service can turn their day around. DBS Bank in Singapore exemplifies this philosophy—its staff is trained to recognize signs of customer distress and respond with extra empathy and attention.

To orchestrate such consistently positive experiences, companies need a systematic approach that covers every customer touchpoint. Here’s how BFSI companies can build a robust CX framework:

Step 1: Understand Customer Needs

This is where it all starts: the big question- what do customers even want? And why do they no longer want the same things they did last year?

The customer needs are not only ambiguous but also evolving and emotional factors. Companies must not approach the situation with adamancy and frustration but with curiosity. CX is quite literally like a treasure hunt. Once you find the key to the hearts of your customers, they remain rather loyal.

There are several methods that companies use to keep in touch with consumer needs, which include

Conduct regular surveys and feedback loops

Surveys and feedback forms are quick and easy sets of questions that allow customers to objectively report their experiences. Usually, the form holds questions about their convenience, areas of improvement, their biggest challenges, etc.

In fact, feedback forms seeking customer experience reviews itself is considered an act that enhances CX because customers like to feel valued, heard, and important.

Here is an example of what a feedback form may look like:

Use analytics to anticipate needs and personalize offerings

Understanding consumer behavior goes beyond just investigating their perceptions. BFSI institutions must leverage data like customer feedback, browsing data, and past transactions. You can also use data to analyze competitors, how users respond to them, commonly searched customer bottlenecks, and how they solve them.

Step 2: Invest in Digital Transformation

As technology advances, customers get acquainted with more accessible ways of doing things. This is why a service that made them happy a few years ago may now impose immense cognitive load and confusion on the users.

Use of AI and chatbots for personalized interactions

No company that cares about their customer experience can leave out the integration of AI in their customer service. Not only is this easier and faster, but customers also build a perception of a company as a ‘problem solver’ when they can find their answers from you; it is the ultimate CX win.

In fact, studies have shown that 90% of consumers say that issue resolution is their top concern. And 83% of customers feel more loyal to a company if they respond and resolve complaints.

Step 3: Train Employees for Empathy and Efficiency

Most BFSI companies already take good care of this, but one must not underestimate the importance of a well-trained line-up of helpful and empathetic employees. Customer service professionals trained in empathy are 2X likely to be high performers.

All employees must inculcate the values that the company wishes to identify with. How can a company advertise itself and be helpful and reliable if, in all interactions, the customer feels lost and confused and leaves without their issues resolved?

Soft skills training for frontline employees

Soft skills training must be mandatory for frontline employees, and their ability to communicate clearly must be among the key factors in hiring. Employees are not just appointed to get tasks done; they are also your brand ambassadors who can turn around the customer experience.

Creating a customer-first culture across teams

CX goes beyond just training employees to speak a certain way. It is about maintaining a customer-first culture in everything that the company does. It means going above and beyond to take care of people. When this happens, customers can truly feel the efforts.

Step 4: Enhance Transparency and Communication

When it comes to BFSI companies, customers know they are dealing with processes they do not fully understand. A regular bank account holder may not fully understand how this works. In fact, it can be rather intimidating for them. Companies must pay special attention to ensuring customers understand what they are signing up for.

Clear communication of terms and conditions

Customers feel at ease when employees are always ready to explain what they want to know in layman’s terms. This means that the employees must first thoroughly understand all terms and conditions and new schemes and be trained to explain them to customers.

Proactively addressing issues or concerns

Most queries that BFSI companies face are usually due to confusion and lack of clarity. Training employees to proactively investigate what customers are struggling with and patiently solve it will help prevent the build-up of frustration and influx of queries in the future.

Step 5: Measure and Refine CX Metrics Regularly

CX, as already established, is quite a dynamic and subjective concept. It can, however, be measured with the following metrics:

- Net Promoter Score (NPS): Measures customer loyalty and likelihood to recommend the service.

- Example: “On a scale of 0-10, how likely are you to recommend us to a friend?”

- A higher NPS indicates satisfied customers, often leading to referrals.

- Customer Effort Score (CES): Assesses how easily customers can resolve issues.

- Example: “How easy was it to resolve your issue today?”

- A lower CES implies seamless and user-friendly processes.

- Customer Satisfaction Score (CSAT): Measures immediate satisfaction with a specific interaction or service.

- Example: “How satisfied are you with your experience today?”

- CSAT is often collected after a transaction or interaction.

Always remember that ensuring and measuring customer experience is an ongoing process, and the rules, premise, and context always evolve. The good thing is that it’s as rewarding as it is challenging.

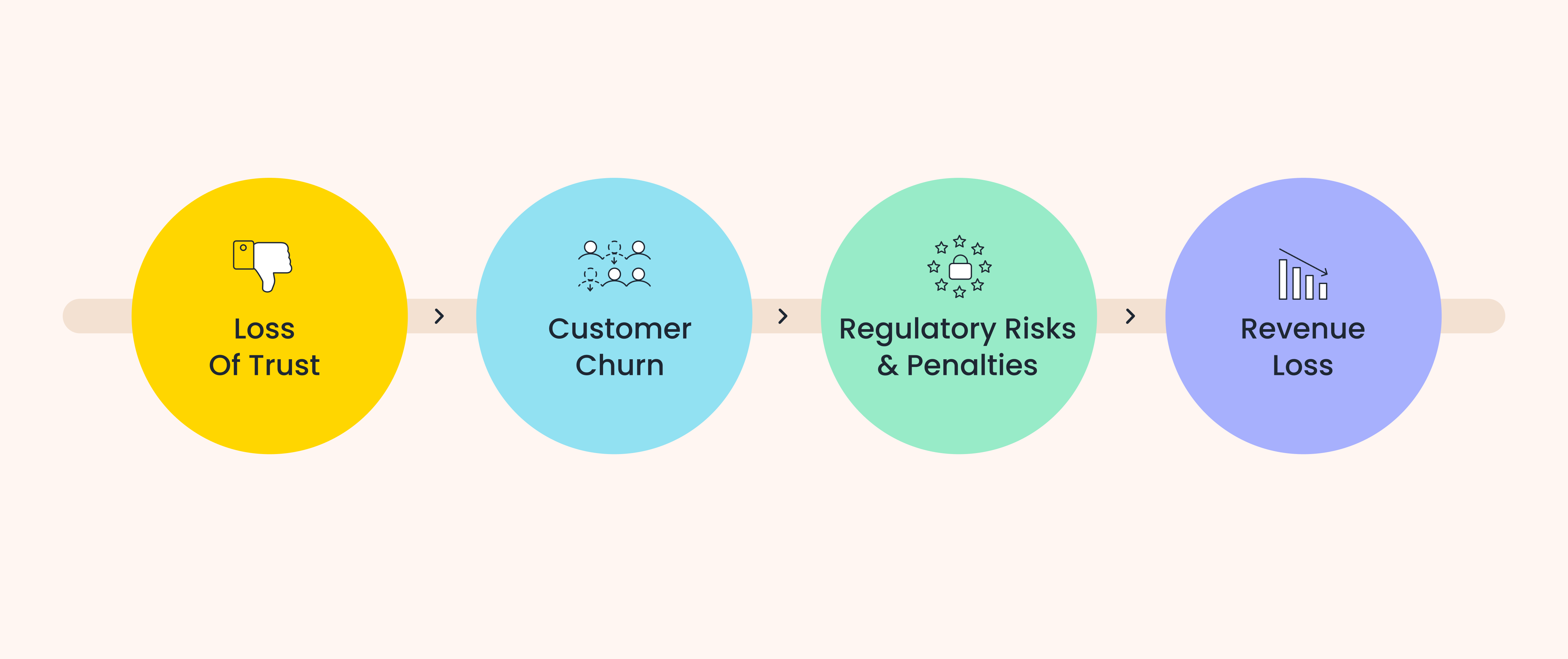

Consequences of Poor BFSI Customer Experience

The consequences of poor BFSI customer experience may not be realized instantly, but they unfold over a period of time. Here’s how the damage typically unfolds:

- Loss of Trust

- A single negative experience can spread rapidly through social media and review platforms.

- Even minor service issues, if persistent, can erode a brand’s credibility built over decades

- Customer Churn

- According to PwC, 32% of customers would stop doing business with a brand they love after just one bad experience.

- Digital-first competitors make switching financial providers easier than ever

- The “silent churn” effect: customers gradually move their primary transactions to other institutions while maintaining minimal activity in existing accounts.

- Regulatory Risks and Penalties

- Poor service often leads to formal complaints with regulatory bodies like the RBI.

- Financial institutions can face hefty fines for service-related compliance violations.

- Increased regulatory scrutiny can lead to costly mandatory improvements and audits.

- Revenue Loss

- Loss of cross-selling opportunities – unhappy customers won’t consider additional products

- The compound effect: each lost customer represents not just their business but potential referrals

Conclusion

As of today, exceptional customer experience isn’t just a nice-to-have- it’s a business imperative. Research shows that customer-obsessed BFSI companies generate 2.5 times more revenue than their competitors who don’t prioritize CX. However, perhaps more telling is what JPMorgan Chase’s CEO Jamie Dimon once noted: “Banking is necessary, banks are not.” This stark reality underscores why customer experience has become the key differentiator in the BFSI sector.

CX is not a one-time project or investment, but rather an ongoing commitment that yields long-term rewards. When financial institutions genuinely prioritize their customer’s needs—from the smallest transaction to major life events-they don’t just earn business; they earn advocates for life.

Ready to transform your BFSI customer experience and drive sustainable growth? Book a demo with WebEngage today to learn how we can transform your customer experience.

Harshita Lal

Harshita Lal

Prakhya Nair

Prakhya Nair

Diksha Dwivedi

Diksha Dwivedi