Table Of Contents:

1. Why is Customer Lifetime Value important?

2. How to calculate Customer Lifetime Value?

3. How to increase Customer Lifetime Value?

If customer journeys would not have been online but in middle earth and the metrics would all be converted into the rings of power, Customer Lifetime Value (CLV or LTV, used interchangeably) would have been the One Ring to Rule Them All.

What is Customer Lifetime Value?

Customer Lifetime Value’s definition is as literal as it gets. It is the sum of total value that a customer generates for you in their entire relationship with you.

Since the lifetime of each customer is quite sporadic in nature, it is either calculated on an average basis or by fixing a time period for it. For instance, pertaining to CLV analysis you would often hear the jargons such as CLV for people aged 18-22 or CLV for a 12-month period, so on and so forth. I will try to shed optimum light on each of them further in the post.

Why is Customer Lifetime Value important?

Every customer that you acquire for your business has a cost attached to it. It may be the cost of the PPC ad you ran, or the cost of promoted posts on social media channels or even the cost of creating interesting content for a direct lead. This is the cost of acquisition of a customer or the Customer Acquisition Cost (CAC).

LTV helps you justify the CAC every channel demands. Let us illustrate the process through an example.

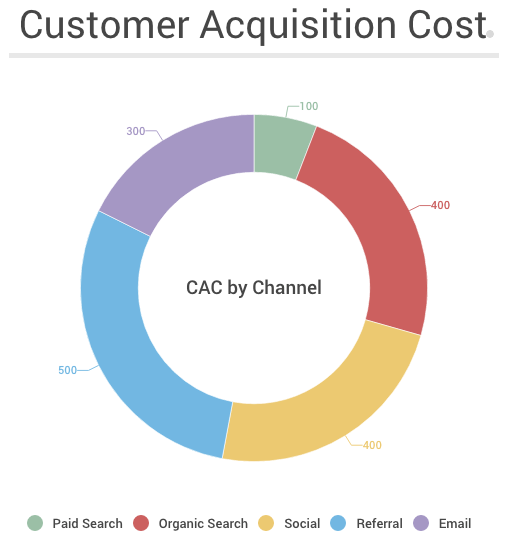

Consider a sample CAC table, having the channels common to almost all the online businesses.

A quick glance suggests that the customers acquired through the affiliate (referral) channel are the costliest, taking up much of your marketing budget. This is where affiliate management software can play a crucial role in reducing costs and improving efficiency. Should you discard the channel and focus on social media instead? When considered in solitude, the decision seems the rational one to make. However, adding the LTV chart into the equation, the customers whom you acquired through the Affiliate Channel, stay with you the longest and hence provide you with the highest revenue per user (RPU). The plot thickens!

How to calculate Customer Lifetime Value?

The obvious answer to this would be Total Profit / Total No. of Customers. Sadly, it’s not that obvious.

The above formula isn’t the right way to calculate LTV because of one primary reason; it ignores the customer history with you. The time each customer has spent with you and their individual buying habits would differ and so should the LTV of each customer.

LTV is calculated by applying 2 approaches in general:

- Historical computation of LTV

- Predictive computation of LTV

1. Historical computation of LTV:

This is an accurate way of calculating the Lifetime Value of a customer. The approach is dependable because you have a constant value to all the variable you need. The formula for calculating historical customer lifetime value is:

Historical LTV = ARPU per month x No. of months in their Lifetime

Where, ARPU is the Average Revenue Per User.

And, ARPU per month = Summation of all the Averages of Revenue per month per user.

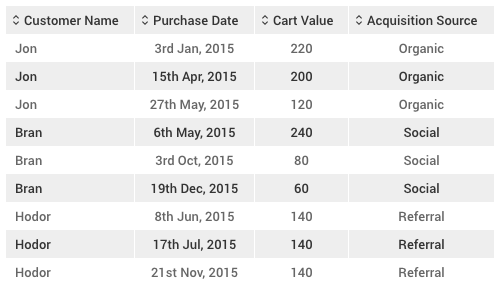

Let’s illustrate the above method by a hypothetical customer lifetime value example. Consider that a business has 3 users and following is the record of purchases they have made in the past year:

As per the above table,

- Jon stayed for 8 months, Average Monthly Revenue for Jon =(220+120+200)/8= $67.5

- Bran stayed for 8 months, Average Monthly Revenue for Bran =(240+80+60)/8= $47.5

- Hodor stayed for 6 months, Average Monthly Revenue for Hodor =(140+140+140)/6= $70

Average Revenue Per User, Per Month = (67.5+47.5+70)/ 3 = $61.7

Find a meaningful timeline for your business, like a 12-month period and your LTV = 12 x $61.7 = $740

Now, time to talk about the elephant in the room – How does LTV help in deciding the budget allocation of different Customer Acquisition Channel and their CAC?

Hence, Cohort Analysis.

A cohort is a group of customers who share an attribute or set of attributes.

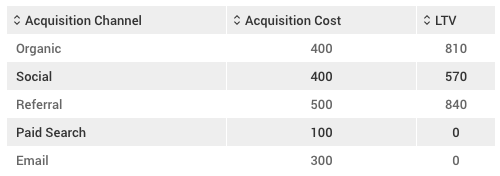

Cohort analysis takes the ARPU method of LTV calculation to the next level. When you create cohorts by the acquisition channels they came from, you can calculate LTVs (using the ARPU method) and plot it against the CACs and the table would give the picture you always dreamt of.

While the customers acquired through Referral channel result in higher revenue than Organic, the LTV/ CAC ratio is higher for customers acquired through the Organic channel. In simpler language, the customers acquired through Organic searches will give you higher revenue in their lifetime, than the customers acquired through any other channel. Hence, SEO should get the bigger piece of your Marketing Budget pie than Affiliate or any other channel of customer acquisition.

2. Predictive computation of LTV

The historical computation of LTV is reliable and comparatively easier, but it leaves one major question unanswered. It talks about the past and at the best present, but the marketing activities that need to be undertaken can only take place in the future.

The historical computation also presents a skewed picture when some customers have been with the business for far too long or there have been some major product changes in the recent past.

Thus comes in the picture, the predictive computation of LTV. By using data modelling techniques such as Regression modelling, Moving Averages, Bayesian inference among others, experts are able to feed the historical data into an equation and predict the future customer lifetime value using predefined models.

Since the methods of computation and modelling are immensely technical in nature, simplifying it down to the scope of this blog post is akin to murdering it. In fact, for most of the cases, the historical computation serves the purpose as a starting point. But if you are a data geek like me, following Peter Fader and reading his paper on How to project customer retention is something you would love to spend your weekend on.

How to increase Customer Lifetime Value?

LTV of a customer depends on the relationship period, the number of purchases and average ticket size of each purchase. An increase in LTV is possible only when an increase in either one of these 3 take place or (in an ideal world) all three shoot up.

Businesses generally put focus on high value customers and place effort into maximizing customer lifetime value for the rest. Eventually, the ball game turns to be about increasing value for customers.

Avinash Kaushik, one of the foremost authorities on Analytics, names the high LTV user as Mr. Right. To lure Mr. Right and likes to your business and more importantly retain them with your business, you have to take a few right steps in the right direction.

Let this post serve as the checklist of those steps to increase LTV for you:

- Identify the right acquisition channel

- Right visualization (Single Customer View)

- Create the right segments

- Right marketing to the right segments.

- Sell them the right things

1. Identify the right acquisition channel

The graph showing CAC vs. LTV attributed per channel, paints you a clear picture of the ROI each acquisition channel bears for you. If you have been looking at low CACs vs. lead ratio to demarcate the marketing budget for your channels, it’s time to go back to the drawing board.

Going back to Pareto principle we talked about, if 20% of your customers account for 80% of the revenue you have, an incremental increase in that 20% can have an astronomic one in your revenues.

2. The (Right) Single Customer View

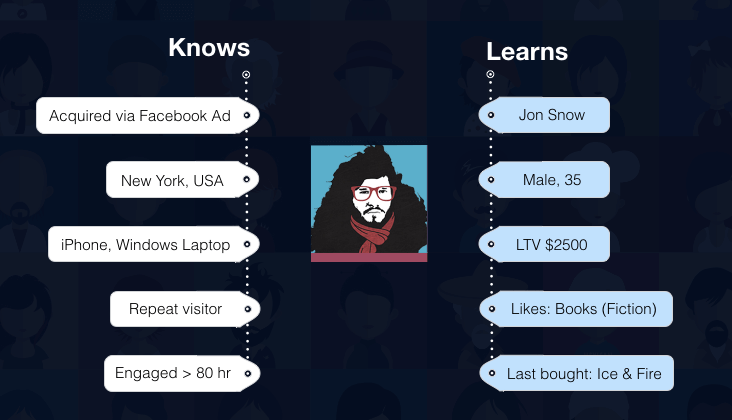

Single customer view is an aggregated, consistent and holistic representation of the data known by an organization about its customers.

A single customer view gives you the ability to track customers and their communications across every channel. It helps to break the marketing silos and understand the customer through all the touchpoints he/ she interacts with.

It is a dynamic snapshot of all the attributes and behaviours of a customer across channels and devices, as illustrated below:

3. Create the right segments

There are many attributes of a customer that defines his/ her buying behaviour. For different businesses, different attributes matter. For some it’s the demography, for some, it’s the frequency of purchase. To each, his own.

However, figuring out these attributes and analyzing the user groups having those attributes is pivotal. Segmentation appears as the savior in such cases.

Segmentation is the process of segregating your users (customers) into groups based on behavior, characteristics and/ or needs. Also, learn how to effectively segment your audience before beginning to segregate them.

4. Right marketing to the right segments

Segments are one of the best ways to visualize and understand your user behaviour. But its benefits do not stop there. You can further use these segments to craft marketing journeys to personalize every touch point with your business.

Personalized marketing and contextual remarketing prove to be the two most effective techniques of retaining your customers and in turn increasing their LTV.

5. Sell them the right things (Cross Sell and Up Sell)

Once you start understanding your users, it’s easy to understand their buying behaviour, preferences, and purchasing power. These 3 form the basis of all the up-selling and cross-selling across industries.

Not only this, you can easily automate all of it through product recommendation engines. It completes your puzzle of marketing automation that you were busy figuring out for so long. A pro-tip here is to use micro-segmentation in marketing automation for convincing results.

What next?

Once you understand Customer Lifetime Value and start acting on it. The next in line would be a Retention Strategy. Guess what, I have a ready post for you – Customer Retention Strategy Growth Hacks.

Bonus Read – Automate Your Email Marketing To Increase Your CLTV

Vanhishikha Bhargava

Vanhishikha Bhargava

Prakhya Nair

Prakhya Nair

Diksha Dwivedi

Diksha Dwivedi

Dev Iyer

Dev Iyer