For digital borrowers, two things are important; speed and efficiency.

Imagine how it would feel if you found a website that could solve your problems, but it takes forever to load. The frustration that sets in while you wait is how your users feel with a long onboarding process. Just as a slow-loading webpage can deter visitors, an extended onboarding process can discourage potential users.

As a lending firm, you are likely losing customers with an over-complicated user onboarding. Offering a frictionless and smooth onboarding experience will not only help you acquire new users but also help in retention, ultimately increasing business revenue. Recent statistics have shown poor onboarding leads to a 40-60% user drop-off rate post-sign-up; this further confirms why priority should be given to smooth onboarding.

In this piece, we’ll talk about what digital borrowers expect from onboarding and how lenders can use marketing automation to ease the process.

Digital borrowers have high expectations for the loan application and onboarding process from lending firms. They expect:

- Simplicity in usage

- Swift application approvals

- Data privacy and security

- Efficient communication

- Financial profile personalization

- Transparency in loan terms and repayments

- Mobile Optimization

These expectations in turn require lenders to be able to:

- Simplify the process by reducing unnecessary steps and minimizing complex terminology.

- Ensure full compliance with lending regulations including KYC and data protection laws.

- Provide clear and consistent information all through the onboarding process.

- Tailor loan offers based on borrowers’ profiles, offering loan options that align with their financial capabilities.

- Enable mobile-friendly applications and provide a seamless experience on various devices

Providing your users with a streamlined onboarding experience can help attain higher borrowing leads leading to retention, driving more interest for implementing an effective Loan Origination System (LOS).

How can you do this?

For digital BFSI, creating a successful user onboarding needs marketing automation.

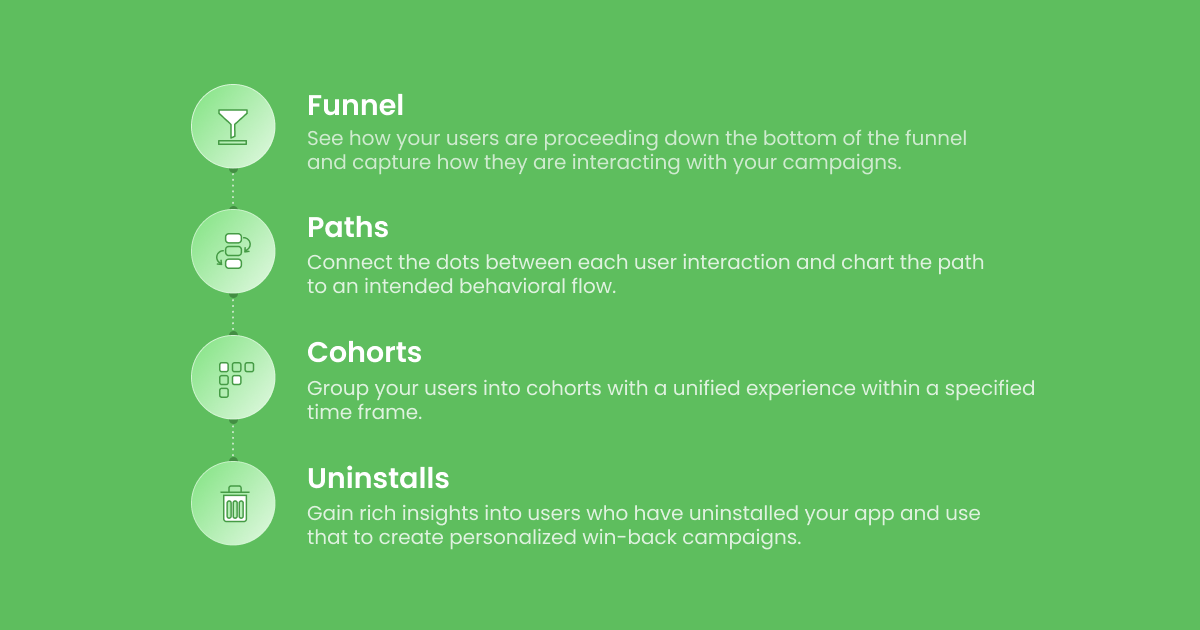

With marketing automation, you can identify drop-offs in your funnel, track cohort engagements and use real-time analytics to monitor user activity.

At WebEngage, we work with lending companies using onboarding automation to ensure their users avoid laborious onboarding.

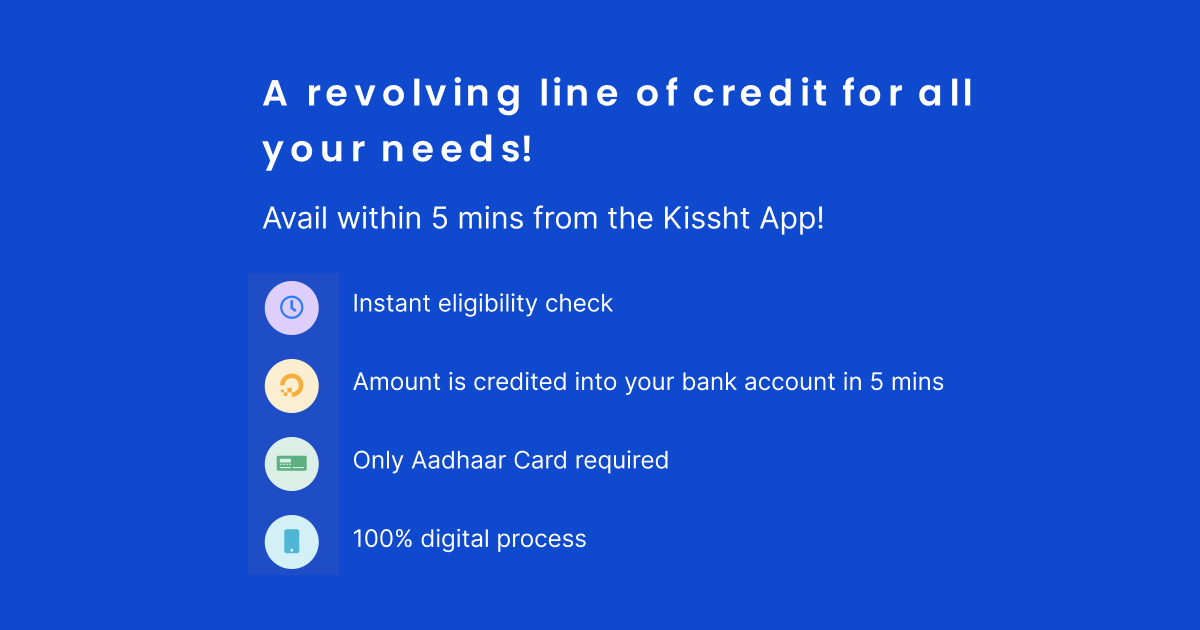

Traditional KYC procedures can sometimes involve multiple visits to banks, and in the case of NBFCs, an arduous online journey making the entire process exhausting.

Here’s a glimpse of how Kissht- India’s fastest Credit Lending App, simplified and automated their onboarding:

What is Onboarding Automation?

Automated onboarding is the process of putting your operations on autopilot like: the various stages of the user onboarding, data collection, user engagement, document verification, and credit checks.

Automation also ensures that borrowers receive timely and personalized communication, reducing manual tasks and minimizing the risk of human errors.

Furthermore, you can also segment borrowers based on their needs, allowing for tailored messages and content delivery. This not only enhances the efficiency of the onboarding process but also improves the overall borrower experience, leading to higher customer retention and satisfaction.

What Steps Can Be Automated in a User Onboarding Process?

Let’s show you what steps you can automate and how WebEngage can be a game changer for your onboarding.

1. Data Consolidation

With our customer data platform, you can collect data and integrate data sources like loan applications, KYC documents, financial statements, credit history and more from third-party sources.

Use our automation tool to unify user data to aid further engagement and protect the data as we comply with international privacy regulations.

Additionally, you have access to real-time data refresh that can help you track user interactions and accurately identify where borrowers drop-off.

RangDe, a lending platform, identified an opportunity to use WebEngage to easily track customer drop-offs from KYC and initiate purchases again. They saw a 7.7% increase in KYC conversions.

Know how WebEngage did it for RangDe and the results it got them.

2. Communication of Information

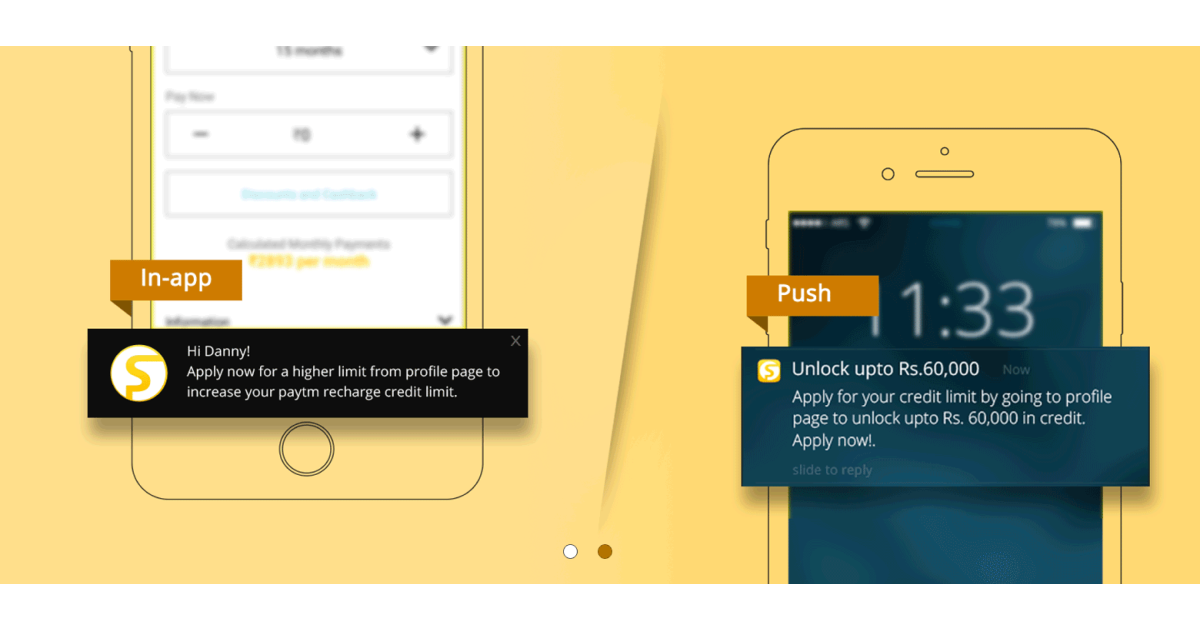

You can automate sending web and mobile push notifications to borrowers at various stages of the onboarding process to keep them informed of their KYC application status.

Both web and app personalizations ensure your users are in the loop of relevant information, tips, and guidance before, during, and after onboarding.

SlicePay, a lending platform for students, partnered with WebEngage to optimize conversions at every stage of its conversion funnel.

Using workflow, they automated communication based on triggers, user actions, and the funnel stage each user was in.

Check out this Impact Story, to know more about how they saw a 64% increase in their sales conversion rate.

3. Integration with Service Providers

Seamless integration of any listed service provider of your choice. As a lending firm, you can have access to several sources, including Cibil or CRIF for credit reports, NSDL or CDSL for PAN numbers, UIDAI for Aadhar numbers, and others.

Ensuring your users complete their KYC registration is integral to their lending application. Leveraging these integrations with our marketing automation tool takes the stress off them.

4. User Analytics

User analytics shows how your users are performing during the onboarding process. You can track live stats for your website and applications using the data to improve your funnel and boost user engagement.

In an episode of the State of Retention Marketing Podcast, Nandini Chandra, Associate Director of Product Growth for CredAble told us she didn’t expect their users to find the KYC process easy and they tracked this with analytics.

“I didn’t expect that it would be easy for our users to upload video KYCs, but it was because other institutions require them too. SME business owners are quite savvy when it comes to uploading video KYCs and filling other onboarding steps.”

Nandini Chandra, the Associate Director of Product Growth, CredAble.

With our analytics tool, you can track product and revenue growth using our approach.

5. Lead Nurturing

Onboarding customers doesn’t just end after KYC completion, customer retention is also important to drive revenue.

WebEngage’s omnichannel campaign management allows you to continually engage and educate customers even after onboarding, helping you foster long-term relationships and reduce churn.

You can engage your digital borrower in real time based on user interaction by creating a marketing automation workflow leveraging WebEngage’s Journey Designer.

CASHe, a credit lending app, witnesses a 300% increase in the value of loans disbursed by creating hyper-personalized omnichannel campaigns within customer journeys. Read about it here.

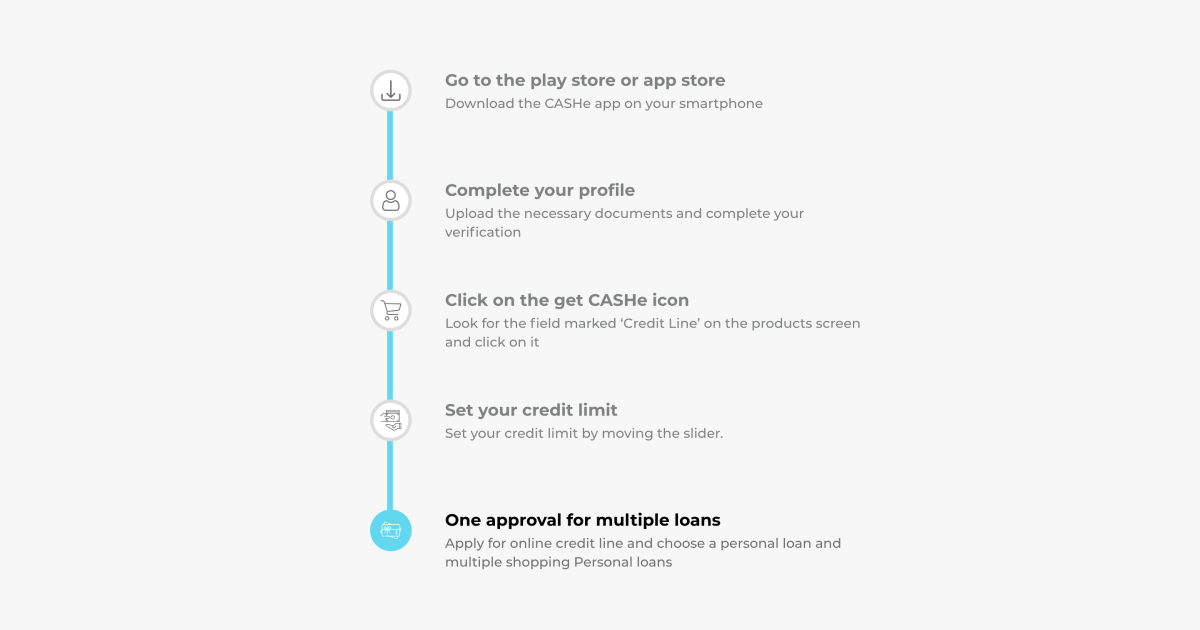

Let’s take an example of the simplified onboarding process used by CASHe:

What’s next?

With our campaign manager, you can also send loan payment reminders to borrowers which will help in faster and better repayments.

WebEngage can integrate seamlessly with the modern tech stack. Such integrations tend to reduce human touchpoints, help with overall service delivery, reduce churn and expedite the loan application process.

Onboarding Automation Made Easy

It’s 2023, the world has gone digital and it’s time to board the train before it leaves the station. Traditional KYC procedures can only take you so far.

Using WebEngage’s tech integrations, you can automate onboarding for new borrowers and get help with keeping up with your old borrowers too. Get access to everything you need for frictionless user onboarding, including product and revenue analytics with WebEngage.

If you’re looking to simplify lending for your customers, you’re in the right place. Book a free demo with us.

Prakhya Nair

Prakhya Nair

Harshita Lal

Harshita Lal

Dev Iyer

Dev Iyer

Avlesh Singh

Avlesh Singh