INTRODUCTION

With the current state of the world, the question on everyone’s mind is whether a recession is approaching. Rather than panic, let’s take a proactive approach and prepare for any eventuality. A recession is not just a word, it can cause severe ramifications for businesses across industries — specially D2C businesses. What’s more, each sector may experience the impact of a recession differently, making it crucial to identify what works best for your organization. By taking the necessary steps now, we can safeguard our companies and thrive, even in tougher times.

Let’s take a look at the example of BlueFly, the popular online retailer that specialized in discounted designer clothing and accessories. It faced a tough battle during the 2008 financial crisis and recession. As consumers became more cautious with their spending, the company struggled to maintain its growth and profitability. Despite a significant restructuring effort in 2010, Bluefly’s sales continued to decline, and it faced intense competition from other online retailers. In 2017, the company filed for bankruptcy, unable to secure the financing it needed to keep operating. Ultimately, Hilco Streambank acquired Bluefly’s assets in 2019.

While it may have been a challenging journey for Bluefly, its story serves as a reminder of the importance of resilience and adaptation in the face of economic uncertainty.

A D2C company may come to face several challenges during the recession, some of them are:

- Customized Incentives: American Express uses data analytics to examine each customer’s purchasing habits and preferences to provide tailored rewards and discounts.

- Personalized Communication: American Express employs data analytics and artificial intelligence to provide its clients with personalized communication. For instance, it makes use of email, mobile app notifications, and other lines of communication to let clients know about account activity, make offers, and send out reminders at the appropriate times.

- Personalized Services: Services that are tailored to the needs of the customer include personalized vacation suggestions based on their tastes, personalized financial planning counsel, and personalized customer service, among others. Personalizing services gives American Express the ability to also upsell some of their products and services when they find that their customers are engaged sufficiently with their current products.

- Innovative Tools: American Express provides cutting-edge technologies, such as its “Amex Offers” function, which tailors discounts and offers to clients based on their purchasing habits and interests.

- Social Media Engagement: Utilizing its robust social media presence, American Express engages with clients and provides help. For instance, it provides clients with individualized aid and support via social media platforms like Twitter and also provides them with bespoke resources depending on their interests and requirements.

The answer to all of these problems lies in one word, data. A period of recession presents a change in the market and customer habits, and the only way to combat it is to know what these changes are, how they are occurring, and at what pace. In other words, being data-driven in your approach can help you cross the hurdles of recessions.

Data-driven decision-making is the boat that will keep your business afloat during these testing times. Data is becoming increasingly important for businesses seeking clarity and insight into the current economic environment.

Businesses can increase operational efficiency and find areas where expenses can be decreased without compromising quality by evaluating client spending trends and other pertinent data. Retailers, in particular, are utilizing data to stay competitive by concentrating on pricing sensitivity, consumer behavior, and other important variables.

Marketers can use data to obtain insights into customer behavior and preferences and use those insights to drive growth and make strategic decisions that will help them get through the recession.

Now, let’s equip you with all the strategies you could need to measure and analyze this data!

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (CLTV)

- Conversion Rates

- Margin: Gross And Net

- Churn Rate

Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) is the price a business pays to bring on a new client. To calculate this statistic, a company’s total spending on marketing, advertising, and other sales-related activities is split by the total number of new clients it has gained over a given time frame.

Keeping customer acquisition costs low is critical to retain profitability during a recession. It costs more to get new consumers than to keep your current ones. As a result, businesses should increase client lifetime value and retention by offering individualized content.

While there are multiple ways to analyze your CAC, two key ways have been explained below:

- Tracking Marketing Spend: Businesses can better comprehend their CAC by examining the amount of money spent on marketing and promoting activities. This involves calculating the expenses of conducting campaigns through various platforms, including email marketing, social media advertising, and Google Ads.

- Conversion Rates: Conversion rates are another crucial measure to consider when evaluating CAC. Companies can assess the overall success of their marketing efforts by monitoring the number of leads produced by marketing initiatives and the proportion of those leads that turn into paying clients. To obtain a new client, fewer leads are required when conversion rates are improved, which lowers CAC.

To reduce CAC, several strategies exist, such as emphasizing low-cost marketing techniques, increasing client engagement rates, and streamlining sales procedures. Companies can also improve each customer’s lifecycle worth by prioritizing their happiness and devotion, ultimately lowering the total cost of client acquisition.

One tactic is to concentrate on reference marketing, which entails rewarding current clients for referring new clients to the company. Another way is to improve ad targeting by avoiding ads and keywords that perform poorly in favor of those that do.

Utilizing user-generated content, collaborating with complementary businesses, and using chatbots for customer support are additional novel methods to reduce CAC. By implementing these strategies, companies can lower their CAC and achieve lasting development in today’s cutthroat business environment.

Customer Lifetime Value (CLTV)

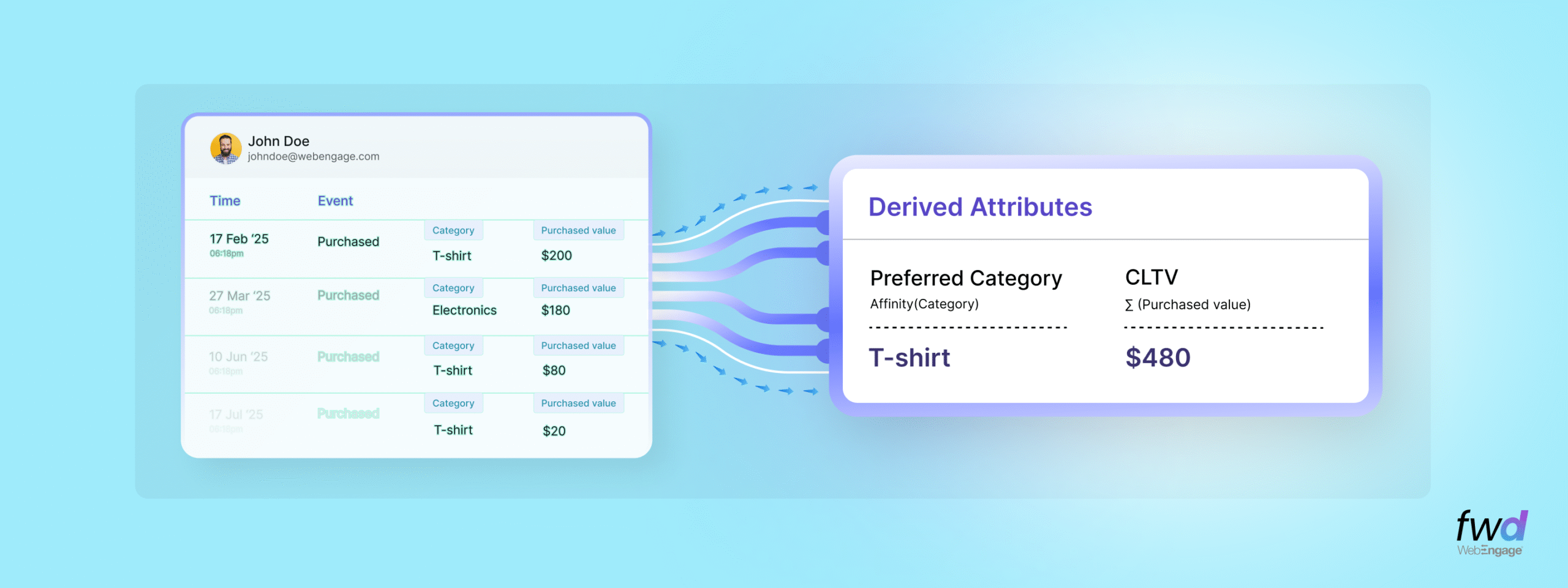

Customer Lifetime Value (CLTV) is the term used to describe the overall quantity of income that a customer is anticipated to bring in for a company over the length of their association with the company. CLTV is a crucial metric for companies because it enables them to comprehend the worth of their customers over the long run and decide how much to spend on acquiring and keeping them.

Businesses can tailor their marketing and client retention strategies by identifying the most important consumers to their bottom line using the CLTV. For instance, if a company knows that its most devoted clients have the highest CLTV, it may spend more on reward programs and other customer retention techniques to keep them coming back.

During the recession, CLTV should be pushed up as much as possible because higher CLTV indicates higher profitability. Making customers feel acknowledged and fostering enduring connections with them is crucial during a recession. A CLTV optimization plan should aim to optimize greater upsell, larger payments, and extended retention times.

To calculate CLTV, several techniques can help you gauge the expected time a customer will likely associate with your company. They include customer retention rate, average order value, gross margin, churn rate, and purchase frequency.

Customer retention rate is the percentage of customers who continue doing business with a company over a period. Businesses can learn how long consumers will likely stick with their brand or product by changing the retention rate to the customer’s lifetime period.

Average order value (AOV) is the average amount of money a customer spends on each transaction with a company. A company can estimate the income it can anticipate from each customer over their lifespan by calculating CLTV using AOV and the average number of purchases received.

Strategies for increasing CLTV are based on adding value to your customer’s life, fostering a relationship, and making the company a space they want to return to. This can be done in several ways:

One of the best strategies is offering loyalty programs that promote enduring relationships and boost repeat business. Special discounts, tailored deals, freebies, or discount codes can also pave the way for a successful and enduring connection with first-time customers. One example is the Sephora Beauty Insider program, which gives customers one point for every dollar spent and allows them to redeem points for complimentary products or discounts.

Another strategy is to identify your most valuable customers and upsell or cross-sell by recommending products. This can be accomplished by offering targeted, tailored efforts that prioritize consumers and pay attention to their input.

D2C businesses can further enhance the client experience by offering a variety of payment methods and improving their websites. Brands can draw and keep consumers by simplifying the purchasing process and enhancing the overall buying experience.

Conversion Rates

Conversion rate is a crucial metric used in digital marketing that measures the percentage of website visitors who take a desired action, such as making a purchase, filling out a form, or subscribing to a service. It is calculated by dividing the number of conversions by the number of website visitors and multiplying the result by 100.

A high conversion rate indicates that a website effectively converts visitors into customers or leads, while a low conversion rate may mean barriers or issues preventing visitors from taking the desired action.

Conversion rate is an important metric because it directly impacts a company’s revenue and profitability. By increasing the number of visitors who convert to customers or leads, a company can maximize its revenue and ROI. Improving the conversion rate becomes even more critical during a recession or economic downturn, as it can help companies offset declining sales and maintain their competitiveness.

Different ways to analyze conversion rates include tracking website traffic, click-through rates, and other key performance indicators. By examining these metrics, businesses can identify areas where visitors may drop off or encounter obstacles in the conversion process. Two of them have been explained briefly:

- Tracking website traffic using tools such as Google Analytics to identify areas where visitors are dropping off and optimize website design and navigation.

- Measuring click-through rates (CTR) to identify which elements of a website are most effective in driving conversions.

To improve conversion rates, businesses can implement various strategies, such as optimizing product pages, simplifying the checkout process, and providing clear and persuasive calls to action. Companies can use compelling copy, high-quality product images, and customer reviews to improve the appeal of their product pages.

Additionally, simplifying the checkout process by minimizing the number of steps, offering multiple payment options, and providing straightforward shipping and return policies can help reduce cart abandonment and increase conversion rates.

A/B testing is another method that can be used. It involves comparing two web page versions or marketing campaign versions to determine which performs better. By testing different elements, such as headlines, images, or calls to action, businesses can identify which variations lead to higher conversion rates and make data-driven decisions on optimizing their website and marketing campaigns.

Margin: Gross And Net

Margin analysis is divided into two categories – Gross Margin and Net Margin. Each one of them is different in the way they function and the way they can be analyzed and optimized. Let us go through them individually to understand their scope better.

Gross Margin

Gross margin is the percentage differential between income and cost of goods sold (COGS). It is a crucial sign of a company’s success and financial stability. During a recession, businesses must be more cautious with their spending to ensure they are maximizing profits.

Gross margin helps companies identify which products or services generate the most revenue and where cost savings can be made. By analyzing gross margin, businesses can make informed decisions about pricing, production, and inventory management, which can help them weather the recession and emerge stronger.

Tracking gross margin thus becomes imperative for businesses to make informed decisions about their pricing, production, and inventory management. One way to do this is by tracking inventory levels and sales data. By monitoring inventory levels, businesses can ensure they are not overstocking or understocking, which can impact their gross margin. Additionally, by analyzing sales data, businesses can identify which products generate the most revenue and adjust their inventory management accordingly.

Improving inventory turnover is another crucial step for businesses looking to maximize profits and reduce costs. One way to achieve this is by using forecasting and demand planning tools. These tools help businesses accurately predict product demand and adjust inventory levels accordingly.

Net Margin

Net margin is the percentage of revenue left over after all expenses, including COGS, operating expenses, and taxes, have been deducted. During a recession, D2C companies face intense competition and pressure on profit margins, making it essential to track net margins closely. A decline in net margin can lead to reduced profitability, lower investor confidence, and limited resources for reinvestment and growth.

To track net margin, D2C companies can use accounting software to record all expenses and revenues and then calculate the difference between the two. This calculation gives the net profit margin, which can then be used to analyze the company’s overall profitability.

D2C companies can focus on reducing costs, increasing efficiency, and optimizing pricing strategies to improve net margins during a recession. This can be done by conducting a cost-benefit analysis of all operations, negotiating with suppliers for better pricing, and adopting automation and technology to streamline processes.

Churn Rate

The churn rate refers to the percentage of customers who stop doing business with a company over time. It is an essential metric for businesses as it can significantly impact their revenue and profitability.

The churn rate refers to the percentage of customers who stop doing business with a company over time. It is an essential metric for businesses as it can significantly impact their revenue and profitability.

In the highly competitive D2C market, losing customers can be costly, especially during a recession when acquiring new customers can be more challenging and expensive. High churn rates can lead to :

- Decreased revenue

- Reduced profitability,

- Damaged brand reputation.

To analyze the churn rate for D2C companies, tracking customer behavior across multiple touchpoints, including website traffic, social media engagement, and customer service interactions, is essential.

Some practical ways to reduce churn rate include focusing on improving customer experience. This can be done through personalized marketing, excellent customer service, and seamless ordering and delivery processes. Additionally, implementing customer loyalty programs and offering incentives for repeat purchases can help build brand loyalty and retain customers.

CONCLUSION

To emerge victorious in the battle of economic recession, staying on top of your data game is vital.

Let us sum up the 5 key metrics you need to analyze and track to ensure your company does not succumb to the challenges of recessions.

Customer Acquisition Cost: A company’s cost of acquiring new customers is an important indicator that needs to be tracked. In a period of recession, it is essential to spend more resources on retaining existing consumers than gaining new ones. Companies can track their CASs by examining their marketing spending and conversion rates.

Customer Lifetime Value: A high customer life value indicates more profits for a company. Following the previous point, the more your existing customers stick with you, the better your company will perform. Thus, keep track of your CLTV by monitoring your customer retention rate and average order value. These metrics will give you a fair idea of how much income your customers bring to your company.

Conversion Rate: Businesses must analyze and improve conversion rates to increase sales and income. They can increase their conversion rates and spur development by using tools like Google Analytics, monitoring click-through rates, optimizing product sites, streamlining the checkout process, and running A/B tests.

Gross and Net Margin: Gross and net margins are critical metrics that D2C companies should closely monitor during a recession. Gross margin provides insights into the profitability of products or services sold, while net margin gives a more comprehensive view of the company’s overall profitability. By tracking both metrics, D2C companies can identify inefficiencies, reduce costs, optimize pricing strategies, and improve profitability, all essential for survival and growth during challenging economic times.

Churn Rate: D2C companies face a significant hurdle during an economic downturn as customers become more risk-averse and less inclined to make purchases, resulting in customer churn. Analyzing churn rate becomes crucial for D2C companies in such circumstances. By analyzing churn rates and employing successful tactics to retain current customers, D2C companies can minimize expenses linked to employee churn and low customer satisfaction while optimizing revenue.

When the economy is not supportive, it can be difficult to steer through and adapt to challenging circumstances. As is the case with every crisis, people change their priorities and way of functioning when it hits. To ensure that your company can handle such waves of change, data-driven decision-making is your key to a recession-resilient future.

Take a demo today with WebEngage today, and safeguard your D2C business against the recession.

Ananya Nigam

Ananya Nigam

Ajit Singh

Ajit Singh

Harshita Lal

Harshita Lal

Surya Panicker

Surya Panicker

Vanhishikha Bhargava

Vanhishikha Bhargava