The basics of customer retention

What is customer retention?

Customer retention means keeping customers by understanding their needs, providing excellent service, and creating long-term relationships that keep them returning to your business. It’s essential to a company’s success as satisfied customers will likely bring in more new customers and make repeat purchases.

Customer retention involves providing value to existing customers through loyalty programs, discounts, free products/services, and other incentives. Additionally, it requires staying in touch with customers, listening to their feedback, and responding promptly to any issues they may have. Companies can use customer retention strategies such as collecting customer data, providing personalized experiences, and offering good customer support. Doing so helps build trust between the company and its customers.

Good customer retention is essential for any business because it helps generate more revenue and directly impacts brand recognition and reputation. It is famously said that 20% of retained customers in any business contribute to 80% of its revenue.

Keeping current customers happy ultimately leads to higher profits because businesses don’t need to spend money on acquiring new ones. Additionally, companies gain valuable insights into consumer behavior that can be used for product development or marketing campaigns.

Finally, customer retention can help businesses stand out from competitors due to positive word of mouth from existing customers. Loyal customers who appreciate the value provided by your business will naturally promote it among their friends and family members, which in turn leads to increased sales and better brand awareness in the long run.

What customer retention do various industries report, and how do they make it work?

Here are some statistics about customer retention across various industries:

- 1. According to a report by the National Retail Federation, the retail industry has a customer retention rate of around 60-80%.

- 2. A study by Accenture found that the customer retention rate in the healthcare industry is around 75%.

- 3. A Financial Brand report found that the banking industry’s customer retention rate is around 89%.

- 4. A study by J.D. Power found that the customer retention rate in the telecommunications industry is around 63%.

- 5. A report by Gartner found that the customer retention rate in the technology industry is around 80-90%.

These significant industries report a higher customer retention rate because they follow a few customer retention strategies to a T. These include a high level of personalization, a commitment to continuous improvement using customer feedback, top-quality customer service, and loyalty programs people love.

The hidden factor contributing the most to customer retention in these industries is data-driven decision-making. These industries use data and analytics to inform their customer retention strategies. This includes tracking customer behavior, purchasing patterns, and feedback to understand customer needs and preferences.

In the following section of the blog, we will look at some data-driven tools that enable customer retention in any industry.

Tools for retaining customers

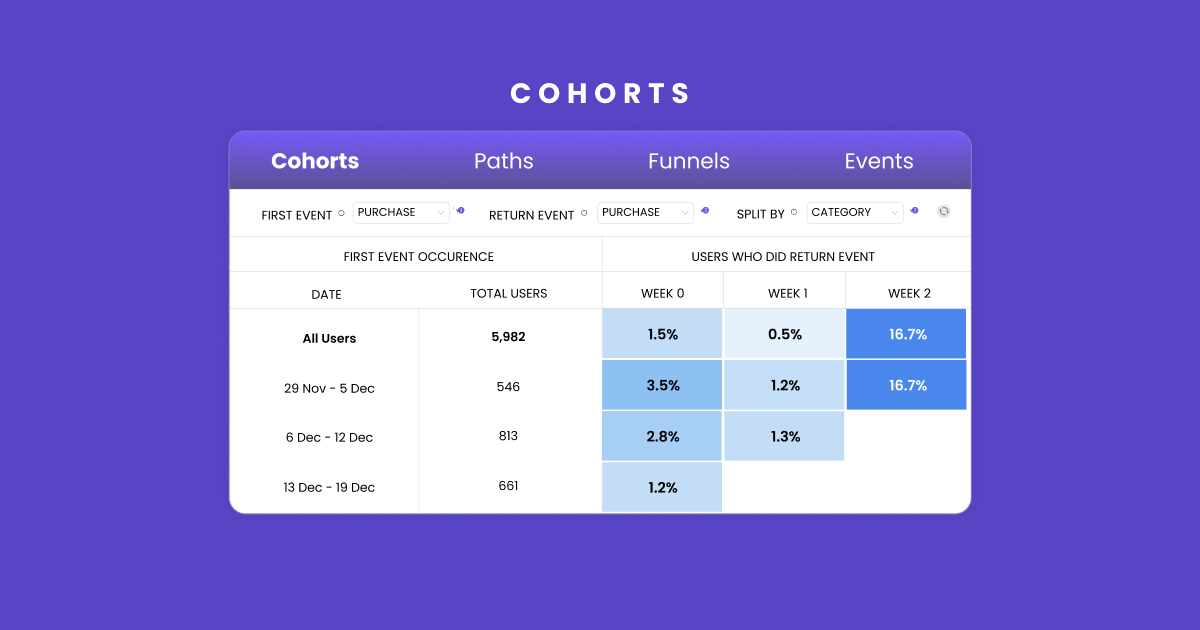

Cohorts

What are Cohorts?

Cohorts are a grouping of customers who share similar characteristics or behaviors and are used in customer retention analysis to track and compare the retention rate over time.

How are Cohorts used?

For example, a cohort could be a group of customers who signed up for a service during the same month or quarter or who made their first purchase in a specific product category. By tracking this group of customers over time, businesses can better understand how customer behavior changes and how different initiatives and strategies impact retention.

Why are Cohorts important?

Cohort analysis allows businesses to identify trends, patterns, and opportunities for improvement in customer retention and to make data-driven decisions to increase customer loyalty and reduce churn.

Example of a company successfully using Cohorts:

Amazon is a famous brand that has used cohorts to increase customer retention. Amazon uses a customer cohort analysis to identify patterns in customer behavior and make improvements to its customer experience. By analyzing these cohorts, Amazon can identify shared behaviors and preferences among different groups of customers and make targeted improvements to their customer experience.

For example, Amazon might notice that a particular cohort of customers is more likely to make repeat purchases after receiving personalized product recommendations. In response, Amazon could invest in improving its recommendation algorithms to meet that cohort’s needs better, ultimately increasing customer retention.

Using a cohort analysis, Amazon can identify the factors that drive customer loyalty and make targeted improvements to their customer experience, leading to increased customer retention and long-term success.

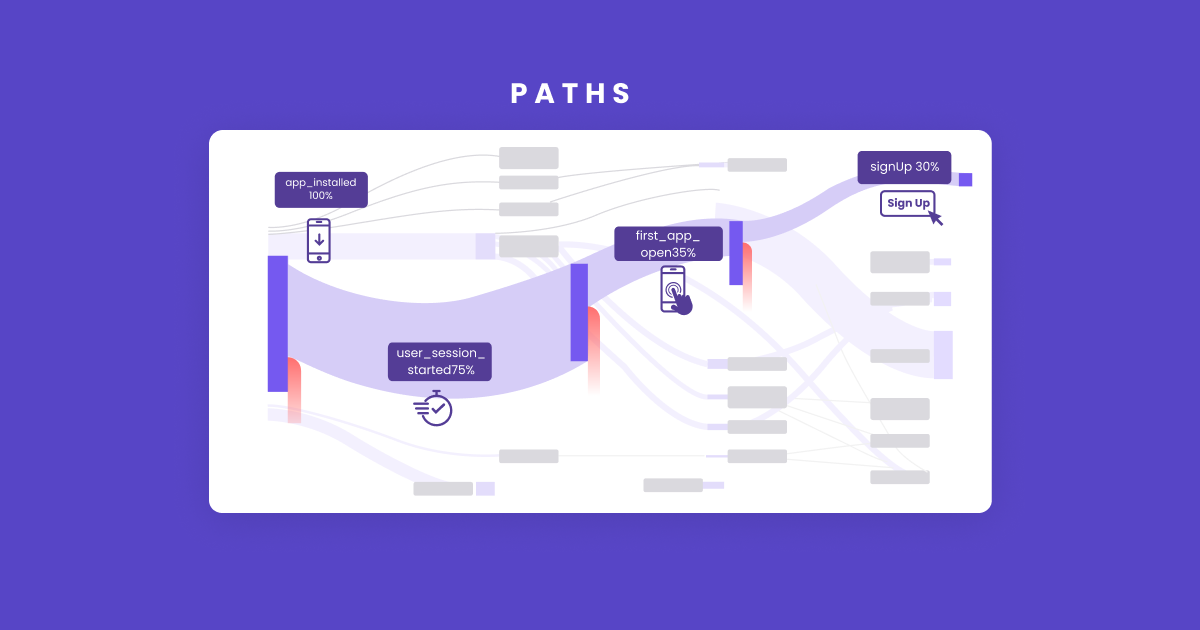

Paths

What are Paths?

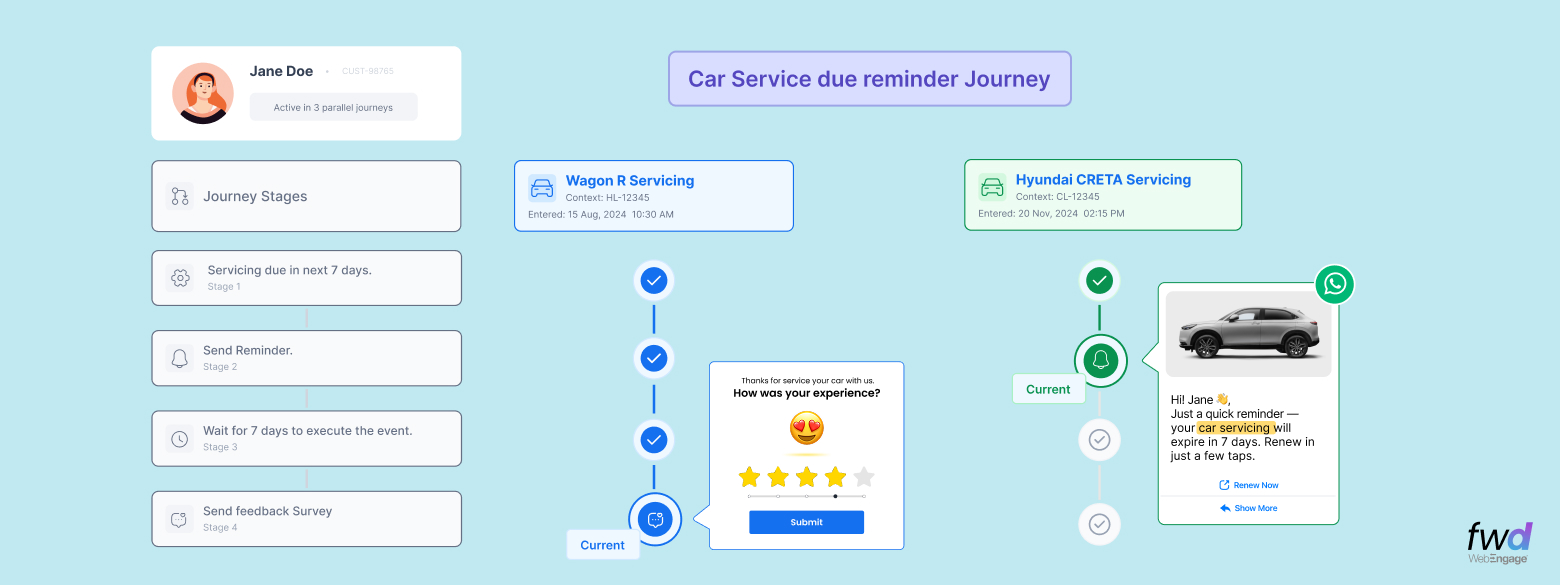

The phases or steps that a client goes through before becoming a devoted and enduring customer are referred to as ‘paths’ in the context of customer retention. These routes often entail a number of encounters and experiences that a client has with a company, such as awareness, consideration, evaluation, purchase, and post-buy activities.

Why are Paths important?

By understanding customers’ paths, businesses can identify key touchpoints and opportunities to engage and retain customers and make improvements to the customer journey to increase customer satisfaction and loyalty.

How are Paths used?

For example, a customer path in e-commerce might involve searching for products, comparing options, making a purchase, receiving and using the product, and potentially leaving a review or making a repeat purchase. By analyzing this path and identifying areas for improvement, a business can optimize its website, customer service, and marketing to enhance the customer experience and increase customer retention.

Know more about using Paths with WebEngage.

Example of a company successfully using Paths:

Spotify is one instance of a business that effectively uses “paths” for client retention. Spotify is a music streaming service that employs curated playlists and personalized recommendations to give each user a special experience. Spotify is able to pinpoint the most frequent user paths and tailor their experience to increase engagement and retention by studying consumer behavior and feedback.

For instance, Spotify may discover that a certain demographic of users tend to like a particular musical genre and are more likely to stick with the service if they have access to more tailored playlists. As a reaction, Spotify might spend money enhancing its suggestion systems to serve the demands of that clientele better, thereby boosting client retention.

Spotify has been able to develop a highly tailored experience that keeps users interested and coming back, increasing customer retention and long-term success. This was made possible by applying customer journey mapping and analyzing customer behavior.

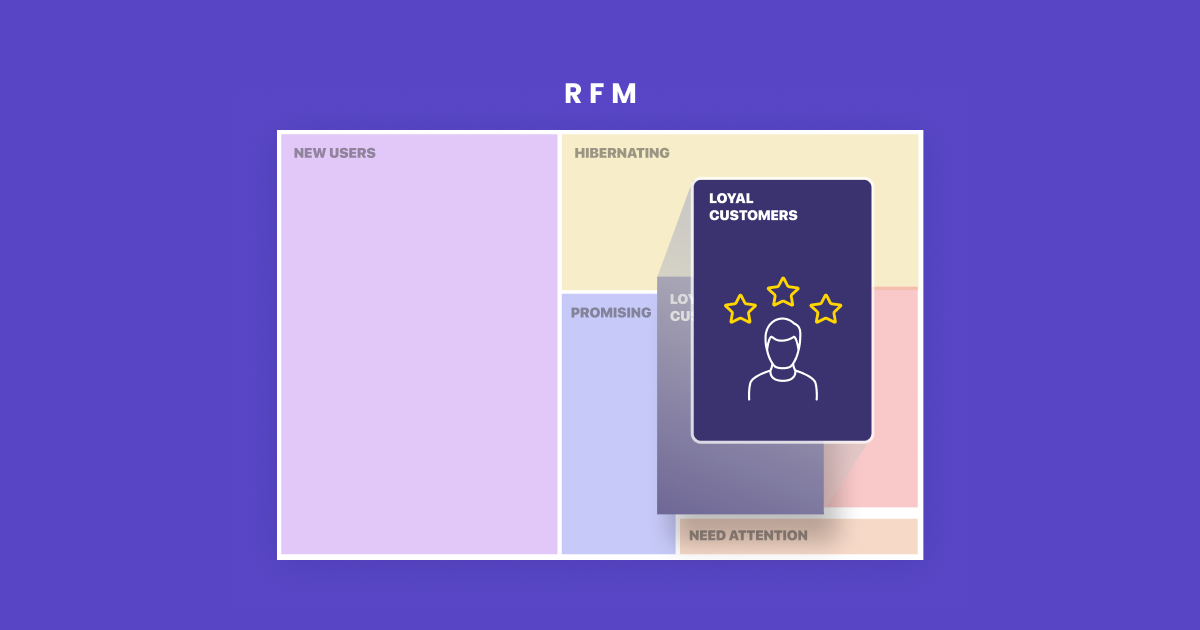

RFM

What is the RFM model of customer retention?

RFM stands for Recency, Frequency, and Monetary Value, and it is a model used in customer retention analysis to segment customers based on their recent behaviors and purchase history. The RFM model helps businesses identify the most valuable customers and understand the behaviors and characteristics contributing to customer loyalty.

The three components of the RFM model are:

- 1. Recency: The time elapsed since a customer’s last purchase

- 2. Frequency: The number of purchases made by a customer

- 3. Monetary Value: The total amount of money spent by a customer

How is the RFM model used?

By combining the three components of recency, frequency, and monetary value, businesses can create a score for each customer and segment their customers into groups based on their RFM score. For example, a customer with a high RFM score may be a loyal and valuable customer who makes frequent purchases and spends a lot of money, while a customer with a low RFM score may be at risk of churn and in need of re-engagement efforts.

The RFM model provides a simple and effective way for businesses to understand their customers and prioritize retention efforts and can be used in combination with other retention tools and strategies for a comprehensive approach to customer retention.

Example of a company successfully using the RFM model for customer retention:

Zara, a global fashion retail brand, successfully uses the RFM model for customer retention. Zara has employed the RFM approach to comprehend consumer purchasing patterns and pinpoint its most important clients. Based on their purchase habits, Zara can divide its client base into various groups and appropriately target its marketing and customer retention initiatives.

For instance, Zara might spot a group of clients who are regular buyers but haven’t made any purchases in a while. Zara might utilize personalized discounts, targeted email marketing campaigns, or other inducements to persuade these customers to purchase in order to keep them.

The RFM methodology has helped Zara better understand the shopping habits of its customers, which has enhanced customer loyalty and retention. This has been crucial to the company’s development and success in fashion retail.

Download Impact Story – Know more about how Pickyourtrail, India’s biggest online D-I-Y holiday booking platform, leverages RFM analysis & witnesses 50% increase in its user engagement

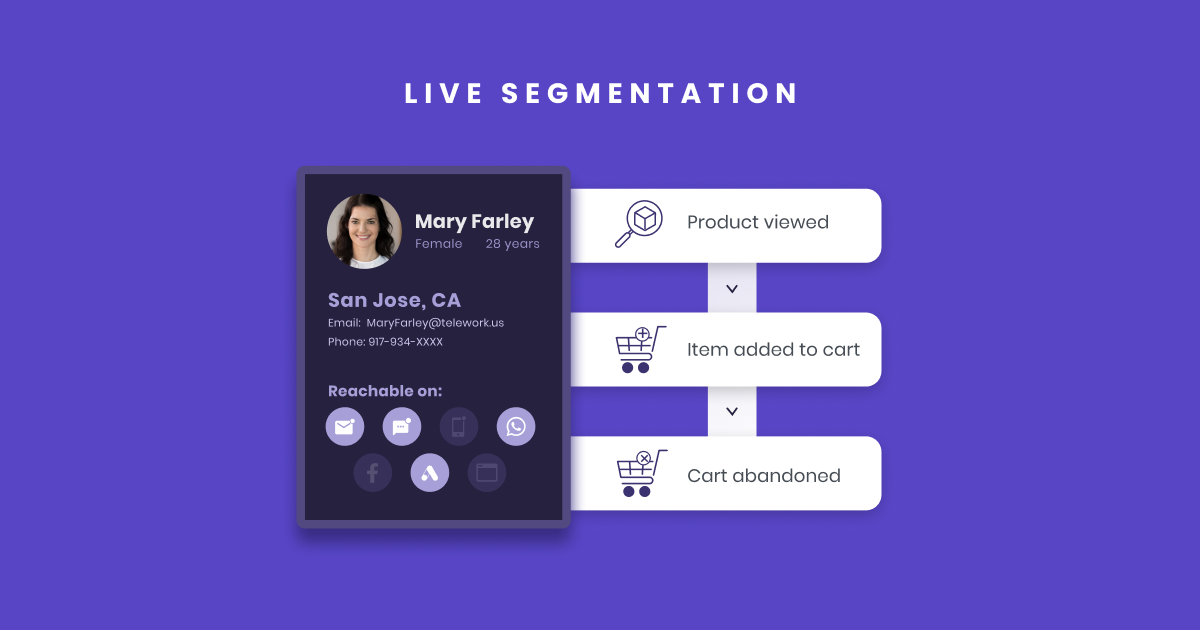

Live segments

What is Live Segmentation?

‘Live segmentation’ in customer retention refers to dividing customers into real-time groups based on their current behaviors and attributes. Unlike traditional customer segmentation methods, which rely on pre-defined segments based on past behaviors, live segmentation enables businesses to adapt and respond to changing customer behaviors in real time.

Live segmentation aims to create highly targeted and personalized customer experiences, which can improve customer engagement and increase customer loyalty. Businesses can deliver relevant and timely messages and offers that resonate with customers by dividing customers into segments based on purchase history, engagement patterns, and demographic information.

Why is Live segmentation important?

Live segmentation could target customers who have not made a purchase in a while with a personalized promotion or to deliver a tailored message to customers who have shown an interest in a specific product category.

Live segmentation can be a powerful tool for customer retention, as it enables businesses to stay on top of changing customer behaviors and to adapt to new opportunities for engagement quickly. However, it requires access to real-time customer data and the ability to analyze and respond to this data in a timely manner.

Example of a company that successfully uses Live Segmentation:

To give each consumer a unique viewing experience and to customize its content recommendations, Netflix uses live segmentation.

With the help of machine learning algorithms, Netflix’s recommendation engine analyses its users’ watching patterns in real time and divides them into several groups according to their preferences. For instance, Netflix may recognize a user as a fan of romantic comedies and make recommendations for comparable films or TV episodes based on that preference.

By employing live segmentation, Netflix can offer its users a highly tailored experience that keeps them interested and returning for more. For instance, Netflix can boost the possibility that its users would keep using the service and paying monthly membership by recommending fresh and pertinent content.

Overall, Netflix’s use of live segmentation has been a major contributor to its success and growth. It has also assisted the business in cultivating a network of devoted clients and boosting long-term client retention.

Predictive segmentation

What is Predictive Segmentation?

Predictive segmentation in customer retention refers to using data analytics and machine learning techniques to divide customers into groups based on their predicted future behaviors and likelihood to churn. Predictive segmentation aims to identify at-risk customers before they leave and target them with personalized retention efforts before it’s too late.

Predictive segmentation typically involves analyzing customer data such as purchase history, engagement patterns, and demographic information to identify patterns and correlations that predict customer churn. This data is then used to build predictive models that classify customers into segments based on their likelihood to churn.

How is Predictive Segmentation used?

A business may use predictive segmentation to identify customers who have shown signs of reduced engagement, such as decreased frequency of purchases or reduced time spent on the website. These customers can then be targeted with personalized retention efforts, such as tailored promotions or targeted messaging, in an effort to prevent them from leaving.

Why is Predictive Segmentation important?

Predictive segmentation can be a valuable tool for customer retention. It enables businesses to proactively identify and target at-risk customers and prioritize retention efforts based on the likelihood of customer churn. By using predictive segmentation in combination with other retention tools and strategies, businesses can improve customer engagement and reduce churn over time.

Example of a company that successfully uses Predictive Segmentation to retain customers:

In order to understand its clients’ behavior and anticipate future client interactions, Salesforce uses predictive segmentation.

Salesforce’s predictive segmentation engine uses machine learning algorithms to evaluate customer data and spot trends in consumer behavior. Using this data, clients are subsequently divided into several categories according to how likely they are to interact with a given good or service.

Salesforce may utilize predictive segmentation to pinpoint a set of clients who are most likely to leave (leaving the service). The business might then employ tailored marketing and engagement strategies, such as customized emails, promotions, or rewards, to entice these clients to stick around.

Salesforce is able to keep its clients by offering a highly personalized experience that is catered to their unique needs and interests thanks to predictive segmentation. This has been crucial to the company’s development and success in the CRM software sector.

How to get started with customer retention tools:

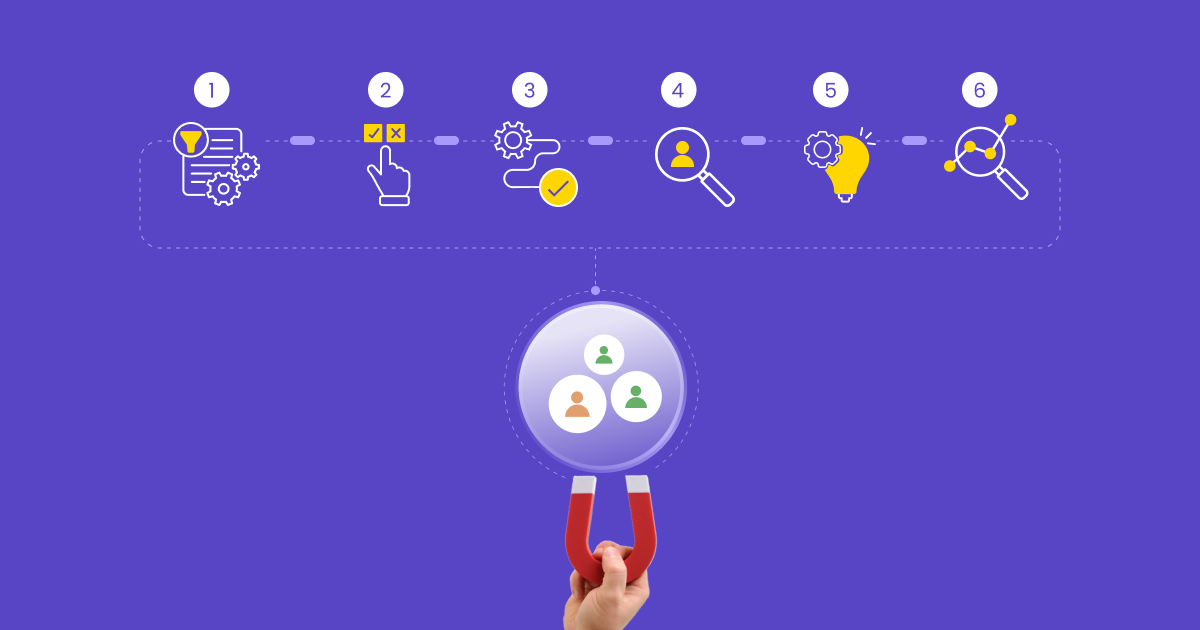

Now that you’re familiar with the key tools that help with customer retention, here are 6 simple steps you can take to put them to use:

- Step 1: Collect customer data

You must have an abundance of client data to evaluate in order to use customer retention solutions efficiently. Start by gathering information on consumer behavior, engagement, purchase history, and demographics. You can segment your customer base using this data to inform your attempts to increase customer retention.

- Step 2: Choose the right tool

There are numerous tools for retaining customers, such as live segmentation, RFM, and predictive segmentation. Select the tools most appropriate for your business objectives and the kind of data you have at your disposal.

- Step 3: Implement the tools

It’s time to put the tools you’ve chosen to work for your company into action. In order to track the effectiveness of your campaigns, you may need to collaborate with a customer relationship management (CRM) software platform or a specific client retention platform.

- Step 4: Analyze customer behavior

Utilize the client information you have gathered to segment your customers into distinct categories based on their engagement and activity.

- Step 5: Develop targeted campaigns

Create tailored marketing campaigns for each client segment using your customer data research learnings. These initiatives ought to be created to increase client retention and foster consumer interaction.

- Step 6: Monitor and measure success

Keep track of and evaluate the results of your customer retention programs frequently. Make necessary tweaks to your campaigns based on data and analytics to ensure they have the desired impact on client engagement and retention.

By following these steps, you can effectively get started with customer retention tools and drive better customer engagement and retention for your business.

Conclusion:

Do you want to increase your repeat purchase rate? WebEngage helps you reduce acquisition costs while increasing CLTV, AOV, and other key retention metrics. We make it easy for you to convert one-time buyers into repeat customers. Our platform is simple and easy to use, so you can get started quickly and see results fast. We have a wide variety of features designed to help you get the most out of your customer relationships. And we’re always here to help if you need us. Take a demo now.

Manoj Chawda

Manoj Chawda

Ananya Nigam

Ananya Nigam

Prakhya Nair

Prakhya Nair

Harshita Lal

Harshita Lal