Not too long ago, a warm greeting at the bank entrance or a face-to-face meeting with a representative was the gold standard for customer experience in banking. But times have changed.

Customer onboarding and banking journeys have become predominantly online. Gone are the days of queuing up at bank branches, doing endless paperwork, or waiting on hold for customer support. Most financial transactions – from loan applications to insurance and investments– happen digitally.

This shift has a major upside. According to McKinsey, customers who engage with their banks digitally tend to be more satisfied.

But here’s the catch: Customers don’t just want digital convenience. They crave personalized experiences.

To stay ahead of the curve, BFSI brands must leverage martech to optimize their customer journeys and drive financial growth.

If you’re in the financial industry, this is an article you won’t want to miss.

What is MarTech’s role in BFSI?

As you most likely have figured, investing in a marketing technology stack is a consideration most brands are making now. But why, you may ask?

- Better Customer Engagement: With the help of martech tools, BFSI brands can design and run targeted and tailored marketing campaigns by understanding customer behavior using data. This allows you to deliver the right message to the right audience at the right time, which means getting more user engagement and better relationships.

- Data-Driven Insights: Martech uses analytics and detailed data to understand how customers behave and what’s happening in the industry. This helps make informed decisions, tailor products or services to customer requirements, optimize marketing strategies, and improve customer satisfaction.

- Compliance and Security: Martech solutions help the BFSI sector (which is highly regulated) stay compliant with data privacy and security regulations. Secured platforms where you can manage your customer’s data, minimize the risk of breaches, and adhere to the rules.

- Enhanced Customer Experience: Martech allows for the creation of a seamless and consistent experience across many channels. No matter how customers interact—mobile apps, websites, or in-store—it ensures an important experience that contributes to customer satisfaction and loyalty for a cohesive marketing strategy.

Optimizing Customer Journeys in BFSI

In the BFSI sector, 78% of customers expect seamless, personalized support from their banks. martech can help optimize customer journeys to meet these expectations. Wondering how?

Identifying Touchpoints in BFSI

The first step is identifying customer touchpoints, which is how you optimize the customer journey. Whatever they are, any interaction a customer has with a brand, online or offline, is called a touchpoint. For BFSI, these can be website visits, mobile app usage, branch visits, customer service calls, or social media interactions.

By mapping such touchpoints, BFSI companies can learn where customers spend time with the brand and where potential additions can be made to those interactions. Visually analyzing these touchpoints can help you understand the touchpoints involved in a customer’s path and build an overall picture of a customer’s journey.

An example is a bank using martech to trace a customer’s path from landing on a website to opening an account. Through this journey, the bank can identify friction points in the process, such as challenges in customer onboarding or difficulty using the application. Addressing these issues can streamline the process and boost conversion rates.

Personalizing Marketing Strategies

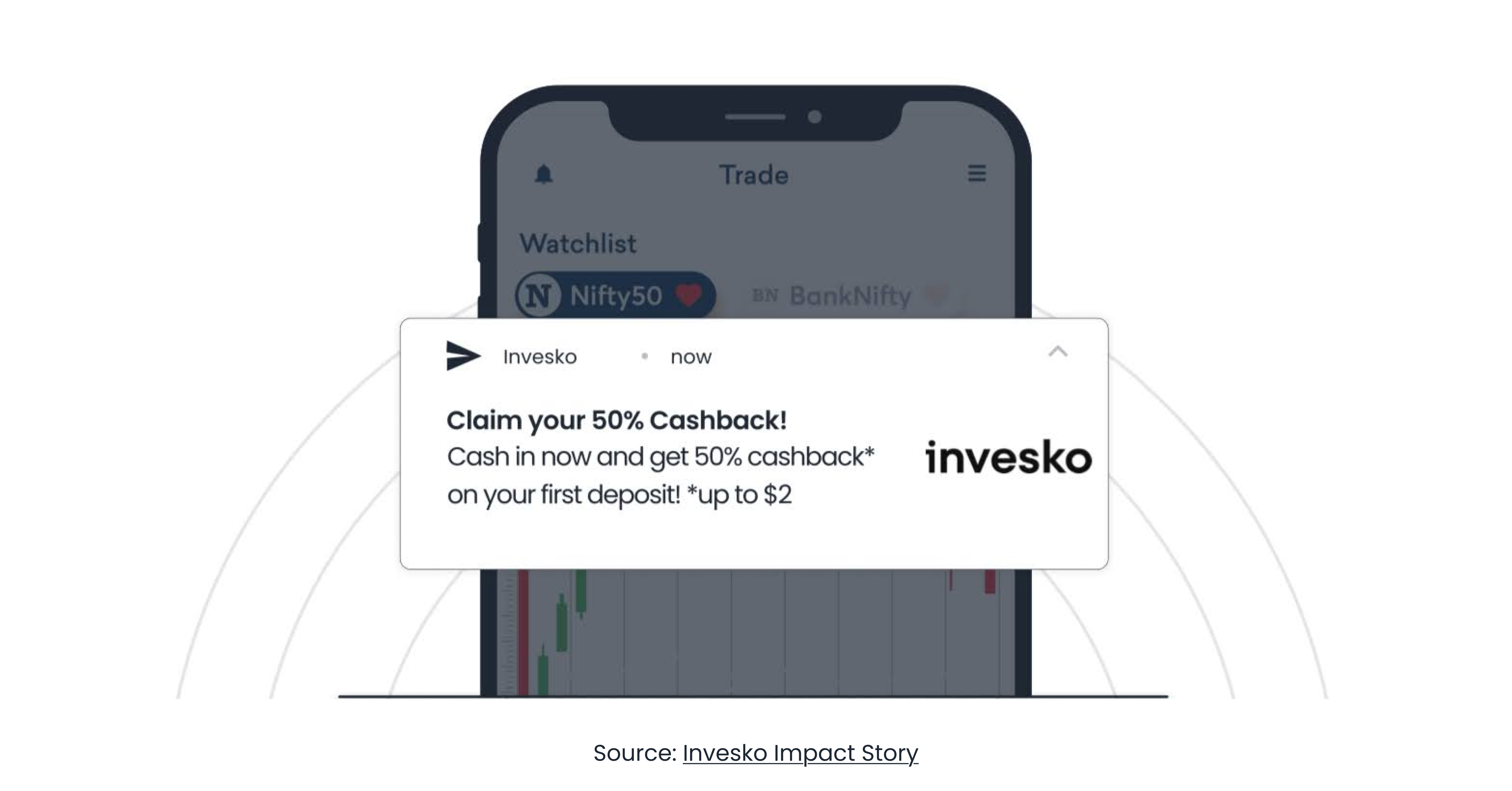

Personalization is the key to creating meaningful customer experiences. Martech for BFSI businesses helps customize communications and offerings according to individual customer data.

A personalization strategy leverages data to determine customers’ preferences, behavior, and needs. Martech platforms can also segment customers into different personas and deliver personalized content. Not only does this improve customer satisfaction, but it also serves as a building block for loyalty and customer retention.

For example, an insurance company could use martech to use customer data to suggest personalized policy options based on real-life events, such as buying a home or having a child. The idea is that customers will receive relevant and timely messages based on individual preferences and needs.

Improving Customer Experience

Crafting a brilliant customer experience means seamlessly connecting touchpoints, ensuring smooth and enjoyable interactions throughout the customer journey. Integrating customer data across channels with martech tools is key to making this happen.

With the help of martech solutions, BFSI companies can deliver a unified customer experience across online and in-person interactions. This integration provides a consolidated view of a customer, enabling efficient and personalized engagement.

For example, omnichannel automated reminders can help reduce loan defaulters. A CRM system can track customer interactions across email, phone, and branch visits. Banks can personalize services and offer preemptive solutions or tailored financial advice by processing this data.

Harnessing Data for Smarter Marketing

Data-driven marketing involves gathering customer information and using that data to decide what to promote and how to promote. Martech provides the tools to collect, analyze, and act on this data effectively.

Targeting the right audience with the right message at the right time increases ROI and engagement.

A bank can use data analytics to determine which segment of its customer base will most likely require a loan and create specific marketing campaigns to reach those potential customers. At the bank, it makes sense to look back at past behaviors and preferences and build messages that will be more effective with each segment.

Powering Martech with Data

Data is the backbone of martech, as it helps generate the insights that drive optimized customer journeys. In BFSI, it plays a crucial role in understanding customer behaviors, preferences, and trends.

Data is gathered from transactions, social media, and customer interactions and then analyzed by martech platforms to extract insights. This enables the creation of detailed customer profiles and informs marketing strategies.

For instance, an investment firm can use martech to analyze transaction data and identify patterns in investment behavior. This insight can then be used to offer personalized investment advice and tailor products to individual customer needs.

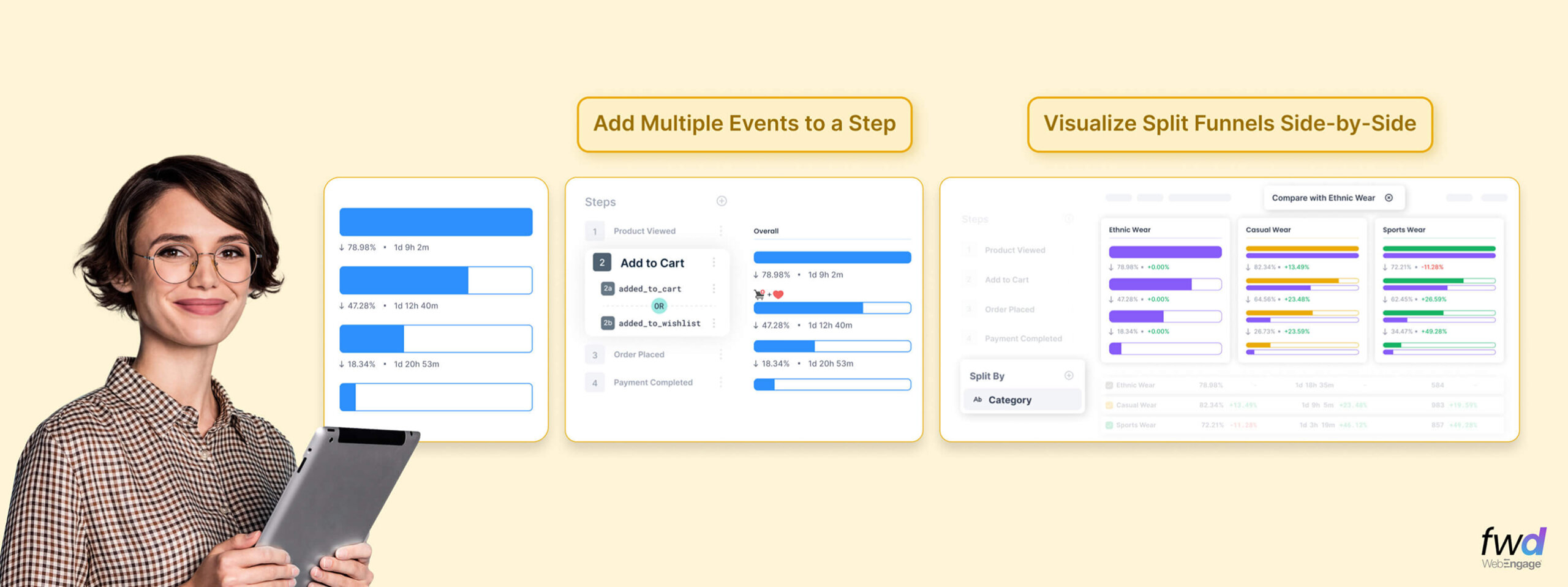

Accessing Growth with Analytics & Insights

Understanding and optimizing customer journeys requires analytics and insights from martech tools. BFSI companies can leverage these insights to refine their marketing strategies and enhance customer experiences.

Martech analytics tools offer in-depth insights into customer data, making it easier to identify trends and opportunities. This enables marketers to run effective campaigns, enhance customer support, and improve overall business operations.

A credit card company can use martech to track the success of a marketing campaign to increase card usage. By analyzing this data, the company can identify the most effective strategies and refine future campaigns for better results.

Maximizing Hyper-personalization for Communication

The future of martech in the BFSI sector is full of exciting possibilities as it continues to change. These advancements promise to transform how financial institutions interact with their customers, leading to a more streamlined and secure experience.

Hyper-personalization is one of the main areas of development in which martech tools use predictive analytics, advanced algorithms, and generative AI to deliver highly personalized experiences to each customer on a one-to-one basis.

As a BFSI brand, you can accurately anticipate customer needs and offer products and services that align with their life stage and preferences. For example, a bank can analyze a customer’s financial behavior and transaction history to recommend tailored investment portfolios and savings plans, enhancing customer satisfaction and loyalty.

This is why martech platforms like WebEngage are building unified customer profiles so interactions can be more unified and consistent. This not only improves the customer experience but also strengthens the brand’s overall identity.

Start Optimizing Your Customer Journeys

The journey towards optimizing customer experiences is constantly ongoing and powered by a deep understanding of customer needs. Martech provides the tools to anticipate these needs and proactively shape customer engagement. It’s about building relationships that are not just transactional but add value for both the customer and the brand.

If you’re looking to embrace using a marketing automation tool for your BFSI brand, we’ve helped over 800+ brands connect in a more personalized way with their customers, and we can do the same for you. Book a demo to learn how.

FAQs

- How can customer journey optimization improve financial growth?

Optimizing customer journeys allows BFSI marketers to align campaigns with customer needs, leading to higher conversion rates. When you understand the touchpoints and customer behavior, you can deliver relevant communications that drive engagement and increase sales. - What role does AI play in enhancing customer journeys in BFSI?

AI enhances customer journeys by providing personalized recommendations, automating communications, and ensuring consistent channel experiences. It helps analyze real-time data to inform marketing strategies and improve customer service efficiency. - What are effective strategies for optimizing customer journeys in BFSI?

Effective strategies include using event-triggered marketing, personalizing communications based on behavior, and employing journey mapping to identify pain points. These approaches ensure timely engagement and help with stronger relationships with customers.

Ananya Nigam

Ananya Nigam

Harshita Lal

Harshita Lal

Manoj Chawda

Manoj Chawda

Prakhya Nair

Prakhya Nair